wellesenterprises/iStock Editorial via Getty Images

Time will take your money, but money won’t buy time.

-James Taylor

To put it mildly, 2022 has not been a banner year for stock market investors. The Federal Reserve has raised rates over 400 bps in their battle to bring down runaway inflation, and the market is down about 20% for the year as of my writing this. However, after 10+ years of zero interest rates, many consumers are unaccustomed to earning interest on their savings, and banks aren’t exactly calling them to let them know. So even though banks can earn about 5% annually on cash, most consumers are either lazy or unaware of the fact that they could earn more than 0%. The Wall Street Journal calls this the “$42 Billion Question”, in reference to how much money consumers are leaving on the table. To this point, 2023 could be set up to be nirvana for bank earnings as the Fed helps net interest income for banks by continuing its rate-hiking campaign, while consumers’ unusually large cash cushion and home equity going into the recession effectively preempts fears of widespread defaults. A lot of bank stocks look good here, but I particularly like Truist Financial (NYSE:TFC) because of its relative unpopularity with investors, low valuation, and 5% dividend yield. Truist is a great value stock, offering a way to stay ahead of inflation by being patient and simply letting time pass. While James Taylor was right that money can’t buy you time, let’s prove him wrong that time will take your money!

Truist Financial Is Low-Key And Unloved

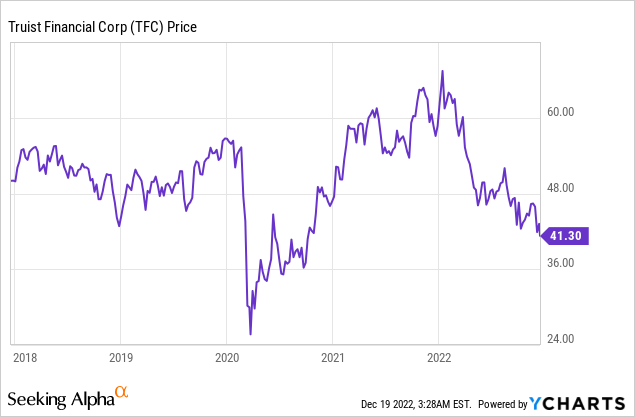

TFC stock hasn’t done much over the last five years. Despite being one of the 10 biggest commercial banks in America by assets, the company is more low-key than many of its peers. Formerly known as BB&T, the North Carolina-based company was formed by the merger of BB&T and Florida-based SunTrust in 2019.

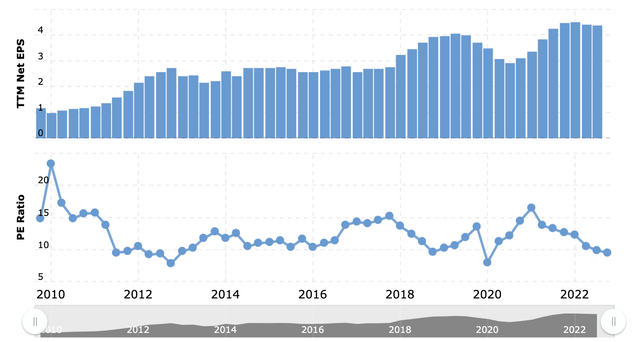

Anytime a stock is sideways or down over a 5-year period, the next thing you should check is the financial statements to see how the business has done. In Truist’s case, its financial statements show that net income is not down, and in fact, EPS has grown nicely over the past five years, from $2.78 in 2017 to $4.40 in the trailing four quarters. What has happened is that the company has gotten cheaper, offering better compensation to new investors than those who bought five years ago.

Truist Financial PE Ratio/EPS (Macrotrends)

Five years ago, TFC traded for about 15x earnings, but now you can scoop it up for 7.9x 2023 earnings estimates of $5.26. The market sometimes takes stocks from typical PE ranges to value stock territory without a corresponding decrease in the business. When it does, you should buy! That’s why it’s important to look at financial statements, to separate value stocks from value traps! I did this manually, but there are also stock screening tools like F.A.S.T. graphs that are perennially popular with Seeking Alpha readers and authors.

Why No Love From Mr. Market For TFC Stock?

So why else would the market dislike Truist even though the numbers are solid? What are the risks? One reason is that the argument could be made that they previously overpromised a bit to investors and underdelivered. Truist has had a hard time integrating the massive SunTrust mergers in the past few years (granted, they closed the SunTrust merger right before COVID, which couldn’t have helped), and the company’s share count has nearly doubled over the past five years. I think these issues are manageable going forward. Truist made the biggest merger of the post-2008 world, and while it didn’t go perfectly, it certainly wasn’t a failure either.

Truist’s position today isn’t too different from CVS Health (CVS) in 2021, which had made several large acquisitions that took time to integrate and pay for. CVS borrowed heavily to finance the buyouts and had a lot of fed-up shareholders. But if you were late to the party, you could buy the stock incredibly cheap. Both CVS and Truist had to push through big pay increases for employees in the post-COVID environment, with CVS getting a lot of press for raising its minimum wage to $15 per hour due to its massive payroll. Truist recently raised their minimum wage to $22 per hour, $1 higher than cross-town rival Bank of America’s planned raise for workers. At the same time, Truist has closed over 800 branches as part of its integration with SunTrust, taking its branch count to about 2100 vs. a total of about 2900 after the merger. None of this should shock you – it’s really hard to get people in the US to work as bank tellers for 40 hours per week when you’re paying $15 per hour. And at the same time, online banking technology has reduced the number of branches that banks need. Truist has other headaches to deal with like integrating data centers, but I think they’ll sort it out with time.

While I will be first to acknowledge that Truist is imperfect and unloved, the stock is too cheap for just having a bit of acne. TFC has growth prospects due to buybacks, M&A costs going away, and plain-old good demographics from being located mainly in the Southeastern US. With the SunTrust integration about to be in the rearview mirror, TFC can take the initiative back by buying back stock, funding small, accretive acquisitions, and investing to grow the business organically. With expectations now dramatically lower for the stock than in prior years, I think Truist can now turn around and outperform them.

Truist Has a Solid Risk/Reward

First and foremost, you’re getting a lot of compensation as an investor for allocating capital to TFC. Moreover, this is really easy to quantify, in the way that getting 14.5 points for betting on a college football underdog is. If you buy TFC shares now, you’re immediately entitled to a nearly 5.1% dividend yield. To this point, if the earnings estimates for 2023 are more or less correct, then the company is paying out less than half of its earnings in dividends, leaving room for them to employ buybacks and invest in the business.

Let’s make fairly conservative assumptions here about Truist’s ability to grow in the future and handicap future returns. 7.9x earnings is an earnings yield of 12.7%, and 4% profit growth going forward (just matching nominal GDP) gets you a total return of 16.7% annually. As far as dividend growth stocks go, that’s extremely high. Popular dividend growth stocks like Coca-Cola (KO) and Johnson & Johnson (JNJ) will be lucky if they do 6% annual returns going forward. Of course, returns could be far higher if the market revalues TFC to a higher multiple, in that case maybe you could double your money and sell. I generally don’t count multiple expansion when analyzing stocks though, multiple expansion is unreliable and hard to predict, and can blind you from investing in the right opportunities.

Financial stocks in general look strong going into 2023. The same arguments I’m making for Truist can be made for stocks like:

- Bank of America (BAC) with a 2.8% yield and a 8.7x forward PE

- Morgan Stanley (MS) with a 3.6% yield, 11.7 forward PE, great acquisition-driven growth prospects, and they own Etrade.

- M&T Bank (MTB), 3.4% yield, 7.3x PE, and down 17% in the last month for no discernible reason.

These are by no means a complete list of all the good bank stocks investors can buy. The financial sector at large is very fertile ground for stock picking in 2023. The stocks I would avoid in the financial sector are big auto lenders like Ally Financial (ALLY), those who are known for doing more on the subprime side, like Capital One (COF), and fintech companies, like Bread Financial (BFH), Affirm (AFRM), and Upstart (UPST).

I’ll also issue a small warning. In recent years you’ve needed to be a lot more careful blindly using sector ETFs than you did 10 years ago, what happened was that the market value of tech became so big compared to other sectors that they moved overvalued tech and SAAS companies into other sectors to create the illusion of diversification. I think this is pure garbage, but the index providers are moving a lot of finance-adjacent tech companies into the financial sector, and moving HR software companies to the industrial sector, for example. This means if you go buy the financial index, you might accidentally be getting a bunch of junky fintech companies that will drag down your returns. Index changes are part of investing, but a lot of questionable stuff has happened with indexes in the past couple of years, such as the Moderna (MRNA) and Tesla (TSLA) S&P 500 inclusions at the peak of the hype around both stocks.

Bottom Line

The financial sector currently offers plenty of stocks with healthy dividend yields trading at 10x earnings or less. With the Fed determined to keep rates high to combat inflation, and consumer cash hoards blunting the impact of the looming recession, I think 2023 could be a banner year for bank profits. I like Truist because of its 5% yield, lack of popularity with investors leading to a low valuation, and the ability to outperform low investor expectations going forward. For these reasons, I’m naming TFC my top stock pick for 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment