Andranik Hakobyan/iStock via Getty Images

Subscription Business models are all around us, from Amazon Prime to Netflix, Peloton to Starbucks. The subscription economy is exploding and growth is expected to continue at an 18% compounded annual growth rate up until 2025, when the market is forecasted to be worth a staggering $1.5 trillion.

Subscription services are the perfect business model, as they lock in repeat custom, easy upsells and a higher average order value. They are also great for consumers as you can get premium services for $10/month as opposed to having to pay thousands of dollars upfront. Thus, it’s no surprise that Subscription models are widely adopted by SaaS business models which can use the model to scale fast and take advantage of their high operating leverage.

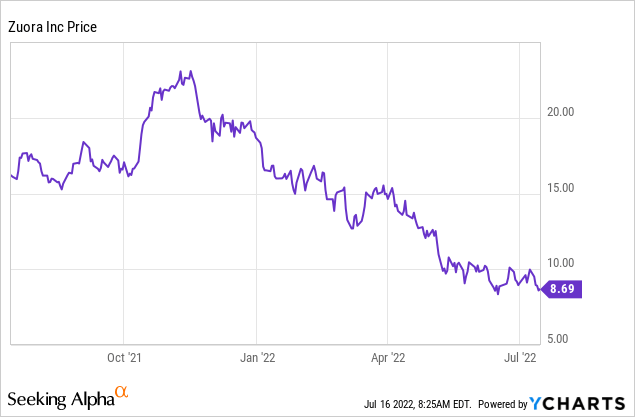

In this post, I’m going to dive into Zuora (NYSE:ZUO), a leading platform which helps to power the “subscription economy”. The founder and CEO even wrote the book on the subject called “Subscribed”. The stock price has been slaughtered since the high inflation numbers were released in November 2021 and is now down 61% from these levels. According to my valuation model, the stock is now undervalued with tailwinds ahead. Let’s dive into the Business Model, Financials, and valuation for the juicy details.

The Backbone of the Subscription Economy

Zuora was founded in 2007 and is a true pioneer of the subscription economy. The company has developed a cloud-based software platform which enables other companies to setup their own advanced subscription business easily. Its major customers include 25 of the Fortune 100 and 12 of the top 15 auto manufacturers. Popular customer names include: Microsoft, GM, Ford, NVIDIA, Zoom, Unity, Trip Advisor, Sony, Siemens and many more.

Zuora Customers (Zuora Website)

You can think of Zuora as the “subscription platform behind subscription platforms“. This is a beautiful business model, as subscription models are a growing industry and the customers for them are inherently “sticky”.

Traditional enterprise software systems manage their “quote to revenue” process via legacy software built for one time billing and payments. This means if they don’t change, they will be losing out on many benefits mentioned prior for both the business and customer. But this is not just a simple “Pay in instalments” payment solution, Zuora provides a range of solutions which are capable of handling complex multi-product streams, these include:

- Zuora Central Platform

- Zuora Billing

- Zuora Revenue

- Zuora Collect

Zuora Platform (Zuora website)

Its platform enables customer data to be analyzed and new insights to be unlocked. This is done by answering business questions such as:

- Which customers are bringing in the most recurring revenue?

- Which Segment has the highest churn?

- What is the lifetime value of our customer?

These insights enable a granular approach to running a subscription business. The platforms flexibility also rapid pricing changes to be done based on time, outcome, or usage. Historically such granular control has been very difficult to implement and monitor using legacy approaches.

The alternative to Zuora usually involves cobbled together software, where each new change has to be hardcoded in, which takes time and money for skilled labor.

Zuora Platform 1 (Zuora Investor presentation)

The Zuora platform is an enterprises dream as it enables faster time to market, greater efficiency, and more control. The platform also has an “Ecosystem” advantage thanks to its 50+ connectors which enable direct integration with Customer Relationship Management (CRM) platforms such as Salesforce. In addition to connection to tax vendors, Enterprise Resource Planning (ERP) software and much more.

It’s 35 pre-built payment gateways also enable faster international expansion for businesses and support for over 150 currencies.

Founder-Led Company

One of the key tenants of my investment strategy is to invest into companies which are “Founder Led” and their CEO’s have “Skin in the Game”. In this case, Tien Tzuo is a former executive from Salesforce who founded the company in 2007. At the time of he has “Skin in the Game” with a 6% ownership of the company, which equates to approximately $67 million. The rest of the management team are also very experienced with former executives from Adobe and Microsoft.

The CEO has been a true pioneer of the Subscription Economy and his vision is ‘‘The World Subscribed’’, is an idea that one day every company will be part of the Subscription Economy.

Financials

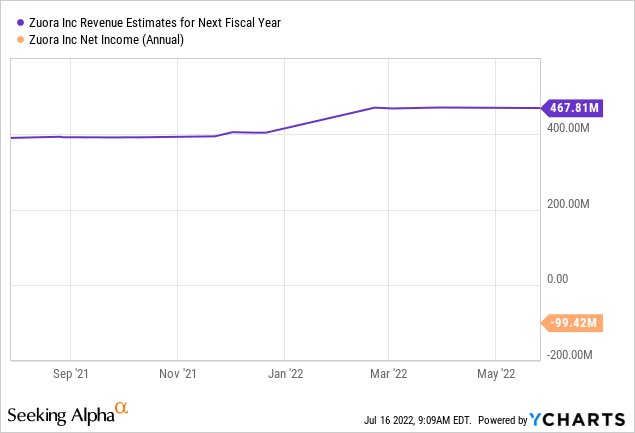

Zuora generated strong financials for the first quarter of 2022. Revenue was $93.2 million, up 16% year over year and above Wall Street expectations of 15% growth. This revenue growth rate was also up from the 15% rate seen in the fourth quarter of 2022.

Annual recurring Revenue (ARR) came in at $326 million, up a rapid 20% year over year. The company also closed some mammoth deals in Q1, these include six with an Average contract value (ACV) of $500k+ and two with an ACV of $1 million+.

Zuora also increased it’s super high net revenue retention rate to 110%, up from 103% in the year prior. This means customers are staying with the platform and spending more. The company’s partner strategy showed strong momentum and influenced approximately 70% of new transactions, according to the CEO.

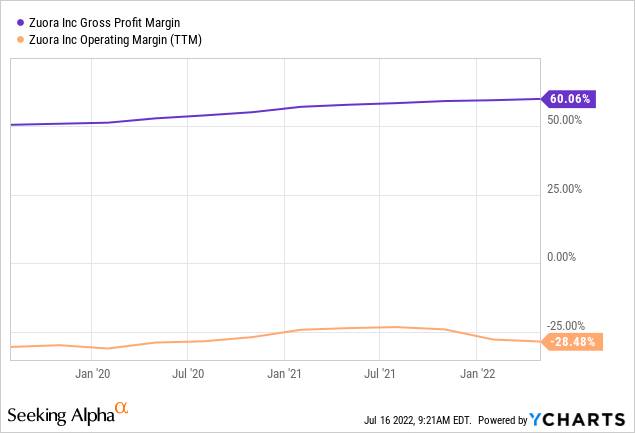

The company is still operating at a loss, as they invest heavily into R&D, Sales, and Marketing. The good news is it’s “Pro Forma” operating margin rose by three point to breakeven vs -3% in the year ago quarter. The pro forma gross margin also increased to 67%, which is a positive sign.

Unlevered Free Cash Flow was $29.9 million in the quarter, up 45% from $20.5 million in the prior year. The company has a fortress balance sheet with $452 million in cash and short term investments and just $259 million in total debt.

Advanced Valuation

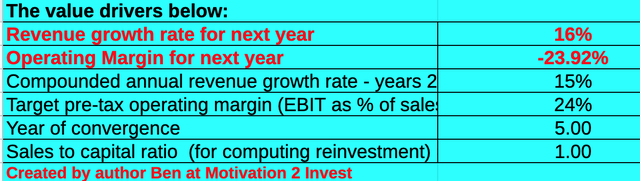

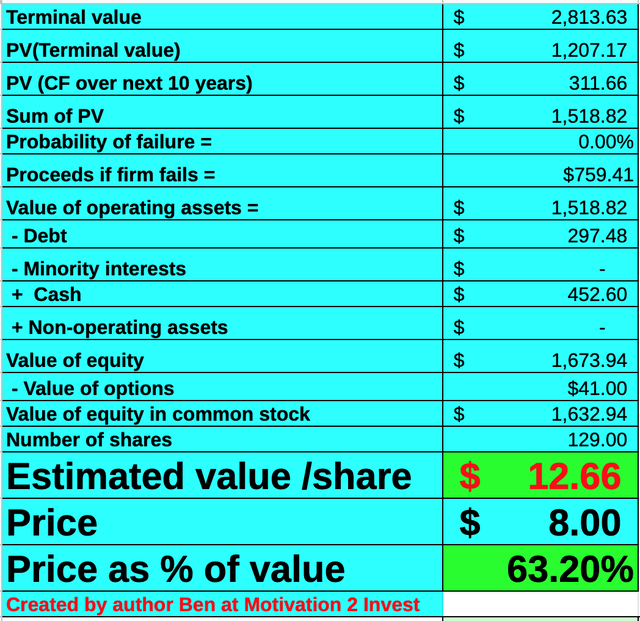

In order to value Zuora, I have plugged the latest financials into my valuation model, which uses the discounted cash flow method of valuation. I forecasted 16% revenue growth for next year and 15% for the next 2 to 5 years.

Zuora stock valuation (created by author Ben at Motivation 2 invest)

In addition, I have forecasted the companies partner strategy to continue with strong momentum and margins to reach 24% in 5 years, which is the average of the software industry. I have also capitalised R&D expenses and stock based compensation to increase the accuracy.

Zuora Stock Valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $12.66 per share, which means the stock is 36.8% undervalued at the time of writing which offers a significant margin of safety.

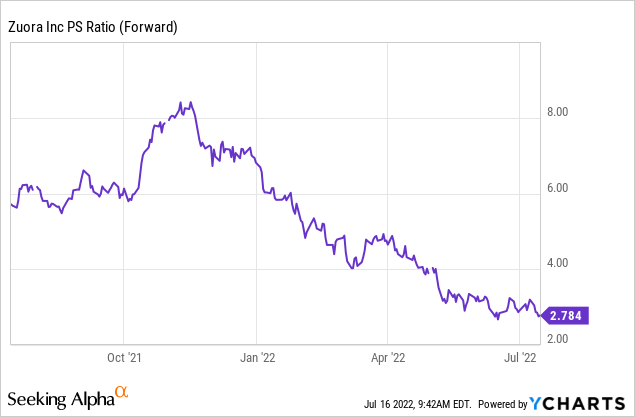

As an extra data point, it also should be noted that Zuora trades at a Price to Sales (Forward) ratio = 2.78, which is significantly cheaper than it’s five year average of ~5.5.

Risk

Competition

Zuora offers a great value proposition to enterprises but it’s clear they are not the only game in town. Many other companies have developed their own subscription solutions (Amazon for example) and do not require the Zuora software. For small businesses there are plenty of very cheap options, I’ve personally used before such as (WooCommerce Subscriptions or Chargify) and thus the Zuora solution would be overkill. However, if an enterprise is going through a “Digital transformation” and wish for an advanced out of the box solution then Zuora is extremely appealing.

Final Thoughts

Zuora is a tremendous company which is truly powered the “Subscription Economy”. The company has an elite list of enterprise customers with high retention which is testament to its gold standard solution. Management’s partner strategy is performing well, and the company has beat estimates for revenue. The stock is undervalued relative to historic multiples and intrinsically and thus looks to be a great long-term investment. As we may be entering a “Recession”, I would expect some short-term volatility as investors may be caution about a temporary cut back in IT spending. But for those businesses with a long-term vision, creating a subscription model is very enticing.

Be the first to comment