vitpho/iStock via Getty Images

Delivery of goods and services has become more vital in the evolving global market. In a capital and labor-intensive market, P.A.M. Transportation Services, Inc. (NASDAQ: PTSI) proves it is capable of meeting the market needs and demands. P.A.M. appears to be a durable company, especially during these fluctuating times. It has solid revenue and margin expansion that exceed the impressive 2021 results. In recent years, there have been some slippages in its financial performance. But overall, the uptrend has become more evident, overshadowing these volatilities.

Company Performance

P.A.M. Transportation Services, Inc. operates in a still stormy market landscape. Borders have not been fully reopened yet across the globe so backlogs may extend this year. Supply chain disruptions are still hitting the market, and P.A.M. is not an exception. But it seems to maneuver its operations with prudence to the rising costs.

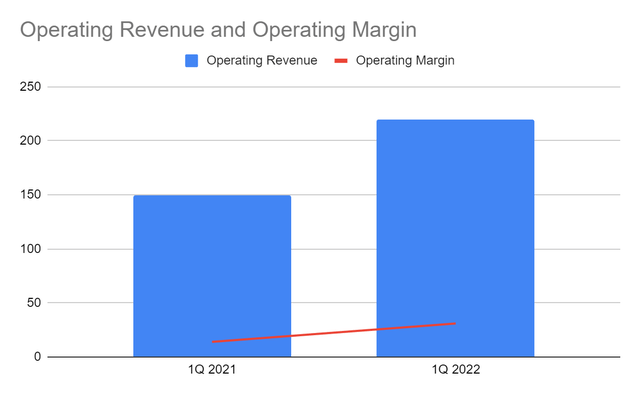

This quarter, its operating revenue reaches $219 million, a 47% year-over-year growth. It indicates that the company continues to maximize its operating capacity. Despite the tight competition, its banks in its solid core operations. Amidst the giants in the trucking industry, it captures the needs of many customers. It shows that the company can go head-to-head with larger peers. It can even compete with those in similar niches. Note that P.A.M. and its close peers are competing with air and ocean cargo.

Operating Revenue and Operating Margin (MarketWatch)

To make things harder, borders and restrictions have not been fully released yet. It is no wonder that the industry faces rising costs of time and fuel and even backlogs. And these aspects seem to separate P.A.M. from many peers of its size. First, its brokerage, logistics, and truckload service revenues remain on the rise. The thing is, P.A.M. benefits from its strategic pricing and strong domestic presence. We know that in this competitive market, there must be an efficient and cheaper way to deliver goods. Thankfully, P.A.M. is one of those companies that have these attributes. The demand is higher as e-commerce companies continue to multiply and diversify. They offer more growth opportunities, given the high demand for door-to-door transport facilities. I will discuss this part later.

Its success in increasing and maintaining its drivers also helps drive its growth. Amidst labor shortages, P.A.M. continues to refute the claims. In fact, it is one of those with the highest concentration of truck drivers in Arkansas. Amidst the difficulty to hire and keep drivers, it continues to navigate through it. Today, it has 2,400 truck drivers, driven by its record hiring in the last year. It also has 1,675 trucks. With that, the driver-to-truck ratio is now 1.43 from 1.20 in 2020. The company can attend to its customer needs with improved efficiency and timeliness. It also manages its backlogs well without leading to driver burnouts. It is no surprise that its traveled miles and revenue per mile keep increasing.

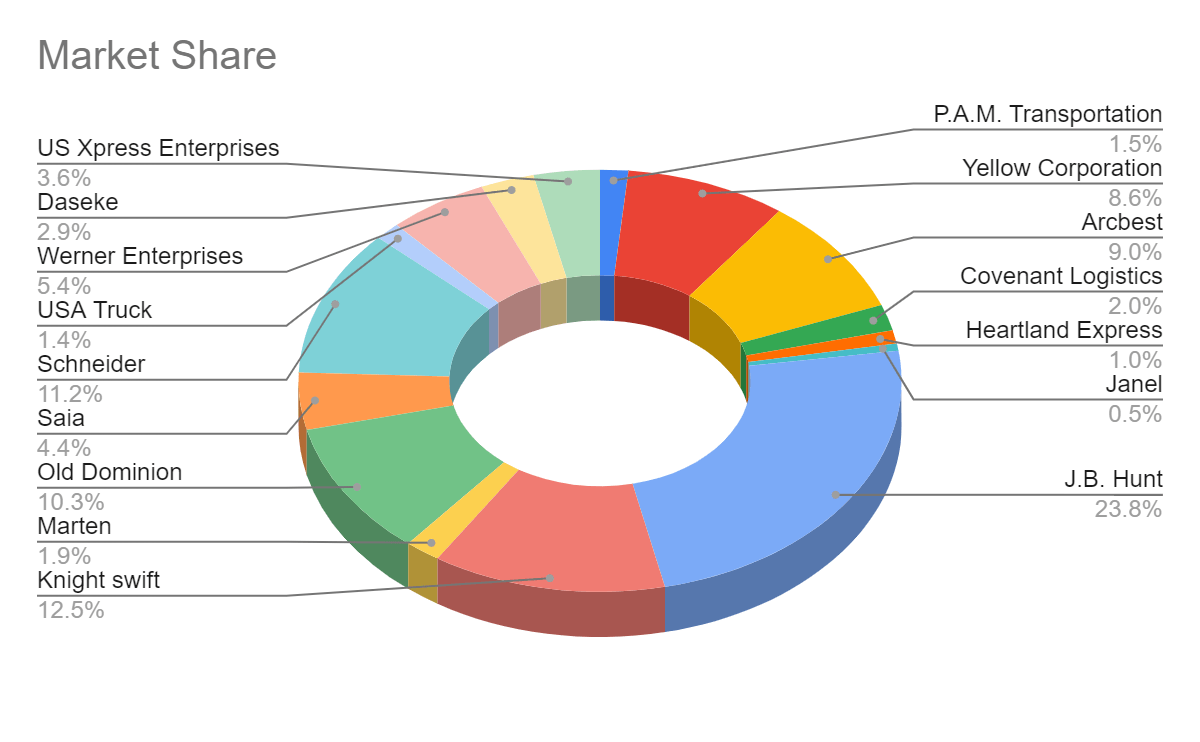

Relative to many of its peers, P.A.M. has more impressive revenue growth. Its revenue growth of 47% is far higher than the market average of 35%. It is becoming more evident and gaining more market visibility. Its market share of 1.5% is higher than 1.1% in the previous year. Although it still has a long way to go, it proves itself to be capable of expanding in a stormy market. Note that I only compare it to companies in the trucking industry in SA.

Market Share (MarketWatch)

Even better, P.A.M. maintains its efficient asset management amidst inflationary costs. It also knows how to maneuver its trucking operations with ease and prudence. For example, its rising fuel costs are offset by its fuel surcharge revenues. And as we can see, revenues are rising faster than costs and expenses. Indeed, the influx of customers and its productivity keep its costs and expenses low. The operating margin now is 14% from 9% in the comparative quarter.

Amidst all these, we still have to remember that market uncertainties persist. It is still in irregular times that do not promise a permanent increase. The thing is, P.A.M. has shown volatility in its financial performance in recent years. Nevertheless, the general uptrend remains visible. It shows that it continues to expand amidst some slippages. Also, its profitability is a testament to its financial resilience amidst operational disruptions.

Potential Growth Drivers

P.A.M. Transportation Services, Inc. operates in a highly competitive market environment. That is why it is susceptible to risks associated with economic changes. Despite the influx of demand, it competes with many freight logistics companies. Larger companies operate in a wider niche, including air freight and water cargo. Even harder, the reopening of borders across states and countries is not complete yet.

And since P.A.M. is capital and labor-intensive, it relies on equipment and manpower. It has to keep an eye on the timely delivery of products and services. It has become more crucial as port congestion and supply chain disruptions ensue. As such, it needs more cash and other liquid assets to sustain its operating capacity.

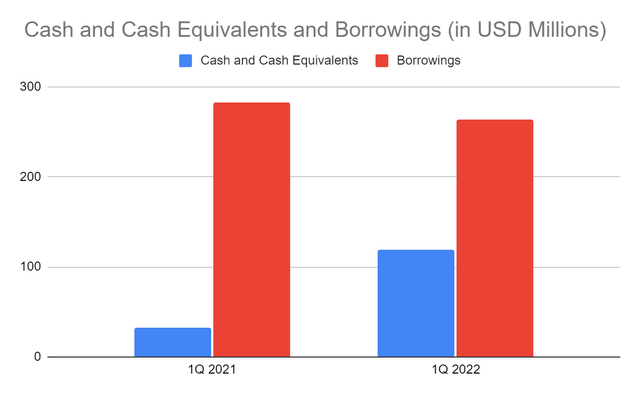

Fortunately, P.A.M. has had adequate cash inflows to cover its CapEx since 2018. That is why it continues to realize positive FCF amidst macroeconomic pressures. We can confirm its sustainability in its Balance Sheet. The sustained profitability and positive cash inflows lead to stable cash levels. Today, its cash and cash equivalents of $119 million are 17% of the total assets from 5% in 1Q 2021. Meanwhile, its fixed assets are lower by 12%. It may be due to its increased disposal of fixed assets. Note that the company continues to dispose of old and less-performing PPEs. Today, the average age of its trucks and fleets is 1.8 and 5.5 years, respectively. It has not received all the remaining equipment yet, but these will be delivered this year. As such, it may lessen its costs for repair and maintenance. New equipment means improved operational efficiency. It is timely and relevant as more customers flock into the industry.

Even better, its borrowings are more manageable at $266 million from $282 million in 1Q 2021. The percentage of cash and cash equivalents to borrowings now is 45%. It is four times higher than in the previous year, making P.A.M. more liquid today. It is a good thing since companies in the industry may need more financial leverage. Given this, it still has more than enough room to cover its financial obligations. It may sustain itself during a crisis even without having to borrow or issue more shares. Remember that interest rate hikes will persist to cushion the blow of inflation. The cost of borrowing may skyrocket this year. So, it is a good thing to see it increase its operational efficiency while remaining liquid. Relative to its earnings, its Net Debt to EBITDA ratio is 3.15, which is within the ideal 3-4 range. The borrowings of the company are still reasonable relative to its cash and earnings. It proves the consistency in the viability and liquidity.

Cash and Cash Equivalents and Borrowings (MarketWatch)

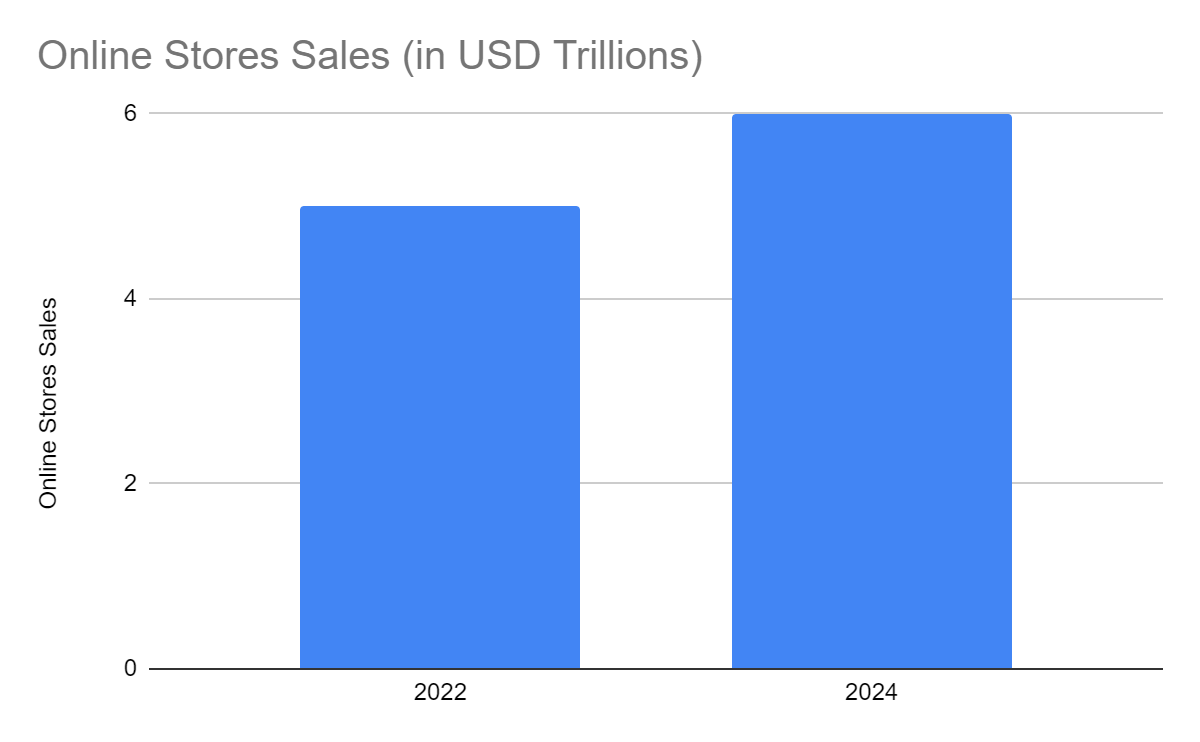

Moreover, other aspects may boost its performance. E-commerce is at the forefront of digital transformation as more people go online. Today, 93.5% of internet users are shopping online. In the US alone, e-commerce has accounted for 20-25% of retail sales in recent years. Despite the easing of restrictions, e-commerce remains on the rise. Thanks to the increased number of people going cashless. Other studies show that more people today are geared toward online shopping. As more people get access to e-payments, e-commerce continues to boom. By 2040, e-commerce may account for 95% of global purchases. That is why e-commerce sales in 2020-2024 may increase to $5-6 trillion.

Online Stores Sales (Shopify)

The boom may benefit the trucking industry. It may further drive the demand for door-to-door transport facilities and delivery services. Note that the US and Canada are in the top ten countries in e-commerce with $843 billion and $44 billion in sales. So, its focus on North America may be both conservative and fruitful. It may opt to enhance its market visibility while meeting customer needs. Also, it may keep the risks of backlogs and increased costs and expenses at bay. It is because a smaller area means fewer hours and fuel spent on delivery.

Once the easing of lockdowns is complete, the economy may become more stable. An effective monetary policy may stabilize inflation at reasonable interest rates. With freer transport of goods and services, efficiency will be more crucial. That is why the improved capability of its technology systems is a wise move to keep up with it. Its newer equipment and technology may help enhance its operational efficiency. Service dispatch delivery software is an important tool for automated monitoring of drivers. Companies may enjoy its features, including scheduling, rerouting, and planning. It also has data analytics that present delivery duration and customer feedback. Hence, the company may enhance business processes without facing higher costs.

With all the potential setbacks and growth drivers, P.A.M. may remain promising. In 2022, I expect the operating revenue to reach $806 billion. It is in line with the average growth in recent years. It is slightly lower than the average quarterly values in the last year. Meanwhile, I project the operating margin to stay at 12%. In 2023-2026, I expect revenues and margins to increase at more stable levels.

Price Assessment

It is not simple to value trucking companies like P.A.M. Although it is trading at only $28.73, volatility remains a concern. The stock price of PTSI is moving sideways after its recent downtrend. But it does not promise an instant rebound. The good thing is that its PE Ratio is only 7.39, lower than the ideal ratio of 20. But of course, this valuation method may not be precise all the time. The current 7-8x earnings multiple is far lower than the 30-40x earnings multiple in 2020. Given this, EV/EBITDA may be a better way to assess whether it is fairly valued or overvalued.

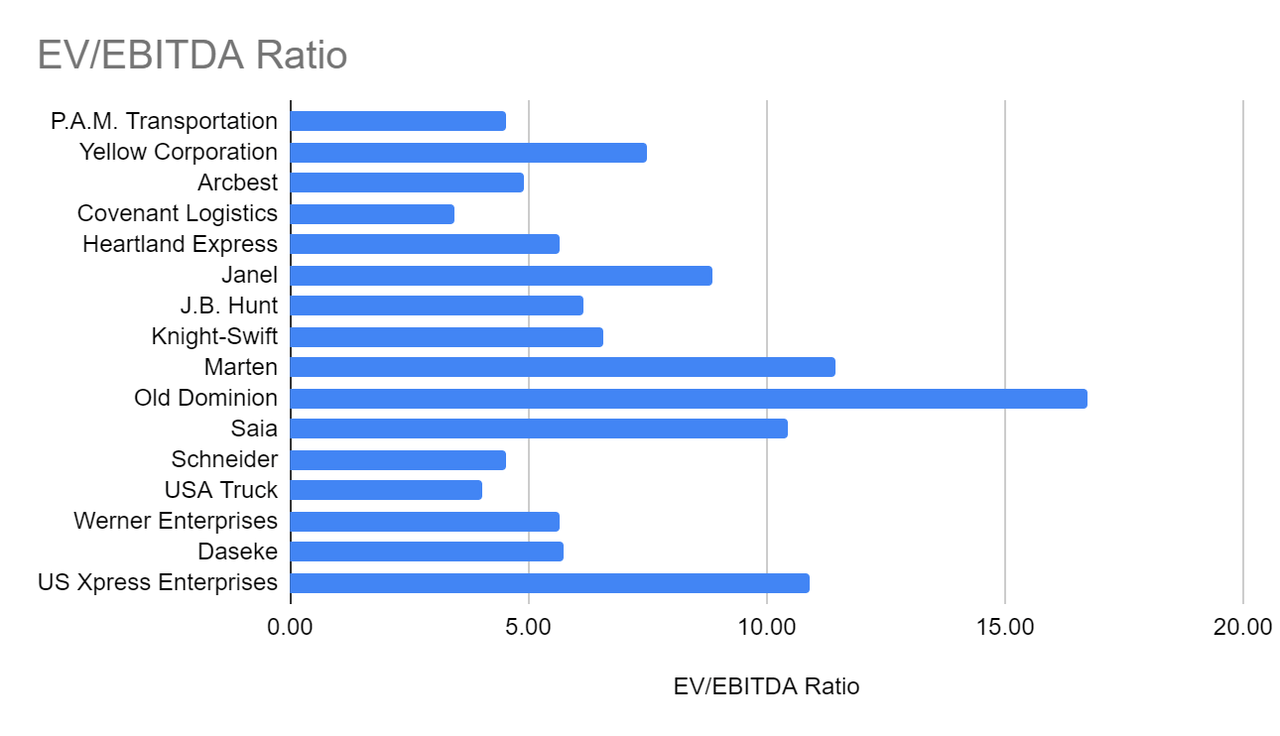

For many analysts, the ideal EV/EBITDA ratio is 10 and below. P.A.M. has a ratio of 4.55, proving that the company is reasonably valued. If we compare it to other companies, it has one of the lowest EV/EBITDA ratios. It also has one of the best EBITDA margin TTM of 22.11%. To assess it better, we can use the EV/EBITDA to find the target price.

EV/EBITDA Ratio (Seeking Alpha)

Stock Price $28.73

EV $782,190,000

Net Debt $144,000,000

Common Shares Outstanding $22,264,802

Derived Value $30.26

The derived value proves that the stock price remains reasonable. There may be an upside of only 5% for the next twelve to twenty-four percent. With that, there may be a little growth potential to drive the stock price upward.

Bottom line

P.A.M. Transportation Services, Inc. continues to prove its resilience amidst external pressures. There may be volatility in its financial performance, but it proves to be sound. Meanwhile, the stock price appears to have a slight undervaluation. One must not anticipate an instant rebound, but growth prospects remain promising. The recommendation, for now, is that P.A.M. Transportation Services, Inc. is a hold.

Be the first to comment