niphon

Tractor Supply (NASDAQ:TSCO) reported mixed Q3 2022 results yesterday (October 20th) with revenues of $3.27 billion (+8.3% Y/Y) slightly missing consensus by ~$10 million while GAAP EPS of $2.10 beating estimates by 2 cents. Comparable store sales were up ~5.7% Y/Y which is impressive given the current macro environment and illustrates the strength of TSCO’s business model and management’s initiatives like growing neighbor’s club program, project fusion, and garden centers. On the 3-year stacked basis, comps declined ~90 bps from 46.5% in Q2 to 45.6% in Q3. However, management attributed this decline to drought and heat conditions rather than a macroeconomic slowdown. According to them, less favorable weather impacted comp sales by about 150 bps in the quarter.

In terms of margins, gross margins declined 32 bps to 35.6%. TSCO’s price management actions and other margin-driving initiatives were able to offset the impact of significant product cost inflation and higher transportation costs. However, product mix from the robust growth in C.U.E. (consumables, usable and edible) products resulted in a downward shift in product mix as these carry lower margins. Selling, general and administrative expenses were also slightly unfavorable rising 16bps Y/Y due to the company’s strategic growth initiatives and investment in hourly wages and benefits which were partially offset by moderation of Covid-19 response costs, more normalized incentive compensation, and operating leverage. Lower gross margin and higher S, G, and A resulted in ~48 bps Y/Y decline in the operating margin which stood at 9.4% in the quarter.

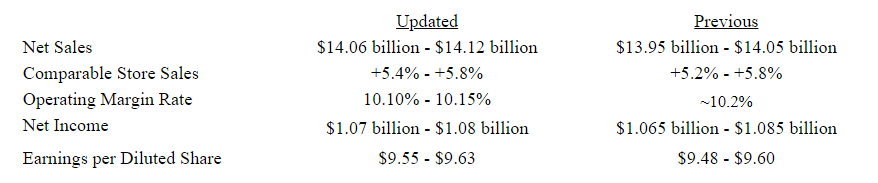

Earlier this month, the company closed the acquisition of Orscheln Farm and Home which is expected to add ~$75 million to net sales in the fourth quarter and fiscal 2022. Based on the strong sales growth and benefit from Orscheln’s acquisition, the company increased its sales guidance. However, for the operating income, this acquisition is expected to be relatively neutral. So, the operating margin is expected to decline slightly.

TSCO updated guidance (Company Press Release)

While I believe the company’s results were good and the outlook was also encouraging, the stock corrected post its results yesterday. I believe some investors were worried about the slight slowdown in 3-year stack comps and slightly lower margin guidance. I believe these worries are misplaced. While the three-year stack comps decelerated 90 bps versus Q2, according to management, each sequential month in the quarter was better than the previous month. In other words, August sales were better than July, and September sales were better than August. This momentum continued in October which bodes well for Q4. Also, if we exclude ~150 bps impact from rough weather, the underlying business momentum actually accelerated in Q3.

So far, the company-specific initiatives have helped TSCO more than offset macro headwinds, and, looking forward, I expect this trend to continue. One example of such initiatives is the company’s neighbor’s club membership program. The company gained significant market share and new customers in the last three years during Covid-19. The company has been able to convert a substantial portion of these new customers to active members of its neighbor’s club program. The company’s neighbor’s club membership last quarter exceeded 27 million members and represented ~75% of TSCO’s sales. This program has been able to incentivize members to increase their spending at Tractor Supply stores. Another good initiative by management is project fusion where the company is remodeling the store by changing the layout, upgrading adjacencies, reallocating square footage, and improving visuals in order to improve store productivity and increase assortments. The company is also transforming its vacant side lots of stores into garden centers, enabling it to expand its lawn and garden offerings. These initiatives are driving the company’s comp sales despite tough macros.

In addition, the company’s need-based business model has proved resilient even during tough economic times and I believe, we will see similar strength even if we enter a recession. So, I believe some of the investor concerns around growth are unwarranted and the underlying trends remain strong for TSCO.

On the margin front, challenges like inflation, supply chain constraints, labor availability, and wages-related issues are not unique to the company. We are seeing these pressures across multiple industries. In fact, I believe TSCO deserves credit for managing these challenges well through price increases and cost cuts. While the company reduced its operating margin guidance, it has more to do with Orscheln Farm and Home acquisition (which is expected to increase topline but contribute nothing to operating profit this year due to transaction costs offsetting benefits) rather than the company’s business fundamentals. As inflation, supply chain constraints and labor availability issues ease, I believe the company’s margins can improve in the back half of 2023 and beyond.

The stock is trading at 19.72x current year consensus EPS estimates of $9.61 and 18.12x FY23 consensus EPS estimates of $10.46. This is a discount versus its 5-year adjusted forward P/E of 21.44x. Hence, I have a buy rating on TSCO stock and believe the company can deliver management’s target of between high single-digit and low double-digit EPS growth even during tough times.

Be the first to comment