hapabapa

Investment thesis

In the second half of 2022, Palantir (NYSE:PLTR), a global leader in AI/ML platforms, abandoned its long-term growth objective as demand for its products came in lower than expected. I will showcase the areas where the company needs to improve and I will pinpoint what I want to see before pulling the trigger and buying Palantir stock.

Financials

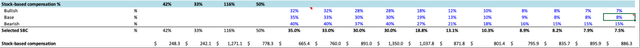

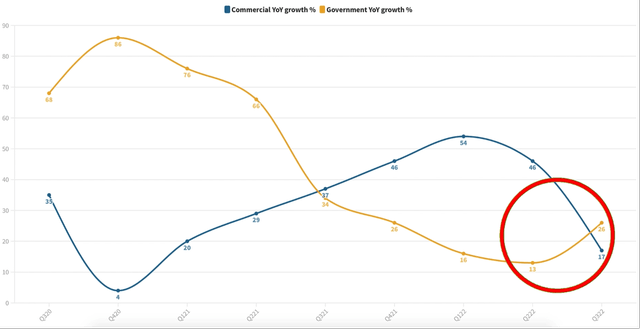

The most important aspect about a business’s future is its revenue growth. Unfortunately, the revenue growth crumbled for Palantir. With such a strong product offering, even considering the macroeconomic difficulties, the growth for Q4 is disappointing. Let’s see more precisely the areas where Palantir is struggling:

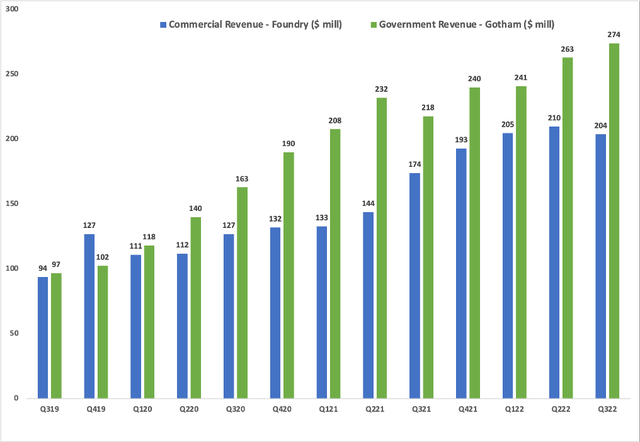

When analyzing Palantir’s business units, the governmental side of the business is still the cash cow with around 57% of the total revenue coming from the Governmental side.

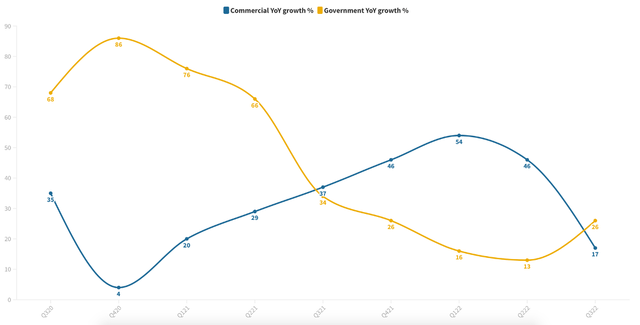

In terms of growth, in 2021 the commercial side grew massively, around 45% YoY, but following the last quarter’s results, the growth slowed suddenly, while the Government business reignited its growth with 26% YoY growth.

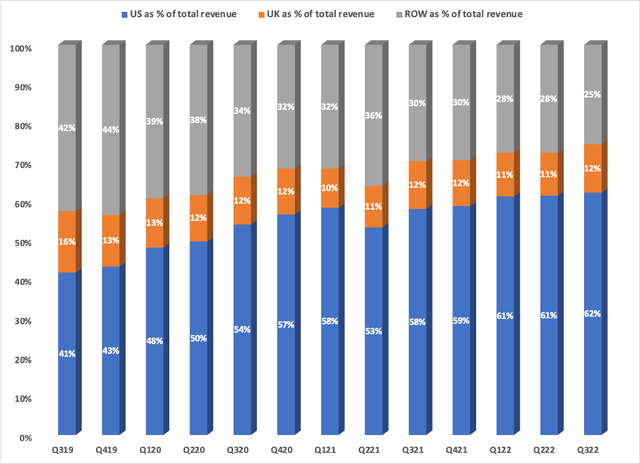

From a geographic perspective, Palantir is mostly concentrated in the US with 62% of revenue and UK with 12%:

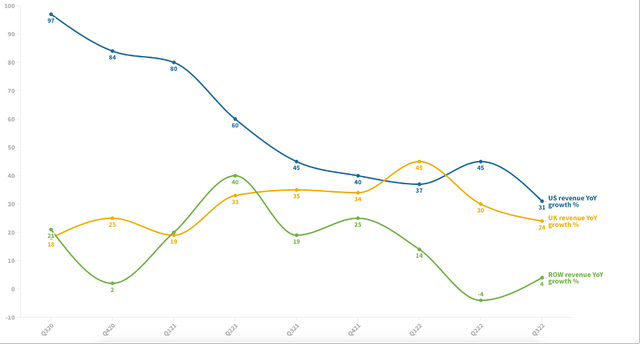

Moreover, the US and UK are also growing the fastest as the rest of world is seriously lagging. This is a first red flag which shows that Palantir is seriously struggling to capture market share outside of the US and UK:

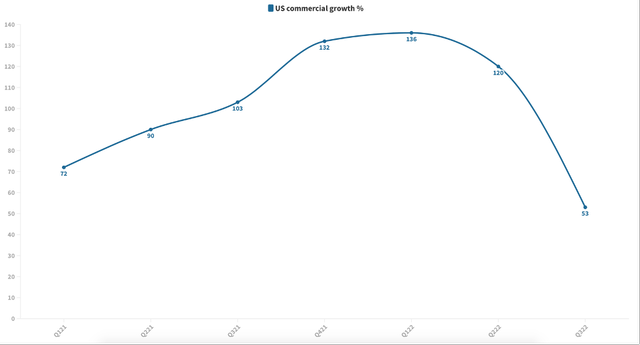

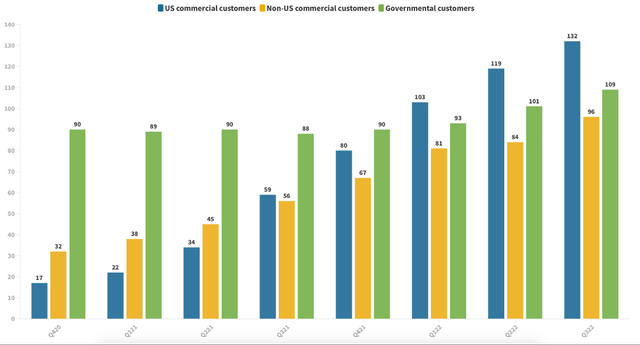

One of the fastest growth areas is the US commercial. It grew >100% during the last quarters, but unfortunately it also slowed down tremendously during the last quarter with 53% YoY growth. The US commercial represents around 18% of the total revenue, growing from 11% just 1 year ago.

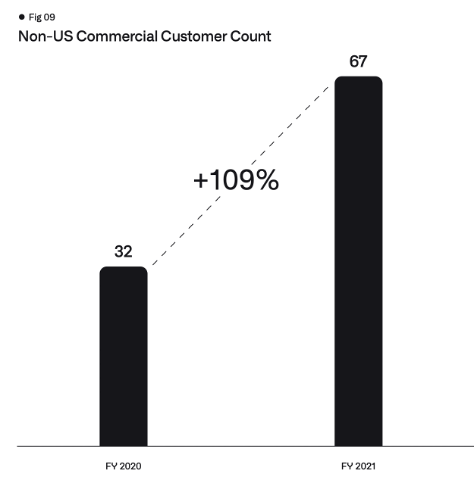

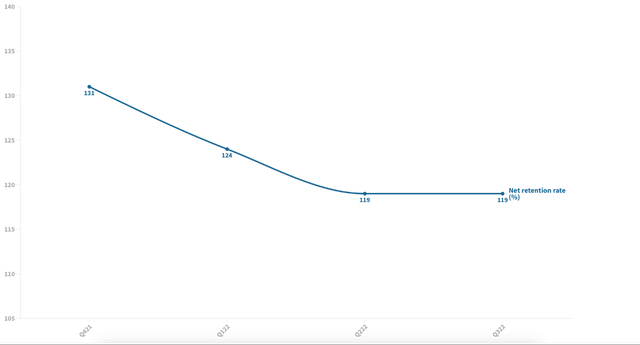

On the other hand, one area where Palantir struggles is its commercial business outside of the US. Palantir has difficulties penetrating the markets outside of US with their Foundry product. Even if the company doubled the number of customers at the end of 2021, its revenue grew modestly, around 16% in the same period:

Palantir 10-K 2021 Palantir 10-K 2021

At the end of 2021 Alex Karp made clear that Palantir will aggressively employ additional salesforce for the non-US commercial business, similar to what the company did in the US, but so far, Palantir didn’t have a ton of success in its endeavors.

To sum up, Gotham is still Palantir’s cash cow, US is still the biggest market and Palantir has difficulties selling Foundry outside of US.

Margins

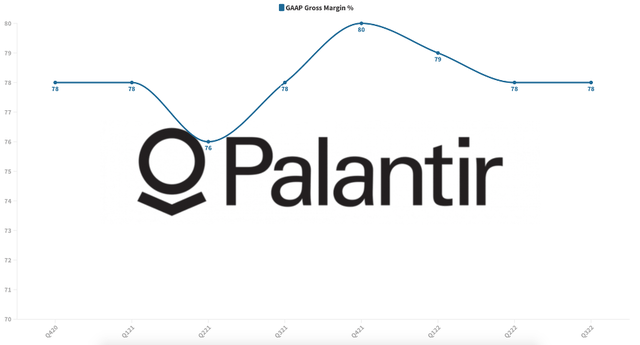

Regarding margins, Gross margin is arguably the most important for a business. I generally try to avoid the low-margin, high turnover businesses because they carry a high degree of risk.

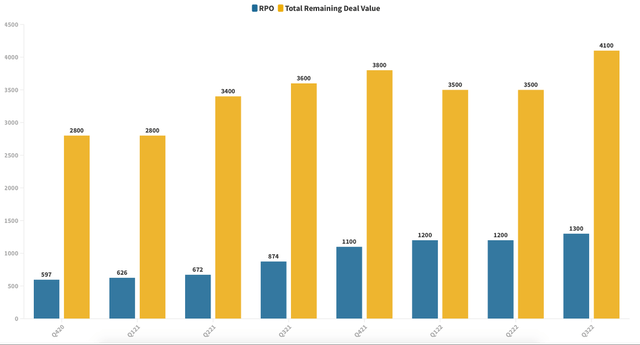

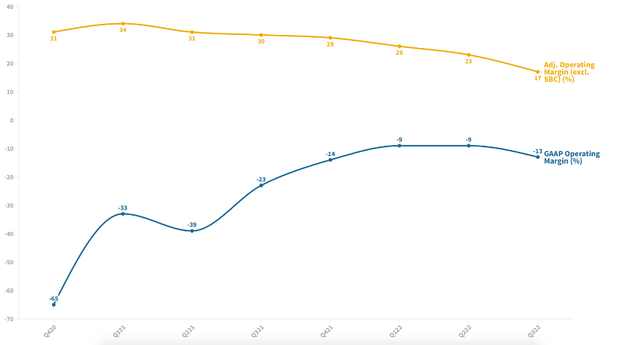

As many other software companies, Palantir has a great gross margin, around 78%. This shows that the company has operating leverage and can grow fast without high amounts of investments needed. Next let’s see the operating margin. Ideally, we want to look at the (GAAP) operating margin, which treats (SBC) as an operating expense as the difference between the two comes often from the treatment of SBC. The trend improved significantly in 2022, with GAAP operating margin sitting around -13%.

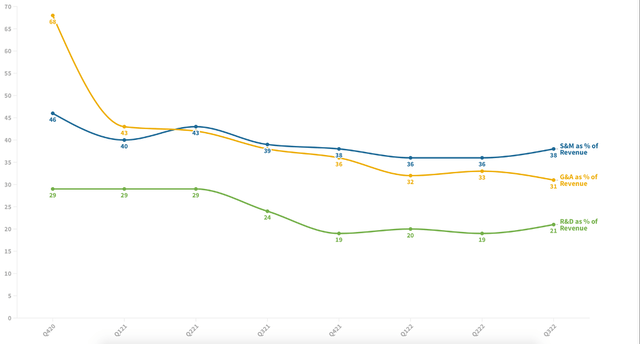

The gap between the 2 margins closed in 2022 as SBC represented a lower % of the revenue. In the second quarter of 2021 the S&M became the biggest spending area as Palantir focused on expanding its salesforce to capture more market share, especially for its commercial business. G&A is trending downwards while R&D remained relatively flat.

Free Cash Flow

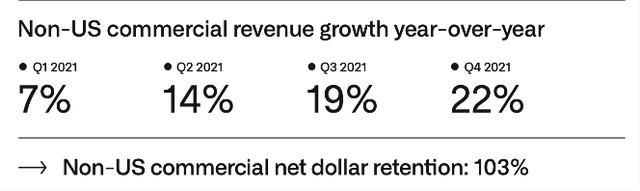

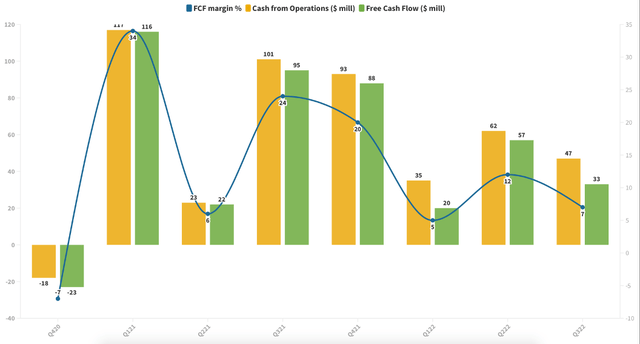

Next let’s see how much Free Cash Flow is the company generating. Remember, even if a company isn’t GAAP profitable, it can still generate cash and that’s one of the most important metrics for a fast-growing company. Palantir’s ability to generate cash has been weaker during the last 3 quarters, with a FCF as % of revenue around 7%. This is significantly lower than the 24% registered 1 year ago.

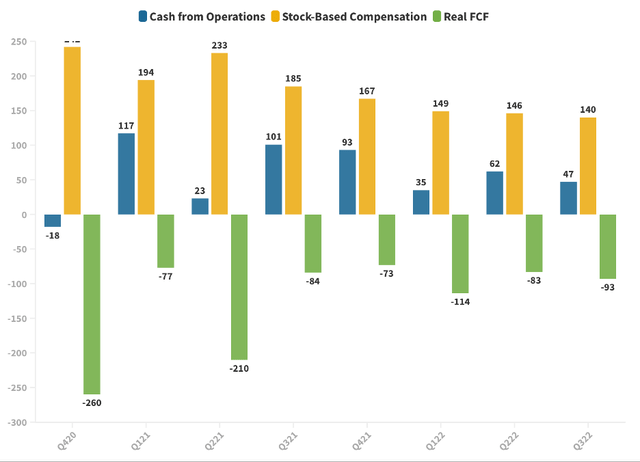

Moreover, since the Free cash flow statement adds back all the SBC that the company pays to its employees, this makes it look like the company generates FCF. However, if we take a look at the SBC amounts, there are much more significant than the FCF generated, so if we take these into account, Palantir has never generated Free cash flow.

As a way to keep track of both fast growth and cash flow, management follows closely a software operating KPIs, called the Rule of 40. Rule of 40 tells us how fast we can grow without burning too much cash. As long as the total is bigger than 40%, the company is executing well.

Investopedia Palantir 10-Q Q3 2022

Unfortunately, Palantir’s Rule of 40 is at an all-time low, with 22% revenue growth and only 7% FCF margin for Q3. This shows that in spite of investing in growth, Palantir’s output is for now disappointing. I will closely watch the Rule of 40 as I want to see an improvement in the trend before investing.

Key Performance Indicators

In terms of customers, since the no of governmental client remained relatively flat, let’s look at the commercial customers:

US commercial customers grew 124%, compared to 71% for international. This is another proof that Palantir’s Foundry has more success in the US, but it still managed to land important deals outside of the US in last quarter.

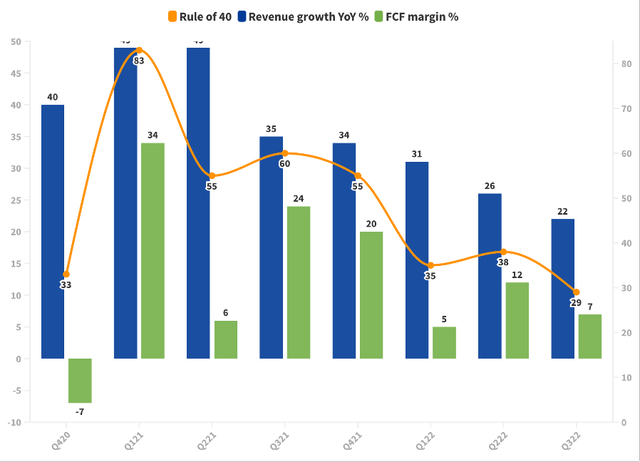

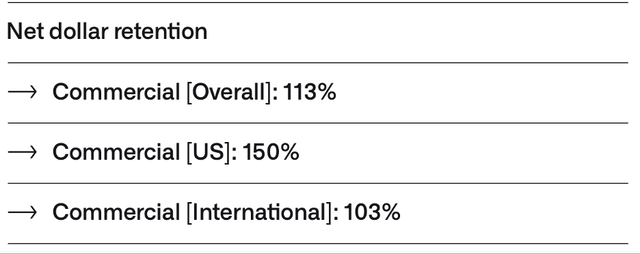

Net retention rate (NRR)

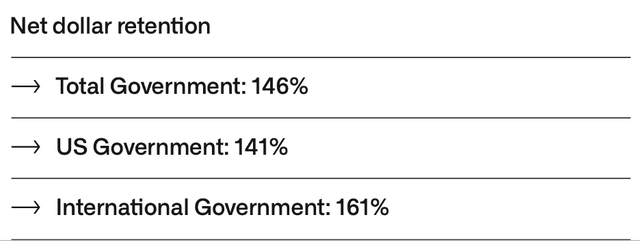

The most important metric regarding customers is the Net retention rate. This shows how much do customers like the platform and it’s calculated as the expansion of recurring revenue from existing customers compared to 12 month ago. Generally, a NRR above 120% is an excellent value:

Investopedia Palantir 10-Q Q3 2022

Palantir saw its overall NRR decrease during the last couple of quarters, sitting now just shy of 120%. Moreover, at the end of 2021 Palantir offered us the NRR split between commercial and Government. The Government business had a much better retention rate, especially outside of US, with more than 160%. This proves that once embarked on the platform, the Governmental customers usually spend more money on Gotham.

On the other hand, the commercial business outside of US is again seriously lagging with a NRR of only 103%, which means that the 32 customers that Palantir had at the end of 2020 only spent 3% more at the end of 2021.

Future demand

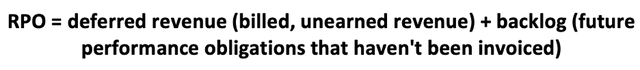

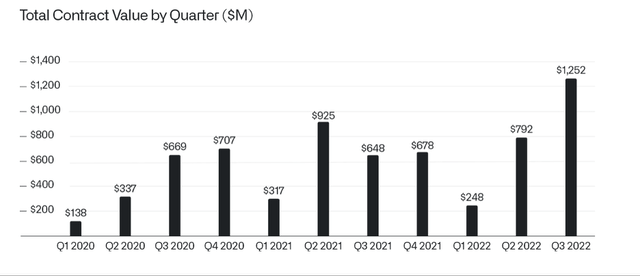

Since Palantir managed to sign many new customers recently, let’s see how future demand looks like. Palantir offers us 2 important metrics for that: Firstly, Total remaining deal value is the remaining value of signed contracts, but the majority of these contracts can be cancelled at any time by Palantir’s customers.

The second metric is the Remaining Performance Obligations (RPO), which represents non-cancelable contracted revenue that has not yet been recognized, which includes deferred revenue (billed amounts for which cash has been received in advanced) and amounts not invoiced yet.

Palantir 10-K 2021 Palantir 10-Q Q3 2022

When looking at the trend for the 2 metrics, we can see that even if the Total deal value grew by $600 million, the RPO only grew by $100 million, which means that many of the contracts signed by Palantir can be cancelled. Considering the high chances of a recession in 2023, I believe there’s a high probability that some of these contracts will be cancelled, generating a period of high volatility in Palantir’s business.

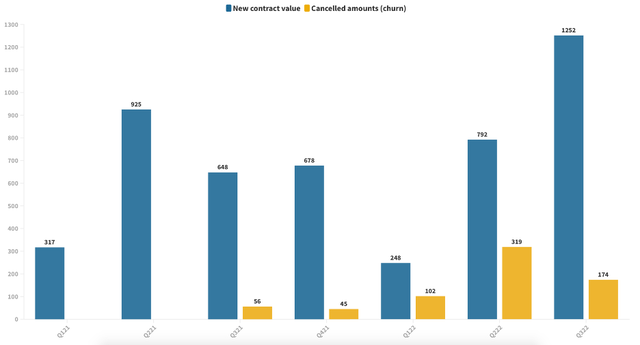

However, if more deals are coming in for Palantir, why is the revenue guidance for the next quarter for only 16% growth? One possible reason is a high churn rate, which shows how much of the contracts do customers cancel. One crucial metric that Alex Karp offered us in the last earnings report is the Total contract value that was signed in the current quarter.

Using this metric, we can approximate the amount from contracts that customers canceled. Since the Total remaining deal value contains the new contract value, but it excludes the revenue recognized (that comes out of Total deal value), we can get a good image of the canceled contracts:

The second quarter of 2022 was by far the worst when customers cancelled almost $320 million dollars. This number came down significantly in Q3, but still remains elevated. I expect this amount to increase, especially if a severe economic recession materializes.

Why I don’t look at the contribution margin

Palantir uses as its main key operating metric the contribution margin. It is defined as Revenue – COGS – S&M expense to acquire a customer, excluding stock-based compensation. Palantir argues that “we exclude stock-based compensation as it is a non-cash expense” so obviously the contribution margin becomes skewed since it doesn’t incorporate an important way of financing for Palantir. Remember, the SBC compensation is a real expense, especially since Palantir uses a lot of Restricted Stock Units (RSUs) that become shares once they’re vested.

Risks

There are 2 main risks for Palantir stock: firstly, during the Q2 earnings report Palantir abandoned its long-term growth objective of 30% revenue growth. It was the first time that Palantir showed weakness and made us realize that its investments might take more than expected to pan out.

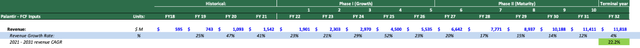

The second risk is the delay of GAAP profitability. Focused on capturing more market share, Palantir hasn’t proved that can become profitable yet and estimates it will do so in 2025:

Valuation & Technical

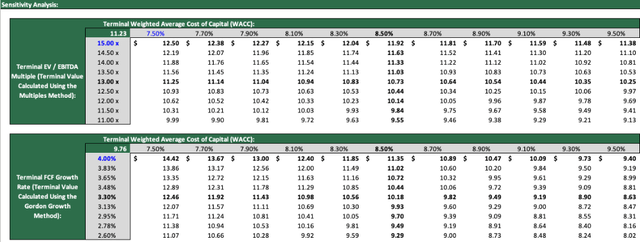

In terms of valuing Palantir, I created a Discounted Cash Flow or DCF template that shows the aims to find the true intrinsic value of the company. My assumptions are a revenue CAGR of 22.2% between 2021 and 20231 with $4.5 billion in revenue in 2025.

I expect the operating margin (excluding SBC) to improve, while the SBC will slowly navigate towards an 8% margin in the mature stage.

Created by the author Created by the author

Finally, using 2 values for WACC (14% for the first 5 years of fast growth and 8.2% for the last 5 years) and a perpetual FCF growth rate of 2.5% (lower than the Risk-free rate of 3.6%), my price target is around $10. However, since I don’t hold a crystal ball to guess the perfect inputs, I believe that the true intrinsic value of Palantir is somewhere around these values, depending on the WACC and the perpetuity growth rate for the Free cash-flows:

Technical analysis

In terms of technical analysis, the stock has been really volatile during the last couple of months, sitting now 45% lower than its August high:

Since Palantir has a high growth profile, with no sign of GAAP profitability the stock is very volatile and I expect it to swing between $6 dollars and $8 dollars in the following months. Please be aware that we find ourselves in a difficult market to navigate. With recession fears mounting for 2023, if the economy goes into a severe recession, Palantir’s stock will also suffer and will probably make a new low in 2023.

Final thoughts – What I want to see

Although Palantir has plenty of potential, I want to see a reignition of the growth in the commercial business, kind of what the Governmental business did here:

At the same time, I will closely watch the churn rate to see how much of the contracts do Palantir’s customers cancel, as well as the Rule of 40. I believe that if a severe financial crisis materializes, there’s no stock that can escape the short-term pain.

Be the first to comment