Yaroslav Litun/iStock via Getty Images

British American Tobacco (NYSE:BTI) has operated as quite a solid company thus far and pays investors handsomely to hold shares by paying about 7.1% annually in cash dividends. This means that any potential downturn in the company’s share price is mitigated by this significantly higher than the broader market payment.

So assessing whether the company is finally ready to be a short position is incredibly difficult, even if the business is set to contract and various other factors are working against it.

But given what these organic and future business contractions mean, I believe that there’s a chance that the company will be forced to cut their dividend. Even if this happens by just a little but, I believe that the effect on the company’s share price alongside their downside with the already-existing headwinds is making that short position look more and more enticing.

Let’s discuss.

Industry and Company Headwinds

There are several things to which I anchor my negative perception of British American Tobacco’s thinking. While there are some tailwinds to talk about, especially the prospects of a sustainable dividends, I’m beginning to believe that they won’t be able to overcome the negatives.

1: Further Decline In Traditional Business Segment

While the company’s e-cigarette business is booming, as I’ll discuss later on in the article, the revenues and royalties from its core cigarette and tobacco business continues to face longer term headwinds as people around the world become more health conscious and moves beyond traditional cigarettes.

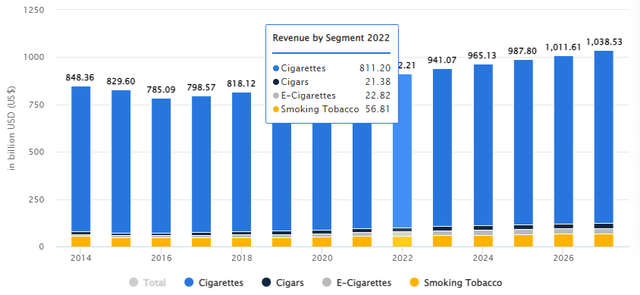

Global Tobacco Market (Statista Visualization)

While there may be places and regions and demographics which can show some growth, my sentiment is derived from market research showing this overall decline. While the global tobacco market is set to grow at a CAGR of just 2.6%, the e-cigarette segment is expected to continue and grow quite rapidly. Given that, it confirms that the traditional tobacco products and their use are in sharp declines in developed nations.

With these traditional tobacco products still comprising over 50% of the company’s overall revenues, according to their website, this sharper decline in their use should hurt the company’s overall performance and contribute to revenue declines they’re seeing and which I expect them to continue seeing.

2: Margins Continue To Face Headwinds

E-Cigarettes sure are seeing higher demand as more people both transition away from traditional cigarettes and as the company and other industry lobbying efforts market these products around the world to younger people who are less focused on health concerns.

But due to rising inflationary costs around the world as a result of supply chain issues from the COVID-19 pandemic, the margins on these products remain quite low. The company’s traditional tobacco products have enjoyed a huge margin boost since they can continue to raise prices with them holding such a huge market share and due to the fact that people are addicted to these products. But with e-cigarettes there is a severe limitation.

Not only is the cost of these products rising, but the emergence of so many different companies coming with various e-cigarette and other vaping products around the world means that the company is limited with how much they can raise the price of their products by.

This means that ultimately while the company’s business sees this transition away from traditional tobacco products and into the e-cigarette and vaping markets – I expect their margins to shrink, even if they’re able to replace a good chunk of their revenues relative to previous glory days.

3: Rules And Regulations Are Increasing

While the world over faced tough times over the past few years, it took away from previous efforts to more tightly regulate vaping and e-cigarette markets when it comes to youth – which are increasingly a large part of the industry.

With things settling down around the world, or at least expected to settle down more over the coming few years, I believe that various governments, both on a national levels and at local levels in cities and nations around the world, will get back to discussing regulations and outright bans on various products which are increasingly linked to health issues among young people.

This means that the company may spend years investing into this new-ish market in order to make up for their lost revenues and profits in the traditional tobacco markets just to find themselves unable to sell to certain age groups or having to spend a fortune on marketing or even, in a worst-case scenario, pay large amounts of money to settle lawsuits related to youth health.

4: Company Financials Put Yield At Risk

This is the ‘biggy’ and the main reason why I’ve shifted my position on the company from neutral or slightly bullish to bearish enough which may potentially warrant a short position in the company.

The company spends about $1.55 billion each quarter on dividend payments, which currently yield around 7.3% annually. However, over the past 2 quarters the company has reported just around $1.22 billion in earnings after taxes. While that number right now remains sustainable given business cyclicality, it’s about the future.

Over the next 3 years, analysts currently expect the company to report an overall decline of almost 12.5%, falling from EPS of $4.49 last year to EPS of $3.93 in 3 years time. This means that a 12.5% decline in profits without taking into account any potential over or under-performance in sales, will result in the company’s dividend payments being larger than their income.

This is the reason, given that I believe that the company is likely to underperform both its current sales and current profit expectations, that the potential for the company to lower, not eliminate, its dividend payments is a real threat. Given how many investors have positions in the company due to their high dividend status, while it’s not exactly clear of the scope, I do believe that we will see a sizable exit of investments from the company should this occur.

Risks & Positive Factors

With any potential short thesis comes immense risk. The first and foremost one is that if the company manages to somehow skirt the underperformance and maintains their dividend yield, any short position is automatically underwater by 7.1% for the year. As a result, a 10% decline in share value means the cost for holding that short through the decline costs you 7.1%, meaning the profit you’ll make is significantly smaller.

The other main risk associated with shorting a company’s shares is that while the upside for your position is limited to 99% (in theory), the downside to your position is unlimited (in theory). This means that in today’s market where many companies have fallen prey to the meme stock trading, where stock traders from various social media style sites pump up the stock price by as much as 1,000% in a matter of a few days, a position can go against you extremely quickly.

There’s also the added risk that the company is, for all intents and purposes, in a decent financial position. They’ve reduced their debt load to minimize interest expense, they hold just over $5 billion in cash, equivalents and short term investments. They can use all of these piles of cash and cash flow to help maintain their dividend for several years, which can in turn hurt any position, whether short through equity stock or options. Rolling over options at strategic times may help mitigate some of these risks, but they remain.

How To Mitigate? We Have Options

Beyond that terrible yet terrific pun I just made, options can be a good way to trade the company’s longer-ish term prospects. While the dividend payments actually work in your favor due to the technical aspects of PUT prices increasing when the company pays out a dividend, we can actually avoid a lot of the risks associated with shorting the company’s shares.

For this position, I’m choosing January 19, 2024 PUT options with both a $30 strike price and a $25 strike price. With current pricing around $1.30 and $0.75, this represents the potential to nearly quadruple the options value if British American Tobacco reaches those levels.

While the loss of the entire position may be possible, which is a real risk, a short in the company’s share price means you can lose well over your initial short investment if the company’s share price spikes – which is why I am contemplating this short position through PUT options alone.

Conclusion: Starting Small & Building

While it’s nearly impossible to determine how much the company’s shares will be affected if they cut their dividends, organic decline in EPS means that they could be trading at around 10x forward earnings per share in the next few years while expected to continue and report EPS declines.

Given that, I believe that the company’s fair value should be closer to a forward multiple of 8x, meaning that even before any of the aforementioned factors take effect, or even if they ever will, the company is, I believe, overvalued by as much as 20% through the next 2 years or so.

After the accumulation of my PUT options position I will be waiting for about 18 months, or 6 quarterly reports, to suss out which of the factors I mentioned earlier will materialize and at what rate. Expect a follow up article around February of 2023, unless some dramatic news takes place prior to that.

I remain bearish on the company’s long-term prospects and am initiating a short position through PUT options to enjoy a potential of as much as a 400% return on the downside investment.

Be the first to comment