DoctorEgg/iStock Editorial via Getty Images

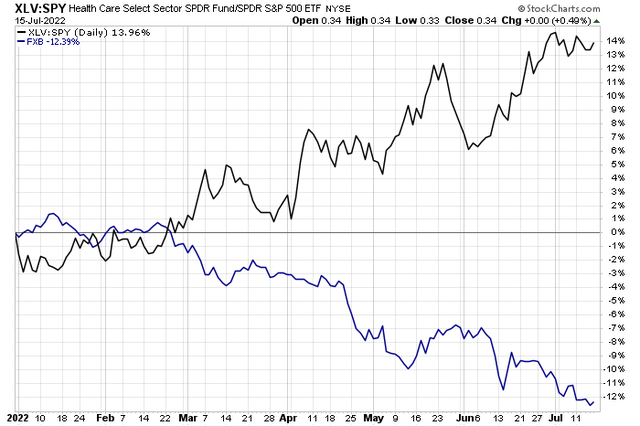

Healthcare stocks are all the rage right now. The sector’s relative price strength catches the eyes of momentum traders while the group’s defensive bent appears favorable to nervous investors. Large pharmaceutical companies usually fare better than other cyclical niches of the market during volatility.

Another key theme right now is what’s happening in the FX market. A very weak Euro, British Pound, and Yen continue to pressure firms with significant overseas sales exposure. Just recently, we have seen price weakness out of the Euro Area as money flocks to the perceived safety of the U.S. dollar.

Healthcare’s Relative Strength, A Dropping GBPUSD

At the intersection and juxtaposition of strong Healthcare equities and a weakening GBP currency is one mega-cap: AstraZeneca (NASDAQ:AZN). The UK-domiciled $197 billion market cap also trades as an ADR on the Nasdaq exchange. It is a member of the Nasdaq 100 index. AZN features a dividend yield of 2.1%, per The Wall Street Journal.

According to BofA Global Research, AstraZeneca is a UK-listed pharmaceutical company focused on health problems in five important therapeutic areas: Gastrointestinal, Cardiovascular, Respiratory, Oncology and Neuroscience. It is a company in transition from primary care small molecules going off patent to an exciting biologics pipeline. The company sports a strong drug pipeline which should promote significant top-line growth in the decade ahead.

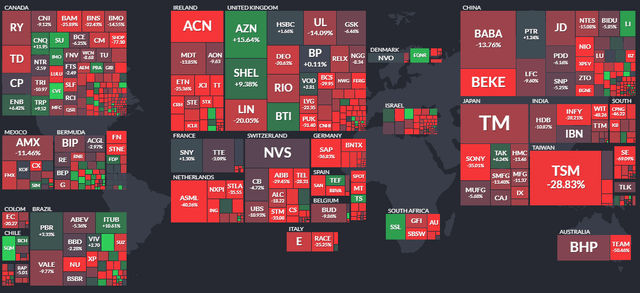

AZN shares are up a whopping 16% (total return) in 2022, according to the global equity performance heat map by Finviz. Among foreign stocks its size, you won’t find many better-performing names this year.

UK’s AZN: A 2022 Global Standout

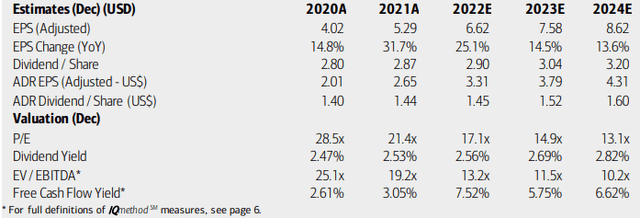

Digging into the fundamentals and valuation, the company is expected to see significant EPS growth in the quarters and years ahead, per BofA’s forecast. Moreover, AZN’s dividend will likely be on the increase as profits grow. Despite negative EPS over the last four quarters, according to the WSJ, AZN’s P/E ratio is poised to move to attractive levels while its EV/EBITDA multiple and free cash flow yield appear reasonable.

AZN: EPS, Dividend, And Valuation Forecasts

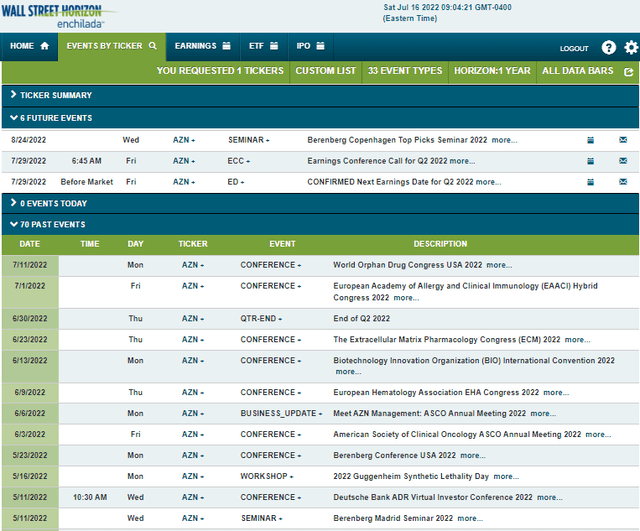

Looking ahead, the consensus EPS estimate for AZN’s July 29 BMO Q2 earnings date (according to Wall Street Horizon) is $0.77 per IBES. There’s also an August 24 Top Picks Seminar at which AZN’s management team is expected to present. Both events could drive share price volatility.

Earnings On Tap Along With A Management Speaking Event

The Technical Take

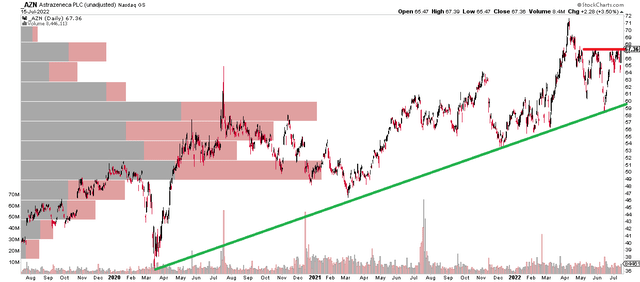

AZN shares are in an uptrend off the March 2020 low. Notice the green trendline below has held on several occasions. Also, there’s significant volume in the $50-$60 range—and the top-end of that range was supportive on a downward move in June. On the upside, the stock is right at resistance below $60. If AZN can take that out, then a test of the $72 high is in play. $64 is near-term support.

AZN: On Breakout Watch Within An Uptrend

The Bottom Line

I like AZN here based on its impressive relative strength and solid earnings and free cash flow growth in the coming quarters. The pharma company has a reasonable valuation given that growth outlook. The July 29 earnings date could spark volatility, but I think risks are to the upside based on accumulation by investors this year.

Be the first to comment