gorodenkoff

A Quick Take On Melt Pharmaceuticals

Melt Pharmaceuticals (MELT) has filed to raise an undisclosed amount in an IPO of its common stock, according to an S-1 registration statement.

The firm is a clinical stage biopharma developing drug candidates for sedation and acute pain.

When we learn more about the IPO, I’ll provide a final update.

Melt Pharma Overview

Brentwood, Tennessee-based Melt Pharma was founded as a subsidiary of Harrow Health and acquired its lead product candidate from Harrow.

Management is headed by Chief Executive Officer Larry Dillaha, M.D., who has been with the firm since June 2021 and was previously Chief Medical Officer of Harrow Health and CEO of Repros Therapeutics until its acquisition by Allergan Sales.

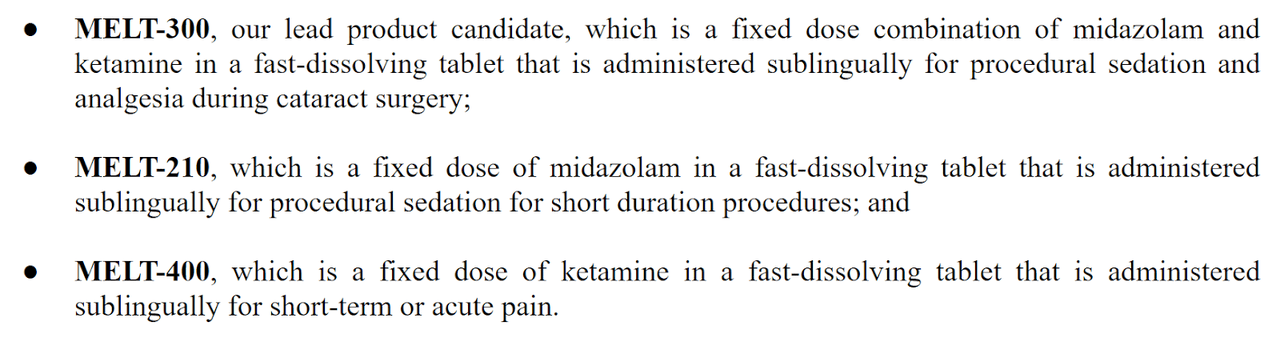

The firm’s lead candidate is MELT-300, ‘which is a fixed dose combination of midazolam and ketamine in a fast-dissolving tablet that is administered sublingually for procedural sedation and analgesia during cataract surgery.’

The drug is currently in Phase 2 efficacy trials and management expects top-line readout to become ‘available in the fourth quarter of 2022.’

Below is the current status of the company’s drug development pipeline:

Company Pipeline Status (SEC EDGAR)

Melt Pharma has booked fair market value investment of approximately $25 million of equity and debt as of June 30, 2022 from investors including Harrow Health and Opaleye, L.P.

Melt Pharma’s Market & Competition

According to a 2022 market research report by Allied Market Research, the global general anesthesia drug market was an estimated $5.4 billion in 2021 and is forecast to reach $7.7 billion in 2031.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 3.5% from 2022 to 2031.

Key elements driving this expected growth are an increase in the prevalence of chronic disease and an increase in funding from private and government sources for development of further innovations.

Also, the development and approvals for novel local or procedural anesthesia drugs will provide new revenue generation opportunities for market participants.

Major competitive products that also provide anesthetic effects include:

-

Midazolam

-

Propofol

-

Diazepam

-

Fentanyl

The company’s MELT-300 and MELT-210 products are being tested in procedural sedation use cases.

Melt Pharmaceuticals Financial Status

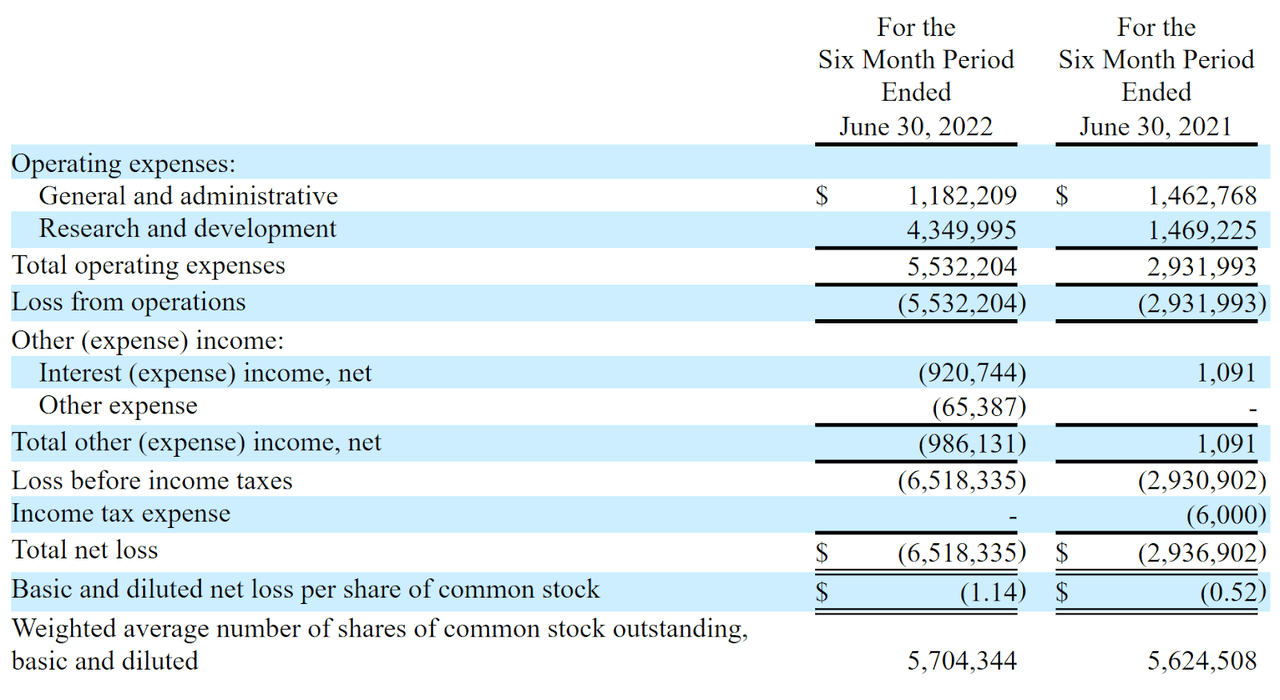

The firm’s recent financial results are typical of a clinical stage biopharma in that they feature no revenue and significant R&D and G&A expenses associated with its development efforts.

Below are the company’s financial results for the first six months of 2021 and 2022:

Company Statement Of Operations (SEC EDGAR)

As of June 30, 2022, the company had $6.2 million in cash and $17.7 million in total liabilities.

Melt Pharmaceuticals IPO Details

Melt Pharma intends to raise an undisclosed amount in gross proceeds from an IPO of its common stock.

No existing shareholders have indicated an interest to purchase shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

Management says it will use the net proceeds from the IPO as follows:

to fund the continued development of MELT-300, our lead product candidate, through the completion of our ongoing Phase 2 clinical study and commencement of our planned Phase 3 clinical study and pivotal PK study, including the manufacturing of clinical supply;

to fund the ongoing development of MELT-210, including the manufacturing of clinical supply, and MELT-400; and

the remainder for increased research and development and general and administrative personnel costs as we expand our organization, cross-program research and development activities, and other general corporate purposes and working capital.

Based on our current plans, we believe that the net proceeds from this offering, together with our existing cash and cash equivalents and taking into account the Harrow Loan Agreement Amendments, will be sufficient to fund our operations through 2023.

The net proceeds of this offering, together with our existing cash and cash equivalents, will not be sufficient to complete development of MELT-300, MELT-210 and MELT-400 or any other product candidate, and we will need to raise substantial additional capital to complete the development and commercialization of any product candidate. None of the net proceeds from this offering will be used to repay the Harrow Loan Agreement, as the Harrow Loan Agreement Amendments extend the maturity date of this loan to September 2026 upon the consummation of this offering; provided, however, that, for the avoidance of doubt, we expect to settle $10,000,000 principal amount of indebtedness under the Harrow Loan Agreement into shares of our common stock upon the closing of this offering.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not currently subject to any ‘significant legal proceedings.’

The sole listed bookrunner of the IPO is Aegis Capital Corp.

Commentary About Melt Pharma’s IPO

MELT is seeking public capital market funding to advance its pipeline of sedation candidates and pain treatment through and into clinical trials.

The firm’s lead candidate is MELT-300, ‘a fixed dose combination of midazolam and ketamine in a fast-dissolving tablet that is administered sublingually for procedural sedation and analgesia during cataract surgery.’

The drug is currently in Phase 2 efficacy trials and management expects top-line readout to become ‘available in the fourth quarter of 2022.’

The market opportunity for general anesthesia drugs is large but expected to grow at a relatively modest rate of growth in the coming years.

Management hasn’t disclosed any major pharma firm collaboration relationships or agreements and the company’s investor syndicate doesn’t include any institutional life science venture capital firms.

Aegis Capital Corp. is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (46.7%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The company is pursuing approval through the FDA’s 505[b][2] regulatory pathway, which could reduce the regulatory burden on new drug development testing.

When we learn more IPO details from management, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment