GoodLifeStudio

Our view

In our recent in-depth analysis of Netflix (NASDAQ:NFLX) at the end of September, we rated it as a “hold” at around $230. Since our rating, the company’s share price is up almost 30% and the company has recently released its third quarter earnings for FY22.

The latest quarterly results were largely a confirmation of existing key trends – some positive, some negative. Membership returned to growth after its first ever decline in the first half of FY22, but the overall trajectory of slowing membership growth continues. Content spending relative to amortization is reducing contributing to improved free cash flow generation. However, it is early days and the company needs to demonstrate that it can sustainably continue in that direction.

As of 20 October 2022, Netflix is valued at around $109 billion excluding cash – equivalent to a price-to-earnings ratio of 22 times based on LTM net income. We retain the same wide-ranging valuation assumptions in our previous in-depth analysis reflecting our “uncertain” view for Netflix’s outlook. This uncertainty is reflected in the disparity between the implied 10Y compound annual returns in our analysis, from 2% at the lower end to 15% at the upper end.

In the short-to-medium term, there are a number of factors with the potential for both positive and negative impact. The introduction of the new ad-supported subscription tier next month could help longer-term growth. However, the strong U.S. dollar is acting as a drag on revenues and profit margins, while households face continued inflationary and spending pressures.

It is entirely possible that Netflix could generate the annual returns of 15% implied by the upper end of our valuation assumptions. However, on the balance of probabilities, we do not feel that the current price provides a sufficient margin of safety given the stage that the company remains in a transitional phase and there are a number of uncertainties. For that reason, we maintain our “hold” rating.

Quarterly earnings

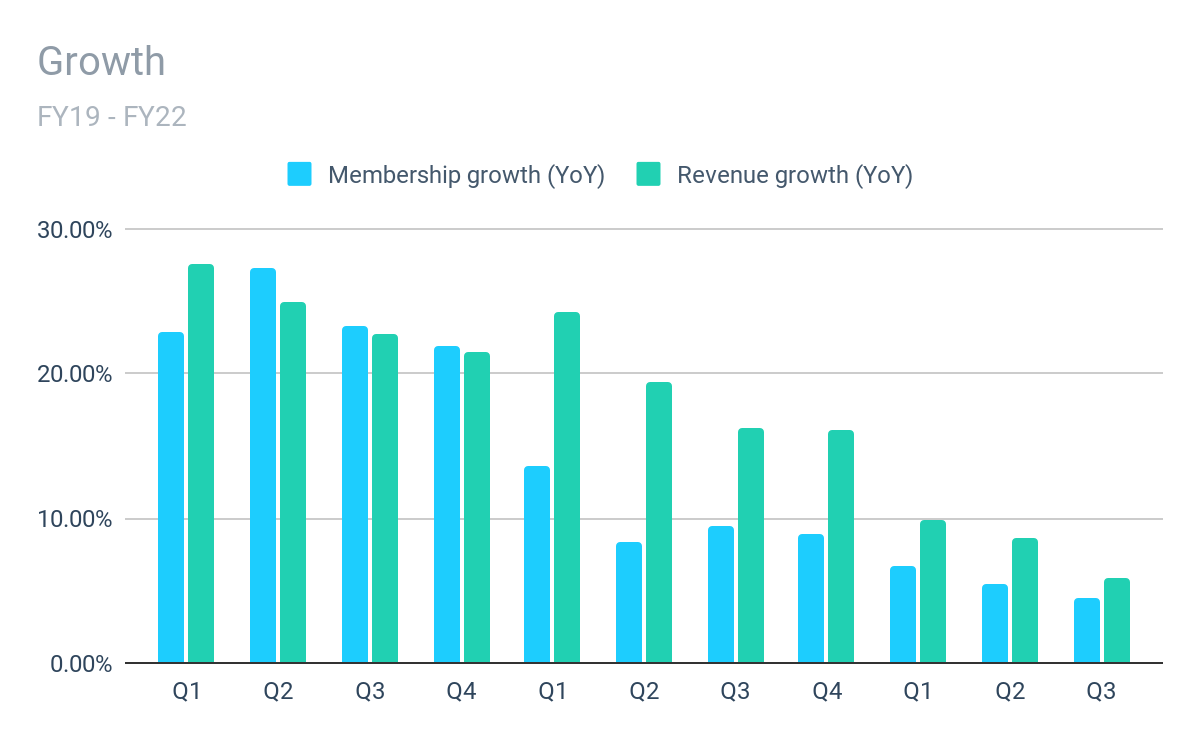

Memberships and revenue

Prepared by author. Data from company reports.

In the first half of FY22, Netflix reported its first ever decline in memberships. The recently released results for Q3 FY22 show that membership has returned to subscriber growth with paid memberships up 1% versus the previous quarter. However, on a year-over-year basis, subscriber growth does continue to follow a trend of slowing growth rates, now well into low-single digits at 5%.

As the key driver of revenue, membership growth has contributed to increased revenue which is up 6% on the same period in the period year. This growth was supported by a 1% increase in average revenue per member (“ARM”).

Like most U.S. based businesses with significant overseas revenues, Netflix’s revenues have been impacted by the recent strength of the U.S. Dollar versus other major currencies. On a constant basis – excluding the impact of foreign currency movements – revenue and ARM were up 13% and 8%, respectively.

While a majority of Netflix revenues are earned in foreign currencies, most of its costs are denominated in U.S. dollars. As a result, the majority of the impact of currency headwinds on revenue translate into a corresponding reduction in operating profits. Despite this, the company’s operating margin in Q3 was 19%, only slightly below management’s target for the year of 20%. However, operating margin in Q4 is expected to be 50% lower than in prior year as the impact is more fully felt.

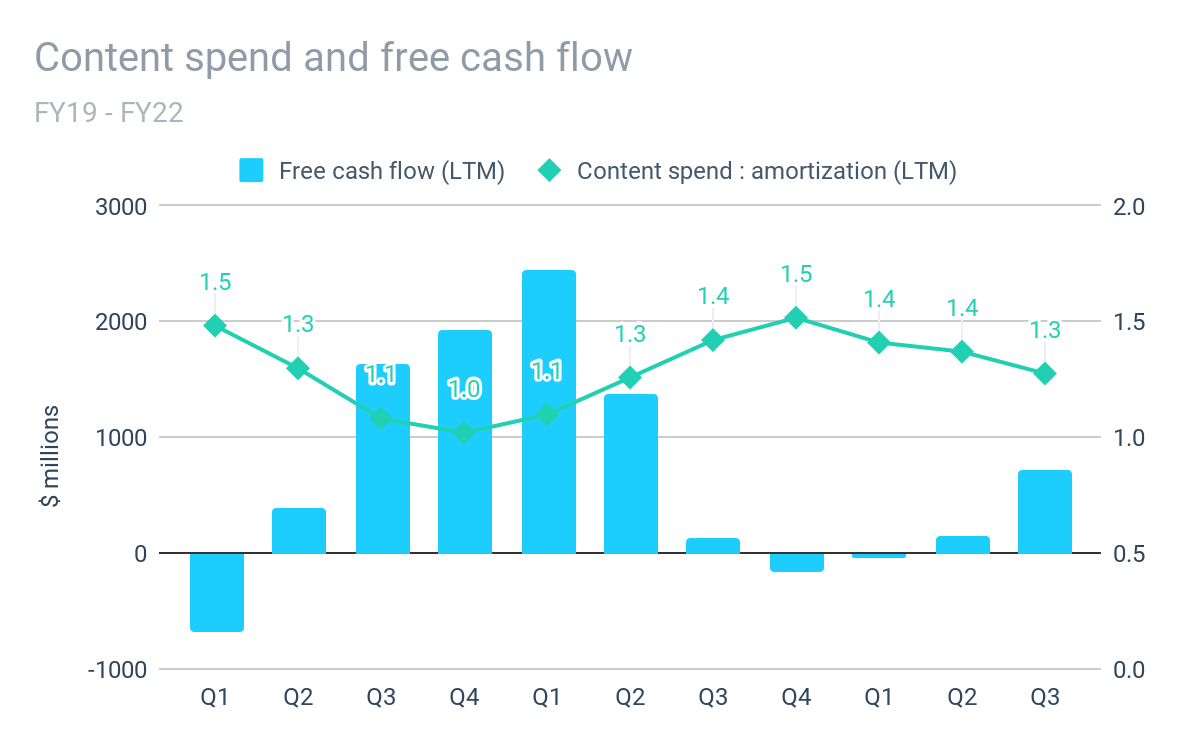

Cash flow

Prepared by author. Data from company reports.

As highlighted in our recent in-depth analysis, content spend is a key factor in the case for or against Netflix. While increased content investment is a driver of competitive advantage and membership growth / retention, it has also historically been a significant drain on free cash generation.

We’re confident we can deliver even more member value per content investment dollar over time

– Management, Q3 2022, Letter to Shareholders

The ratio of content spending (cash spending) compared to the amount of content amortization charged to the income statement has been declining through FY22. However, at more than 1.25x across the last twelve months, the company continues to invest in content at a rate above current expense rate. Management delivering on their objecting of providing more value per dollar invested in content will be an important factor if Netflix is to successfully execute its transition to a sustainable free cash generating model.

In the period FY19 – FY21, Netflix generated negative free cash flow of $4 billion despite generating nearly $10 billion in net income. The gradual reduction of spending on content (relative to amortization charges), has contributed to increasing positive free cash flow in recent quarters. Management expects free cash flow generation for full year FY22 to exceed $1 billion, followed by a “substantial increase” in FY23.

The early signs are positive, but the company will ultimately need to demonstrate that it can increase free cash flow over a sustained period while also attracting, or at least retaining, subscribers. The increased free cash flow has contributed to a reduction in net debt which has been falling consistently through FY22. At 30 September 2022, net debt amounted to $7.9 billion at the, equivalent to 1.2x EBITDA (LTM).

Management reiterated their capital allocation priorities are expanding the business (including through selective acquisitions), with any excess cash returned to shareholders through repurchases.

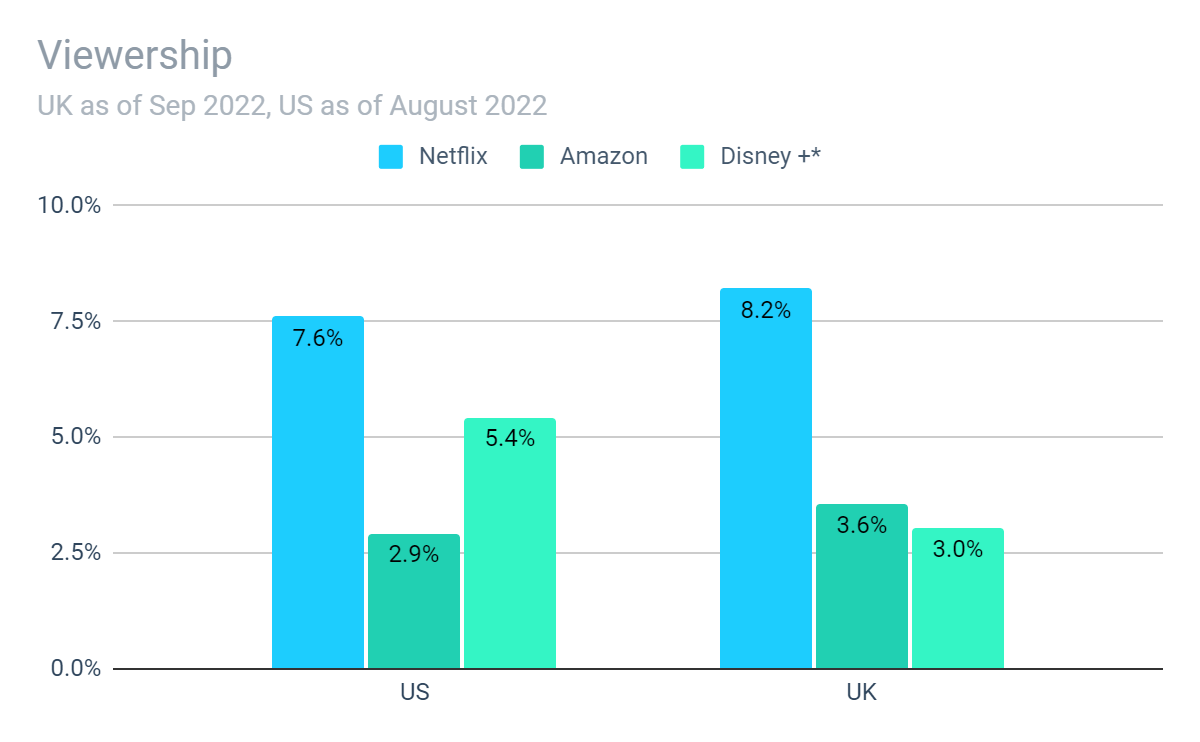

Viewership

Prepared by author. Data from company reports.

* Disney+ in the US includes Hulu which is unavailable in the UK.

While viewership does not directly impact revenues under the current subscription-only model, it is an indication of the value subscribers place on Netflix’s content and will become increasingly important under an ad-supported model which monetizes viewing hours. It also provides context to Netflix’s performance against streaming and traditional broadcasting alternatives.

In September 2022, Netflix accounted for 8.2% of viewing in the UK, which is more than 2.3x the level of engagement achieved by Amazon and 2.7x Disney+ (BARB, as of September 2022). The results in the U.S. are similar, achieving 7.6% of the viewing in August 2022, up from 6% when the metric launched in May 2021(Nielsen’s Gauge, as of August 2022). Netflix’s U.S. share is more than 2.6x Amazon and 1.4x Disney (including its various Hulu offerings).

Netflix generates c.$30 billion-plus of annual revenue. In the 190 countries in which it operates, this represents only roughly 5% of the combined market for pay TV/streaming, branded advertising market, and gaming combined, highlighting room for growth through increased market share.

Outlook

Management forecast a further 4.5m paid membership additions in the final quarter of FY22, representing year-over-year growth of 2.6%. At this level it is around 50% lower than in the same quarter last year.

Netflix will launch its ad-supported subscription plan in 12 markets at various dates throughout November. These 12 markets account for 75% of the global advertising spend market across tv and streaming so will act as a strong indicator of the potential of the company’s ad-supported model. The low-priced ad plan – Basic with Ads – will be offered at 20%-40% below the current starting price. In the US, for example, Netflix will now start at $6.99 per month (compared to $9.99 today).

Management do not expect the introduction of ad-supported tier to have an immediate material impact on Q4 results as it is designed to attract new members to Netflix over time, rather than encourage existing members to downgrade from their existing plan. It may take a while to build the membership numbers to attract advertisers and generate significant ad revenue. It will be interesting to see what proportion of existing users chose to downgrade – a move which could hurt performance in the short-term depending on the extent to which Netflix can monetize viewership through advertising.

In their attempt to capture lost revenue from account sharing, the company also announced that they are introducing the ability for borrowers to transfer their Netflix profile into their own account, and for sharers to manage their devices more easily and to create sub-accounts (“extra member”), if they want to pay for family or friends. We are skeptical about how much of an impact this will have on curtailing account sharing and generating incremental revenues.

Based on current foreign currency headwinds, management expects a slight decline in quarterly revenue in Q4 of this year. However, on a constant currency basis, this will represent 9% year-over-year growth.

Management’s target operating margin in 2022 and 2023 is 20%. On a currency neutral basis, management expects to meet these targets with the exception of one-off restructuring costs in 2022. At current exchange rates, reported operating margins are likely to be below target. If exchange rates persist, management will need to explore options to adjust pricing or their cost basis if target margins are to be maintained in the medium-term.

Moving forward, management will no longer provide forward guidance on memberships. While this is understandable as the introduction of ad revenue will decouple revenue from membership numbers to some extent, it could also be seen as an indication that management do not expect meaningful membership growth and instead are directing attention on top-line growth through additional revenue from advertising, gaming and pricing changes.

Risks

The key risks are consistent with those set out in our previous in-depth analysis. A summary of these are as follows:

Content spending

Content costs are largely fixed in nature and contracted over several years meaning the company has limited flexibility to reduce costs in the short-term. The acquisition and/or creation of new content has historically consumed all of the company’s free cash generation.

Competition

Competition in the video entertainment market is strong and increasing. Competition is not limited to alternative video streaming services, with the company competing for user attention with other platforms such as Instagram, YouTube and TikTok.

Economic conditions

Netflix is an easy target for households looking to cut their monthly spending. However, it may also benefit from consumers looking for cheaper stay-at-home entertainment options. As long as the strength of the U.S. Dollar prevails, it will be a headwind for profitability. In the medium-term, the ability of the company to maintain margins will depend on its ability to adjust its pricing and cost structure to compensate should exchange rate headwinds persist.

Valuation

As of 19 October 2022, the company’s shares trade at around $270, giving a total market capitalization of $116 billion. Excluding cash reserves of almost $6 billion, this implies a valuation of $109 billion for the business.

Our approach to valuing operating businesses is based on determining the true underlying earnings power of the business or “owner earnings”. Based on FY22 YTD net income of $5 billion, the operating businesses are valued at 21.7x times net income. In the case of Netflix, net income likely overstates owner earnings as actual content cash spending has consistently outpaced the corresponding amortization charge in the income statement.

Netflix is at a transitional point and we consider the outlook to be uncertain. For that reason, our valuation models apply a wide range of assumptions:

| Valuation assumptions | Lower | Mid | Upper |

| Earnings growth | 5% | 10% | 15% |

| Re-investment rate | 100% | 75% | 50% |

| Price-to-earnings ratio | 15.0 | 17.5 | 20.0 |

| Total return (10Y) | 18% | 130% | 319% |

| Implied compound annual return | 2% | 9% | 15% |

The high level of uncertainty is reflected in our analysis which implies a wide range of possible outcomes for investors over the next decade. At the lower end, we assume that cash generation continues to be fully absorbed by content or other investment and that earnings growth will be minimal at 5% p.a. At the upper end, we assume that the company achieves net earnings growth of 15% p.a. and converts 50% of its earnings into free cash flow.

These wide ranging assumptions imply a wide range of potential outcomes, with annual compound returns of 2% at the lower end but increasing to 15% at the higher end of our range.

Conclusion

The results for the third quarter of 2022 was confirmation of pre-existing trends both negative and positive. Membership growth continues to slow, but there are positive signs that the company can continue to transition to a model that is free cash flow positive, albeit it has a long way to go before it is yielding free cash flow at the levels we would find attractive in the context of its growth rate.

Netflix is at an important point and the outlook from here is uncertain. Membership growth has slowed (or even declined), the company is investing increasing amounts in exclusive content, and competition from well resourced competitors has increased.

Overall, we reach the same conclusion we reached in our analysis in September. While we retain a positive outlook for Netflix in general, we don’t feel that the current price provides the right risk-reward balance for the risks and uncertainties that Netflix faces in its ongoing transition and we continue to rate it as a “hold”.

Be the first to comment