Shahid Jamil

Introduction

Apple recently introduced their new powerful iPhone 14 series, Apple Watch series and AirPod series. These come with best-in-class health and safety features, top performance hardware and an updated interface.

Who loves Apple (NASDAQ:AAPL) products? I do. I always work on my MacBook Pro and use my iPhone daily. I also recently bought their Watch, to provide insight into my calorie consumption during exercise.

I was an avid Microsoft (MSFT) (laptop) and Android (smartphone) user, using Samsung (OTCPK:SSNLF), HTC and even OnePlus smartphones. But I switched to Apple. Why? Because the Apple ecosystem gives me more focus and peace of mind. In addition, the MacBook screen is much brighter than my Windows laptop. For me it’s a big improvement.

I’m not bashing Windows or Android, they are great too. Especially for specific applications such as working with engineering software. MacBooks are often used for video/music editing applications and for writing. Both brands are fine.

Apple consumers are proving to be very loyal and sticky, and yes, I admit it. The Apple ecosystem increases your productivity while the interface is so soothing that it lowers your stress levels. And the design is sleek and attractive too. I would gladly pay a premium for that.

You buy a piece of art, a piece of apple, a high-quality top product. That’s why investors should check out Apple shares. Their loyal customers will upgrade their Apple products to the new series. Apple is also loyal to its shareholders. Apple rewards shareholders by paying dividends and buying back its own shares.

But that’s the catch, Apple stocks are highly valued compared to their historical valuation and compared to the current market. From experience, I can say that stocks will remain overvalued for a long time if the company continues to grow, but given the deteriorating macroeconomic situation, I am putting Apple shares on hold.

Apple Is Growing Fast

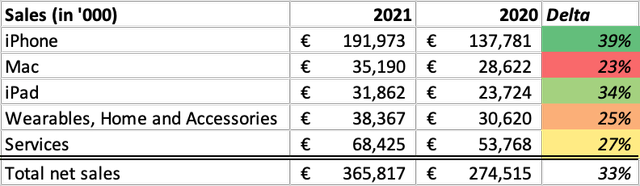

Apple’s top product is the iPhone series, which accounts for about 52% of sales (in 2021). Sales of the iPhone series rose sharply in 2021, mainly because Apple announced significant price increases.

Product Sales (Apple’s 2021 Annual Report, and Author’s Own Calculations)

Interestingly, Apple Services accounts for an increasing share of revenue, with Services accounting for approximately 19% of revenue in 2021. Revenue in this segment rose sharply by 27%. It is interesting because the gross margin of Apple Services (gross margin = 70%) is much higher than that of Apple products (gross margin = 35%). These are positive prospects for an improvement in consolidated profit.

Apple services include advertising, AppleCare, cloud services, digital content, and payment services. Apple has provided the iPhones with extra privacy features in 2021, where users can choose whether they are tracked on the internet. This is detrimental to other advertising platforms such as Alphabet (GOOG)(GOOGL) and Meta (META). Their advertiser adoption rate dropped 2% and 3% respectively, while Apple’s rose 4%.

The first quarter of the year is Apple’s top quarter as Apple announces their new iPhone series in September.

State-of-the-art Apple Products

Apple recently released its new iPhone 14 series, the Watch series and AirPod series to the public. Here is a short summary of the first two with state-of-the-art features.

iPhone 14 Series (Apple)

New features of the iPhone 14 series:

- Dynamic Island

- Always on display

- Crash detection

- SOS Satellite connectivity

- Hardware improvements

- Thermal improvements

Apple Watch Ultra (Apple)

New features on Apple Watch (Ultra):

- Titanium design

- SOS function

- Depth meter

- Improved battery time

- Hardware improvements

- Integrated scuba dive computer

Apple’s latest products include an SOS feature that allows the iPhone to communicate with satellites to call for help when the user needs it. A handy feature, I expect that the iPhone will become very popular because of this feature, not only for businesspeople but also for adventurers.

The new Apple Watch Ultra is robust, beautiful and offers state-of-the-art features. The Watch Ultra is suitable for divers and includes an integrated dive computer. The watch can dive 40 meters and the Oceanic+ app serves as a fully functioning dive computer.

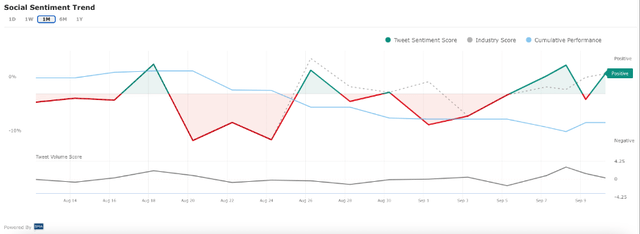

People Are Generally Enthusiastic

In general, Twitter users are positively surprised by the state-of-the-art Apple products. SMA’s social sentiment trend (see image below) is positive.

Apple’s Social Sentiment Trend (“SMA”)

However, the 23-year-old daughter of Steve Jobs (Eve Jobs) was less enthusiastic because the design of the iPhone has remained unchanged. She posted on her Instagram story an image of a man buying the same shirt he is currently wearing.

Does this change my stance on buying the latest iPhone? No, I still want to upgrade to the latest iPhone. I’m actually quite happy that Apple hasn’t changed the design. There were rumors that Apple would introduce a foldable iPhone. I find it clunky, doesn’t look solid and nice, and I expect a lot of headaches when watching a movie.

I think current iPhone users will upgrade their iPhone to the new 14 series. But I don’t think potential users will be satisfied with the unaltered design, and Eve Jobs’ meme has provided added incentive to wait a little longer before embarking on the Apple ecosystem adventure. If Apple wants to grow its customer base, I think they should come up with a new design.

Apple’s Popularity Remains Stable

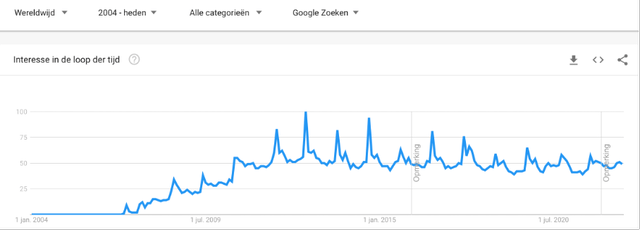

The iPhone series is Apple’s top-selling product, and Google Trends notes that iPhones aren’t as popular as they used to be. It peaked in September 2012, when the iPhone 5 came out. But this isn’t a problem for Apple, iPhone sales in 2013 were $91 billion and have grown to $192 billion in 2021 despite declining popularity.

A small note: the chart always shows a peak in the month of September, but because the month of September has not yet ended, the current data is not yet available. This month’s peak is yet to come.

Worldwide iPhone Popularity (Google Trends)

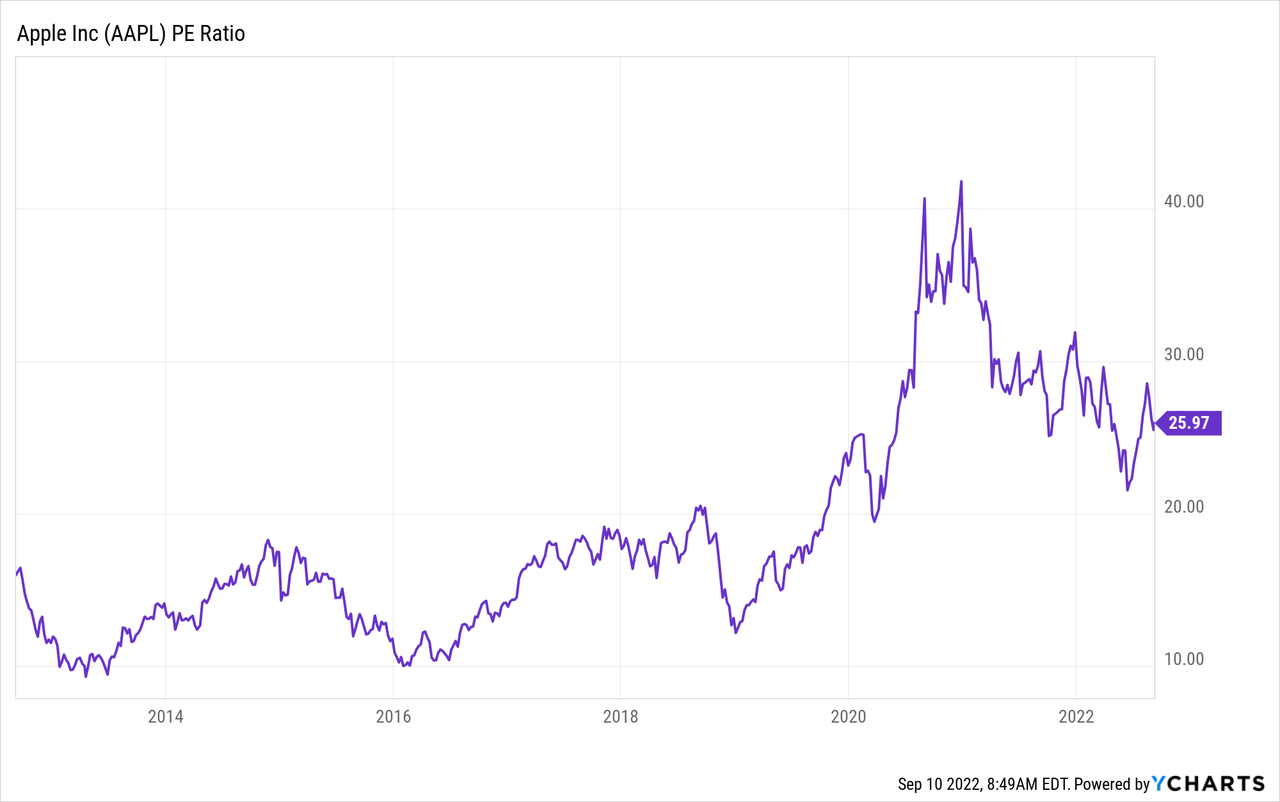

Apple’s Stock Valuation Is Somewhat High

What I don’t like about Apple is their stock valuation. With a forward P/E of 24, Apple’s stock valuation is high compared to its historical valuation and to the S&P 500 (P/E = 20). Analysts expect Apple’s EPS to grow 6% from 2022 – 2023. Quite pricey, especially as I knew Apple with a P/E ratio of only 10 in 2016.

In 2016, Apple generated its revenue primarily from product sales, and investors may have thought that product sales could fall just as quickly as they did with BlackBerry (BB).

Now, Apple is getting more and more revenue from Services, and this ensures a higher profit margin. One of those services is the app store, it is affiliated with Apple’s iOS, so when iPhones are less popular with the public, it will hurt service revenues as well.

A high valuation does not immediately mean the shares must be sold. If the company continues to grow, the high valuation of the shares can remain intact.

Apple is loyal to their shareholders by paying dividends and repurchasing shares. Apple offers a dividend of $0.92 per share (0.58% dividend yield). In addition to the dividends, Apple has repurchased $85 billion worth of shares in the past four quarters. At current market capitalization, this implies a buyback yield of 3.4%. The share repurchase program should increase the share price because there is more demand and fewer shares available.

I love Apple and I am loyal to their products. But I think the valuation of the company is expensive, especially now that US GDP growth is negative, inflation is high and interest rates are rising.

I wait for the share price to drop a bit and open a position.

Key Takeaway

- The recent Apple event presented new Apple products with state-of-the-art features.

- Current Apple users are very loyal to their Apple products, I expect them to upgrade their iPhone to the latest 14 series.

- Potential users will wait to buy an Apple product because of the unaltered appearance of the iPhones, and because Eve Jobs posted a meme about it on her Instagram Stories.

- Apple Services accounts for an increasing share of revenue, with Services accounting for approximately 19% of revenue in 2021.

- Gross margin of Apple Services (gross margin = 70%) is much higher than that of Apple products (gross margin = 35%).

- Apple is loyal to its shareholders to pay a dividend and initiate a generous share repurchase program.

- Apple’s stock valuation is high compared to its historical valuation and to the S&P 500.

- I wait to buy until the share price falls.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment