jetcityimage/iStock Editorial via Getty Images

Introduction

Between December 2021 and January 2022 we saw two important spin-offs in the construction machinery and heavy trucks industry that gave birth to Daimler Trucks (OTC:DTRUY) and IVECO Group (OTC:IVCGF). The focus of both was to unleash the potential of the two by making them pure-plays in order to create added value. I plan on covering these two companies, along with their major peers. This is the first article of the series in which I look at Daimler Trucks and show why I currently rate it a hold, given some uncertainties on how the company will improve its profitability.

The Context

With the latest spin-offs, the market sees now four large independent European truck and bus manufacturers. To the two companies mentioned, we have in fact to add TRATON (OTCPK:TRATF), whose spin-off by Volkswagen happened in 2019 and the established Volvo Group (OTCPK:VOLAF). The profitability of IVECO Group, Daimler Truck, and TRATON was not the main priority when they were parts of their former mother groups. All of them have told the market that they will focus on improving margins.

Daimler Trucks

On December 10th, 2021, Daimler Trucks was spun off from Daimler AG that became Mercedes-Benz Group AG (OTCPK:DDAIF). The newly independent company stands now on its own and produces trucks and buses that are marketed under the BharatBenz, Freightliner, FUSO, Mercedes-Benz, Setra, Thomas Built Buses and Western Star brands. Daimler Trucks is divided into five business units: Mercedes-Benz, Trucks North America (Freightliner, Western Star, Thomas Built Buses), Trucks Asia (FUSO, BharatBenz) and Buses (Mercedes-Benz & Setra), Financial Services. In 2021, the company sold 455,445 vehicles, with a revenue just shy of €40 billion and an EBITDA of €2.5 billion. Its current market cap is $26.1 billion.

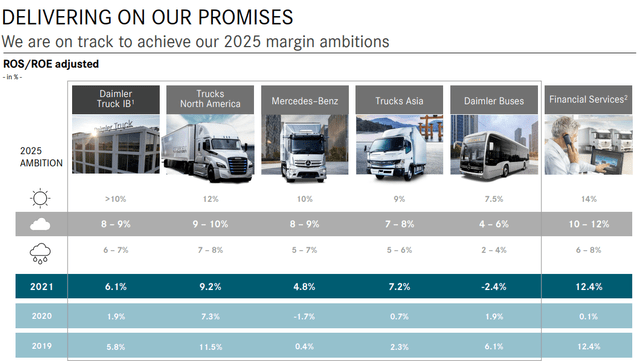

These are the goals it announced to investors, that we will have to carefully keep in mind to evaluate how the company is running its business:

Daimler Truck’s ambition is to achieve more than 10% Return on Sales (Industrial Business, adjusted) by 2025, assuming strong market conditions. Based on its “every segment must deliver” approach, Daimler Truck’s top management today announced margin range ambitions for its individual segments reflecting different macroeconomic conditions. In a 2025 scenario with strong market conditions, Daimler Trucks North America (DTNA) is aiming for a 12% adjusted Return on Sales, Mercedes-Benz for 10%, Truck Asia aims for an adjusted 9% Return on Sales and Daimler Buses for 7.5%.

Daimler is the industry leader in North America for trucks and the global leader for buses. Daimler Buses, however, as we will see, even though it has a strong leadership, it is still suffering greatly from the pandemic since buses sales were strictly linked to travel.

Among its targets, the company also stated that it wants to achieve by 2023 a 15% reduction in fixed costs and that it is expecting for 2022 an adjusted return on sales of the industrial business between 7% and 9%. With volumes increasing, fixed costs should also become lower on a percentage basis. Furthermore, the company is taking action since 2021 to reduce employees, with a €70 million benefit in the EBIT of 2021 and another €70 million that will be seen between 2022 and 2023.

The company is clearly focused on developing electric trucks and buses, but it is also focusing on hydrogen vehicles and autonomous driving. This last focus sees the company, as far as we may know, well positioned to become a future market leader.

Financials

Daimler Trucks was awarded a Moody’s first issuer rating of A3 (outlook stable), while Fitch Ratings assigned it an A- (outlook stable). The company has $7.73 billion in cash and bears a total debt of $18.60 billion. It is managing to reduce SG&A expenses, achieving a 6% reduction from 2019 to 2021, which is quite a result, considering the environment we are in, characterized by strong inflation and price increases all over the supply chain. As a result also of this cost control, Daimler Trucks’ net income from 2019 to 2021 increased by 38%.

As we’ve seen, as investors we will have to keep track of Daimler Trucks’ ability to increase its return on sales, making it a more profitable company. Since the company is quite new, we can only have a glimpse of what is happening through the Q1 2022 results.

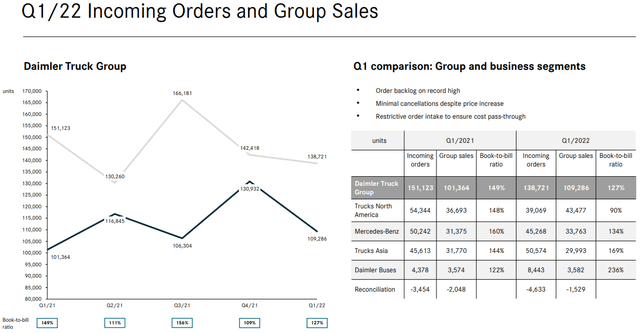

During the Q1 earnings call, Jochen Goetz, CFO of Daimler Truck, presented a positive development, showing that the company’s EBIT increased to €651 million versus €580 million in Q1 2022. However, the return on sales was of 5.9% versus 6.3% last year, showing a decrease which investors would not want to see. Free cash flow was also very low, coming in at €73 million, due to high inventory levels and increased investments. To this, the typical seasonality of the business must be added, which usually tends to have higher orders and lower sales in Q1. In the graph shown below, we can partially see this happening quarter after quarter, with one having strong orders and the next one showing stronger sales.

Daimler Trucks Q1 2022 Earnings Presentation

As we can see, while group sales are growing YoY, in the last quarter the incoming orders decreased, especially for Trucks North America and Mercedes-Benz. This may sound a bit disappointing for investors, who could expect weaker results as we head towards 2023. When asked about this, Goetz explained his view, by highlighting that, at the moment (bold mine),

the market size is not defined by demand but by supply[…] the markets would be easily 50,000, 60,000, 80,000 higher than what we see. And what basically happens, what could happen is that even if the demand is not that strong any longer but if the customers were not able to get the trucks for this high demand, it’s still in line. Therefore, we see our market guidance, still a case laden with this upside potential […] it’s important to understand, in 2021, the US markets without restriction on the supply chain would be a spike market, very, very strong market. So what happens, supply chain constraints limited the market and demand was postponed to 2022. So now the postponed demand in 2022, meet a still very strong demand in 2022, but still cannot fulfill because of the limitations in the contract. So basically, a portion of 2021 is moved to 2023 and the not fulfilled demand of 2022 is moved to 2023. At the same time, you see more efficient truck, and you see an aging fleet.

I think this to be a very interesting remark. First of all, Goetz turns the point of view on supply chain constraints around, by stating that supply today is defining market size. Thus, it should be known that the market’s potential size is quite larger than what today appears. On the other hand, the fact that in this environment, part of the 2021 demand is being fulfilled in 2022 and that part of it will be fulfilled in 2023 sets the ground for a smooth upward trajectory that is not often seen in cyclical businesses. In addition, while demand is being fulfilled at a slower pace, the existing fleet do age and create further demand in the years ahead. I wouldn’t be surprised that, as we move forward, a company like Daimler could keep its supply under control in order to spread demand over a longer period of time, keeping control of a constant stream of orders and revenues. This would change a lot of the current business model and would enhance Daimler’s return on sales.

Guidance

Daimler Trucks recently reassured investors that its 2025 margin goals will be achieved, as declared in the slide shown below, taken from Daimler’s roadshow presentation.

Daimler Trucks Roadshow Presentation

As we can see, Trucks North America still hasn’t recovered its pre COVID marginality, while Mercedes-Benz and Trucks Asia are really improving. Daimler Buses appear to be suffering, and this can be understood. While the travel rebound is taking place, travel operators still need to recover from recent losses before investing into renewing their bus fleets or expanding them.

When asked about this segment, Goetz gave two interesting facts to consider. The first one is that they are seeing higher demand for spare parts. This leads to the conclusion that buses are being used once again, and this will lead to new orders in the future. Secondly, he pointed out that there are not many large operators in the segment with huge fleets made up of thousands of buses. On the contrary, travel operators are usually midsize companies that did manage to survive during the pandemic, by offering their buses for school transportation and other similar activities. Since most of these companies survived, there is reason to believe that the segment will pick up speed in the next two years.

Finally, one consideration that may change the 2021 return on sales upwards. Daimler Trucks noted that the chip shortage is changing and that now the company has changed its production to seize the reallocated chips used in Asia and our other regions to Europe and North America. The company is intentionally doing this, expecting a negative impact on Asian sales, in order to support a higher margin business in Europe and North America. If we add to this that Daimler Trucks declared it is more or less sold out for 2022, we should expect North America and Europe marginality to grow in the next three quarters.

Risks

Although Daimler has manufactured trucks and buses for many decades, now the company has to stand on its own feet in a traditionally low margin industry. For sure, the recent spin-offs of its competitors will lead all the major players to find a profitable way of running the business. However, a price war may occur in order to take some of the smaller competitors out. Daimler’s strong position in North America, however, should be a good hedge against this risk.

Inflation and supply chain constraints do impact on Daimler Trucks, as well as on everybody else. However, I think Mr. Goetz’s remarks show that the company is moving in the right direction to take advantage of the current situation and gain time to make every segment grow.

Valuation

It is difficult to give a valuation of Daimler Trucks (even Seeking Alpha’s Quant Ratings doesn’t have any available valuation metrics). Since the spin-off, shares have traded down 8.34%, which is in any case an outperformance compared to the major indexes. However, I think a forward PE of 10 is still a bit high, compared to the similar auto industry that now sees better margins, higher volumes and lower multiples. Its forward EV/EBITDA of 7 is, too, a bit high, if we think that some automakers trade around a 1. Discounting the uncertainty about the future moves of the company, I would suggest waiting at least one more quarter before jumping in, in order to see how the company will manage its way towards enhancing profitability, the key without which this investment will not go anywhere. I see the price to free cash flow ratio also a bit high, reaching almost a 17, higher than other vehicle manufacturers that have a larger business than Daimler. To me, this is a hold that needs a bit more time to clarify where it is headed towards.

Be the first to comment