DaniloAndjus/E+ via Getty Images

Quest Diagnostics (NYSE:DGX) is a company I’ve reviewed in the past. I’m about to review it again and shift my targets a bit from the recent set of results. Investing well depends, in my view, on the twin qualities of valuation and inherent company quality.

Quest Diagnostics has one of these – and the company saw an extreme upswing during 2021 due to non-recurring upsides.

Let’s look at what the future might bring for DGX.

Revisiting Quest Diagnostics

The fundamental upsides of the company are quite clear. Quest Diagnostics serves a large portion of all US hospitals and physicians – 50% or so, as it happens. This upside alone is worth both valuation and implies qualities. The company also holds a massive amount of patient data, processes over 1.8M of tests on a daily basis, with 6,580 retail and patient access points.

It translates into serving a full third of the U.S adult population.

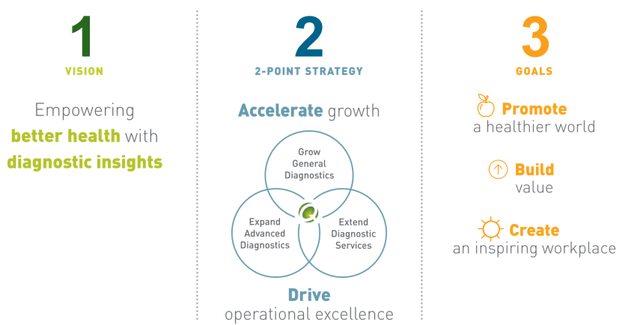

This company’s goals are also clear.

Quest Diagnostics Presentation (DGX IR)

The company’s market share in specific segments is impressive. The total lab market in the US is an $82B market, and the company sees this market growing by 2-3% on an annual basis beyond 2022. It’s important to understand just how non-recurring COVID-19 is in the medium to long term. While the income from the pandemic has been massive and allowed the company to really expand its operations and grow more agile, it’s something that won’t be recurring going forward. This has driven valuation very high, and this is the main challenge with Quest Diagnostics.

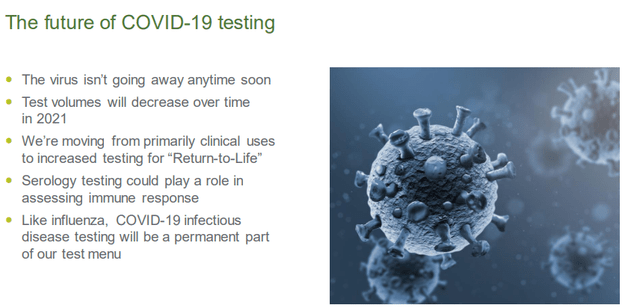

The company, of course, seeks to ensure the continuation of COVID-19 as an income.

Quest Diagnostics Presentation (DGX IR)

However, it’s my view, and the view of the forecasts for DGX by most analysts, that this will disappear in 2022-2024. Still, the company has managed to establish partnerships that will outlast COVID-19, and the company has some key characteristics that will drive future growth. Increased health plans should account for some, as well as an increased market share in the hospital segment. Advanced diagnostics and testing will drive growth to high-single-digit percentages per year. The company will also introduce D2C testing, which is expected to drive a quarter million in revenues by 2025 and forward.

This translates into a long-term 2022-2024 CAGR of 4-5% in revenues, as well as earnings growth of 7-9% EPS per year, higher due to better margins. The company also wants to target growth through M&As.

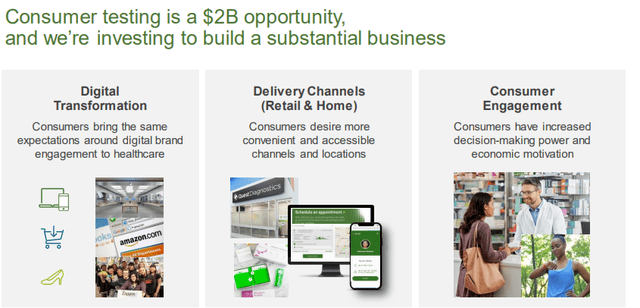

The company believes that D2C is a $2B market in the US alone, and DGX has a first-mover advantage here.

Quest Diagnostics Presentation (DGX IR)

All this expansion should coincide with savings through digital, continuous process improvement, reducing denials and concessions, and increased automation.

The key thesis for DGX, therefore, is growth – but it’s growth on the basis of pre-COVID-19 numbers. Prior to COVID, DGX was a company that delivered annual EPS of around $6-$7. While this will not normalize down to this level from $14.24 back in 2021FY, the current expectation is for a 2022 normalization of $9, and a 2023 normalization of around $8.5, which is the trough for the current forecast (Source: FactSet). Most other analysts would agree with this level.

Quality isn’t the issue with DGX. The company is one of the most qualitative healthcare service businesses in all the United States. But unfortunately to any amount of normalized P/E, it trades to a multiple of 16-17X, which is a significant premium to its 10-year average of below 15X.

There’s no outsized yield or dividend growth to reward investors with here. The company’s current yield is less than 1.9%. Because future growth estimates are limited to that $9/share level, which by the way is a very positive growth rate if we completely remove COVID-19 from the calculations, things are not in a good place here. On average and until 2024E, the market is expecting company earnings to decline on average by almost 10% per year.

This is a problem that, with a bullish thesis, would demand some sort of different upside, yield, or growth potential which just isn’t there with this business.

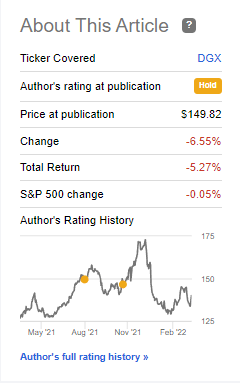

Look, ever since my first article on DGX, the company has returned negative RoR if we look at today’s share price.

DGX performance (Seeking Alpha DGX article)

I view DGX as far too under-covered a company on SA. The views and the response my articles get compared to others, as well as the number of coverage articles, implies that this company isn’t viewed favorably by many.

At today’s valuation, this is understandable. However, once DGX normalizes down say 10-15% more, there will be a definite, bullish upside to this business, and one I mean to take advantage of.

However, the writing for the current target is on the wall. I am far from the only analyst covering DGX that currently forecasts the company is unable to meet its EPS targets for the 2023-2024 years. UBS (UBS) did the same in February and lowered its PT to $139.

While Quest (DGX) has a FY 2023 earnings target of $8.50, UBS said that rising costs could hinder the company’s ability to meet it. “Meaningful invigorate cost savings and faster organic volume recovery at higher margins would need to more than offset investments, heightened labor pressures, and reimbursement cuts,” the firm wrote, adding that the recent leadership transition adds uncertainty to Quest’s long-term strategy. as a result, UBS added that shares should trade at a lower multiple, 17x from 18x.

(Source: Seeking Alpha/UBS)

To my mind, even a target such as this is far too rich for what the company really offers at this valuation.

Let’s look at where I believe the company should be.

Quest Diagnostics Valuation

It’s a simple thesis. Quest Diagnostics based on 2021-2022 EPS trades at around an 11X P/E – but for any normalized level, it’s closer to 16-17X. This might be in line with UBS’s price target of $139, at current prices of $140, but it’s still above my PT.

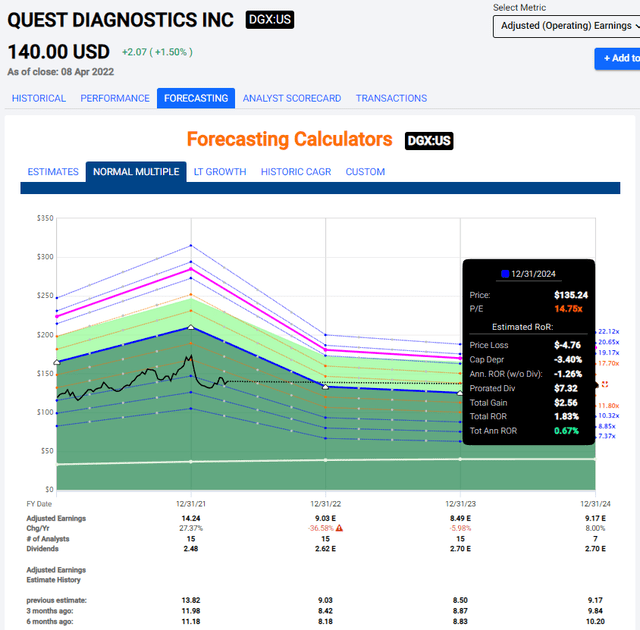

I want a 10-12% conservative upside to a good valuation. I don’t get that here. A conservative FV upside to a 15X P/E at today’s valuation gives us an annualized RoR of less than 2% until 2024.

F.A.S.T Graphs DGX Upside (F.A.S.T Graphs)

That graph nicely summarizes the issue with DGX today. Forward earnings are going to be negative. This is not something I or other analysts expect. This is the company’s own forecast.

Even if the company slightly outperforms, which I doubt, the resulting returns wouldn’t be all that impressive anyway. Investing in any one of a dozen undervalued or fairly-valued telcos would yield better investment results, as I see it.

S&P Global gives us a price target for DGX with a range of around $129 up to $185, with an average of $147. My own PT is closer to $120, which would give the company a sufficient upside at today’s price.

I’ve looked for forecast adjustments that could justify the higher upside that other analysts are giving the company here. I’ve found none to do this. The company is BBB+ rated and has low leverage, but also a low yield and doesn’t have the growth-related upside I’d want to see with companies where I would invest at such multiples seen to historical and future levels.

While I understand investors that consider this one a “BUY” based on safety, safety isn’t enough for me. Quality isn’t enough. I want valuation. DGX still lacks a level that makes it appealing, though I am shifting my PT to $120.

Thesis

The DGX thesis is this:

- This is a great player in the healthcare services/lab market. It has the proven and admirable ability to make attractive returns from superb customers and markets. At the right price, this company is a definite “BUY” to me.

- However, at $140, this company is too expensive. I currently don’t see an appealing RoR for the company based on current valuations.

- I would be interested at $120/share.

- DGX is a “HOLD”.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

DGX is currently a “HOLD”.

Thank you for reading.

Be the first to comment