ivanastar

By Valuentum Analysts.

Lowe’s Companies, Inc. (NYSE:LOW) is a Dividend Aristocrat that has fundamentally transformed its business during the past several years. This strategy involved the firm rationalizing its non-U.S. operations and placing a great emphasis on bolstering its omni-channel selling capabilities. On the digital and e-commerce front, Lowe’s is firing on all cylinders, which supports the company’s long-term outlook, in our view. Lowe’s updated its store format to better enable Pro customers to find related products quickly, among other things.

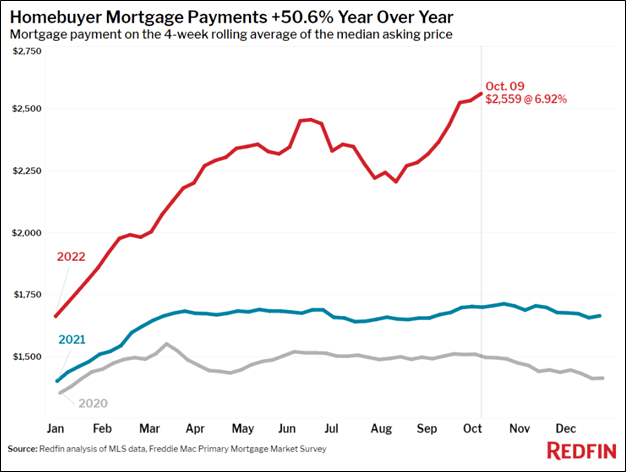

So far, Lowe’s restructuring program has yielded meaningful results with room for additional upside. We expect Lowe’s will continue to grow its dividend going forward, but we note that there are risks on the horizon. Its financial performance still depends in part on the stability of the housing, residential construction, and home improvement markets. The outlook for new home construction activity in the U.S. has weakened significantly of late, and this is something that investors will have to keep a close eye on.

Homebuyer mortgage payments on new homes have increased more than 50% since last year due to rising interest rates. We think this is a precursor to lower housing prices, which could have implications across the banking and financials sector. (Redfin)

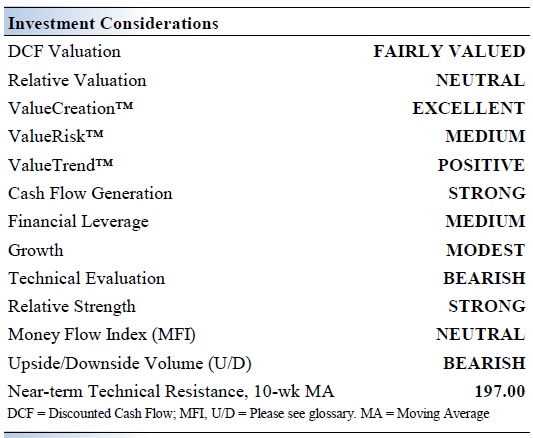

With that risk clearly noted, let’s take a closer look at Lowe’s key investment considerations and derive a fair value estimate for shares.

Lowe’s Key Investment Considerations

Image Source: Valuentum

Lowe’s is the world’s second largest home improvement retailer. It operates 1,700+ stores in the U.S. The company strives to be its customer’s first choice for home improvement. Lowe’s generates almost all of its revenues in the U.S. and will sell its Canadian retail business to Sycamore Partners for $400. It was founded in 1946.

Lowe’s is a fantastic company, and its e-commerce operations continue to impress. Though the new residential construction market looks to be ominous in the near term, the long-term outlook for new home construction activity in the U.S. is incredibly bright (given demographics), and Lowe’s is in a prime position to capitalize on that upside going forward.

In fiscal 2018-2019, Lowe’s launched a major restructuring program that saw the firm close underperforming stores and exit Mexico. This program has already started to yield significant cost savings, which is helping offset sizable inflationary headwinds seen of late. Lowe’s views its total addressable market standing at ~$900 billion.

Lowe’s places a great emphasis on constantly improving the customer experience to grow its sales over the long haul. By updating its store format to make it easier for Pro customers to quickly find related products, Lowe’s aims to grow sales to its Pro customers by twice the market rate going forward. The firm is focused on improving its e-commerce operations as investing in its omni-channel selling capabilities remains a top priority. That includes shifting from a store delivery model to a vendor delivery model by 2023.

Lowe’s third-quarter results, released August 17, were mixed. Revenue growth faced a bit of pressure on a year-over-year basis as its Do-It-Yourself business was impacted by lower demand in certain discretionary categories and a “shortened spring.” Earnings per share, however, advanced nicely on a year-over-year basis in the quarter thanks to a focus on productivity initiatives. During the third quarter, Lowe’s spent $4 billion in buybacks, as it paid $524 million in dividends.

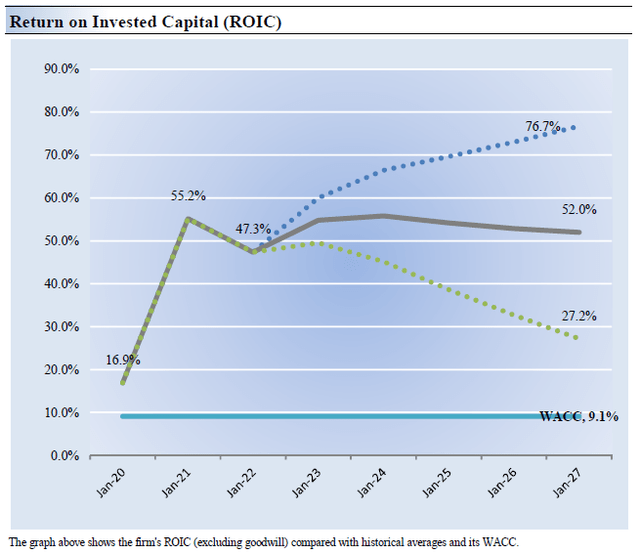

Lowe’s Economic Profit Analysis

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [ROIC] with its weighted average cost of capital [WACC]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Lowe’s 3-year historical return on invested capital (without goodwill) is 39.8%, which is above the estimate of its cost of capital of 9.1%.

As such, we assign the firm a ValueCreation rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. A focus on improving ROIC gives Lowe’s an attractive Economic Castle rating.

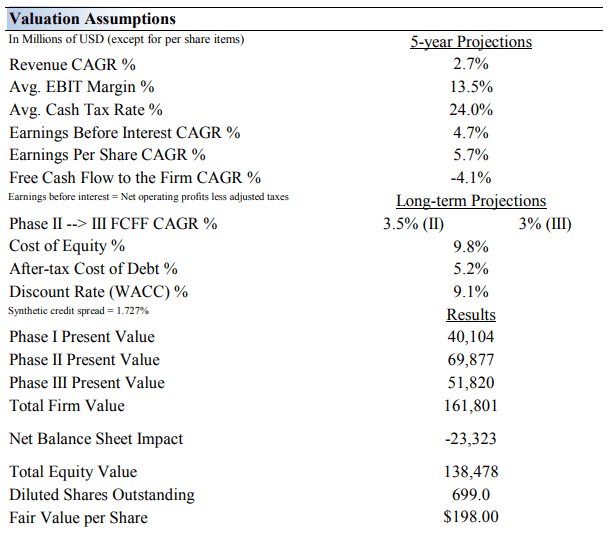

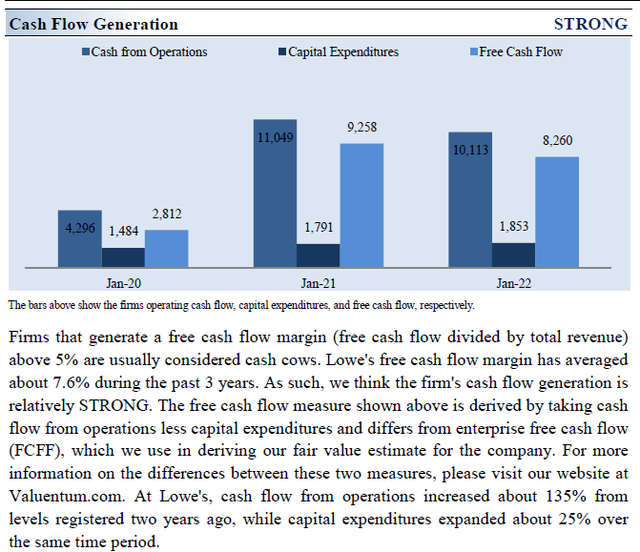

Lowe’s Cash Flow Valuation Analysis

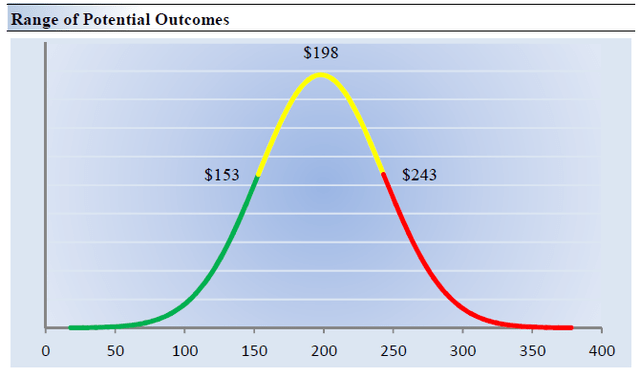

We think Lowe’s is worth $198 per share with a fair value range of $153-$243. At ~$209 each, shares are trading about in line with our fair value estimate at the time of this writing. The margin of safety around our fair value estimate is driven by the firm’s MEDIUM ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our enterprise valuation approach reflects a compound annual revenue growth rate of 2.7% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 10.5%.

Our valuation model reflects a 5-year projected average operating margin of 13.5%, which is above Lowe’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 3.5% for the next 15 years and 3% in perpetuity. For Lowe’s, we use a 9.1% weighted average cost of capital to discount future free cash flows.

Valuation Assumptions (Valuentum)

Lowe’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate the Lowe’s fair value at about $198 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk™ rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Lowe’s. We think the firm is attractive below $153 per share (the green line), but quite expensive above $243 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Lowe’s remains a great generator of free cash flow and its past restructuring efforts have gone a long way in improving its cash flow outlook. We expect Lowe’s will continue to grow its payout at a brisk pace going forward. The Dividend Aristocrat remains committed to rewarding income seeking shareholders, and we do not expect that to change anytime soon as Lowe’s continues to grow its e-commerce business. Shares yield ~2%.

The biggest threat to the long-term dividend health of Lowe’s is its balance sheet as its large net debt load weighs negatively on its Dividend Cushion ratio. Additionally, share repurchases compete for capital against the company’s dividend payout. We can’t ignore competition from the likes of Home Depot (HD), nor can we ignore the substantially weakening new residential construction market.

Our fair value estimate for Lowe’s is slightly below where shares are trading at the moment, but we like its long-term outlook and view its intrinsic value as resilient.

Be the first to comment