brightstars

Aggressive US Federal Reserve is Not Good for Gold, but Recession in 2023 Could Mean Another Bull Market for The Metal

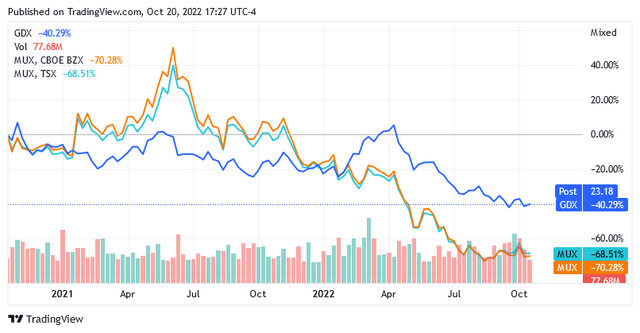

US-listed gold mining stocks have lost some of their appeal in recent months, especially since the US Federal Reserve [FED] began raising interest rates to counter runaway inflation, making investing in fixed income much more appealing. The VanEck Gold Miners ETF (GDX) is used as a proxy for the gold mining stocks industry. It dropped over 40% over the past year.

As long as the FED continues to raise interest rates aggressively, the situation for gold and its publicly traded miners will not change easily.

However, this situation also increases the risk of a recession, which many economists are predicting for 2023. At that point, the Fed will move to a dovish interest rate approach to weather the negative economic climate, not only favoring gold but also encouraging investment in publicly traded miners and other gold-backed securities.

Given the high volatility associated with price changes in the yellow metal [this appears in the chart above], McEwen Mining (NYSE:MUX) (TSX:MUX:CA) could see a very strong rebound should bullish sentiment in the gold market recover well.

McEwen Mining Inc and Its Mineral Deposits in Production

Based in Toronto, Canada, McEwen Mining mines and explores precious and base metals in the Americas.

The company operates gold and silver production mineral activities in Nevada, Canada and Argentina and has interests in copper ore drilling activities in Argentina’s Los Azules deposit for future large-scale production of the red metal.

For the first six months of 2022, McEwen Mining had consolidated production of 61,200 gold equivalent ounces [GEOs], down 14.2% year on year, citing issues with its 100% stake in Canada’s Fox Complex. But they weren’t the only factors hampering the company’s performance.

The company’s 100% interest in the Gold Bar Mine located in Central Nevada did not perform as expected as excess waste material resulted in much less material being processed than in the past and throughput rates were significantly lower due to staffing issues.

While the company’s third producing asset, the San Jose Mine, which consists of McEwen Mining’s 49% interest in a silver-gold deposit in Argentina’s Santa Cruz Province, had issues earlier this year due to a new wave of COVID-19 outbreaks affecting labor availability at the mine site.

The Fox Complex: Operational Status, Issues, and Outlook on Projects

At the Fox Complex, in early 2022, operations were affected by labor shortages due to the COVID-19 pandemic and mechanical issues in the mine site’s grinding plant.

While mechanical issues can be addressed with some maintenance at the facility, COVID-19 should no longer be a concern for available mine site jobs as the virus is on track to be downgraded to seasonal cold or flu levels.

With a mine life of approximately 4 years [as of early 2022], The Fox Complex accounts for approximately 30% to 32% of total consolidated production in GEOs. The asset includes the Black Fox mine [discontinued], the Froome mine [reached commercial production a year ago], and the Tamarack and Gray Fox mineral projects.

Operating the facility implied cash costs of $1,066 per GEO and all-in sustaining costs [AISC] of $1,460 per GEO, with the first item flat year-on-year, while the second item increased 14% year-on-year due to noted issues and higher

What Exploration Can Do:

Exploration is aimed at improving mill throughput and extending the life of mineral operations. They will exploit the strategic location of the identified resources and some very interesting mineralogical characteristics of gold content. There appears to be serious potential for high precious metal concentrations per tonne of ore in some parts of the deposit. Recent assays show peak values in excess of 5.5 grams of gold per tonne of ore [g/t] and in excess of 6.62 g/t in mineral intervals of 7.5 meters or longer.

This sets the stage for building self-financing production [on a larger scale than the Froome asset], reducing future reliance on loan capital. This could result in significant operating cost savings if the US Federal Reserve’s current tightening to combat galloping inflation means borrowing costs remain high for years to come.

Factors that Can Affect the Success of the Mining Project:

However, the success of the project will also depend on the gold futures price. This is likely to trade above its historical average if a very uncertain future prompts investors to use the precious metal as a hedging tool against emerging headwinds. If so, gold prices will be supported by robust safe-haven demand as the current geopolitical and macroeconomic issues [the war in Ukraine, US-China tensions over Taiwan, elevated inflation and the looming recession] do not radiate a rosy outlook for the economy.

But higher interest rates preclude higher gold prices and vice versa. In the case of fixed-income securities [e.g. bonds] that appear attractive because of their coupon payments, the cost opportunity of holding bonds instead of gold is lower and higher when gold is more attractive.

Bottom Line: McEwen Mining shareholders and gold fans hope for a tightening of the FED that will fight inflation as soon as possible, return to low-interest rates and benefit the economy as it did during the uncertainties of the COVID-19 crisis.

Returning to the activity at the Fox Complex, this is targeting an area of the mining concession, specifically to the west of the initial operations [Froome], where the exploration team has identified the best potential for growth in terms of resources to complement the current budget. The objectives and their strategy are outlined in the Preliminary Economic Assessment [PEA] document announced on January 26, 2022. This document indicates that the mining project aims to produce nearly 81,000 ounces of gold annually over nine consecutive years of operation [about 84% to 65.3% above projected levels in 2022], which is expected to come online to replace current production.

The PEA document includes a section that provides an economic analysis of the project, with data on profitability and costs associated with mining the precious metal.

The Fox Complex upgrade project has a profitability profile, expressed in terms of an after-tax internal rate of return [IRR], of 21%. This is an estimate based on a gold price of $1,650 per ounce. Although a project is usually considered profitable when the IRR is above 30%, it appears to result in significant cost savings. It estimates cash costs at $769 per ounce [27.8% below current levels] and an AISC of $1,246 per ounce gold [14.7% below current levels].

The project is expected to recoup invested capital in less than 6 years while its net present value [NPV] at a discount rate of 5% is approximately $137 million. Dividing the NPV by the number of shares outstanding of 47.43 million, the operation yields $2.9 per share, which is approximately 8% below the McEwen Mining Inc. stock price at the time of writing. So the share price is currently expensive compared to the value of the project.

The Gold Bar Mine: Higher Waste-to-Strip Ratio Issues Toward Resolution and Increased Production Expectations

At the Gold Bar Mine in central Nevada, the current problems of excess waste and lower throughput can also be largely overcome. And when COVID-19 is over, it will no longer cause staffing problems.

Regarding the diminished performance of mining and processing operations, the favorable dynamics in the recovery rates of the heap-leach pad are currently a valid ally for McEwen Mining Inc. to get around the operational problem. The heap-leach pad is a system for recovering precious metal from the mineral through percolation and the use of cyanide-containing leachate materials.

Meanwhile, with the insightful guidance of drilling activities and specific metallurgical tests, miners are better able to strip the material with more waste while advancing into areas of less carbonaceous material.

The waste-to-strip ratio [it expresses how much waste is mined per specific volume of minerals] is fundamental to the performance of mining activities, as McEwen Mining Inc directly experienced in H1 2022.

The company believes the waste-to-trip ratio could improve significantly after the addition of a production called Gold Bar South to the Nevadan asset. Gold Bar South is expected to contribute as early as this quarter and is expected to make a significant contribution to 2023 operations, with characteristics that broadly define an operating profile as such: higher gold concentration per tonne versus lower heap leach system performance during metal recovery.

The Gold Bar Mine will account for 24.8% to 25.6% of McEwen Mining Inc’s total consolidated full-year 2022 production of 153,000 to 172,000 GEOs.

Gold Bar Mine is currently mining 38,000 to 44,000 GEOs per year and the activity, which is somewhat expensive compared to the other assets, implies a cash cost of $1,951 for GEO and an AISC of $2,377 for GEO.

Mine San Jose: There’s No Reason Not to Expect a Hit to The Production of GEOs.

Due to a resurgence of the COVID-19 virus earlier in the year, the San Jose, Argentina mine slowed somewhat, but that will not prevent the plant from meeting 2022 production guidance.

Its contribution for this year should be no less than 69,500 GEOs or about 45.4% of the company’s total consolidated production for 2022. Cash costs per GEO [$1,351 for H1 2022] and AISC per GEO [$1,737 for H1 2022] should be on track to be lower than H1 2022 as shown by the Q2 2022 declining trends.

Results from recent drilling activity appear to indicate a favorable trend in terms of the concentration of precious metals in the mineral. So, barring major issues during mining activity, San Jose could also exceed this year’s maximum production guideline of 77,500 GEO. If these are the expectations in San Jose, they don’t seem unreasonable.

Higher production from the San Jose Mine coupled with improvements at the Fox Complex and Gold Bar Mine will potentially have a positive impact on the share price.

The Share Price Continues to Face Headwinds

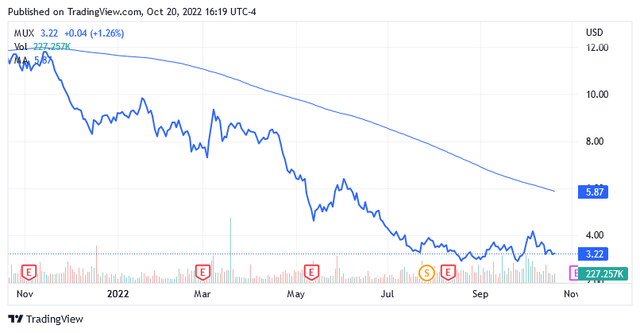

The stock was trading at $3.22 per share as of this writing for a market cap of $159.83 million and a 52-week range of $2.84 to $11.95.

The share price is trading below the middle point of $7.395 of the 52-week range and below the long-term trend of the 200-day simple moving average of $5.87.

On the Toronto Stock Exchange, McEwen Mining Inc. [MUX.TO] was trading at Canadian Dollars [CA$] of 4.44 per share giving a market capitalization of CA$210.65 million and a 52-week range of CA$3.68 to CA$14.90. The stock price is trading below the long-term trend of the 200-day simple moving average of CA$7.5922.

The stock price looks low, but that doesn’t mean it can’t fall further. This is likely as McEwen Mining Inc stock should follow the same path of an expected downtrend in gold prices due to metal’s inverse relationship with the rise in interest rates following the Fed’s hawkish stance.

A buy can then be considered if the global macro picture shifts in favor of the commodity.

Conclusion – Shares Are on the Verge of Interesting Valuation Levels, but Gold Needs to Be in an Uptrend for the Stock to Rally

Achieving a more favorable environment for gold prices depends on how effective the aggressive monetary policy of the US FED is at controlling inflation and whether and how much damage it will do to the economy.

When inflation has returned to levels that guarantee price stability, the economy will need more doves to make the US Fed meeting’s decision to exit the negative cycle that many economists are expecting for 2023.

Then, given its inverse relationship with interest rates, gold should cause McEwen Mining Inc shares to rise in the stock market. Higher production and lower costs offer further upside potential.

At that point, McEwen Mining Inc’s stock price could potentially start to recover from well below $3, which is the NPV per share of The Fox Complex’s upgrade project. As seen above, this estimate could provide a valid benchmark for investment decisions regarding this stock.

Be the first to comment