cagkansayin/iStock via Getty Images

Stock markets will be closed this coming Monday, marking the first time that US financial institutions will shut down in honor of Juneteenth. Many investors will no doubt appreciate the extra day of peace and quiet after a week of seemingly unrelenting turbulence, and the chance to think ahead as to what may lie in store. One of the near-term events likely to have an impact on sentiment is earnings season for the second quarter, which will get under way in the first half of July. This is likely to reveal much about how inflation, consumer sentiment and growth prospects are reverberating in the executive C-suite.

Double Tailwind For The P/E Ratio

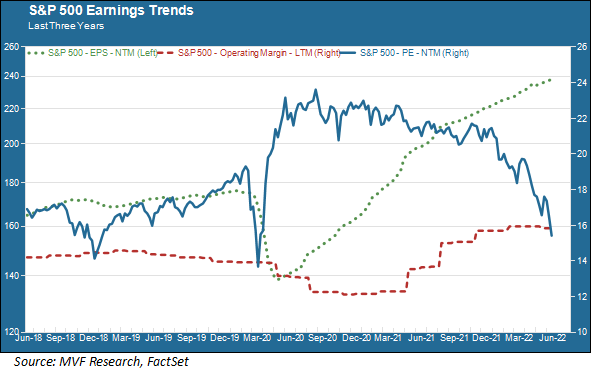

The chart below shows the next twelve months (NTM) P/E ratio along with the earnings per share forecast (green dotted line) and the trailing twelve months (i.e., actual reported) operating margin (crimson dotted line) for S&P 500 companies. There is a lot going on in this chart, and we’ll explain it all below.

The chart shows that the forward P/E ratio has come down considerably, from just under 24 in late 2020 to 15.4 times today. By this measure, stocks are quite a bit cheaper today than they were then – in fact, they are at levels last seen in 2018. But are they cheap enough to suggest a turnaround in sentiment from negative to positive? That’s where it gets tricky.

Let’s do a quick refresher on P/E math. The numerator – stock prices – is clearly lower because of what has taken place in the market so far in 2022. But while prices have been coming down, earnings forecasts – the denominator – have continued to rise (see the trend for the green dotted line). So the P/E has fallen both because of falling share prices and because of rising earnings estimates. It would be great if those rosy earnings estimates would continue indefinitely. There is good reason, though, to think they won’t.

Margins Matter

Profit margins are what everyone will be focusing on with laser-like intensity in the upcoming earnings season. In the above chart, the crimson dotted line shows that operating margins (i.e., operating profits as a percentage of sales) have risen steadily since the pandemic and remain well above their levels in 2018 and 2019. What does this mean? It means that even while dealing with sharp increases in virtually every category of input costs – from raw materials to freight and other logistics costs to labor – companies have been able to more than offset those cost increases by raising their selling prices. If you dig into the profit composition of many companies, you will see that they are selling fewer units – for a variety of reasons, including disrupted supply chains – but that the unit price at which they are selling is high enough to more than compensate for the lower volumes. As a result, profit margins have remained resilient.

Sentiment Sours

That resiliency is fragile. Last Friday, while all the attention was focused on the higher-than-expected inflation shown in the Consumer Price Index report, another data point came out courtesy of the University of Michigan Survey of Consumers, an index of consumer sentiment and expectations. This index fell to its lowest recorded value, comparable to the level at the bottom of the 1980 recession. Inflation, it would seem, is now firmly fixed in the minds of US households. That in turn suggests that consumer spending habits are likely to change, with some discretionary categories getting tossed out entirely while families economize on their weekly staples of food, clothing and transport.

It’s not entirely clear how much of this change in consumer sentiment is going to show up in the reported numbers as companies discuss their second quarter results. But it is very likely to show up in their forward guidance. As of today, the FactSet analyst consensus for full year 2022 is for earnings per share to grow by more than ten percent. We would frankly be surprised if that estimate is still standing when the Q2 earnings season concludes.

Better Here Than There

The good news is that, as dour as things may look in terms of the current market environment, the US economy still appears to be in vastly better shape than others around the world. The Eurozone has its own set of problems, which we will be discussing in more detail in forthcoming commentaries. China is still stuck in a problem of its own making with the government’s refusal to back off from the unrealistic zero-tolerance policy for Covid. It cannot be any fun to be a resident of Shanghai these days.

Those problems do affect us indirectly, but they have a more direct impact on their own citizens. On a relative basis, we expect the US economy to be better equipped to navigate the current troubled seas. Eventually, that means we should expect to come out stronger.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment