blackCAT

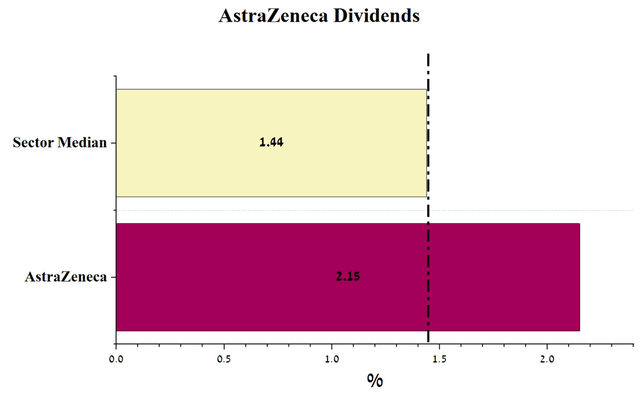

AstraZeneca (NASDAQ:AZN) is one of the most renowned global companies and a world leader in the development and commercialization of medicines aimed at combating cancer, respiratory and cardiovascular diseases. Thanks to aggressive M&A and R&A policies, AstraZeneca’s portfolio has many drugs such as Tagrisso, Calquence, Farxiga that bring in billions of dollars every year. Strong year-on-year growth in EBITDA and revenue, continued high gross margins of the business amid rising inflation, and a dividend yield of 2.15% make AstraZeneca an excellent candidate for investors with a long-term investment strategy.

Improving the financial position of AstraZeneca’s business

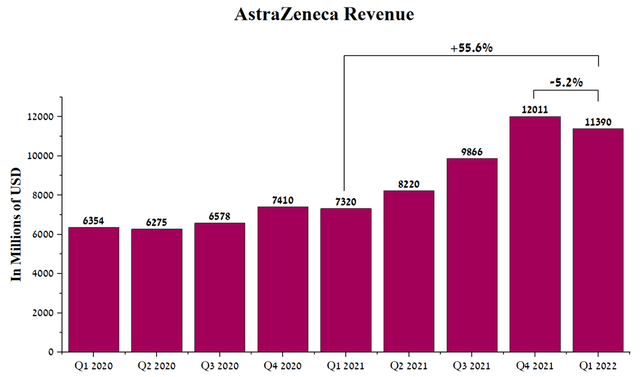

AstraZeneca’s management is successfully managing the business during the ongoing COVID-19, which has been gaining momentum in recent weeks, earning $11,390 million in Q1 2022, up 55.6% from the previous year.

Source: Author’s elaboration, based on Seeking Alpha

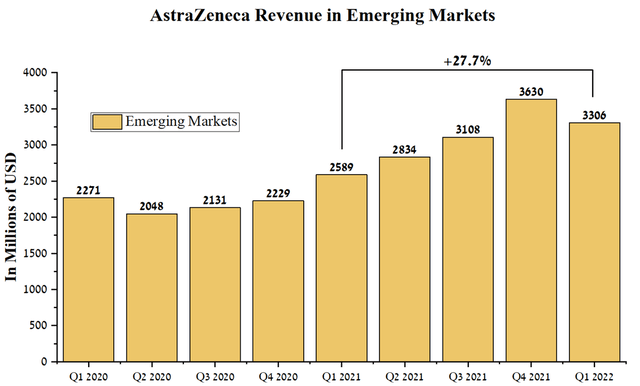

The company’s revenue continues to grow in all regions. Thus, sales of medicines and vaccines in emerging markets brought AstraZeneca $3,306 million in Q1 2022, which is 27.7% more than in Q1 2021. This increase was mainly driven by increased demand for Tagrisso in China, which is used as a first-line treatment for patients with EGFR-mutated non-small cell lung cancer. In addition, the sales of Lynparza, the world’s leading PARP inhibitor, is growing at a significant pace due to its inclusion in China’s National List of Reimbursable Drugs as a treatment for ovarian cancer patients.

Source: Author’s elaboration, based on quarterly securities reports

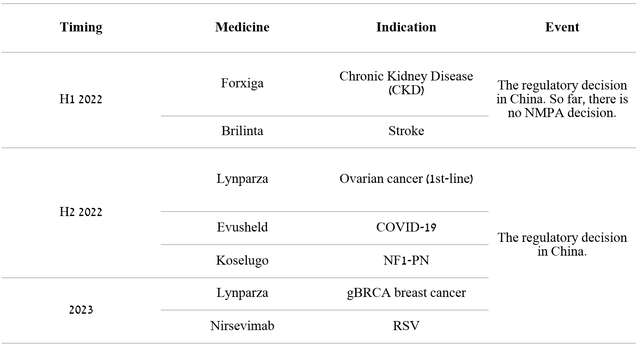

I estimate that the company’s average annual revenue growth in developing countries until 2025 will be about 18.9%, thanks to the approval of the following key drugs that can improve the quality of life of hundreds of thousands of patients in this region.

Source: Author’s elaboration, based on Form 6-K

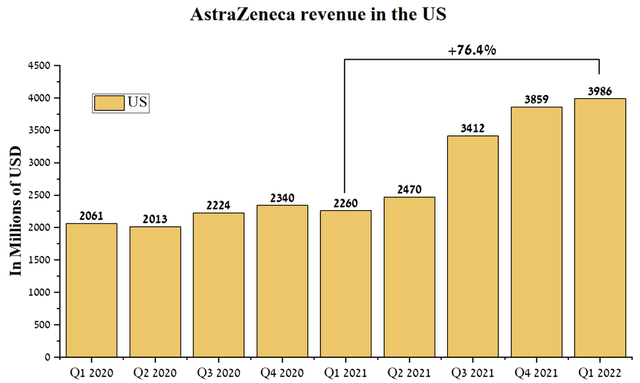

AstraZeneca’s top drug sales were in a key region for the pharmaceutical industry, the United States. The company’s revenue was $3,986 million in Q1 2022, up 76.4% from the previous year. The significant increase in revenue was driven by a variety of factors, key among them being the growth of cancer screening tests and the expansion of indications for the company’s approved medicines.

Source: Author’s elaboration, based on quarterly securities reports

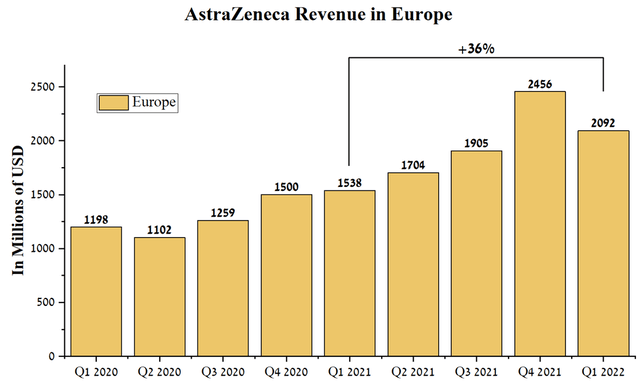

In my estimation, revenue will continue to grow in the coming years, thanks to Farxiga’s increased market share in the treatment of chronic kidney disease and heart failure. In addition, the high efficacy of the company’s nascent blockbuster Enhertu, shown in clinical studies on competitive treatments for certain types of breast and stomach cancer, is contributing to a 61% increase in sales of this drug compared to the previous year. Also, given the new wave of coronavirus, the US government is beginning to grow interest in orders for Evusheld, which is used to prevent COVID-19. I believe that demand for this medicine will continue for at least the next two quarters due to continued effectiveness in the fight against BA.4 and BA.5 variants of the virus and the presence of serious side effects in Pfizer’s (PFE) oral therapy, which were identified during clinical trials and after receiving the EUA. The third region in terms of revenue was Europe, which brought the company $2,092 million in 1Q 2022, which is 36% more than in 1Q 2021. The increase in revenue was due to favorable reimbursement decisions for Lynparza in some European countries and the successful introduction of the drug as a first-line treatment for BRCAm ovarian and prostate cancer. Despite double-digit revenue growth for the oncology and CVRM divisions, it showed a quarterly decline in sales due to lower demand for the COVID-19 vaccine, whose sales were $135 million in 1Q 2022, down 54.8% from 4Q 2021.

Source: Author’s elaboration, based on quarterly securities reports

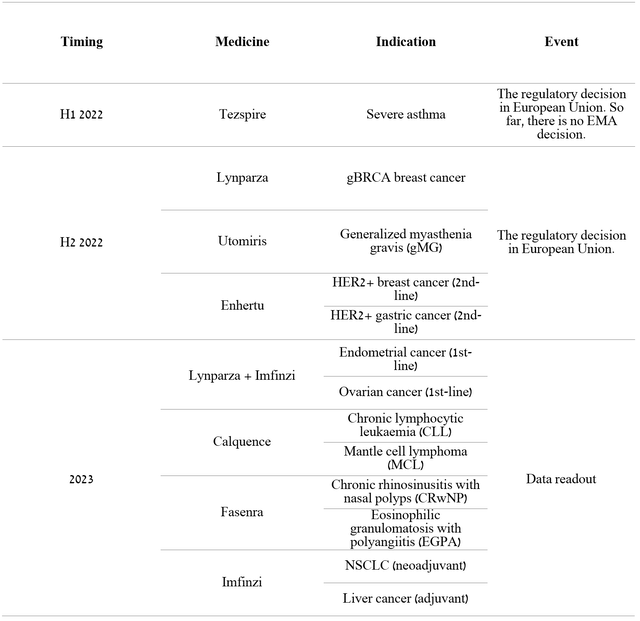

I estimate that the company’s average annual revenue growth in Europe until 2025 will be about 12.5%, driven by the expansion of the company’s drug indications in 2022 and the publication of data on the efficacy and safety of product candidates during 2023.

Source: Author’s elaboration, based on Form 6-K

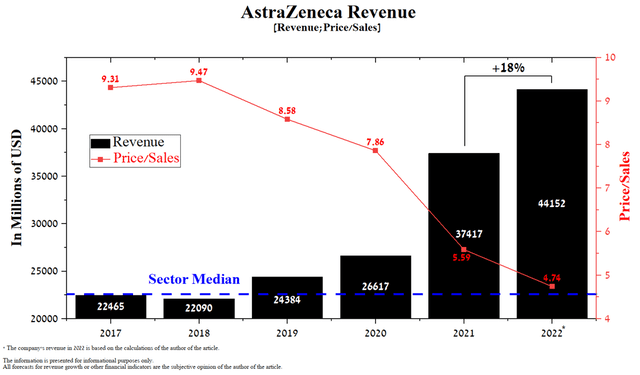

Overall, I estimate that the company’s revenue in 2022 will increase by 18% from a year earlier, which is in line with the guidance of AstraZeneca’s management, which expects revenue growth by high double-digit percentages. Despite the growth in sales of Calquence, Farxiga, and other medicines of the company, the Price/Sales ratio continues to decline year on year and stands at 4.74, which is slightly above the average for the healthcare sector. Thus, this indicates a fair evaluation of AstraZeneca by Wall Street in this indicator.

Source: Author’s elaboration, based on Seeking Alpha

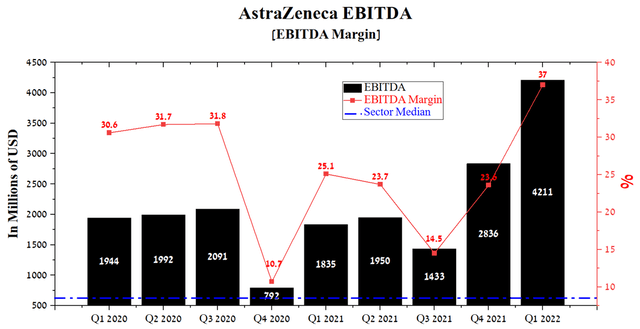

EBITDA was $4,211 million in Q1 2022, up 129.5% QoQ. This indicator continues to improve quarter on quarter, mainly due to increased sales of patent medicines for the treatment of cardiovascular, renal, and metabolic diseases.

Source: Author’s elaboration, based on Seeking Alpha

Despite a significant increase in inflation in the European Union and the United States, AstraZeneca’s EBITDA margin remains one of the highest among global pharmaceutical companies, which stood at 37% at the end of Q1 2022, up 13.4% quarter-on-quarter, indicating an efficient business model built under the direction of Pascal Soriot.

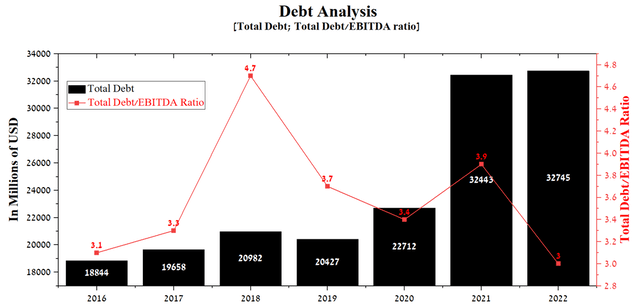

AstraZeneca debt

At the end of July 2021, AstraZeneca closed the largest $39 billion acquisition of Alexion in years, which pushed the company’s debt to a record high by funding the deal with $17.5 billion in bank loans. This brings total debt to $32,745 million in Q1 2022, slightly more than the previous quarter. However, due to the growth in the business margin, AstraZeneca’s Total Debt/EBITDA ratio continues to decline and was 3 at the end of Q1 2022, which indicates the presence of insignificant risks associated with the company’s debt.

Source: Author’s elaboration, based on Seeking Alpha

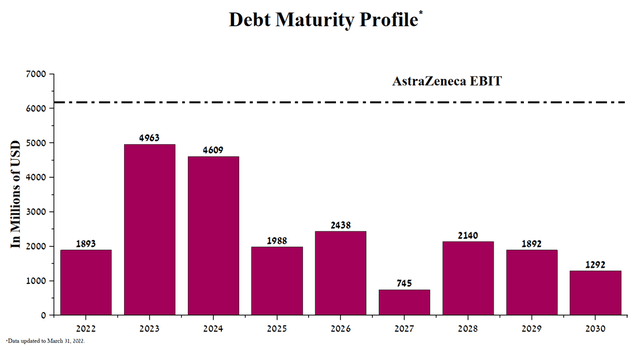

At the end of March 2022, the company’s maturity profile until 2030 is as follows.

Source: Author’s elaboration, based on 20-F

Although EBIT exceeds maturity in all years, there is a risk that AstraZeneca’s management will have to partly spend the company’s cash, which is about $5.8 billion, or partly refinance senior bonds maturing in 2023-2024.

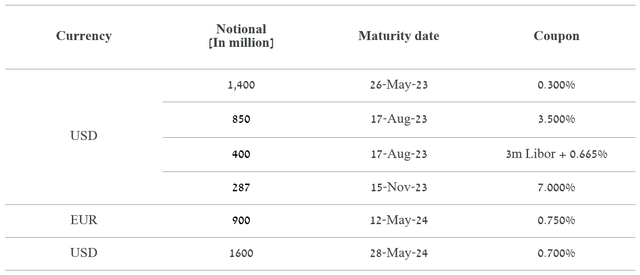

Source: Author’s elaboration, based on 20-F

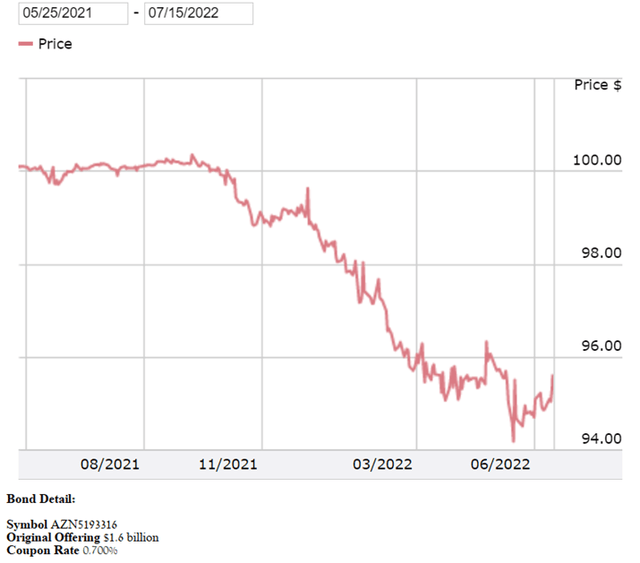

In my estimation, it is unlikely that AstraZeneca’s management will have to approach the holders of these bonds to refinance part of these liabilities. However, even if such a need arises, the company will not have any difficulties with this because most senior notes are traded below face value and are not volatile. For example, a $1.6 billion senior bond maturing May 28, 2024, is trading below par at $95.09 per bond on July 15, 2022, with price movements less than $2 in recent months.

Source: FINRA Bond Center

In addition, the bonds with a maturity date of up to 2024, except for one issue, have a constant coupon and, as a result, the Fed and ECB rate hikes will have a minimal impact on AstraZeneca’s financial position.

AstraZeneca Dividends and Buyback Program

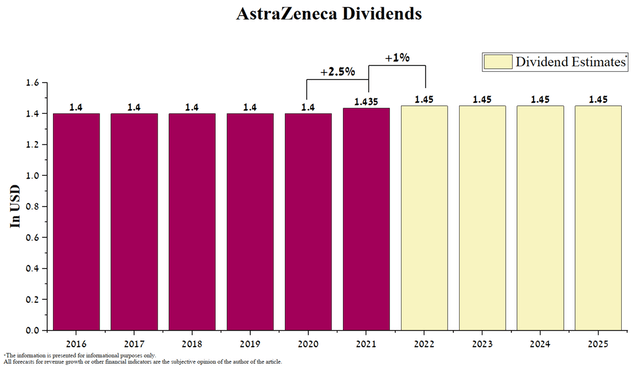

Thanks to a significant increase in the company’s revenue over the past two years, this contributed to the growth of dividend payments for the first time since 2010. Under AstraZeneca’s new dividend policy, holders of the company’s American depositary shares should receive $1.45 per ADS in 2022, up 1% from a year earlier.

Source: Created by author

The company’s dividend yield of 2.15% is above the sector average, despite the high R&D spending needed to develop next-generation drugs.

Source: Author’s elaboration, based on Seeking Alpha

In my opinion, the company’s management will not increase dividend payments in the next four years due to the need to repay the debt and reduce the risks associated with the macroeconomic situation in the world. In addition, it is highly likely that AstraZeneca will not start resuming its share buyback policy, which was suspended in 2013. I believe that this is the right decision, as the company’s shares continue to grow without additional stimulation, but due to the strategically correct actions of the CEO of the company. Thus, it shows the effectiveness of business management, which attracts investment interest from institutional investors.

Technical Analysis of AstraZeneca

Despite the high volatility in the market and the negative macroeconomic situation in the world, the company’s shares are above the 200 EMA, which is a signal that AstraZeneca shares remain bullish. On the daily chart, we see that after the end of the impulse wave ①, the wave ② was started, formed by the correction pattern “Running Flat”. As a result of the price movement of the company’s shares in this pattern, a gap was formed in the range of $69-70.4 per ADS, which has not yet been closed. This is pushing AstraZeneca’s share price higher ahead of the quarterly report, which I estimate should beat Wall Street analysts’ expectations. On June 14, wave ③ began, which, according to the Elliott wave theory, cannot be the shortest, and thus, after closing the gap and completing the corrective movement to the support level in the range of $62-63, I expect the continuation of the impulse wave to my target price of $92 per share.

Source: N_Aisenstadt — TradingView

Conclusion

AstraZeneca is one of the world’s most prominent global companies whose cancer, immunological and other medicines delivered about $6.3 billion in operating income in 2021, up 37.5% from a year earlier. With the acquisition of Alexion in 2021 and revenue growth in recent years, AstraZeneca’s portfolio has many next-generation product candidates that could strengthen the company’s leadership position in numerous therapeutic areas. On the other hand, several of the company’s blockbusters may lose their exclusivity in the 2027-2030 period, which encourages AstraZeneca’s management to pursue an aggressive R&A policy, leading to increased expenses and volatility in recent quarters. However, thanks to the growth in net income, dividend yield, and a significant expansion of the company’s portfolio of product candidates that outperform competitors, AstraZeneca is an excellent candidate for long-term investors.

Be the first to comment