wacomka

Investment Thesis:

I have written about Curis (NASDAQ:CRIS) in the past and by own admission have been early/wrong in my assessment of the name. My original thesis (article link here) on Curis is that CA-4948 (Emavusertib) had shown good clinical benefit and that the market potential for this product particularly in a combination therapy with Imbruvica® (ibrutinib) was significant. Curis has other development products notably CI-8993 which I originally covered in this article as well as an approved drug marketed by Roche (OTCQX:RHHBY; OTCQX:RHHBF).

What changed? On April 4, 2022, the FDA placed a clinical trial hold on the TakeAim Leukemia trial for Emavusertib following the death of a patient who experienced rhabdomyolysis while on therapy. Curis also placed a hold on its TakeAim Lymphoma study for Emavusertib as a precautionary measure. The hold understandably spooked the market and the stock price dropped significantly.

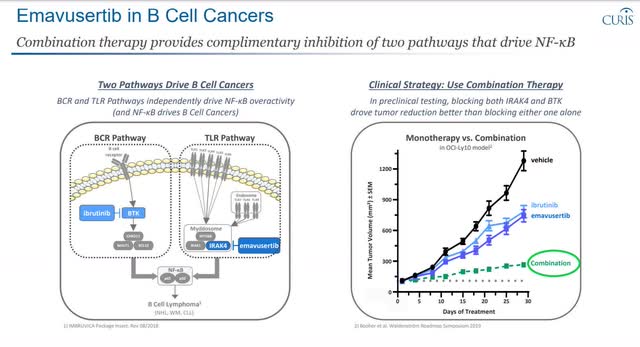

That said, at the current price point, I believe that Curis represents an asymmetric risk/reward opportunity largely skewed to the upside. In a plausible scenario where Emavusertib makes progress and is used in conjunction with Imbruvica® (ibrutinib), the upside potential is quite large (10x+, in my view). One thing to consider is that Emavusertib has shown efficacy in Lymphoma patients in combination with Imbruvica® and is thought to target a different pathway in the body. This also makes Curis a potential acquisition target for AbbVie (ABBV) or other larger drug makers.

I do not recommend this as a large relative position for an investor due to the speculative nature, however, for the risk-tolerant investor, it could add significant contribution in the upside case with the caveat that complete loss of investment is also possible.

Price Charts: The Bad, The Ugly, and The Good

The one-year price chart for Curis is abysmal (The Bad).

The 6-month price chart shows the effect of the FDA Clinical hold for Emavusertib on April 4, 2022 (The Ugly).

6 Month Price Chart (Fidelity)

Interestingly, since bottoming at $0.71 on May 24, 2022, price action and volume have been relatively bullish (The Good).

3 Month Price Chart (Fidelity)

Valuation

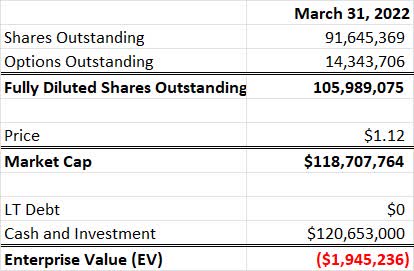

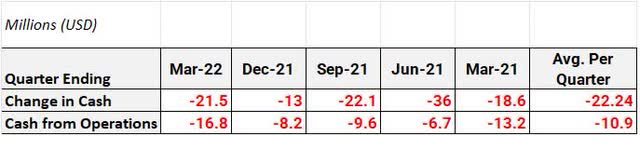

Curis valuation on a purely balance sheet basis is extremely low. As of March 31, 2022, the company’s fully diluted market cap was about $125 million and enterprise value actually reflects about +$2 million relative to the market cap (e.g. more cash the market value) which included $121 million in cash and investments. Please note there are also short-term accounts payables due that are not factored here.

Essentially, the company is trading at cash value, that said, Curis does have ongoing R&D and corporate expense and is consistently cash flow negative.

Share Count, Market Cap and EV (Author’s Calculation from publicly available data)

Since March 2021, Curis has spent ~$111 million more than they have taken in or about ~$22 million per quarter. On the Q1 Earnings call, the Curis CFO stated that they believe they have adequate cash and investments to last them into 2024.

Cash Flow Since Q1 2021 (Author’s Calculation)

For reference, here is a link to the latest 10-Q filing for Curis.

Clinical Programs for Emavusertib

The FDA hold for the TakeAim Leukemia trial that was announced on April 4, 2022 really takes center stage here. This event cratered the stock price, is a large risk but also potentially a large opportunity and a lift of the hold would almost certainly be a catalyst for the name. To compound matters, Curis also announced that it was placing a partial hold (not enrolling new patients) in its TakeAim Lymphoma study.

The reason for the hold is that a patient unfortunately died while on the study and experienced rhabdomyolysis, which is a known dose-limiting toxicity for Emavusertib.

These holds understandably caused fear amongst investors and a significant drop in the stock price (as shown in the charts above). Curis is currently limited from enrolling new patients in The TakeAim Leukemia and Lymphoma studies, however, it has continued its study with enrolled patients that are benefitting from treatment, and it published new data in June specifically on the Lymphoma study and including in combination with Imbruvica® (ibrutinib). FDA clinical hold procedures (link here) mandate a response within 30 days of submission of a complete response from the application sponsor (Curis). Curis has not been specific as to whether it has submitted a complete response but clearly this is high priority for them and head of R&D Bob Martell answered questions about it on the Q1 Earnings call on May 5, 2022. Given the importance to Curis of resolution and the 30-day timeline for FDA response, it is plausible that the hold could be resolved as early as August 2022.

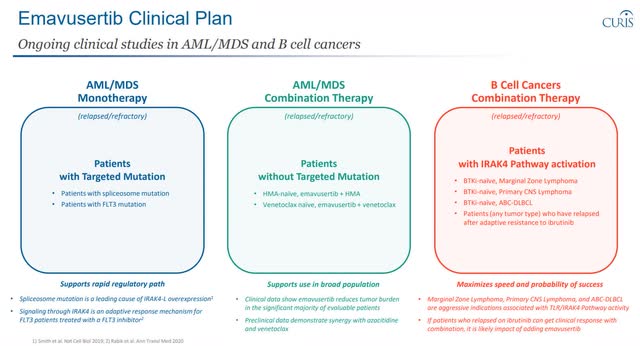

Below is an overview of the current clinical trial plans for Emavusertib and some detail on anti-cancer activity. For additional context, I covered this in some detail in these previous articles here and here.

Emavusertib Clinical Plan Emavusertbi in B Cell Cancers

Risks:

The FDA hold for Emavusertib is not lifted and trials are halted. This would make Curis uninvestable in my mind as the other pipeline products have not shown the same level of progress and the existing product is a marginal contributor. This is the key near-term risk.

Curis is unable to raise money to keep funding operations. They are cash flow negative and have relied on capital raises to meet expenses. They have stated recently that they have adequate cash and investments to last into 2024.

A competitor comes out with a more effective therapy, targeting IRAK-4 inhibition in the TLR pathway.

Given the need for funding above, further share dilution on positive clinical results is likely.

All of these are REAL risk and thus why this is speculative play.

Final Thoughts on Valuation and Investment in Curis

Curis has several projects and one marketed drug; however, the clear near-term value proposition in my mind is development of Emavusertib (formerly known as CA-4948). The recent clinical hold understandably scared investors but created a potential entry point for very risk-tolerant investors.

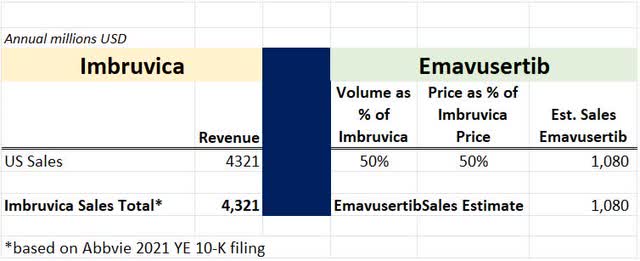

I have covered this previously, but to put the opportunity into perspective, I’ll do some simple math on only combination product with Imbruvica® (ibrutinib).

For the calendar year 2021, AbbVie reported global sales of Imbruvica® of $5.4 billion, of which $4.3 billion were in the US. So, assuming that Emavusertib shows clinical benefit in combination with Imbruvica – it appears that the synergy could be that many patients with Lymphoma unfortunately do not respond to treatment with Imbruvica, but this is difficult to know in advance. Emavusertib targets a different “pathway” and may help those patients that are not helped by Imbruvica.

Assuming value only for US sales and 50% usage relative to Imbruvica® and 50% price, the resulting product sales are shown below.

Sales Estimate (Author’s Calculation based on publicly available data)

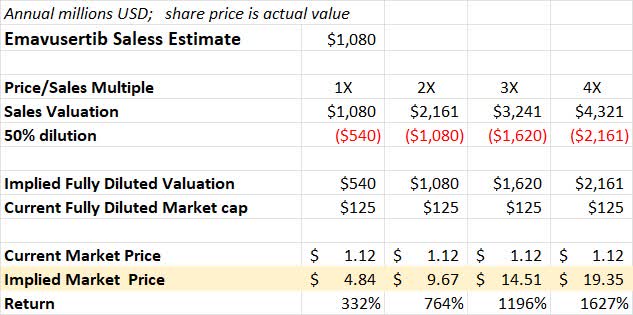

If clinical hold is lifted and Curis continues to show positive clinical results, then its share dilution is very likely, so I will assume an additional 50% share dilution as well in this model.

A simple price/sales valuation with additional 50% share dilution is shown below relative to today’s ending stock price.

Price to Sales Valuation with Share Dilution (Author’s Calculation)

As you can see from the chart above, the numbers are very compelling. That said, these numbers are, of course, wrong. This is a simplification and there are many positive and negative variables I have not considered. The share price action from early/mid-2021 on positive clinical data does give some indication of the potential. Curis could be worth many times its current share price, but it could also be worth $0 at some point, so please keep that in mind.

My Approach

Given the asymmetric risk, I have been accumulating shares of Curis on soft days (most of my current shares were purchased at ~$0.92), and barring bad news, I will accumulate on weakness. This represents a relatively small part of my overall portfolio. I welcome your comments and questions.

Be the first to comment