@canada_by_alexis/iStock via Getty Images

If you are a longer-term holder of Cedar Fair (FUN), you likely feel as if you have just stepped off the above swing ride after the last few years. After nearly a decade of nice and steady returns, COVID fired up extreme volatility in the company’s stock and seemingly threatened its entire existence.

In this article, I will go over why I believe the COVID chapter can now be closed at Cedar Fair and why I believe the business is both recession and inflation resistant. In addition, the restart of the distribution can provide a catalyst for a return to relative normal at the company in the near future.

Overview

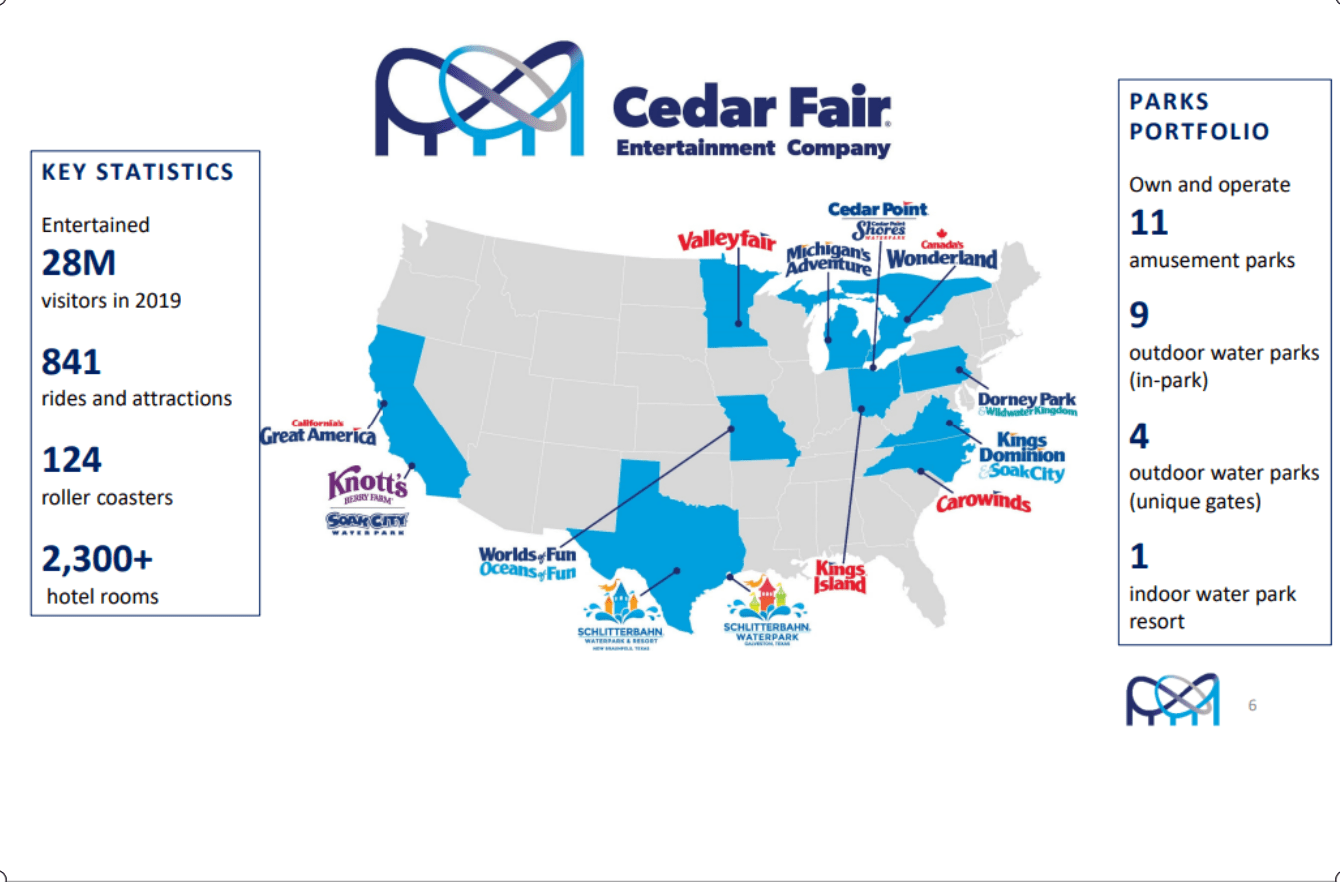

Cedar Fair, if you are unfamiliar, operates one of the largest portfolios of amusement and water parks in the United States. The company structures its parks as regional attractions, attempting to draw crowds from a 300-400 mile radius. As you can see, the company owns and operates parks from coast to coast, along with Canada Wonderland, which is just outside Toronto.

Cedar Fair

The company, as you would expect, was a severe victim of the COVID shutdowns and restrictions imposed on nearly all operators once the pandemic began in March of 2020. Cedar Fair lost the entire operating season for basically all of its assets in the first year of the pandemic, going from $1.47 billion in revenue during 2019, to only $181 million for fiscal year 2020.

The timing of the pandemic was quite unfortunate for the company as in July of 2019, literally just before it started, Cedar Fair acquired the Schlitterbahn water parks in Texas for $261 million in cash and decided to purchase outright, the land which holds California Great America Amusement Park outside San Francisco for $150 million. Talk about bad luck.

As soon as the pandemic, along with the government’s reaction, became clear in March of 2020, the company immediately went into what can only be described as turtle mode. It was lights out across all parks, nationwide.

During this time, the company proactively issued nearly $1.3 billion in debt and suspended any distributions in order to remain a viable enterprise and to provide an adequate cash cushion for a prolonged shutdown. This was truly scary times for investors in the business.

Debt

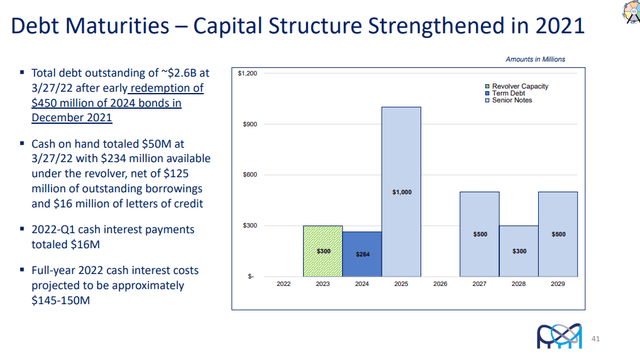

Thankfully, as the world began to reopen in 2021, it became clear that the company was on the road to recovery. By the end of the year, the company had generated over 90% of the revenue it earned in 2019 along with paying off a whopping $926 million of the debt taken on during the COVID shutdown.

The company still does have some work to do if the goal is to end the year at a $2 billion net debt level, however, it does appear that the debt maturity profile is not nearly as daunting as you may assume.

In what I believe may be a very underappreciated move announced in late June, the company executed a sale leaseback of its California Great America park to Prologis (PLD), generating proceeds of $310 million, along with retaining the option of continuing to operate the park for up to 11 years.

Cedar Fair intends to use proceeds from the land sale transaction to continue to reduce debt to achieve its $2 billion net debt target, to invest in high-return projects within its portfolio such as upgrading resort properties, and reinstating a sustainable unitholder distribution as early as Q3 of 2022.

Please remember that the company purchased the land it just sold for $310 million, for only $150 million in 2019, more than doubling its investment in only 3 years’ time. In addition, the company now can focus on squeezing out every last drop of profit from this park over the next 11 years with very minimal CAPEX requirements.

This was a very savvy move by the company in my opinion and builds my confidence even further in stating that Cedar Fair has a best-in-class management team behind the wheel.

Recession and Inflation

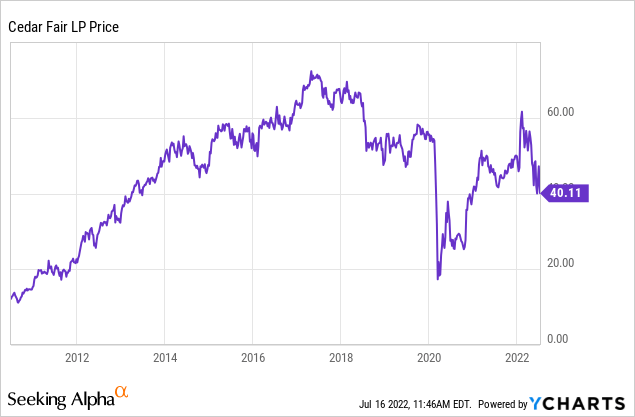

Shares of Cedar Fair, so far in 2022, have been hammered since reaching a high of $62.56 in mid-February, sliding over 35% to the current $40.11 price. Substantially all of this drop can be accounted for by recession and inflation worries in the market and for the leisure industry as a whole.

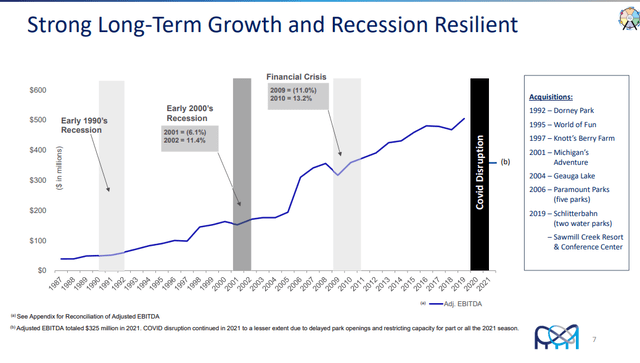

While these worries make logical sense in theory, the actual business results seem so show a remarkably different story when looking at historical, traditional recessions.

As you can see from the above slide, the company has performed remarkably well during prior recessions and even growing Adj. EBITDA during the recession in the early 1990s. The 2000 recession and the 2008-09 financial crisis did have a negative effect on company results, however, in both cases the company recovered all of its losses and then some in the subsequent year of operation.

Regarding inflation, the company operates what is likely one of the most inflation resistant models available. Cedar Fair can literally adjust prices charged for admission, food and lodging by the day if need be. This kind of pricing power is rather unique among industries and allows the company to track and react to cost pressures immediately.

The real inflation threat comes in the form of demand destruction; however, the company does not appear to be seeing much of that lately as its parks are packed and in park per-capita spending so far in 2022 is $59.52, well ahead of the $46.13 achieved in 2019. Even if demand destruction does occur, history tells us that it is likely to be extremely short lived.

Regional amusement parks have a natural advantage during tougher economic times as the vast majority of guest can simply hop in the car and have a nice family day at a Cedar Fair park and avoid the Airfare and second mortgage required to visit a national park like Disney World (DIS).

Valuation and Distribution

In looking for reliable valuation information of Cedar Fair, we are forced to both look into the future and to look at pre-COVID earnings as the years of 2020 and 2021 are frankly not at all useful given the unique disruption the company faced during this time period.

The company is forecast to earn $4.09 in 2022, giving shares a forward PE of 9.81, well below the historical 16.33 PE ratio average from 2011 to 2019. In fact, the current forward PE is the lowest valuation assigned to Cedar Fair since 2012.

As you can see, had you purchased shares in 2012, you would have been in nearly on the ground floor of an epic bull run, taking shares from $23 all the way up to $72.10 five short years later. This run in shares, does not even include the distributions you would have collected along the way, which would have been substantial. $16.90 per share to be exact.

The distribution is a key part of holding shares in Cedar Fair as the company is a master limited partnership, which means that the income generated is passed through to unitholders by way of a K-1. Generally, the cash distribution is treated as a return of capital. I am not your accountant, so your tax consequences can and will vary, however to some, myself included, this can be advantageous.

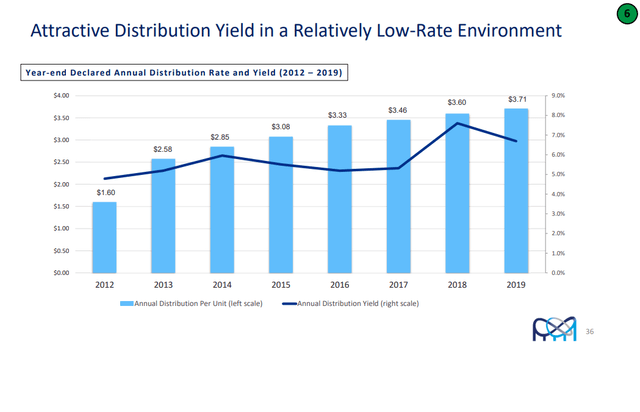

Prior to the COVID disruption, the company had an annual distribution of $3.71, which means at the end of 2019, the company yielded roughly 6.7%.

Now, this $3.71 distribution of 2019 is unlikely to return immediately, however, the company has stated that the distribution will be reinstated in Q3 of 2022 as they now feel comfortable that they can achieve the debt reduction required on an accelerated timetable.

I am looking forward to further clarity on the plan going forward, however it would appear based on the verbiage of “sustainable distribution” in the most recent press release, that the company is likely to start small. My guess is around $.25 per quarter, with the payout ramping up substantially over the next few years, perhaps reaching or exceeding 2019 levels by 2025.

More clarity on this issue will be coming soon and I fully expect that the distribution will become once again, a large and very attractive portion of the total return generated in the shares.

Bottom Line

Neither a recession nor continued inflation scares me in any real way from Cedar Fair. The company has a long operating history in environments such as this and has always emerged stronger and more valuable in the process.

The stock market may not agree and is likely to punish all leisure companies in the event of a severe recession or continued inflation, however, as a long-term investor, I invest for the actual business results, not the immediate popularity contest that is short term returns.

The company is showing first hand just how powerful their cash generation potential is during this time period and with the return of the distribution just around the corner, in my opinion, long-term investors are getting a heck of a bargain at the current price. I plan to continue to add to my position at current levels.

Be the first to comment