John Pennell

Earnings of Northrim BanCorp, Inc. (NASDAQ:NRIM) will benefit from the up-rate cycle and the margin’s elevated sensitivity to interest rate changes. Further, subdued loan growth will support the bottom line. On the other hand, normalization of mortgage banking income and above-average provisioning will likely drag earnings. Overall, I’m expecting Northrim BanCorp to report earnings of $5.06 per share for 2022, down 16% year-over-year. Compared to my last report on Northrim BanCorp, I’ve increased my earnings estimate mostly because I’ve revised upwards my net interest margin estimate. For 2023, I’m expecting earnings to grow by 23% to $6.22 per share. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Northrim BanCorp.

Margin is Set to Surge Amid the Rising Rate Environment

Northrim BanCorp’s margin surged by 49 basis points in the second quarter of 2022 thanks to the high loan beta. At the same time, Northrim was successful in holding down its funding costs even as market interest rates surged.

The Federal Reserve has surprised me by increasing the Fed Funds rate by 300 basis points so far this year. The Federal Reserve expects to further increase its rate by 125 to 150 basis points by the end of 2023, according to its latest projections release. This monetary tightening will significantly boost Northrim’s interest income. As of December 2021, loans totaling $967 million were going to reprice this year, including floating-rate loans and fixed-rate loans scheduled to mature in 2022, as mentioned in the last 10-K filing. These loans represented a massive 68% of total loans at the end of December. Northrim BanCorp mentioned in the latest 10-Q filing that the rate sensitivity has not changed materially since the issuance of the 10-K filing.

Unfortunately, a majority of the deposit book will also reprice this year. Interest-bearing demand, savings, and money market accounts made up 57% of total deposits at the end of June 2022. These interest-bearing deposits reprice frequently; therefore, they will hurt the margin soon after every rate hike.

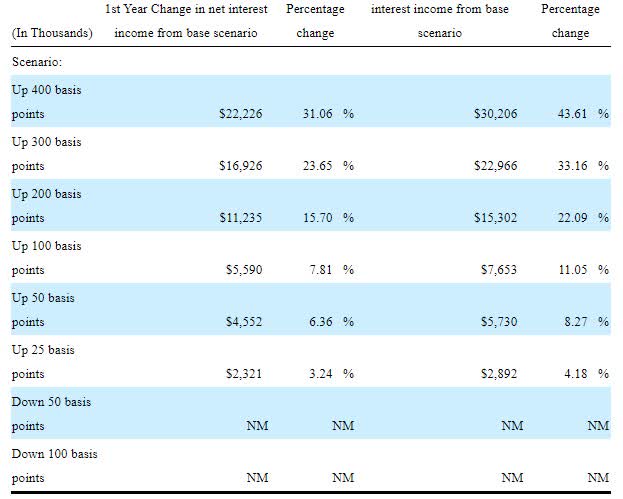

Nevertheless, the management’s rate sensitivity analysis shows that the net interest margin is highly sensitive to rate changes. A 200-basis points hike in interest rates could boost the net interest income by 15.7% in the first year and 22.09% in the second year of the rate hike, as mentioned in the 10-K filing.

2021 10-K Filing

Considering these factors, I’m expecting the margin to increase by 60 basis points in the second half of 2022 and by a further 50 basis points in 2023. Compared to my last report on Northrim BanCorp, I’ve raised my margin estimate because my interest rate outlook is now more hawkish than before.

Loan Outlook Remains Positive Thanks to Oil Prices

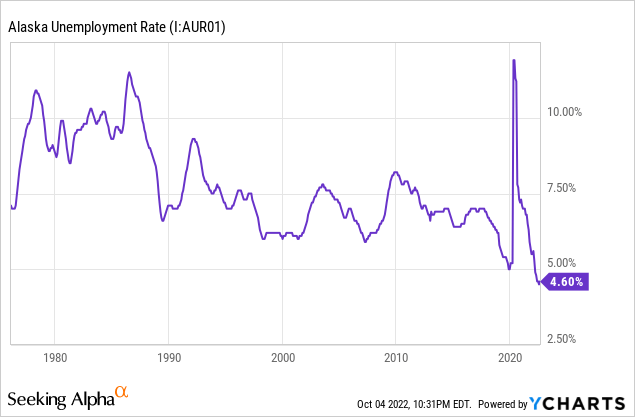

After four consecutive quarters of decline, the loan book grew by 2.1% in the second quarter of 2022. Going forward, loan growth will depend on the Alaskan economy. Alaska’s job market is currently one of the worst in the country. Nevertheless, it has undergone a big improvement from a historical perspective, and the unemployment rate is at a record low.

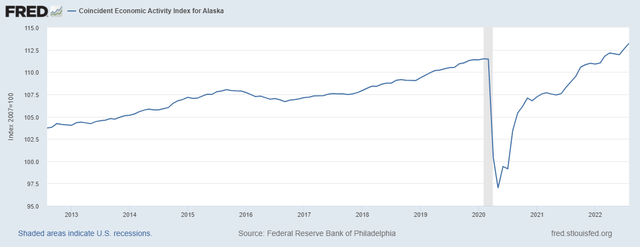

The coincident economic activity index shows that economic activity in the state is on an unsure footing.

Federal Reserve Bank of Philadelphia

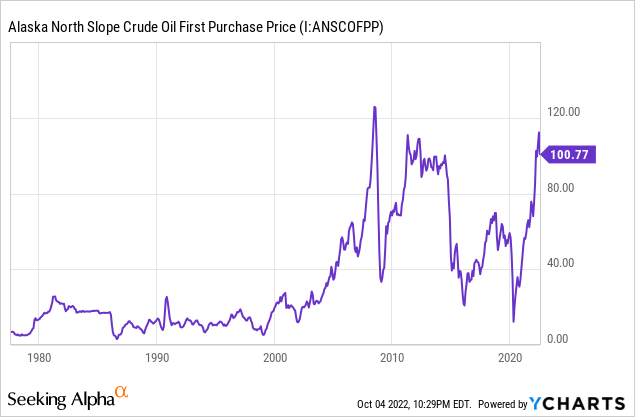

Nevertheless, I’m positive about Alaska’s economy mostly because of oil prices. Despite a recent downturn, they are still very high.

The crude oil future curve is currently in backwardation, with the November 2022 contract trading at $86.52, the November 2023 contract trading at $74.78, and the November 2024 contract trading at $69.05. Nevertheless, despite the negative trend, the curve suggests that the market expects oil prices to remain high even two years out from today.

Considering these factors, I’m expecting the loan portfolio to grow by 0.75% every quarter till the end of 2023. Meanwhile, I’m expecting other balance sheet items to grow mostly in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 965 | 1,024 | 1,423 | 1,402 | 1,415 | 1,458 |

| Growth of Net Loans | 3.4% | 6.2% | 38.9% | (1.5)% | 0.9% | 3.0% |

| Other Earning Assets | 365 | 429 | 506 | 1,157 | 977 | 997 |

| Deposits | 1,228 | 1,372 | 1,825 | 2,422 | 2,371 | 2,442 |

| Borrowings and Sub-Debt | 52 | 19 | 25 | 36 | 35 | 36 |

| Common equity | 206 | 207 | 222 | 238 | 227 | 251 |

| Book Value Per Share ($) | 29 | 30 | 35 | 38 | 39 | 43 |

| Tang. Book Value Per Share ($) | 27 | 28 | 32 | 36 | 36 | 40 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Provision Expenses to Drag Earnings this Year

After reporting large provision reversals last year, provisioning for expected loan losses was almost back to normal in the first half of 2022. Allowances were 158% of non-performing loans at the end of June 2022, as mentioned in the earnings release. Although this coverage is uncomfortably low, it’s still an improvement over the last year. Northrim BanCorp habitually keeps a low level of loan loss reserve coverage. Therefore, I’m not too worried about provisioning pressures from heightened inflation during the second half of 2022.

In my opinion, loan additions will likely be the primary driver of provisioning in the coming quarters. Considering these factors, I’m expecting provisioning to be slightly above normal through the end of 2023. I’m expecting the net provision expense to make up 0.12% of total loans (annualized) in the second half of 2022 and 0.08% of total loans in 2023. In comparison, the net provision expense averaged 0.06% of total loans from 2017 to 2019.

Mortgage Income Normalization to Further Drag Earnings this Year

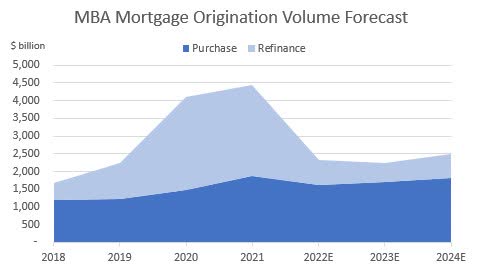

Mortgage banking is an important component of non-interest income for Northrim BanCorp. During the second quarter, mortgage banking income made up 76% of non-interest income. Therefore, the ongoing slump in mortgage refinancing activity will have a significant impact on Northrim BanCorp’s revenues. The Mortgage Bankers Association forecasts mortgage refinancing volume to plunge by 73% year-over-year in 2022.

Mortgage Bankers Association

Apart from the anticipated fall in mortgage banking income, the higher provision expenses will also drag earnings this year. On the other hand, significant margin expansion will lift earnings through the end of 2023. Further, earnings will receive support from subdued loan growth. Overall, I’m expecting Northrim BanCorp to report earnings of $5.06 per share for 2022, down 16% year-over-year. For 2023, I’m expecting earnings to grow by 23% to $6.22 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 61 | 64 | 71 | 81 | 92 | 104 |

| Provision for loan losses | (1) | (1) | 2 | (4) | 1 | 1 |

| Non-interest income | 32 | 37 | 63 | 52 | 35 | 35 |

| Non-interest expense | 70 | 77 | 89 | 89 | 89 | 91 |

| Net income – Common Sh. | 20 | 21 | 33 | 38 | 29 | 36 |

| EPS – Diluted ($) | 2.87 | 3.04 | 5.11 | 6.00 | 5.06 | 6.22 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

In my last report on Northrim BanCorp, I estimated earnings of $4.63 per share for 2022. I’ve increased my earnings estimate mostly because I’ve revised upwards my margin estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

High Total Expected Return Justifies a Buy Rating

Since 2010, Northrim BanCorp has increased its dividend in the third quarter of every year. Given the earnings outlook, it’s likely that the company will increase its dividend by $0.02 per share to $0.52 per share in the third quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 33% for 2023, which is close to the five-year average of 35%. Based on my dividend estimate, Northrim is offering a forward dividend yield of 4.8%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Northrim BanCorp. The stock has traded at an average P/TB ratio of 1.19 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 25.3 | 27.2 | 28.1 | 32.5 | 35.9 | |

| Average Market Price ($) | 31.3 | 37.8 | 36.5 | 28.5 | 41.9 | |

| Historical P/TB | 1.24x | 1.39x | 1.30x | 0.88x | 1.17x | 1.19x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $36.3 gives a target price of $43.4 for the end of 2022. This price target implies a 1.1% upside from the October 4 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.09x | 1.14x | 1.19x | 1.24x | 1.29x |

| TBVPS – Dec 2022 ($) | 36.3 | 36.3 | 36.3 | 36.3 | 36.3 |

| Target Price ($) | 39.8 | 41.6 | 43.4 | 45.2 | 47.0 |

| Market Price ($) | 42.9 | 42.9 | 42.9 | 42.9 | 42.9 |

| Upside/(Downside) | (7.3)% | (3.1)% | 1.1% | 5.4% | 9.6% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 10.9x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 1.88 | 2.87 | 3.04 | 5.11 | 6.00 | |

| Average Market Price ($) | 31.3 | 37.8 | 36.5 | 28.5 | 41.9 | |

| Historical P/E | 16.6x | 13.2x | 12.0x | 5.6x | 7.0x | 10.9x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $5.06 gives a target price of $55.0 for the end of 2022. This price target implies a 28.2% upside from the October 4 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.9x | 9.9x | 10.9x | 11.9x | 12.9x |

| EPS 2022 ($) | 5.06 | 5.06 | 5.06 | 5.06 | 5.06 |

| Target Price ($) | 44.9 | 49.9 | 55.0 | 60.0 | 65.1 |

| Market Price ($) | 42.9 | 42.9 | 42.9 | 42.9 | 42.9 |

| Upside/(Downside) | 4.6% | 16.4% | 28.2% | 40.0% | 51.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $49.2, which implies a 14.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 19.4%. Hence, I’m maintaining a buy rating on Northrim BanCorp.

Be the first to comment