Brandon Bell/Getty Images News

Shares of Exxon Mobil (NYSE:XOM) are back in a buy the drop situation. The price of Exxon Mobil’s shares skidded approximately 17% in June, but a strong pricing environment for crude and natural gas as well as higher expected capital returns make Exxon Mobil a buy on the drop. Exxon Mobil is still set to generate a material amount of free cash flow in FY 2022 which could and should support the firm’s share price!

Best pricing environment in years and positive outlook

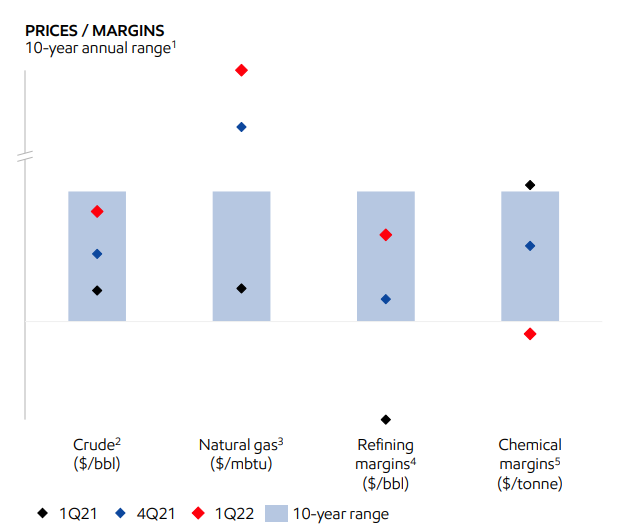

A post-pandemic petroleum demand recovery coupled with supply uncertainty due to energy sanctions on Russia have led to the best pricing environment, especially in natural gas, for the fossil fuel industry in the last ten years. Petroleum prices have skidded in June, but at $108 a barrel remain significantly above 2021 prices. Improved pricing in crude and natural gas products has driven an upswing in Exxon Mobil’s profits in 4Q’21 and Q1’22 and the company stands to benefit from elevated prices in Q2’22 as well, especially because there seems to be no quick solution to the war in Eastern Europe.

Exxon Mobil

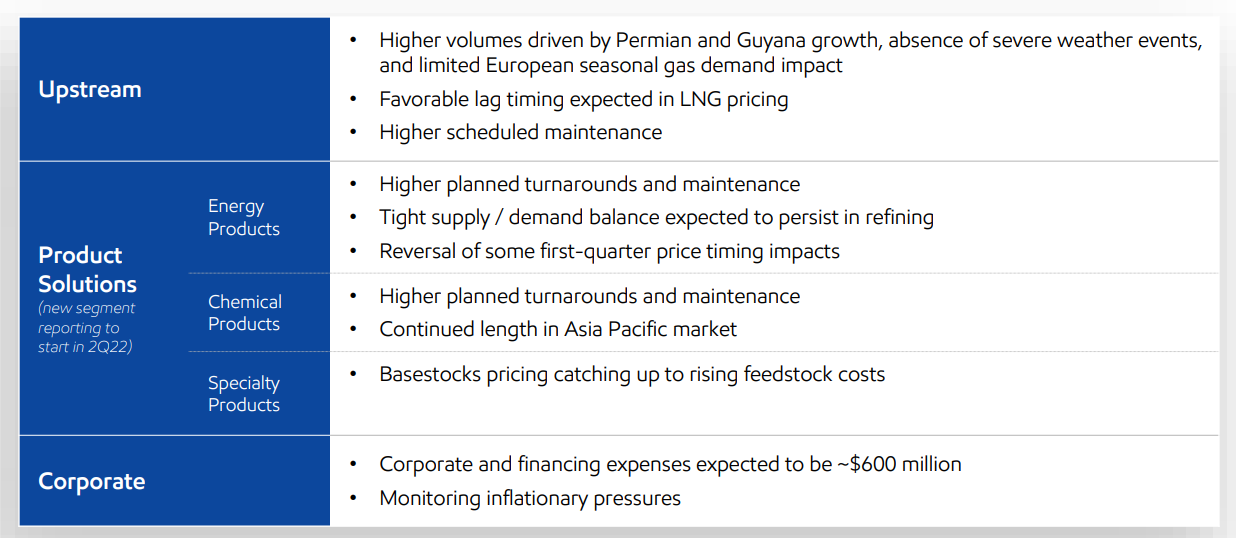

The outlook for Exxon Mobil’s Q2’22 was positive from the beginning as well. Petroleum prices remained high throughout the entire second-quarter and, additionally, higher expected volume production in Permian and Guyana in the second-quarter could lead to record Q2’22 results for Exxon Mobil.

Exxon Mobil

Updated free cash flow expectations and P-FCF ratio

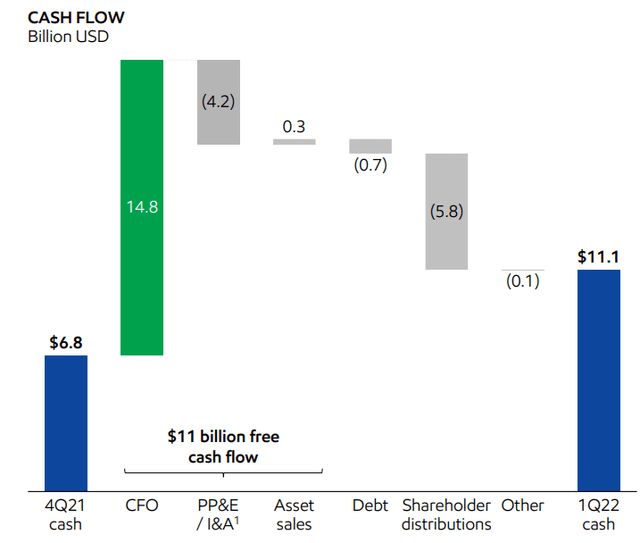

Exxon Mobil generated $14.8B in operating cash flow and $10.8B in free cash flow from its upstream, downstream and chemicals businesses in the first quarter of 2022. Of those $10.8B in free cash flow, Exxon Mobil returned 54% ($5.8B) to shareholders (share buybacks and dividends).

Although Exxon Mobil’s free cash flow is supported by strong market pricing for petroleum products, crude prices have decreased from more than $120 a barrel in the second week of June to about $108 a barrel today. For that reason, I am lowering my expectations for Exxon Mobil’s free cash flow for FY 2022 from $48B to $52B to a new range between $44B and $46B. Despite the drop in petroleum prices this month, Exxon Mobil is still going to generate a ton of free cash flow this year, and this FCF is still very reasonably priced. Based off of $44B to $46B in FY 2022 free cash flow, shares of Exxon Mobil have an 8.0 X – 8.3 X P-FCF ratio.

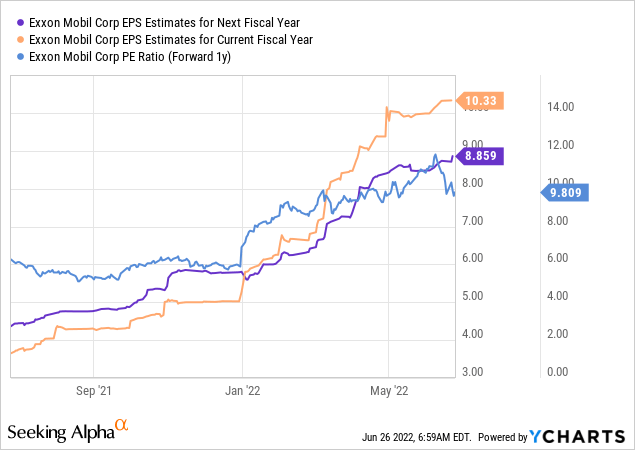

Exxon Mobil’s valuation is cheap based off of earnings

Exxon Mobil currently benefits from strong petroleum demand, limited supply, pricing strength as well as expected volume growth in Permian and Guyana which is why the firm is facing very attractive near term earnings prospects. The market consensus is for Exxon Mobil to achieve EPS of $10.33 in FY 2022 and $8.86 in FY 2023, so predictions imply that market prices for petroleum will drop-off next year. Based off of next year’s earnings estimates, however, Exxon Mobil’s earnings are still cheap. Using $8.86 as a benchmark for valuation, Exxon Mobil’s shares have a price-to-earnings ratio of 9.8 X.

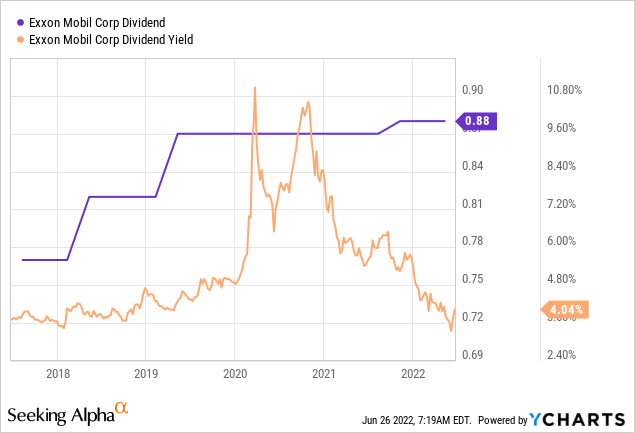

Expected dividend increase

Exxon Mobil’s dividend growth markedly slowed since 2019. The last major dividend increase shareholders received occurred in Q2-19 when Exxon Mobil raised its dividend from $0.82 per-share to $0.87 per-share. Exxon Mobil again raised its dividend $0.01 to $0.88 per-share only in Q4’21 while maintaining a $0.87 per-share dividend throughout the pandemic. With free cash flow and earnings prospects dramatically improving in FY 2022, however, I believe Exxon Mobil will deliver a much stronger dividend raise in Q4’22. I continue to estimate that Exxon Mobil will strive to give shareholders a 5-6% increase at the end of the year.

Risks with Exxon Mobil

A steep drop-off in petroleum prices is possibly Exxon Mobil’s biggest risk right now. The firm benefits from high prices for petroleum products and therefore has been a beneficiary of the war in Eastern Europe. A correction in petroleum prices is likely to drive a sharp revaluation of Exxon Mobil to the downside. However, I believe the dividend is not at risk.

Final thoughts

Exxon Mobil is back in a buy the drop situation. The firm’s free cash flow is extremely strong right now due to limited supply and higher market prices for energy products. For Exxon Mobil, this means that the firm could see record free cash flow in FY 2022 and even if petroleum prices were to correct to the downside in the second half of the year, FY 2022 would be a great year for the production company. Because Exxon Mobil’s shares are still cheap based on earnings and free cash flow, I believe the risk profile is still heavily skewed to the upside!

Be the first to comment