The order battle between Boeing (BA) and Airbus (EADSF) (OTCPK:EADSY) is one way for the companies to flex their muscles, next to marketing their respective products as the best solution with the highest fuel efficiency and passenger comfort. Even though the orders (in terms of value) are in no way a reflection of financial performance, it’s important to have a look at the order inflow. That’s because the order tallies give a nice impression of which manufacturer has the best mix of discount, comfort, slot availability, and efficiency, and they give an idea of the overall health of the aircraft market and appetite for new aircraft.

Source: Pinterest

In this report, AeroAnalysis will look at the order inflow in January for both manufacturers and their role in the narrow- and wide-body markets.

Note: While this piece will be released in March, it’s important to keep in mind that this report only covers the order activity for January. Order data for a specific month always is published by manufacturers two weeks later, so that introduces a two-week delay in our schedule, but due to other factors such as February being a short month and other items worthy of analysis, this order report has slipped into March.

Overview for January

Airbus and Boeing together received 296 gross orders in January compared to 46 orders in the same month last year. You can attribute this increase to 100 single aisle jets orders by Spirit Airlines, a 103 plane order from Air Lease Corporation, and 40 orders from CALC. Looking at the division of the orders in January, Airbus is the clear winner as it booked all orders.

Source: Air Lease Corporation

During the month of January, Boeing received no orders. It’s the first time since 1962 that Boeing received no orders in the first month of the year.

The full report on Boeing’s orders and deliveries as well as conversions and customer reveals in January can be read here.

Source: Air Lease Corporation

During the month of January, Airbus received 296 orders valued at $16.2B after discounts:

- Air Senegal ordered eight Airbus A220-300s.

- Air France ordered 10 Airbus A350-900s, likely as a replacement to their Airbus A380s.

- BOC Aviation ordered 20 Airbus A320neos, likely taking over the delivery slots from Avianca.

- Cebu Pacific ordered 10 Airbus A321XLRs.

- Air Lease Corporation (ALC) ordered 50 Airbus A220-300s, 25 A321neos, 27 A321XLRs and 1 Airbus A350-900.

- Spirit Airlines finalized an order for 100 A320neo aircraft (47 A319neos, 33 A320neos and 20 A321neos). The deal was tentatively signed in October 2019.

- CALC ordered 40 Airbus A321neos.

The full report on Airbus’ orders and deliveries as well as conversions and customer reveals in January can be read here.

Overview year to date

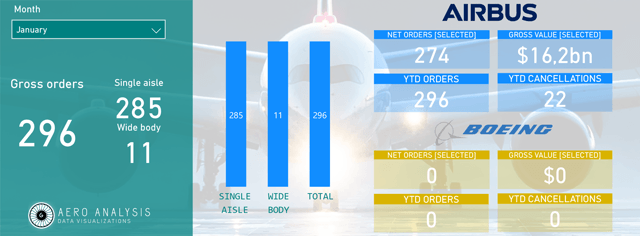

Figure 1: Infographic January 2020 (Source: AeroAnalysis)

Figure 1: Infographic January 2020 (Source: AeroAnalysis)

In January, Airbus received 296 orders and 22 cancellations, leaving the jet maker with 274 net orders for the month. Boeing received nor orders and no cancellations. Obviously, Airbus is having a promising start of the year and I wouldn’t be surprised if Airbus will significantly outperform Boeing during the year, although the US jet maker could be seeing some upward pressure when the Boeing 737 MAX is cleared for service.

Conclusion

Based on one month, we can’t draw a lot of conclusions other than Airbus having a very strong start of the year, while Boeing is still suffering the consequences of the Boeing 737 MAX crisis which could continue throughout the year. After March, I’m expecting a more definite direction for Boeing’s order book and order inflow. For Airbus, it will be interesting to see how it performs in the wide body arena as its single aisle dominance is clear.

For both jet makers, January did not yet include any impact from the COVID-19 outbreak. The longer COVID-19 stays around, the more likely it’s going to affect the order books and delivery profiles.

*Join The Aerospace Forum today and get a 15% discount*

The Aerospace Forum is the most subscribed-to service focusing on investments in the aerospace sphere, but we also share our holdings and trades outside of the aerospace industry. As a member, you will receive high-grade analysis to gain better understanding of the industry and make more rewarding investment decisions.

Disclosure: I am/we are long BA, EADSF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment