Lubo Ivanko/iStock via Getty Images

Introduction

In a world where the desire to save lives meets immense competition, one of the most important ways to drive rapid and efficient progress is through research partnerships. Over the past two decades or so, a burgeoning industry of contract R&D firms have formed and realize their necessity with incredible financial performance. Whether it is the monoclonal antibody experts Genmab (GMAB), software provider Schrodinger (SDGR), or the diversified professional and operational services provided by firms such as Thermo Fisher (TMO), there is little doubt that the sector is a great area of the market to gain exposure to for investors.

Thankfully, these same companies also trade at the whim of the market, allowing investors to capitalize when the fundamentals diverge from the valuation. I believe that the best example of this would be with Evotec SE (NASDAQ:EVO), a European firm. Here at the end of 2022, the company is approaching all-time low valuations, but the quality of the company is increasing. Therefore, the data suggests that 2023 will be the start of a fruitful investment for those willing to enter during this market weakness.

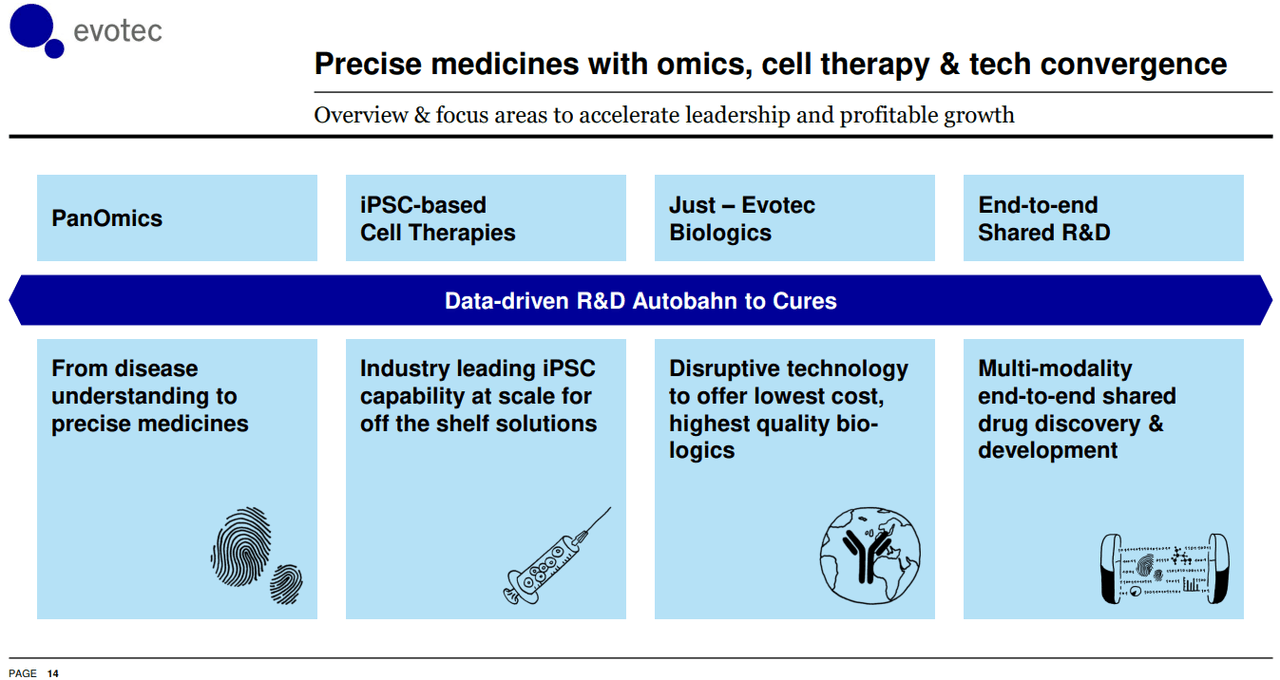

Evotec offers three main operational paths for securing revenues. First, the company offers a wide range of research services, from the earliest stage of discovery to commercialization. Revenues are earned in a variety of ways, but primarily through usage fees, subscriptions, milestones, and eventually royalties on approved therapies. Expect stable earnings growth from this segment to be reinvested into more risk and reward segments below.

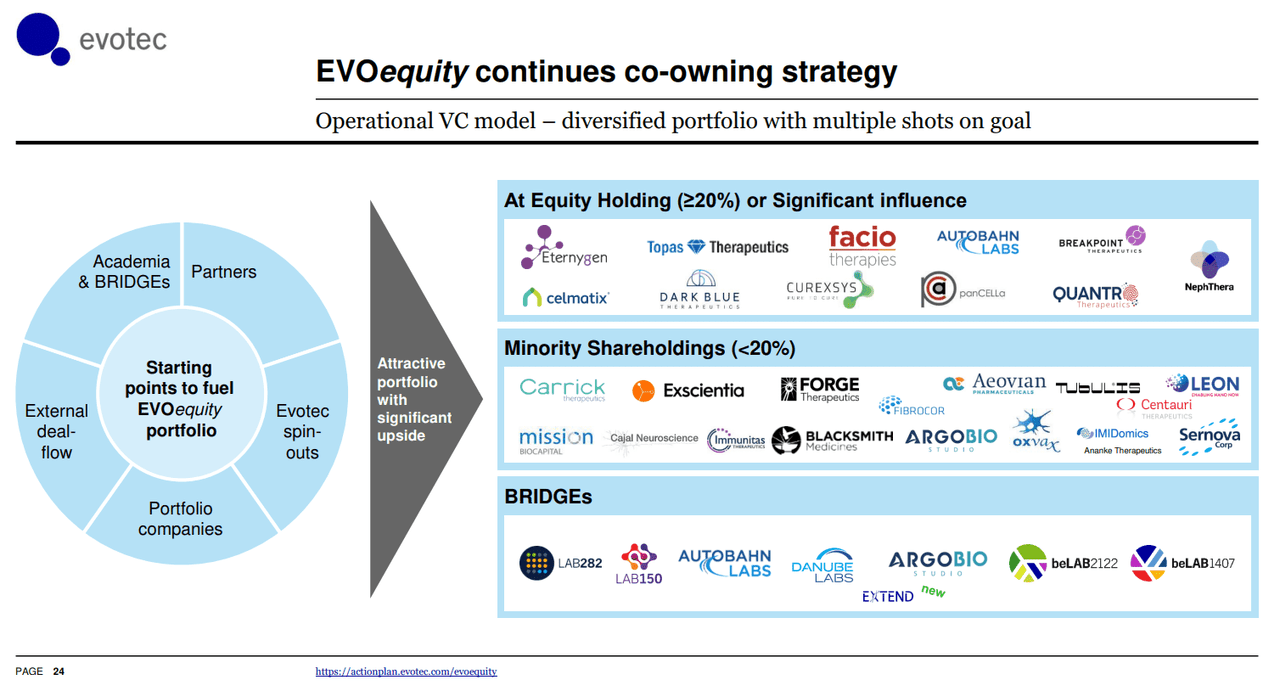

One way Evotec uses their research segment profits is to fund various equity stakes and research grants across the industry. These may lead to significant returns over the years, similar to a small royalty company such as Royalty Pharma (RPRX), XOMA (XOMA), or even private equity. Some examples include a minority stake in public AI software provider Exscientia (EXAI), 20%+ stakes in multiple private companies, bridge grants with the University of Oxford, University of Toronto, CEBINA, and many more.

Lastly, the company even is entering into the CDMO industry with new investments in biologics production facilities, another profitable industry with references such as Lonza (OTCPK:LZAGY), WuXi (OTCPK:WUXAY)(OTCPK:WXXWY), or Catalent (CTLT). While this segment is currently facing losses due to capex spending on expanding production, data from the peers suggest this revenue source will be profitable and growing at a rapid clip with time.

Evotec Investor Presentation

The Omics Growth Story

Modern medicine is advancing rapidly, but the difficulty in discovering and manufacturing these innovations is also increasing at an even greater rate. Part of this is due to the rise in understanding of the omics, or building blocks of cells and tissues:

The word omics refers to a field of study in biological sciences that ends with -omics, such as genomics, transcriptomics, proteomics, or metabolomics. The ending -ome is used to address the objects of study of such fields, such as the genome, proteome, transcriptome, or metabolome, respectively…

Overall, the objective of omics sciences is to identify, characterize, and quantify all biological molecules that are involved in the structure, function, and dynamics of a cell, tissue, or organism.

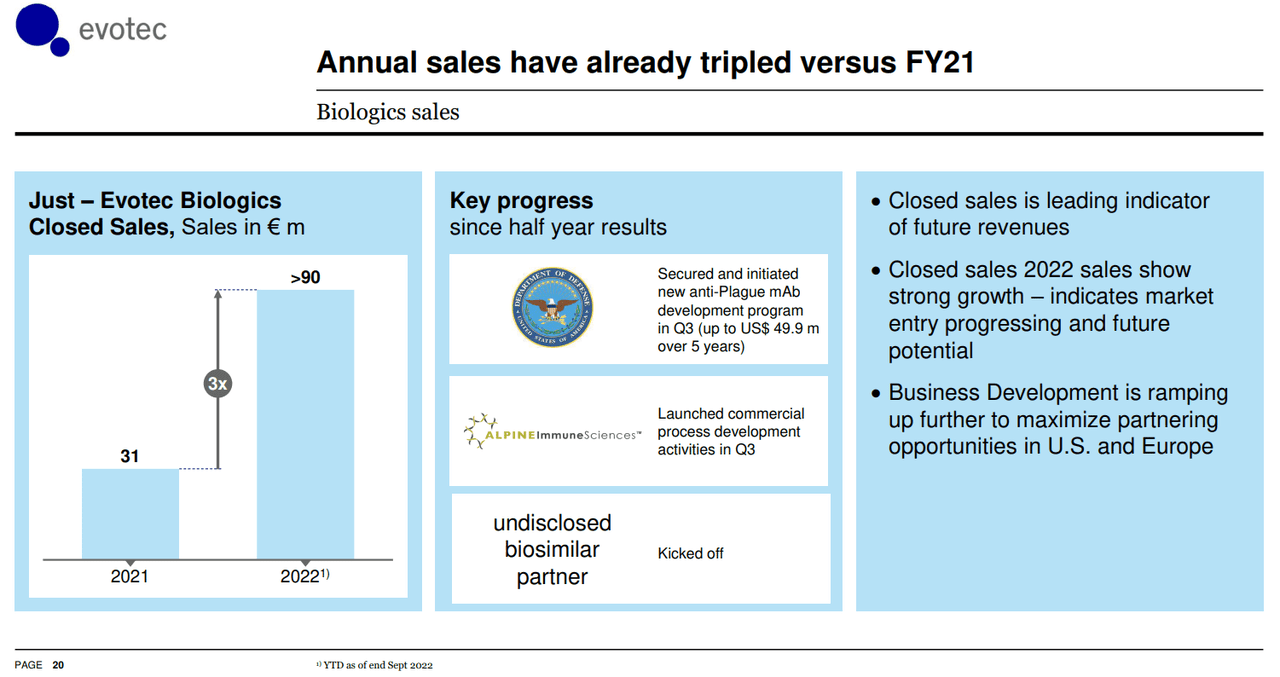

This detailed analysis focused now on building cell-based and advanced biological therapies, or biologics, requires significant data analysis technologies. Evotec is just one of many providers of research tools and software to aid researchers in their path to discovering new life-saving therapies. As a specialist in providing R&D services, the company has grown rapidly over the years, but recent developments have increased the diversity of their offerings. Most important of which is the rise of their biologics manufacturing segment that has seen a three-fold increase in sales in just nine months thanks to multiple new contracts, including with the US government.

Evotec Investor Presentation

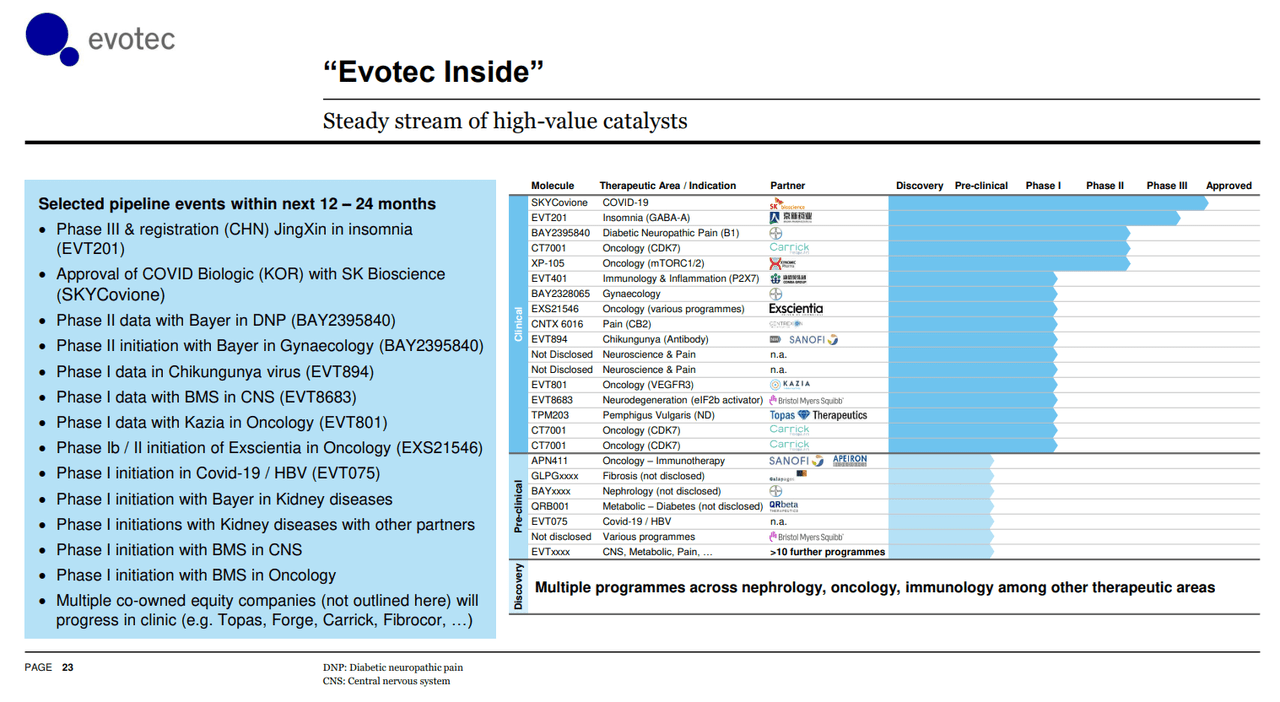

Due to the various partnerships, customer services, and equity investments over the past few years, Evotec has a number of pipeline catalysts in store for the short- to intermediate- term. In fact, most of the dozen and more clinical trials listed in the image below should offer the company milestone payments and even royalties upon successful completion. Assuming just 25% probability of success across 40 instances of a potential payment (i.e. Phase 1 going to Phase 2) and an average of $25 million in milestones per phase, Evotec is set to receive $250 million in cash over just the next few years.

Then add in the potential manufacturing contracts, legacy R&D fees and services, and royalties, then Evotec has plenty of cash flow potential in the future. It is also important to note that most of the costs and risks are left with competitors, rather than Evotec. The primary revenue segment remains R&D fees and services, not the milestone payments. As such, the $250 million cash flow is more of additional service revenues that can be reinvested, rather than a formal revenue source. And, don’t forget the pipeline is also boosted by the wide equity stakes in public/private companies that will be cash flow sources in the future as well.

Evotec Investor Presentation

Evotec Investor Presentation

Financial Breakdown

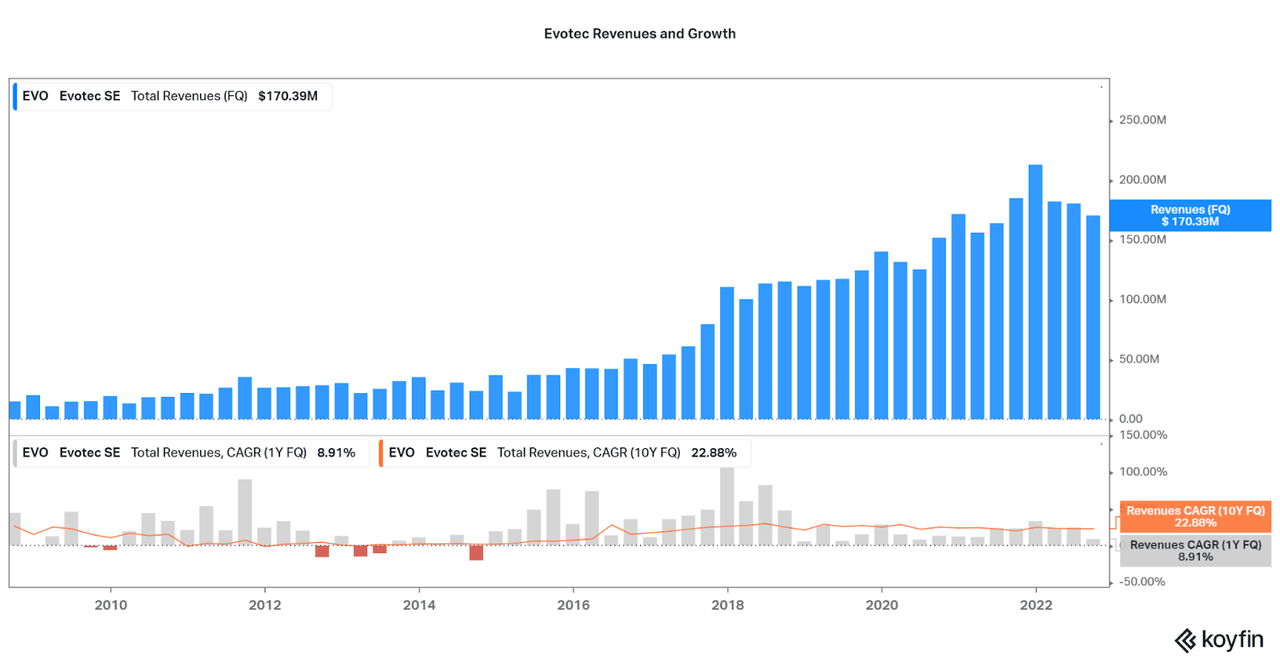

Stepping back, we should assess the historical performance alongside the future potential. Importantly, we can see that Evotec has a long financial history that is insightful on the future success as long as growth remains. As of the past five or so years, revenue growth has increased to an average of over 20% per year. However, revenue growth is lumpy due to some milestone payments that are attributed to the top line and so investors should be aware of the volatility moving forward.

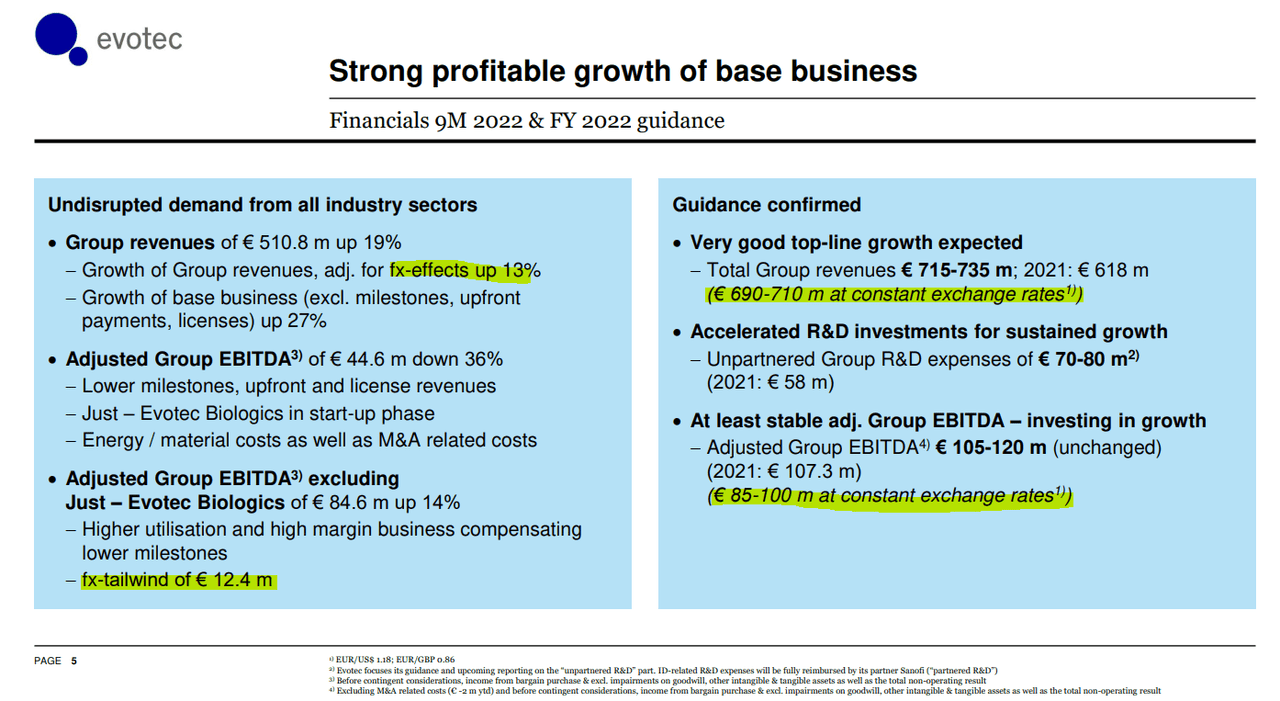

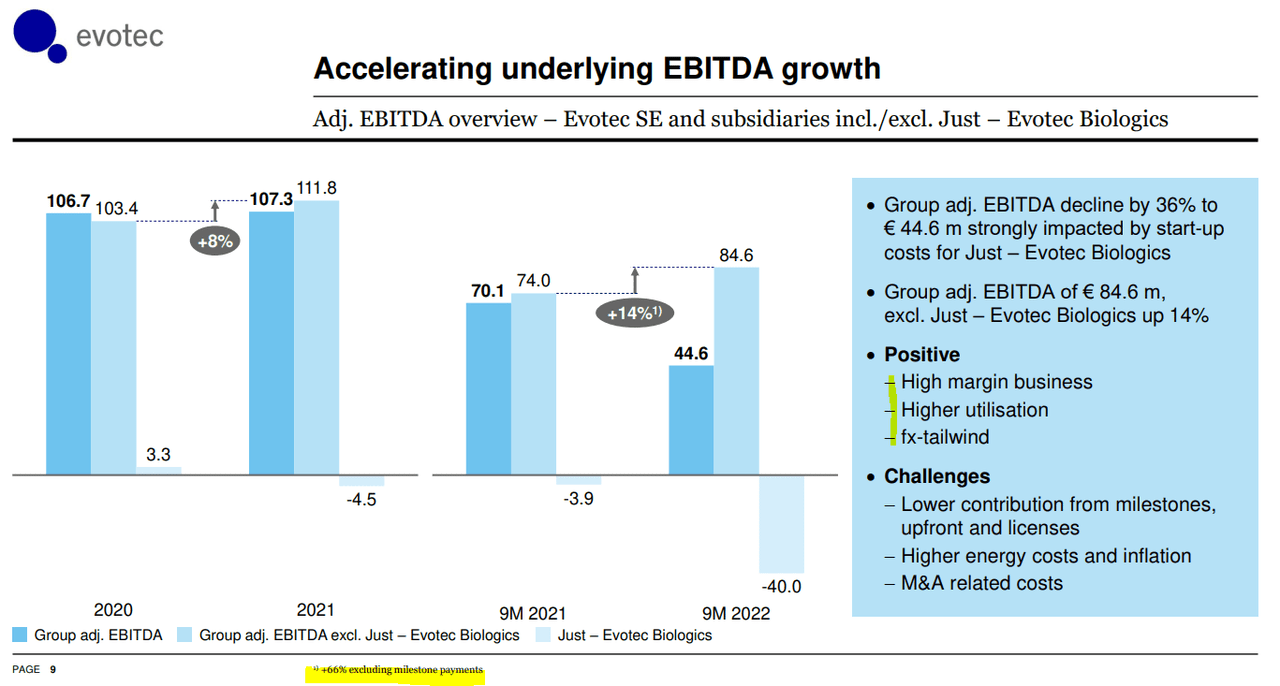

Despite European economic weakness and rising interest rates, growth is also still 19% YoY for the first 9 months of 2022. Interestingly, much of this is thanks to foreign exchange benefits and I expect the tailwinds to continue for at least a few more quarters. As discussed, the core business is growing above 25% YoY and the slight reduction in revenues can be attributed to the lumpy milestone payments.

Koyfin Evotec Investor Presentation

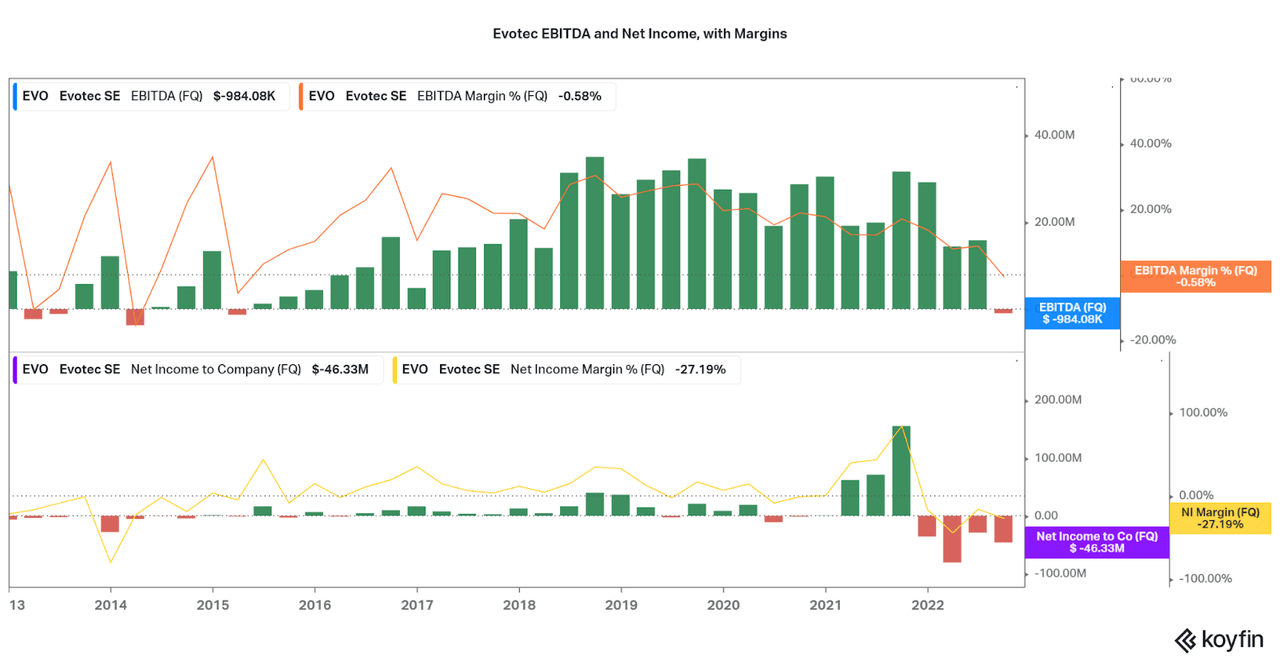

Other beneficial data points include a pattern of high profitability between 2016 and early 2022. While operating expenses are increasing this year due to inflation, supply chain issues, and energy costs, these remain temporary issues rather than reflections of the company’s ability to drive high profit margins. Evotec is also now investing heavily into their internal research and manufacturing, and this will be a tradeoff for future growth. However, when all is well investors can look forward to EBITDA margins in the 20s percentage and positive net income, the key factors of a long-term, low-risk investment. Also, keep an eye on those large milestone payments that help to keep net income positive.

Koyfin

Evotec Investor Presentation

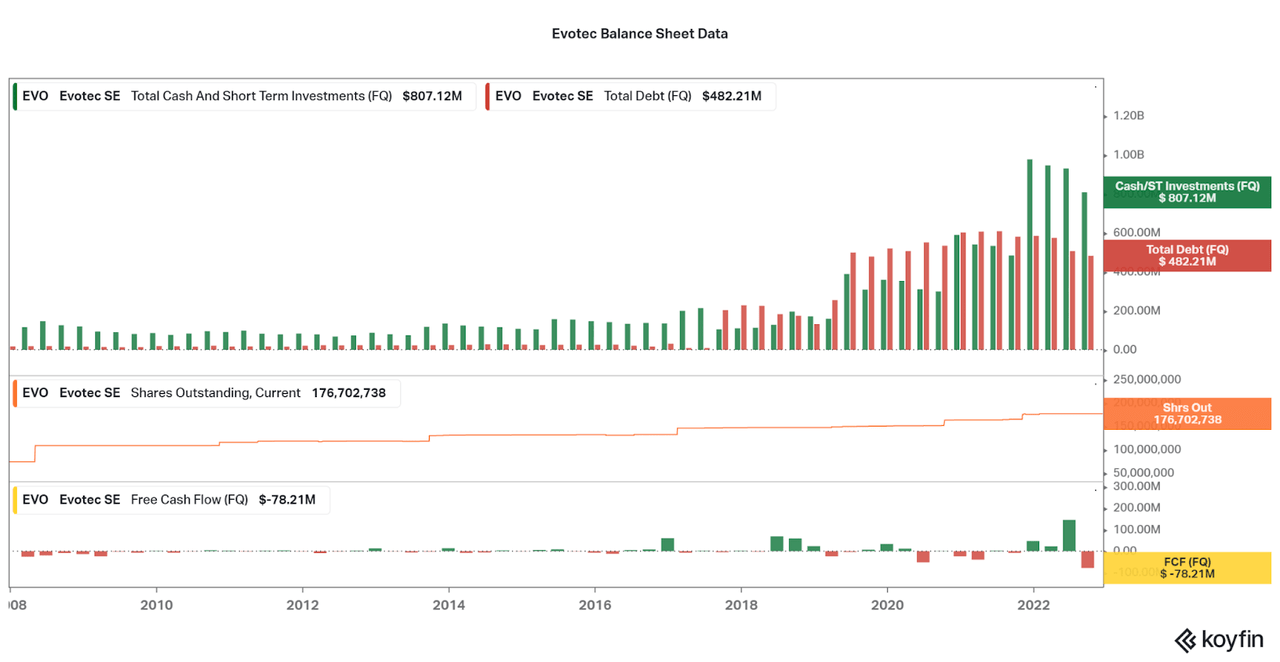

In terms of the balance sheet, Evotec paints a mixed picture. While current cash of $800 million is above current debt of $482 million, the total amount of debt is above my desired level. Thankfully, Evotec has been reducing the total debt on a quarterly basis. Unfortunately, to fund things the current cash pile dilution has been a recurring issue for at least a decade and there are no signs that this will cease. However, buybacks would be a potential catalyst for investors to look forward to once capital expenditures subside, perhaps by the back half of the decade. I also expect it may occur sooner if more frequent milestone payments allow for FCF to remain positive on a more regular basis.

Koyfin

Valuation

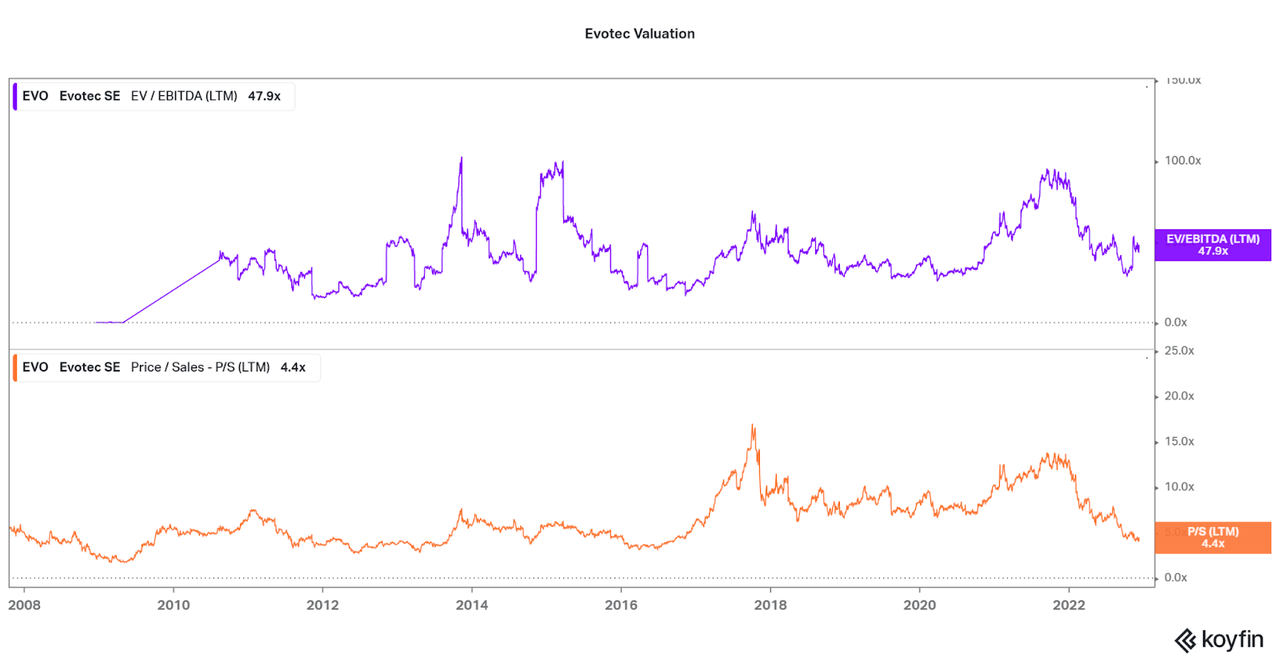

Evotec is now trading at a near-record low price to sales ratio of 4.4x. Despite this, due to the volatile earnings and rising debt, the current EV/EBITDA remains a less dependable measure of the current opportunity. Due to the risk, I look forward to seeing if the share price can fall lower over the next quarter, but I predict the upward trend may continue again in 2023. One factor to watch, and that prevents further downside for current investors, is the fact that the USD is now weakening compared to the Euro, leading to a rise in price by 5-10% with forex alone.

To further understand the discrepancy, I can also compare the valuation to other similar companies. First there is Schrodinger who trades at a 7.1x P/S and does not even have positive EBITDA. Then there is Genmab who trades at a 20x P/S and 42.7x EV/EBITDA, but has 40% EBITDA margins. There are a range of other close or secondary peers that all offer a higher P/S, apart from a few black sheep. Therefore, I believe the current valuation is appropriate for investors to take advantage of.

Koyfin

Conclusion

In my prior article, I discussed an innovative Chinese biopharma company, Zai Lab (ZLAB), who is using commercialization partnerships to drive growth and establish a global position. However, they faced higher risk due to US-China politics and a depressed valuation/increased risk. I find that Evotec has the same strong outlook and opportunity, but without the geopolitical and regulatory risks. Therefore, for those not willing to go with Zai Labs, I believe that Evotec is also a wonderful healthcare investment.

Over the next quarter, I would look to establish a position and begin long-term accumulation. While the price may go down or remain volatile, investors looking out more than a year or two will see a high probability of a positive return. Then, those in for the long haul should be able to reap the reward of lucrative royalty payments, R&D service fees and services, and all the other beneficial cash flows that Evotec is set to earn in the coming decades. In turn, we should see improving fundamentals, particularly in regards to the balance sheet, and this will drive positive effects such as buybacks, dividends, and bolt-on inorganic growth. I will be sure to update investors along the way.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment