Joe Raedle

It’s been one year since Block, Inc. (NYSE:SQ) officially changed its name from “Square” with the move meant to highlight the company’s focus on new technologies including opportunities in blockchain. In hindsight, that decision suffered from poor timing, coinciding with the peak of Bitcoin (BTC-USD) prices and “crypto-mania” last year. Indeed, 2022 has been defined by a market reckoning with shares of SQ losing more than 55% amid the shifting macro environment with a growth slowdown.

On the other hand, what may be getting lost in the narrative is the positive earnings momentum in the core payments business and Cash App ecosystem. We see value in the stock considering the reset of valuation with an expectation that growth can re-accelerate. The crypto exposure has been a crutch although the potential that the sector stabilizes would also add a boost to financials going forward. We are bullish and see SQ as a winner in 2023.

SQ Key Metrics

Our best explanation to describe Block’s stock price performance this year is simply that the results over the last few quarters failed to live up to what was likely some exuberance at the end of 2021. The first point here is that while firm-wide growth is positive, Bitcoin activity has been a drag on the results, as it still represents nearly 60% of the top line. The poor sentiment toward crypto overall has hit SQ.

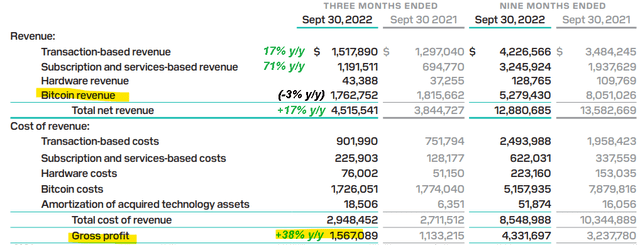

The company last reported its Q3 earnings in November with total revenue of $4.5 billion, up 17% year-over-year, or an even more impressive 36% excluding Bitcoin. Again, the figures here are in sharp contrast to trends in 2020 and 2021 where revenues nearly doubled in both those years. In other words, SQ stock is down more than 75% from its all-time high reflecting a moderation in its growth outlook.

Favorably, the -3% y/y drop in Bitcoin revenue in Q3 slowed from the -35% decline in Q2. Beyond some impairment charges to the carrying value of Block’s direct Bitcoin investments, that side of the business can still be described as relatively stable.

source: company IR

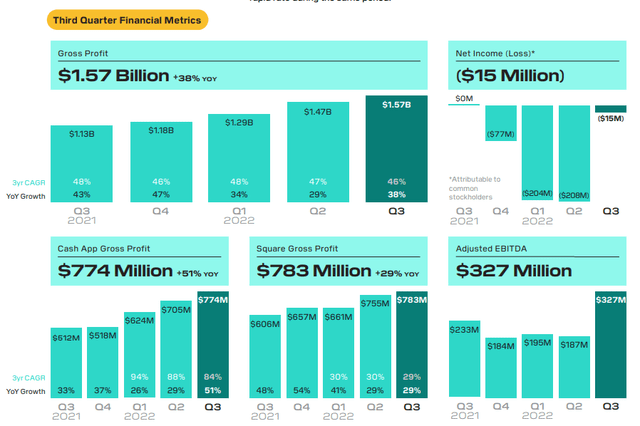

The bigger story we want to highlight is that the underlying earnings continue to climb with a gross profit of $1.6 billion up 38% year over year. The adjusted EBITDA of $327 million is also an increase from $233 million in Q3 2021, which was in an environment where Bitcoin was trading significantly higher. The momentum now has been driven by more traditional transaction and payment activity, particularly in the Square and Cash App segments.

source: company IR

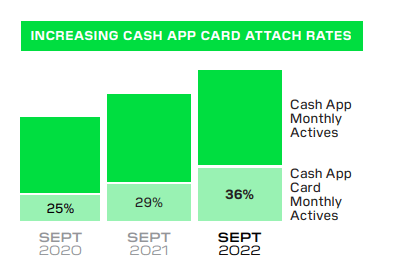

Management notes that Cash App now counts on 49 million active users, up 20% y/y in Q3 with the pace of daily and weekly activity even stronger. The company is capturing higher real money deposits as an alternative form of banking for many customers. Within the platform, a major theme is an expansion into broader financial services including through the Cash App Card where 18 million monthly active users were up 36% y/y.

The indication is that these trends have accelerated compared to 2021 signaling a growth runway with an expectation that this cohort of users expands their banking activities in the future into more services.

source: company IR

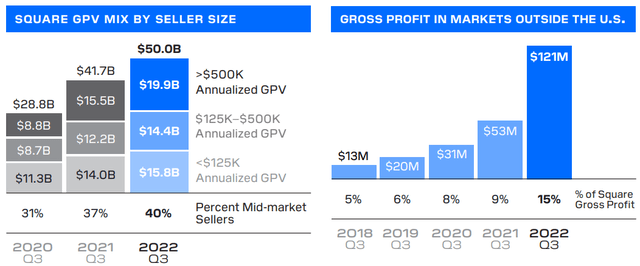

Let’s not forget the traditional Square ecosystem and merchant services, which generated $1.8 billion in revenue in Q3, up 27% year over year. The company has found success in the subscription options as a growth driver while also seeing momentum in mid and large-size businesses compared to its historical concentration in small vendors. Square gross payment volume (GPV) specifically at $50 billion in Q3, was up 20% y/y, supported by an expansion of services like buy-now-pay-later and seller loans.

Finally, we can bring up the company’s international expansion as another tailwind. The firm-wide gross profit from business outside the U.S. now represents 15% of the total, up from 9% in the period last year. It’s also worth mentioning that Block maintains a rock-solid balance sheet, ending the quarter with a net cash position of nearly $1 billion.

source: company IR

What’s Next For SQ?

Part of the challenge for Block is this apparent identity crisis or at least the perception of such. With the name change, the company is now forever tied to the blockchain and crypto which has nearly become an expletive this year amid the myriad of scandals in the sector.

Curiously, “Bitcoin” was only mentioned a single time in the Q3 conference call, down from eight times in Q1 at the start of the year, and seventeen times at the cycle peak in Q3 2021. Our interpretation is that while Bitcoin and the related on-platform trading activity are still very important to Block, the company wants investors to look beyond that exposure.

From us, we’re bullish on Bitcoin and there is a case to be made that Block will ultimately benefit as the broader crypto sector consolidates. For a segment of customers, storing BTC on the Cash App looks to be a much better option compared to some fly-by-night startups or other unregulated exchanges.

Digging through the financials, it’s encouraging to see that the number of Bitcoins held for customers at 26k at the end of Q3 was actually up compared to 23k at the end of 2021. In a scenario where BTC can regain bullish momentum by climbing above $25k, for example, Block is well-positioned to ride alongside that wave as an incremental growth driver.

Taking a step back, the real value in the company right now is its operating and financial momentum in the Cash App financial services driven by peer-to-peer transfers and the otherwise “boring” Square ecosystem. Here the trends will be more closely related to macro dynamics including the strength of consumer spending over the coming years.

There is some concern about the potential for a pending recession that would be defined by a surge in unemployment, and this backdrop would most certainly impact demand for Cash App and Square services as a new drag on the business. We don’t agree with that view and instead see the potential that economic conditions improve which would likely add upside to the earnings trend. Signs inflation is trending lower and the Fed will pare back to the pace of rate hikes have improved the outlook.

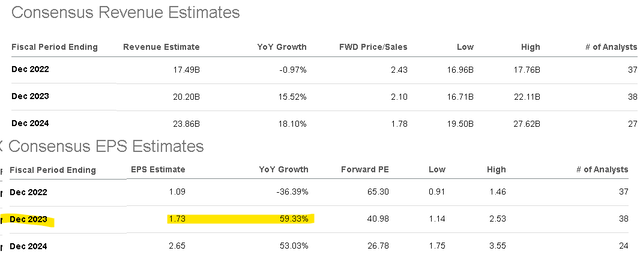

According to the consensus, the market is forecasting 2022 EPS of $1.09, which represents a decline of -36% from 2021, based in large part on the Bitcoin impact. Looking ahead, the market sees EPS rebounding toward $1.73 in 2023, which compares to $1.71 in the company’s record 2021. We’ll take the over on these figures and see room for revenue to outperform expectations with risks tilted to the upside.

Seeking Alpha

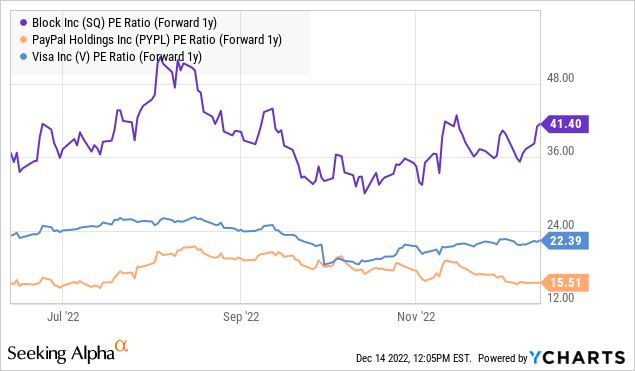

As it relates to valuation, a 1-year forward P/E of 41x on the 2023 consensus EPS or 27x for fiscal 2024 estimates is compelling, in our opinion, for a company where earnings are expected to more than double over the next two years.

SQ trades at a premium to names like PayPal Holdings, Inc. (PYPL) with a 1-year forward P/E of 22x and payments giant Visa Inc. (V) at 16x on this metric, but we sense that the spread is justified given the company’s higher earnings momentum. We can also say that exposure to Bitcoin provides some optionality where the upside can be significant with an optimistic view of the sector.

SQ Stock Price Forecast

We rate SQ as a buy with an initial year-ahead price target of $115. The way we get there is by forecasting EPS of $2.25 for next year which is towards the upper end of current consensus estimates across 38 Wall Street estimates for 2023. By this measure, our price target implies a 1-year forward P/E of 50x which is consistent with a high-growth category leader that will begin to appear increasingly attractive as momentum builds. If Bitcoin breaks out higher, shares of SQ can reprice materially higher.

On risks, a deterioration in the global macro environment or a surge higher in inflation would undermine the bullish case. Monitoring points for the company over the next few quarters include user trends across Cash App, as well as Square GPV. As long as shares remain above the cycle low of ~$50 the bulls are in control.

Seeking Alpha

Be the first to comment