Wolterk

Dear readers/Followers,

When looking at toy and gaming stocks, you come across a few big names fairly quickly. One of them is Hasbro (HAS). The other is Mattel (NASDAQ:MAT). I already own stock in the former, and I consider the latter worth looking at. Today, this is my target – to look at and decide whether Mattel can offer you an appealing upside.

Because like most toy companies, Mattel is an IP-driven playing business trying to create long-term shareholder value, with the very simple slogan that “We make toys.”

Let’s take a look at what Mattel can offer us.

Mattel – looking at Toys

Mattel is a more volatile company than we might expect. The way this business’ earnings flow, with a negative EPS for the past 3 years, you’d be excused for viewing the company with some skepticism. When I say the company does not pay a dividend, it no longer does this. It did in the past, cut back in 2017.

Toys are about brands. And Mattel owns a lot of them.

Mattel IR (Mattel IR)

Some of the biggest are Barbie, Fisher Price, Mega Bloks, Hot Wheels, Bob the builder and others. These brands play a big role in the company’s performance, managing over $1B in adjusted EBITDA for 2021 fiscal, and doubling FCF on a YoY basis to around $340M. It also saw the company significantly improving its debt.

Unfortunately, MAT is not BBB-rated. It has a current BB+, making it (barely) junk grade. The share price and valuation currently reflect where the company has been going in a big way – more on that later.

The company saw growth in every measured market for the last year, with significant growth in 6 out of 7 categories, including in all three “power brands” as well as American Girl. The company argues that it has shifted to a “growth” mode.

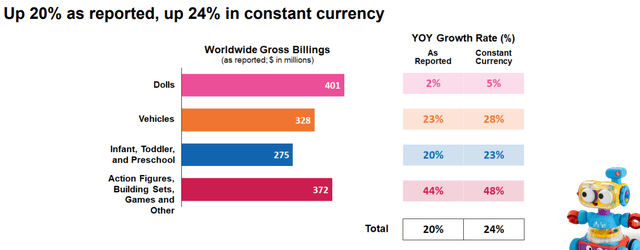

A few words on how the company is structured, for a business like Mattel, this is at the heart. Mattel has a simpler product categorization than Hasbro. What Mattel does is organized into Dolls, Infant/Toddler/Preschool, Vehicles, and Action Figures/Building Sets/Games other. This in turn is structured into 3 different geographical segments. NA, which is US/CAN, International, and the American girl brand, which is its own segment.

This is a very seasonal business, with large percentages of sales during traditional holiday seasons, meaning weighted towards 3QXX and 4QXX, which means we’ve not yet seen how this company is going to do this year.

Sales are global – either through retailers, omnichannel, free-standing toy stores, chain or department stores, or wholesalers. The company has its own sales channels as well and does a fair bit of DTC sales at this time. The company’s biggest customers are Walmart (WMT), Target (TGT), and Amazon (AMZN). These three customers alone represent a relatively unfavorable 45%+ of consolidated worldwide net sales.

In terms of manufacturing and input, the company both manufactures its own products and does this through third parties. The company also outsources and purchases from unrelated entities that do the entire process from design to manufacture. The company has a high degree of flex here, and tries to every way it can, reduce its manufacturing costs.

However, in the interest of retaining control, the company does most of its core products in company-owned facilities and balances this weird some of the more non-core into third-party facilities – a good mix, to keep trade secrets.

Geographical exposure is to China, Indonesia, Malaysia, Mexico, and Thailand for manufacturing. The company is already cutting China with 3 plants in 2019 as well as Indonesia and Mexico and shuttered the Canadian plant in 2021. Feedstock for the operations is easily-available chemicals and materials bought from a multitude of sources.

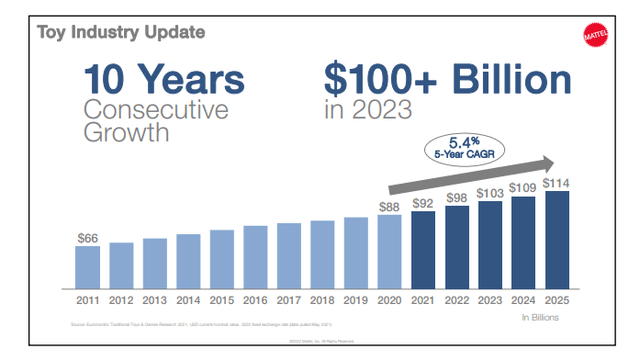

The toy industry is expected to grow significantly over the next few years, averaging around 4-5% CAGR, and this can flow directly to Mattel. Current company guidance called for 8-10% net sales growth, and 47% in adjusted GM, which would be excellent. Also guiding for $1.1B in adjusted EBITDA, with around $1.5 in EPS on the high side.

The company is excellent at sourcing branding deals. Some include Disney (DIS) products, which the company has been working with extensively.

2Q22 has more or less confirmed the overall upside for the company for this year in relation to its targets. Net sales are up 20%, which is the 8th consecutive quarter of YoY growth, and adj income on an operating basis is up 82%. EPS improved to around $0.18 quarterly. This may not sound much for the target but remember the seasonality here.

‘

Mattel was the 2Q22 #1 toy company in the US and globally in its market-leading categories of Dolls, Vehicles, and Infant/Toddler/Preschool, and all segments are growing at double digits. We can also see this in company billings, which are up.

The company is also pushing into entertainment. Things like the Barbie movie are coming, and the company is doing even more, with things like Monster High, Matchbox, and other movies.

Things are going in the right direction for the company, and this impacts how we view the valuation and the upside prospects. The fact that it cuts the dividend is an issue we do need to discount for, or at least make sure that the discounting is being done at a high level from the valuation.

So, let’s see where this goes.

Mattel Valuation

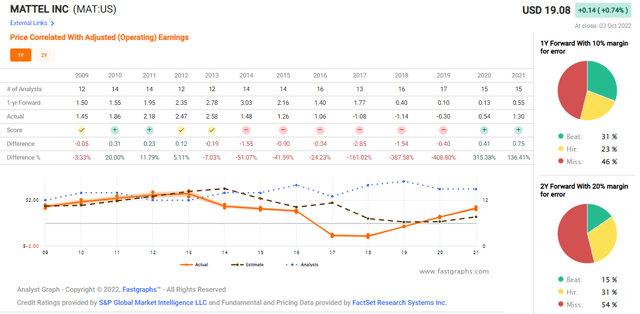

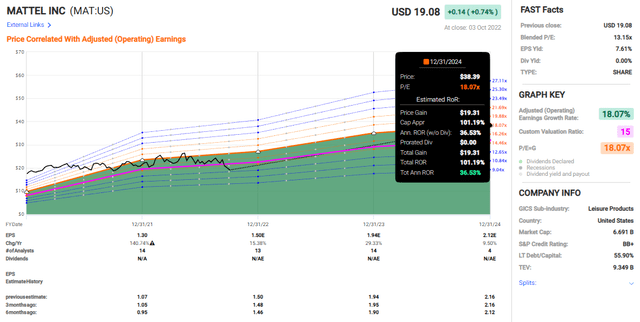

Valuation for Mattel isn’t bad per se. The company has a history of trading at 20-25x P/E premiums, but this was due to the company’s very poor EPS trends between 2016-2020. Analyst targets for the company come in at a relatively low certainty, but still better than some, with a 46% miss ratio for a 1-year forward with a 10% margin of error. Most of these misses were exactly during those years, when the analysts forecasts were missed by several hundred percent.

The analysts then went “too negative”, and saw the exact opposite happen the last 2 years.

To put it simply, the fact that the company does not yet pay a dividend again, and the fact that its recovery clarity is still somewhat muddy means that I’m going to want to heavily discount it regardless of how positive things seem here. Mattel is currently at a 13x P/E. The difference is that for the year, I expect the company to at least generate $1.4/share in EPS unless something truly disastrous happens. We then see the forecasts increasing this to reaching $2.1 in the outlying 2024E. Even on a 16-18x P/E and ignoring the company premium, this implies an upside in the triple digits.

The premium multiple can come upwards of twice as high, or close to it. Do I view it as realistic?

No, not right now. There’s too much uncertainty baked into things here. While S&P Global also gives credence to these EPS forecasts on a GAAP basis, I would discount the valuation heavily, as I don’t expect the company to trade up quite as quickly as that.

I base this reduced EBITDA growth rate on impacts from inflation, supply chains, labor costs, and increased costs across the entire chain, despite the company’s cost savings programs.

The valuation that’s being targeted for the company range from $24-$45 – an extremely, wide range followed by 14 analysts. The current share price is lower than anything that’s being forecasted here. Out of 14 analysts, 13 are either a “BUY” or an “Outperform” here, with an average target of $31.

The view on Mattel is clear here from the market. The expectation is that the company will outperform with increased sales volumes and improved margins – and this seems to be a view shared by most following the company. I’m of a more conservative view, and this especially includes how the company is currently moving – with no dividend and no concrete plan for reinstatement.

I would view this company as a “BUY” only at a very low valuation. From some perspectives, this is what we have, and I could view this as an appealing, complementary play to my other toy companies.

However, the company does come with the following valuation facts. it is not significantly cheaper than Hasbro – and Hasbro has a similar, triple-digit upside while also offering a well-covered yield of around 4%. This is better than Mattel. This does not make Mattel bad, but I want it cheaper.

I’ll give MAT a P/E of 10x – no higher than that – this puts us at a discount of $17/share. This is low – lower than any analyst target, but it’s what I view as fair given everything.

Here is my thesis for Mattel.

Thesis

My thesis for Mattel is as follows:

- I view Mattel as an appealing play in the Toy universe, but one that needs to justify itself next to other plays in the same sectors – like Hasbro. Mattel is currently cheap, but it’s not cheap enough as I see it. I would want Mattel to be cheaper before I start investing here.

- I would not go higher than a 10x P/E for the company, despite its qualitative portfolio, and this implies a discounted share price of no higher than $17. That’s my current target.

- For that target, this company is currently a “HOLD” here.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative.

This company is fundamentally safe/conservative & well-run.

This company pays a well-covered dividend.

This company is currently cheap.

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment