Ekaterina79/iStock Editorial via Getty Images

Investment thesis

Shimano’s (OTCPK:SHMDF) shares have corrected 38% since their peak in September 2021. Despite what appears to be a stable long-term outlook for this global market leader of bicycle components, we believe short-term challenges stemming from a cooling market and limited global scope for discretionary consumer spending dampen earnings visibility. Current valuations appear fair in our view and we rate the shares as neutral.

Quick primer

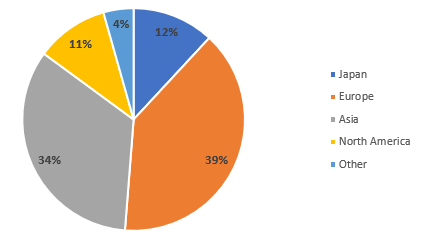

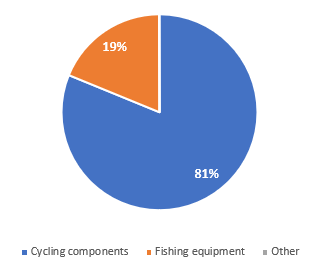

Established in 1921 in Sakai City in Japan, Shimano is the global market leader in cycling components with an estimated 70% share in the mid to high-end market. The largest geographic market is Europe making up approximately 40% of total FY12/2021 sales. Shimano is also active in manufacturing fishing equipment such as rods and reels, and rowing equipment. It has 13,000 employees and President Taizo Shimano is a member of the founding family. Manufacturing is based in Japan, China, Singapore, Malaysia, and the Philippines. Its single largest customer in FY12/2021 was Germany’s bike parts specialists Paul Lange & Co. Other customers include Taiwan’s Merida Industry (9914.TW) and Giant Manufacturing (9921.TW). Key peers are SRAM of the US, Campagnolo of Italy, Yamaha Motor (OTCPK:YAMHF), and Bridgestone (OTCPK:BRDCY).

Sales split by geography (FY12/2021)

Sales split by geography (Company)

Sales split by segment (FY12/2021)

Sales split by segment (FY12/2021) (Company)

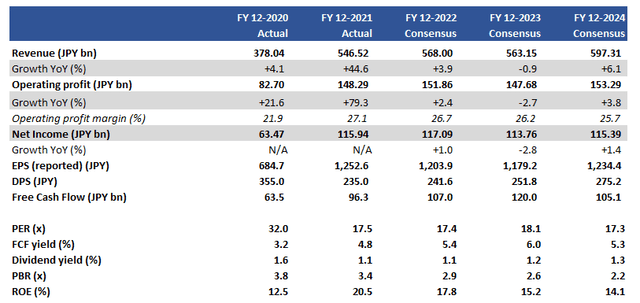

Key financials including consensus estimates

Key financials including consensus estimates (Company, Refinitiv)

Our objectives

Shimano saw very strong performance in FY12/2021, driven by pent-up demand for outdoor activity products as restrictions were lifted worldwide. Although the company experienced some supply chain issues, it expanded its manufacturing capacity in Singapore and at two domestic factories. The shares peaked in September 2021 and have corrected 38% since then – we would like to see whether the shares are a buy.

The longer-term secular theme

The global bicycle market is expected to grow around 3% to 4% YoY in the medium, driven by a multitude of factors such as clean transport, a shift away from congested public transit, promotion of health and exercise, and an uptick in more outdoor leisure activity. In essence, the market pie is not expected to grow that significantly, although there are pockets where growth is anticipated to be higher (in China for example). But what makes Shimano an attractive business is its 50-year track record as the dominant market leader, its strong brand, and the environmental credentials of its products.

There appears to be limited scope for Shimano to expand into the electric motor vehicle market. e-Scooters and similar modes of transport do not usually need gears, and EVs parts are dominated by conventional auto parts manufacturers. However, Shimano has its e-bike components although it is currently not a major part of their business.

We believe investors can look forward to a relatively stable earnings outlook with Shimano, delivering high operating margins and generating stable free cash flow. The key questions, therefore, appear to be more to do with the outlook in the short term and valuations.

Market cooling post-pandemic

After a strong FY12/2021, it may come as no surprise that Shimano talked about cooling conditions in Q1 FY12/2022 results. It would appear that the levels of demand seen last year are unsustainable. There are also new headwinds to contend with, such as falling consumer sentiment in Europe due to the war in Ukraine and consumer discretionary spending under pressure with high inflation. Shimano has commented that high-end product demand remained high, whilst demand seems to cool down most in Asia (including Japan) and Central and South America.

With current global consumer spending patterns not in a healthy state, we do not expect trading conditions to improve as the year progresses. This line of thinking appears to be reflected in consensus estimates (see Key Financials above) which are below company guidance for the current financial year (JPY151.86 million consensus operating profit versus JPY161 billion guidance). Although this is not a wide margin (about 6% lower), it highlights the sense of direction for earnings in the short term.

With the shares visibly correcting since autumn 2021, we believe a lot of the current negatives are priced into the stock. The shares are not as ‘hyped’ as they were a year ago, although there are uncertainties over rising input costs with a strong dollar. We now take a look at valuations to see whether the shares are cheap.

Valuation

On current consensus estimates the shares are trading on PER FY12/2023 18.1x and a free cash flow yield of 6.0%. For a dominant and profitable global market leader, we believe valuations are decent but not significantly undervalued. The dividend yield of 1.2% is not particularly high with a limited payout ratio, which is disappointing considering the large net cash pile of JPY360 billion/USD2.7 billion (around 20% of total market capitalization). Historically, share buybacks have not been a consistent element of Shimano’s shareholder returns policy.

Risks

Upside risk comes from a sudden uptick in demand for bicycle components demand. This stems from a major economic recovery on a global scale, resulting in a resurgence in consumer discretionary spending.

Although the theme of ESG investing is now well-publicized, Shimano fits the bill in terms of its environmental credentials and could be seen as an attractive home for such investors.

Downside risk comes from a continued deceleration in demand for the next 2-3 years, as consumers begin to cut back spending on leisure activities. There is also the strong dollar resulting in input cost inflation, pressuring margins despite the weakening yen favoring export sales.

Conclusion

There is no doubt that Shimano is a high-quality company with a solid market position and a sustainable long-term growth theme. However, we do not believe the shares are undervalued sufficiently to invest – the shares have corrected but perhaps valuations were previously too excessive with unrealistic expectations. We would prefer to invest in the shares around PER 15x or lower, and hence rate the shares as neutral.

Be the first to comment