wildpixel

Background

For those interested in John and Jane’s full background, please click the following link for the last time I published their full story. Here are the key details about John and Jane that readers should understand.

- This is a real portfolio with actual shares being traded.

- I am not a financial advisor and merely provide guidance based on a relationship that goes back several years.

- John retired in January 2018 and his only consistent source of income is Social Security.

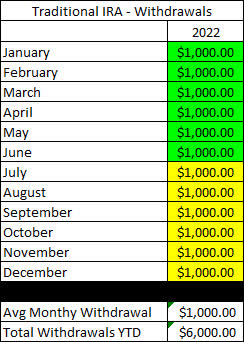

- John has begun drawing $1,000/month from his Traditional IRA to supplement his retirement income.

- Jane officially decided to retire on December 31, 2020. She is now collecting social security as her primary source of income.

- John and Jane have other investments outside of what I manage. These investments primarily consist of minimal risk and minimal yield certificates.

- John and Jane have no debt and no monthly payments other than basic recurring bills such as water, power, property taxes, etc.

John and Jane requested my help after we discovered that their financial advisor was charging excessive fees and engaging in trades that appeared to be more favorable to the advisor than it was to John and Jane. I do not charge John and Jane for anything that I do and all I have asked of them is that they allow me to write about their portfolio anonymously to help spread knowledge and to make me a better investor in the process.

Generating a stable and growing dividend income is the primary focus of this portfolio, and capital appreciation is a secondary characteristic.

Dividend And Distribution Increases

Three companies increased their dividend/distribution or paid a special dividend during the month of June in the Traditional and Roth IRAs.

We previously covered MAIN in Jane’s monthly article so I will include a summary of the dividend change but will not rehash my summary of MAIN.

Main Street Capital

MAIN paid a special dividend of $.075/share which was paid on June 30th, 2022.

Pepsi

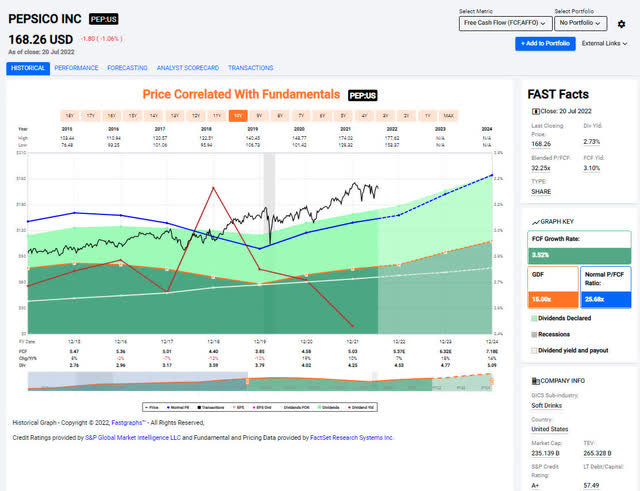

Pepsi is one of those stocks that is pricey but will likely fare well when it comes to the negative impacts of inflation. One advantage that Pepsi has is that it can handle some of the rising costs by engaging in shrink-flation which essentially means that they will continue providing products the same price, but they will reduce the quantity of goods in the package. This means that snacks like chips will see a 12-ounce bag reduced to a 10-ounce bag while maintaining the same price. This means that Pepsi has more levers to pull before they will need to consider eating the rising costs. Pepsi has also continued to market its product well by targeting impulse buyers. I also like that executive management at Pepsi appeared to be realistic about how long this inflationary period is going to last for.

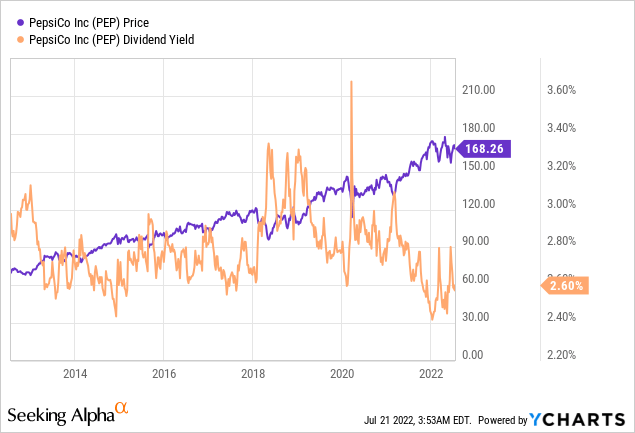

The primary issue with Pepsi’s stock is that it is currently priced for perfection. I would typically target a yield of 3% (see the 10-year yields below) when buying shares but right now the stock is closer to the low end of the range at 2.73%.

Pepsi (FastGraphs)

The dividend was increased from $1.075/share per quarter to $1.15/share per quarter. This represents an increase of 7% and a new full-year payout of $4.60/share compared with the previous $4.30/share. This results in a current yield of 2.73% based on the current share price of $168.26.

Southwest Gas

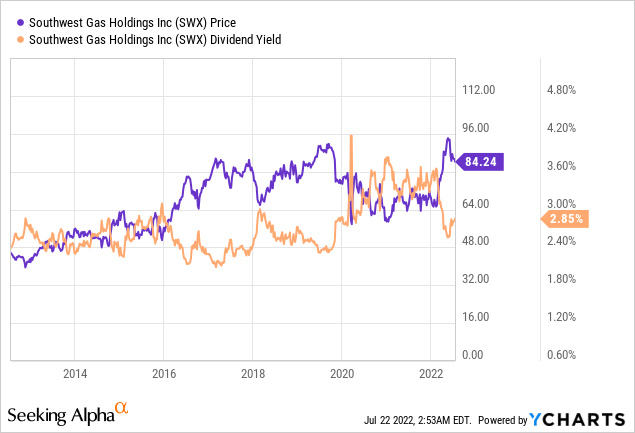

SWX was originally added to the portfolio at the end of Q1-2021 when the stock price plunged in the dividend yield moved up into the 3.5% and higher range which is attractive for a company that over the last 10 years has seen the dividend yield run into a ceiling at approximately 3%. Little did I know that SWX would formally begin attracting bidders looking to buy the business. The stock price was driven up by this news and we decided to take our gains on 33% of the position and see how the rest plays out. The stock is not currently trading at an attractive price point in with the level of uncertainty I would discourage investors from building a position.

The dividend was increased from $.59/share per quarter to $.62/share per quarter. This represents an increase of 4.2% and a new full-year payout of $2.48/share compared with the previous $2.36/share. This results in a current yield of 2.87% based on the current share price of $84.24.

Retirement Account Positions

There are currently 40 different positions in John’s Traditional IRA and 21 different positions in his Roth IRA. While this may seem like a lot, it is important to remember that many of these stocks cross over in both accounts and are also held in the Taxable Portfolio.

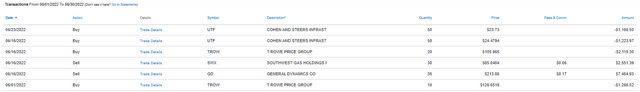

Below is a list of the trades that took place in the Traditional IRA during the month of June.

Traditional IRA – June Trades (Charles Schwab)

Below is a list of the trades that took place in the Roth IRA during the month of June.

Roth IRA – June Trades (Charles Schwab)

I am going to begin writing a separate article that discussed my buys and sells more in-depth, so I won’t be writing my summary in this article. These articles are already a lot of work so breaking them up into smaller pieces should help me feel a little more motivated.

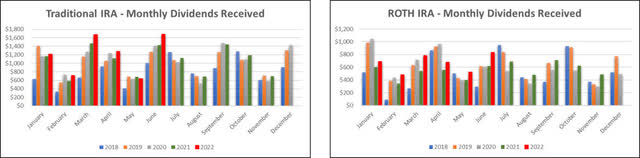

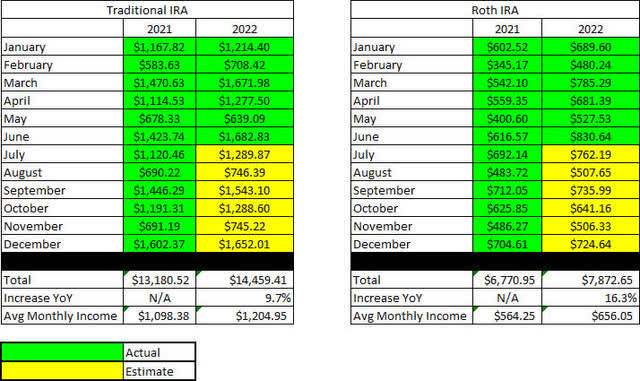

June Income Tracker – 2021 Vs. 2022

June’s income was up considerably year-over-year for John’s Traditional IRA and Roth IRA. The average monthly income for the Traditional IRA in 2022 is expected to be up about 9.7% based on current estimates, and the Roth IRA is looking to grow by an astounding 16.3%. This means the Traditional IRA would generate an average monthly income of $1,204.95/month and the Roth IRA would generate an average income of $656.05/month. This compares with 2021 figures that were $1,098.38 and $564.25 per month, respectively. We are on track to generate approximately $1,400 of additional dividend income in 2022.

SNLH = Stocks No Longer Held – Dividends in this row represent the dividends collected on stocks that are no longer held in that portfolio. We still count the dividend income that comes from stocks no longer held in the portfolio even though it is non-recurring.

All images below come from Consistent Dividend Investor, LLC. (Abbreviated to CDI).

Traditional IRA – June – 2021 V 2022 Dividend Breakdown

Roth IRA – June – 2021 V 2022 Dividend Breakdown

Here is a graphical illustration of the dividends received on a monthly basis for the Traditional and Roth IRAs.

Retirement Account – Monthly Dividends Received – June 2022

Based on the current knowledge I have regarding dividend payments and share count, the following tables are a basic prediction of the income we expect the Traditional IRA and Roth IRA to generate in FY-2022 compared with the actual results from 2021.

Retirement Projections – June 2022

Below is an expanded table that shows the full dividend history since inception for both the Traditional IRA and Roth IRA.

Retirement Projections – June 2022 – Full Dividend History

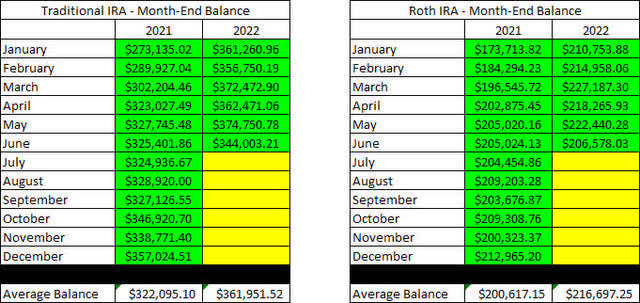

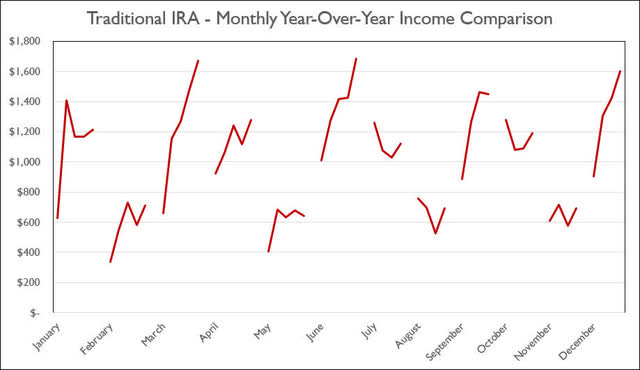

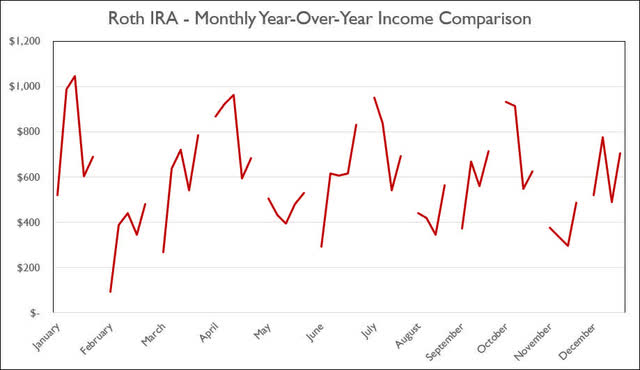

I have included line graphs that better represent the trends associated with John’s monthly dividend income generated by his retirement accounts. The images below represent the Traditional IRA and Roth IRA, respectively.

Retirement Account – Monthly Dividends – June 2022

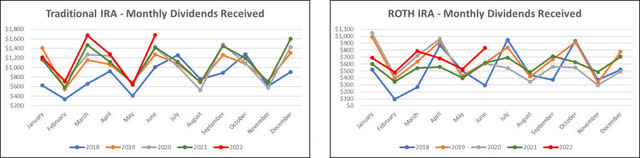

Here is a table to show how the account balances stack up year over year (I previously used a graph but believe the table is more informative).

Retirement Account – Month End Balances – June 2022

The next images are the new tables that indicate how much cash John had in his Traditional and Roth IRA Account at the end of the month, as indicated on his Charles Schwab statements.

Retirement Accounts – June 2022 – Cash Balances

The following two tables provide a history of the unrealized gain/loss at the end of each month in the Traditional and Roth IRAs, going back to the beginning of January 2018.

Retirement Accounts – June 2022 – Unrealized Gain-Loss

John has finally begun taking disbursements from his Traditional IRA, and he currently receives $1,000/month.

Traditional IRA Withdrawals – June 2022

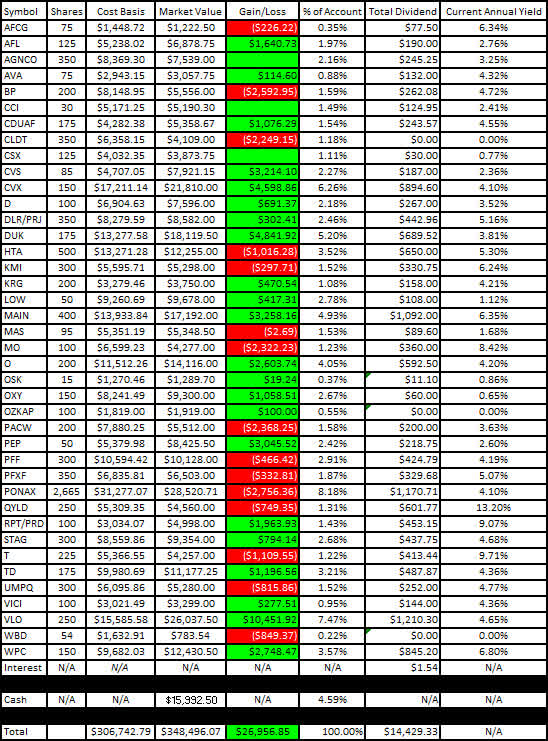

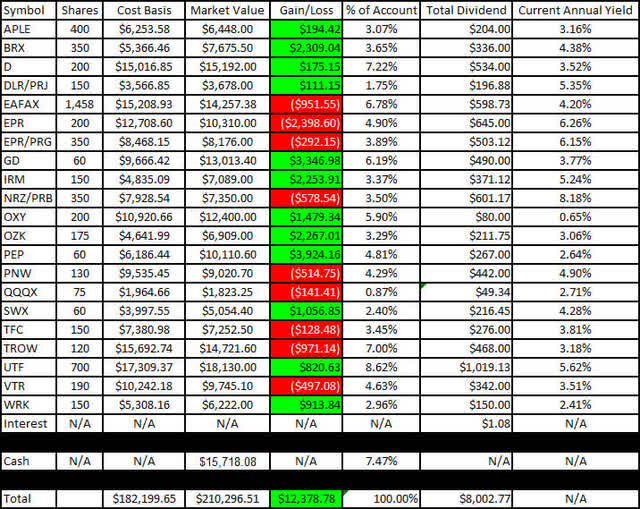

I like to show readers the actual unrealized gain/loss associated with each position in the portfolio because it is important to consider that, in order to become a proper dividend investor, it is necessary to learn how to live with volatility. The market value and cost basis below are accurate as of the market close on July 21, 2022.

Here is the unrealized gain/loss associated with John’s Traditional and Roth IRAs.

Traditional IRA – June 2022 – Gain-Loss

Roth IRA – June 2022 – Gain-Loss

The last two graphs show how dividend income has increased, stayed the same, or decreased in each respective month on an annualized basis. Now that we are in our fifth year of tracking, the trend for each respective month of the year has begun to show interesting trends for when income increases year-over-year.

Traditional IRA – June 2022 – Annual Month Comparison

Roth IRA – June 2022 – Annual Month Comparison

Conclusion

Dividends are up considerably which is a major positive compared to the previous two years when John’s portfolio took a hit due to dividend cuts and eliminations from COVID (2020 & 2021). These dividend increases are positive in the current inflationary environment.

John’s Traditional IRA continues to pump out more dividends than his withdrawals are but readers can see that I am emphasizing cash reserves at this point in time because we always want to make sure that John doesn’t have to sell shares in his initial phase of withdrawals from the Traditional IRA.

June Articles

I have included the links for John and Jane’s Taxable Account and Jane’s Retirement Account articles for the month of June below.

The Retirees’ Dividend Portfolio: John And Jane’s June Taxable Account Update

The Retiree’s Dividend Portfolio – Jane’s June Update: Record Dividends

Article Format: Let me know what you think about the format (what you like or dislike) by commenting. I appreciate all forms of criticism and would love to hear what I can do to make the articles more useful for you!

In John’s Traditional and Roth IRAs, he is currently long the following mentioned in this article: AFC Gamma (AFCG), Aflac (AFL), Apple Hospitality REIT (APLE), Avista (AVA), BP plc (BP), Brixmor Property Group (BRX), Crown Castle (CCI), Canadian Utilities (OTCPK:CDUAF), Chatham Lodging Trust (CLDT), CVS Health Corporation (CVS), Chevron (CVX), CSX (CSX), Dominion Energy (D), Digital Realty Preferred Series J (DLR.PJ), Duke Energy (DUK), Eaton Vance Floating-Rate Advantage Fund (EAFAX), EPR Properties (EPR), EPR Properties Preferred Series G (EPR.PG), General Dynamics (GD), Healthcare Trust of America (HTA), Iron Mountain (IRM), Kinder Morgan (KMI), Kite Realty Group (KRG), Lowe’s (LOW), Main Street Capital (MAIN), Masco (MAS), Altria (MO), New Residential Investment Corp. Preferred Series B (NRZ.PB), Realty Income (O), Oshkosh (OSK), Occidental Petroleum Corp. (OXY), Bank OZK (OZK), Bank OZK Preferred Series A (OZKAP), PacWest Bancorp (PACW), PepsiCo (PEP), iShares Preferred and Income Securities ETF (PFF), VanEck Vectors Preferred Securities ex Financials ETF (PFXF), Pinnacle West (PNW), PIMCO Income Fund Class A (PONAX), Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX), Global X Funds Nasdaq 100 Covered Call ETF (QYLD), RPT Realty Preferred Series D (RPT.PD), STAG Industrial (STAG), Southwest Gas (SWX), AT&T (T), Toronto-Dominion Bank (TD), Truist Financial (TFC), T. Rowe Price (TROW), Cohen&Steers Infrastructure Fund (UTF), VICI Properties (VICI), Valero (VLO), Umpqua Holdings (UMPQ), Ventas (VTR), WestRock (WRK), Warner Bros Discovery (WBD), and W. P. Carey (WPC).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment