Daniel Balakov

Now, the first answer to the question posed in this article would be “Yes”. York Water Company (NASDAQ:YORW) can definitely help you limit your downside even as the market seems to be crashing all around us.

Why do I say this?

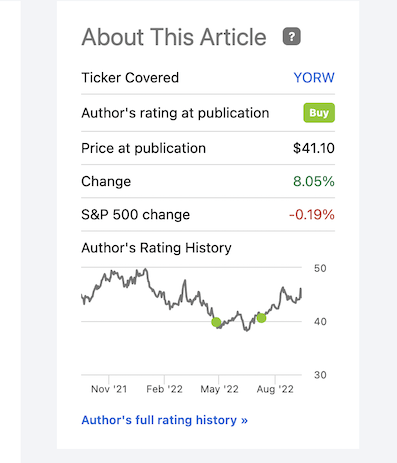

Take a look at what York Water has been doing since I last wrote about the company in my article in July, during which the S&P has done almost zero, and most companies seem to be firmly down.

YORW article (Seeking Alpha)

This is not at all a bad trajectory, given what the market has done since. The reason for this performance is simple. There are very, very few things that can derail a company like York Water – it can be argued that it doesn’t exist, outside of some macro catastrophe – and by that, I mean even larger than the pandemic.

And it’s a superb investment – provided you can actually buy it at a halfway-decent price, as I did a few months back.

Updating on York Water

York Water Company deals with, as the name and my previous articles suggest, water.

They do it for a relatively small area – 51 municipalities in three counties. Now, I own a few companies that manage water and waste – and when it comes to water, the things to understand about the business are its assets and dependencies. My other water investments are primarily in Uponor (OTCPK:UPNRY), a Finnish company not in regulated water utilities and distribution, but in water infrastructure and installation – more akin to a typical infrastructure/contractor business.

York Water, meanwhile, provides water services for roughly 200k people. As we move into environments and patterns that clearly seem to be characterized by higher degrees of weather instabilities, it’s important to see how this could influence the business. Weather patterns influence water supply balances and impound levels, and create challenges for the company in managing their supply.

The company has a very capital-light business that’s not subject to massive CapEx – it doesn’t have the ambition to expand beyond its current area, only manage its assets. It doesn’t require a massive amount of working capital. This visibility in its cash flows is typically one of its strengths. However, it’s not immune from inflation or other external effects, which can give it a bit of a risk of moving into an environment like this. YORW has been an excellent investment on a historical basis. If you had invested money in the company at 21X P/E back in 2002, your Annualized RoR would today, even considering recent declines, be close to 9%, or 450% RoR in total.

If you invest at the right time and with the right timeframe in mind as a goal, this business can really deliver some absolutely solid alpha, despite its size and usual overvaluation.

Keep in mind what I said though – consistent dividend does not mean the longest growth. York Water Company does not hesitate to cut this time-tested dividend when needed. They did so in 2006 and again in 2008 – but since then, it’s been on a growth streak to where it currently sits close to a 2% yield.

The company recently issued its 607th consecutive dividend – it also reported 2Q22. Both EPS and Revenues came in at slight, single-digit beats. There are very few/no surprises to a company like this. YORW also doesn’t host any earnings calls.

A quick review of the numbers shows us that things continue to work along as normal with YORW, with no trouble or real issue in sight. The company is expected to continue to generate double-digit earnings growth even this year while paying its current 1.76% – a very small amount, but backed by what I would argue is beyond bond-like safety.

It’s important to point out that even with the 2Q22 now past, there has been no material impact on the company as a result of COVID-19. We also receive higher clarity with regard to earnings, with the company’s revenue increasing more than the offsetting effect from cost increases/expenses. Revenues saw an 8% increase on an operating level, mostly due to growth in customer base and from distribution system improvement charges (DSIC), allowed by the regulators. The average number of wastewater customers served in 2022 increased, because YORW actually acquired the West Manheim Township, and water customers increased by around 750 to just above 70,000.

Operating expenses saw some slight growth as well – most of this was D&A, insurance, water treatment, and wage cost increases.

The company also, surprisingly enough, saw interest cost decreases of near-on 1.5%, mostly due to paying down long-term debt, and a repayment on an LOC.

The recent M&As are the big news from the company, though it’s a relatively small acquisition, all things considered.

On June 9, 2022, the Company signed an agreement to purchase the wastewater collection and treatment assets of MESCO, Inc. in Monaghan Township, York County, Pennsylvania. Completion of the acquisition is contingent upon receiving approval from all required regulatory authorities. Closing is expected in the first quarter of 2023 at which time the Company will add approximately 180 wastewater customers.

(Source: YORW-10-Q)

There are 4 more of these around the same size, totaling around 200 more wastewater and water customers for the business. So, YORW isn’t staying inactive.

Overall, my updated thesis as of this article is based on increased visibility despite headwinds. Despite rate increases and instability, company earnings from YORW remain stable, and the business is continuing to generate very impressive levels of EPS stability. I don’t expect any surprises, and what little uncertainty from rates and the current macro there was, I no longer consider all that relevant.

This leads me to be more positive on the company.

York Water Company Valuation

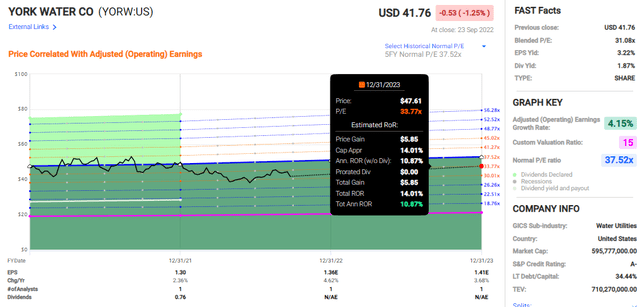

York Water Company remains at an extreme premium. You’re now looking at over 33x P/E with a growth expectation of 4% annually. Not at all great numbers, until you consider that estimating this company at a 5-year forward average P/E multiple, it could yield almost 15% per year – and you give the company some credence for what it “is”.

I bought shares of the company at closer to 30x P/E, which was a valuation I could stomach. As of today’s market action, this company is now once again hovering very close to that $40 mark, pushing the yield to close to 1.9%.

Provided that you accept the company’s 10-year premium of 33.5X or even a 5-year average premium of 37X, there’s an upside to be had here in the company. You can still call this a conservative upside if you expect the company to perhaps revert to that 38-40X multiple or so. In almost any case you care to calculate here between a 32-40x P/E on a forward basis, YORW now generates a close-to or above double-digit annual RoR, with a 37x forward P/E going up to 17% annually.

I would consider YORW at a forward P/E of perhaps closer to 33x at most. At 33x forward, the company now shows potential of a double-digit appreciation.

I would therefore argue that it’s the time at this valuation, to reiterate my “BUY” on York Water Company. I would say that YORW has a conservative upside, with the company approaching the safe of companies like adidas (OTCQX:ADDYY) or LVMH (OTCPK:LVMUY).

This still isn’t as clean-cut investment or a bullish thesis as I might like to present. Any time a company trades above 30X, the demands on those cash flows and those safeties are extreme – and now we’re a fair bit beyond 30x. But it’s definitely getting close enough at close to $40/share here.

My PT is closer to a 33X P/E and comes to $44/share – and that is where I would consider the company too expensive to buy. If you look at the share price now, you can see that the company is quite significantly undervalued to my PT, and it could be considered time to move forward and to “BUY” more of the company here.

S&P Global would agree with this overall assessment, giving the business a “BUY” average of $55/share. That means the company is now 31.7% undervalued to this analyst price target (Source: S&P Global). I wouldn’t go quite that far – but I would say the company is most certainly now starting to look undervalued, and the subject of excessive punishment by the market.

It’s therefore time to add to the company here. My thesis is updated and strengthened in part due to increased clarity from 2Q22 results, but also due to recent price action seeing the company fall significantly.

The upside the company has provided is excellent – and I could be adding more here.

Thesis

My thesis for York Water Company is the following

- This is the oldest consistently dividend-paying company in existence. It’s trading at a significant premium but may well deserve some of this premium.

- My target for YORW is a 33X P/E, accepting the 10-year P/E average, giving us a PT of $44/share.

- I consider YORW a “BUY” here, and I believe the upside is close to 11% even to a 33x P/E here. That’s good enough for me to reiterate, and strengthen my positive thesis.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment