JasonDoiy

Thesis

We discussed in our pre-earnings article on Intel Corporation (NASDAQ:INTC) urging investors not to throw in the towel, as it reached extreme pessimism. Accordingly, INTC has attempted its mean-reversion counter-trend rally, as it posted a total return of more than 10% since our update, outperforming the S&P 500 (SP500) (SPX).

Our analysis suggests that the market capitalized on the pessimism of Street analysts, who slashed their forward estimates and ratings on INTC over the past couple of months. As a result, while INTC remains well-entrenched in a medium-term downtrend, it still has an opportunity to recover its long-term uptrend bias.

Therefore, despite posting a worse-than-expected Q4 and FY22 outlook, bearish investors were taken for a ride as the market forced them out at the worst possible moments.

We discuss why there could still be reasonable upside to squeeze out of this counter-trend rally before investors should consider sitting out or even taking profits if they picked its October bottom.

Maintain Speculative Buy, with a price target (PT) of $33 (implying a potential upside of 17%).

Intel Slashed Its Guidance

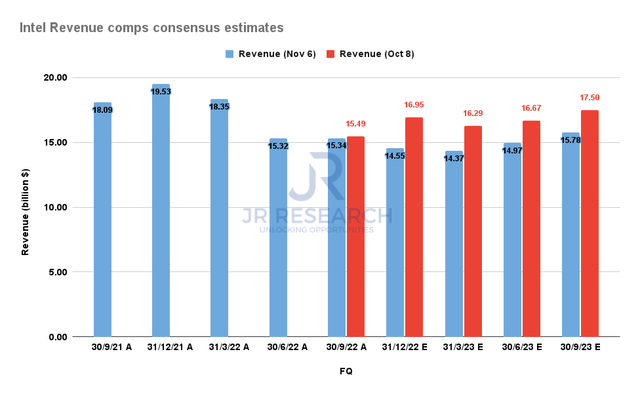

Intel Revenue comps consensus estimates (S&P Cap IQ)

Intel cut its FY22 outlook further as it sees headwinds in its PC segment continuing into FY23. As such, the company revised its FY22 revenue to $63.5B (midpoint), down 15% YoY.

Accordingly, the consensus estimates have been revised further to reflect Intel’s updated guidance. Notably, the Street also cut Intel’s forward estimates through FY23, seeing the weakness persist.

Trefis’ sum-of-the-parts (SOTP) analysis estimates that its CCG segment accounts for 37% of its valuation. Hence, we believe it’s prudent to model for significant weaknesses that could persist in its downstream customers as they continue to digest their inventory.

DIGITIMES reported that PC vendors are contemplating further discounts to clear their inventory in Q4, as inventory digestion could continue through H1’23. It added:

PC brand vendors are expected to launch a series of product price cuts during the year-end holiday season as a way to clear excess inventory. Companies are actively trying to clear inventories, but weak buying sentiment in the consumer market is making it difficult, resulting in the use of promotions to slash prices and promote sales, sources said. The industry has acknowledged that price cutting has reached an unimaginable stage, but in order to clear inventory, all they can do is follow suit. – DIGITIMES

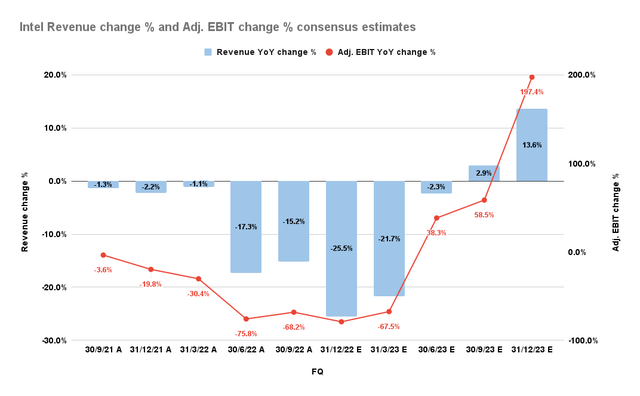

Intel Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

The revised consensus estimates (neutral) suggest that Intel could see significant headwinds through H1’23 before recovering. We highlighted analysts have already slashed their estimates in our previous article.

The company’s updated guidance corroborated what the market had anticipated as it battered INTC into its lowest levels, last seen in August 2015. Therefore, Intel’s weak guidance proffered in its Q3 earnings card has likely been reflected, as we postulated.

Is INTC Stock A Buy, Sell, Or Hold?

CEO Pat Gelsinger & team helped investors to rationalize the company’s revised forecasts, knowing that investors are concerned with the current macro weakness.

As such, management highlighted that it’s pursuing a cost-optimization strategy that could see the company achieve cost savings of nearly $3B in FY23. In addition, the company is confident in driving more mid-term efficiencies, expecting cost savings of almost $8B-$10B annually by the end of FY25.

Therefore, we believe management has offered investors a vital yardstick to measure its spending levels and ability to drive leverage even as it ramps up its investments for its IDM 2.0 roadmap. Therefore, Gelsinger demonstrated sharp acumen and understood what the market was looking for, which likely also helped stanch further downside volatility, given the battering.

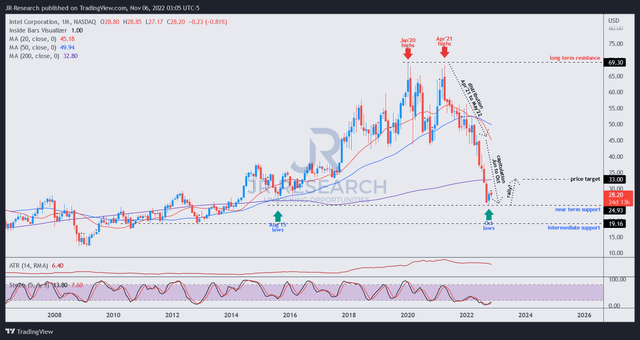

INTC price chart (monthly) (TradingView)

We gleaned that the market had correctly anticipated a poor earnings release, as it sent INTC spiraling down to its recent October lows (pre-earnings).

However, that move also formed a validated bear trap on its long-term chart, as buyers came in to stanch further selling downside. We noted the capitulation move only occurred from June onward. The market clearly needed to de-risk Intel’s execution risks further, as it anticipated significant weakness in the PC market.

However, the battering has set up INTC for a significant mean reversion move already underway. We see the potential for the move to continue in earnest until it faces resistance at its 200-month moving average (purple line).

Hence, while the reward/risk is not as attractive as its October lows, we believe it’s still favorable for investors at the current levels.

Maintain Speculative Buy, with a PT of $33.

Be the first to comment