Vera Bracha/iStock via Getty Images

Introduction

As a dividend growth investor, I constantly seek additional income-producing opportunities. Sometimes I consider new positions to increase my exposure to different segments I lack. On other occasions, I add to existing positions whenever I believe the share price is attractive enough.

In this article, I will look at Medtronic (NYSE:MDT). Medtronic is an existing position in my dividend growth portfolio. In the healthcare sector, I own shares in pharmaceutical companies, medical devices companies, drug distributors, and health insurers. Medtronic is an exciting prospect to analyze as its share price has reached a 52-week-low.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that Medtronic develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. It operates through four segments: cardiovascular, Medical Surgical Portfolio, Neuroscience, and Diabetes Operating Unit. The company was founded in 1949, and its headquarters is in Dublin, Ireland.

Fundamentals

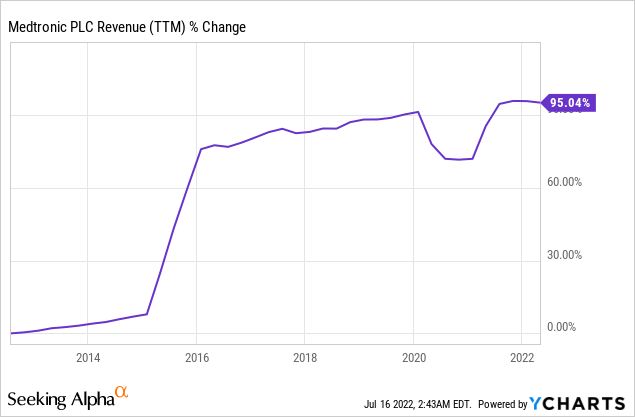

Over the last decade, the sales of Medtronic have almost doubled. Medtronic achieved a 95% increase in sales mainly through the acquisition of Covidien for $42.9B. Medtronic also made smaller acquisitions in addition to its organic growth. The purchases allow Medtronic to reach new markets and business segments and acquire new tech. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Medtronic to keep growing sales at an annual rate of ~4% in the medium term.

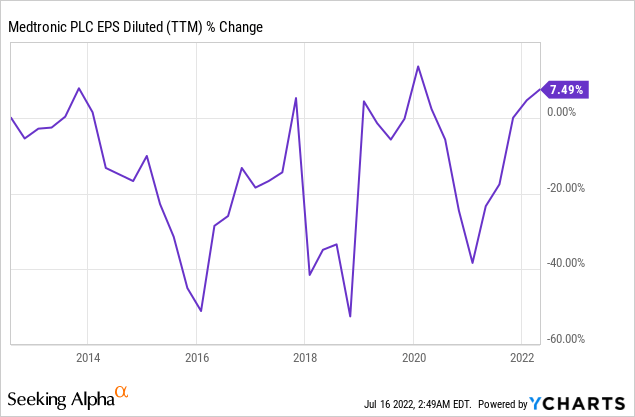

The EPS (earnings per share) over the last decade has increased by 7.5% when using GAAP measures and 48% when using non-GAAP measures. The EPS has grown slower than the sales for two reasons. Firstly, the increased number of outstanding shares due to Covidien’s acquisition. Secondly, the operating margin decreased from 28% to 20% due to higher costs and competition. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Medtronic to keep growing EPS at an annual rate of ~6% in the medium term.

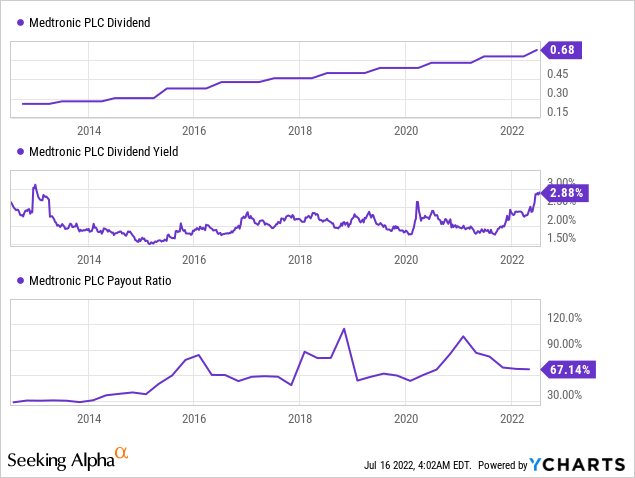

The dividend of Medtronic is attractive following the last 8% increase in May, which will be paid in July. The dividend yield is 3.1%, which was the 44th annual increase. The company is a reliable dividend payer on the verge of becoming a dividend king. The dividend is safe as the company only pays 67% of its GAAP earnings and only 45% of its non-GAAP EPS. The dividend is sustainable and growing with an enticing entry yield.

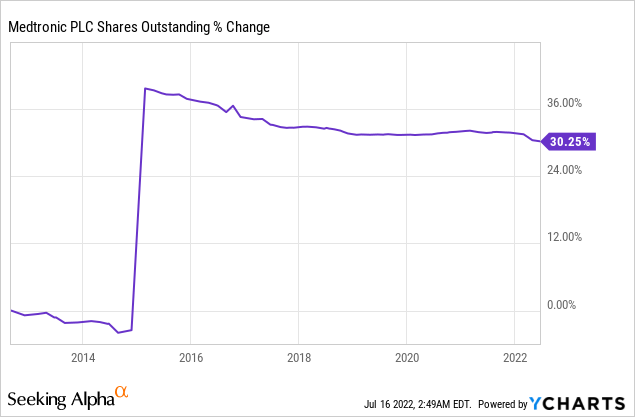

In addition to the dividends, the company also returns capital to shareholders via share repurchases. Buybacks benefit a growing company by supplementing EPS growth and allowing for faster dividend increases. Over the last decade, the number of shares outstanding has increased by 30%. However, this is due to the acquisition of Covidien. Since then, the company has constantly repurchased its shares, thus supporting EPS growth.

Valuation

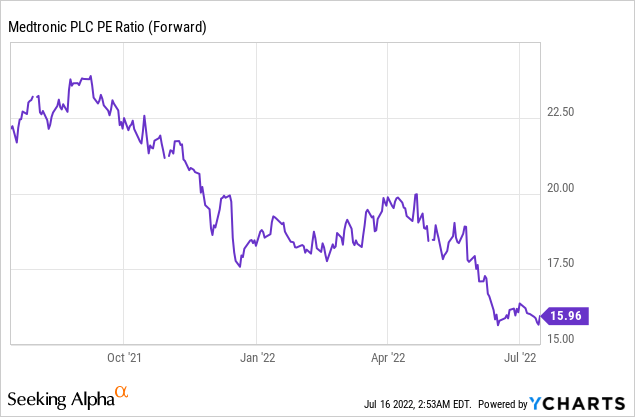

The company’s P/E (price to earnings) ratio is at its lowest over the last twelve months. The company trades for less than 16 times its forward for the next twelve months. Paying 16 times earnings for a blue chip with a long history of growth and a positive growth outlook makes sense to me. The company is not extremely cheap, but the valuation is attractive.

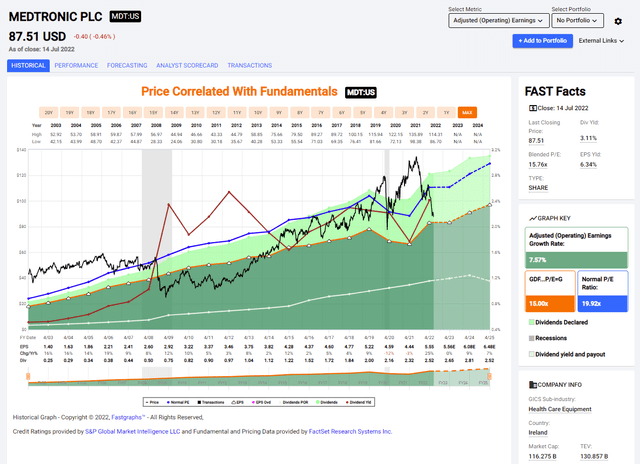

The graph below from FAST Graphs emphasizes the trend. You can see the average valuation in blue and the share price below the blue line. It was not the case a year ago. That change has made Medtronic attractively valued, as its P/E ratio is 20% below average, while the analysts expect the company to grow at a similar growth to its 7.5% historical growth rate.

To conclude, Medtronic is a leading medical devices company. The company has steadily grown its top and bottom line over the last decade. It utilizes its excess free cash flow to pay a progressive dividend and repurchase its shares. This package comes at what I believe to be an attractive valuation as the valuation is significantly lower than the average valuation.

Opportunities

The company is very well diversified and has a significant scale in the segment. Diversification can appear in two ways. First, it has several business segments, which means the company can take advantage of opportunities that arise more effortlessly. Second, the company operates worldwide, so if there is an opportunity in a specific market, it can quickly capitalize on it using its existing logistics and distributors. Therefore, Medtronic can offer various markets various solutions, thus focusing on lucrative markets.

Diabetes is the western pandemic of the 21st century. The number of diabetes patients is constantly growing, and Medtronic is well-positioned to assist their treatment. In the last quarter, the diabetes segment grew by high-teens sequential internationally yet declined 5% YoY as Medtronic awaits product approvals in the US. These products will support continued growth in the US.

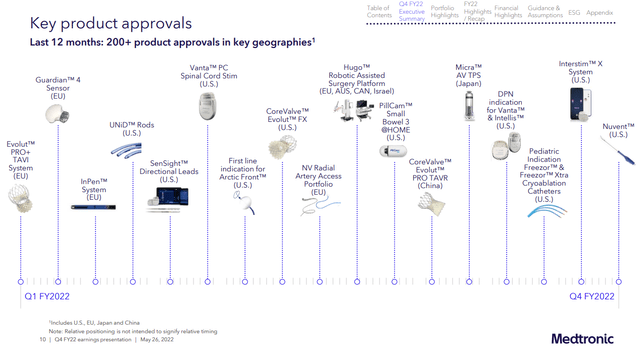

Medtronic’s pipeline is offering significant growth catalysts for the company’s future. The chart below shows how the company has approved more than 200 products in its larger markets. The products will drive sales forward in the future. These products are launched in developed countries like the US and the EU and emerging markets like China. Emerging markets and launches are another key to growth, as sales increased by 13% last year.

Risks

Supply chain challenges are short and medium-term risks. This risk impacts mainly the medical surgery portfolio. The shockwave from the pandemic is still affecting Medtronic. During the pandemic, it focused on ventilators. As the focus shifts back, the supply chain challenges make it harder to gain all the materials needed for the products hampering short-term sales.

Then they have several waves of COVID and, more recently, these supply chain issues. So it’s — and then on our own, we had a few of our growth drivers get pushed back, so pushed out in time. So it’s been a lot choppier. And like I said, more recently here with the supply chain issues, it — not getting — not precisely getting the short-term results that we would like.

(Geoff Martha – Chairman & Chief Executive Officer of Medtronic on Goldman Sachs Global Healthcare Conference)

China is another short-term risk for Medtronic. This emerging country is still suffering from the pandemic, and its “zero covid” policy keeps lockdowns whenever there is a small outburst. It hurts Medtronic’s production, and it also hurts the Chinese demand as GDP growth slows down.

So in the short term, one, we got — with these lockdowns, we got to get out of that, the COVID lockdowns. So we see that like I talked about earlier, starting to abate here, things to open up but it’s tenuous. So if they have another wave of COVID, they’ll continue to shut things down. But we — it’s important for us because China is an end market, plus we have some of our supply chain there.

(Geoff Martha – Chairman & Chief Executive Officer of Medtronic on Goldman Sachs Global Healthcare Conference)

The competition is another long-term risk for Medtronic. Medtronic’s business model is investing upfront in its pipeline to launch successfully. The products may succeed or fail commercially depending on the competitive landscape and the products offered by peers. The company is competing with giants like Johnson & Johnson (JNJ), Abbott Laboratories (ABT), and smaller startups trying to disrupt current markets.

Conclusions

Medtronic is on the bluest blue chips. The company is a leading medical devices company with a long track record of success in sales and EPS growth. The company utilizes its excess cash to reward its shareholders with dividends and buybacks. The company is well positioned to keep growing in the future with its diversification and business focus.

There are also several risks to the investment thesis. Supply chain challenges and China are short-term risks, and competition is always a threat. However, these are all risks the company can deal with in the long term. Therefore, at the current valuation, the shares seem attractive. I believe that at the current price, Medtronic is a BUY for long-term dividend growth investors.

Be the first to comment