Nordroden

The iShares Latin America 40 ETF (NYSEARCA:ILF) gives primarily exposure to Mexico and Brazil. In doing so, it is rich with commodities but also pretty well exposed in the rate hike environment. FX risks are thankfully limited, and the commodity exposures bring with it a low multiple, reflecting investors’ belief that the commodity cycle is in its late stages. With geopolitical factors likely to continue to support energy prices, and key commodity exposures being pretty beaten down already, the ETF looks pretty attractive.

ILF Breakdown

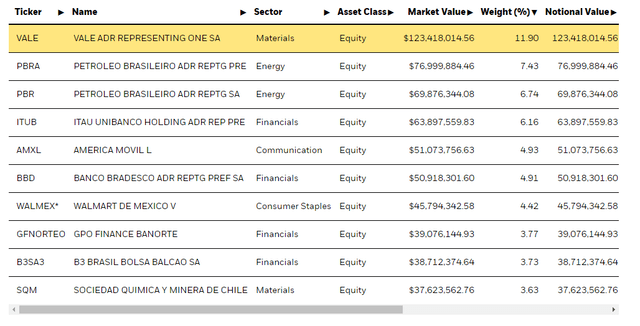

The ILF’s key holdings are the following.

We see some familiar names, with 11.9% in Vale (VALE) which is an iron ore exposure primarily. Below it are various instruments connected to Petrobras (PBR), and below that Latin banking and telecoms exposures.

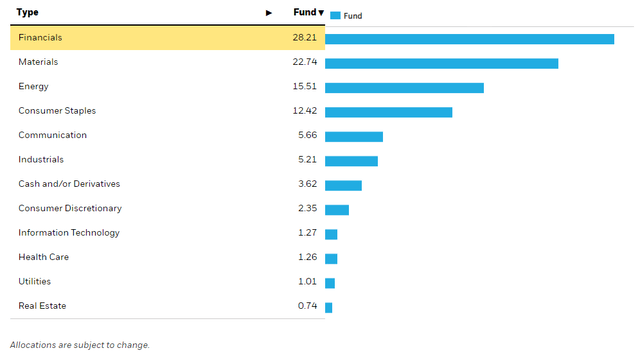

Sectoral Breakdown (iShares.com)

The sectoral breakdown shows a pretty heavy tilt towards financials at 28% allocation. As in the rest of the world, both the insurance and banking side of financials are benefiting from higher rates. In insurance, it is because their fixed income portfolios get to roll over into higher yielding short-term fixed income instruments, supporting the return on their reserve funds. In banking, which is more heavily represented in the ILF allocation, savings rates continue to lag lending rates, and the interest income spread grows in banking.

The materials exposure is to basic materials like iron ore. The situation with iron ore is relatively beleaguered because of issues in China, where their economic productivity, especially in construction and real estate, has been an important driver of steel and in turn iron ore prices. China’s woes weigh on the iron ore price. On the bright side, energy development is going to require steel, and order books are building with respect to those industries. Iron ore prices are about as low as they can get, and their average TTM levels are pretty normalized when comparing to 5-year averages.

Energy is going to continue to be supported by the conflicts in Ukraine and the dislocation caused to markets. Finally, consumer staples, which is represented substantially by Mexican companies as well, are going to be resilient in a recession and worsening economic conditions, if those conditions indeed worsen.

Conclusion

The good news is that FX risks are fairly limited.

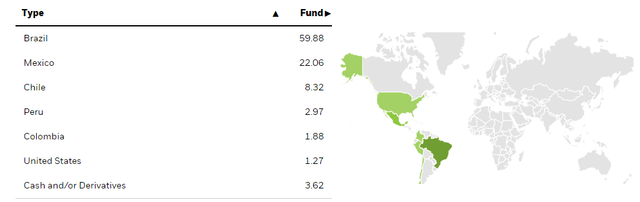

Geographic Breakdown (iShares.com)

Geographically, the key exposures are Brazil and Mexico. The Peso is relatively dollarized, even just implicitly due to currency exchange to do with remittances as well as currency exchange to do with oil resources, which have to cross the border in its various stages of processing. From an economic point of view, Mexico is also more stable than a lot of other countries, without a boom-bust cycle since Mexico refrained from stimulus following COVID-19. Brazil is similarly doing pretty well on the Real side, as commodity demand is supporting that currency, as well as the rate hike regime. We do note some political risk with Brazil as Bolsonaro’s term may come to an end, to be replaced by Lula. This could mean a reversal of monetary tightening. It could also be a cause for political unrest, as Bolsonaro might reject an election result if won by a small margin. There are also questions about Petrobras, which is being used as a political scapegoat for inflation, and could be choked by government intervention with things like windfall taxes.

Nonetheless, as far as the sectoral exposures go, the worst is either behind these sectors, or the sectors are likely to be resilient. Therefore, a P/E below 7x, and a yield above 10% suggests that perhaps more risk than is reasonable is being priced into the ETF. Without FX risks, the more specific concerns look pretty limited thanks to diversification. We like the ILF.

Be the first to comment