designer491/iStock via Getty Images

With market volatility back on the rise, increasingly many investors are now turning to alternative investments like crowdfunding.

Since I mainly cover real estate investment trusts (“REITs”) (VNQ) on Seeking Alpha, I often get asked questions about Fundrise. Specifically:

What do you think about it and how does it compare to REITs?

In case you aren’t familiar with Fundrise, it is today the largest crowdfunding platform for real estate investments in the world.

They have about $7 billion of assets under management and over 300,000 users on their online platform.

That’s quite an achievement!

They pride themselves on leveling the playing field and letting everyday investors get a piece of properties that have traditionally been reserved for the rich and wealthy.

If you go on their website, you will notice that they like to compare themselves to REITs and make a lot of claims that puts them in a good light.

But how much of that is really just marketing?

In short, I would never invest in Fundrise. While I respect what they have built, I strongly believe that REITs are better investments in most cases, and especially at today’s valuations.

Below, I present 5 reasons why investors should favor REITs and, towards the end, I also shortly discuss an alternative crowdfunding site that you may want to consider for diversification purposes.

Reason #1: Significant Conflicts of Interest

Most REIT investors understand that external management agreements create significant conflicts of interest.

This is why externally-managed REITs are typically avoided and trade at persistent discounts to internally-managed REITs.

Yet, for reasons that I ignore, investors don’t seem to care about the fact that all Fundrise vehicles are externally managed.

This means that they get paid a fee based on the volume of assets under management, which incentivizes them to grow at all costs, even if it comes at the cost of lower returns.

Internally-managed REITs do a better job at aligning interests with shareholders because they hire the management as employees of the REIT and they get paid salaries that are tied to shareholder performance rather than fees based on the volume of assets.

This is one of the main reasons why internally-managed REITs have historically generated a lot higher returns than externally-managed REITs as well as other externally-managed private real estate vehicles.

EPRA

Fundrise fits in the category of externally-managed vehicles and therefore, it suffers much greater conflicts of interest, and we think that this will be eventually reflected in its performance.

Good examples of externally managed REITs are Office Properties Income (OPI), Global Net Lease (GNL), and Industrial Logistics Properties (ILPT).

They all share one common characteristic: they underperform internally-managed REITs due to significant conflicts of interest.

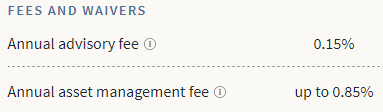

Reason #2: Much Higher Fees

Fundrise also prides itself on being a low-cost alternative to other private vehicles. Their fee is typically about 1% per year.

Fundrise

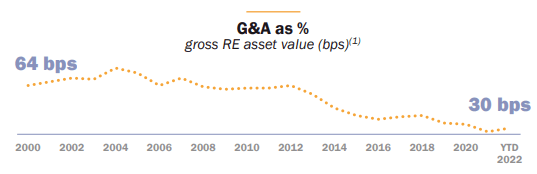

That may be cheaper than other private alternatives, but it is a lot more expensive than the typical management cost of a public REIT, which is closer to 0.5% according to research from EPRA:

And that’s just the average.

Some of the larger and most successful REITs like Realty Income (O) have a management cost of just ~0.3%. You can clearly see that as the company grew, its management cost came down over time:

Realty Income

Publicly listed REITs are much more cost-efficient because they are internally managed by people who are hired as employees of the REIT. The salaries enjoy economies of scale and don’t just rise because of the volume of assets under management.

Fundrise, however, is an external asset manager with a profit motive. It earns a fee that’s based on the volume of assets and therefore, you don’t enjoy the same economies of scale.

Your interests are completely misaligned and not surprisingly, the management cost is also a lot higher.

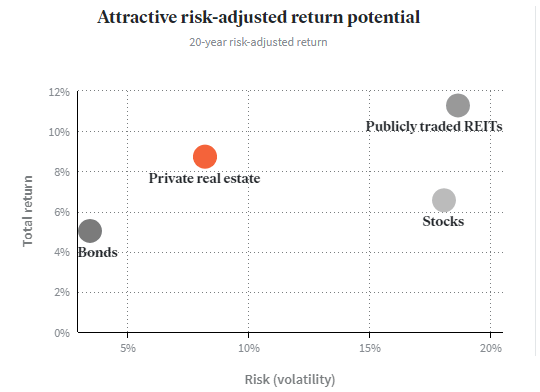

Reason #3: Lower Returns / Higher Risks

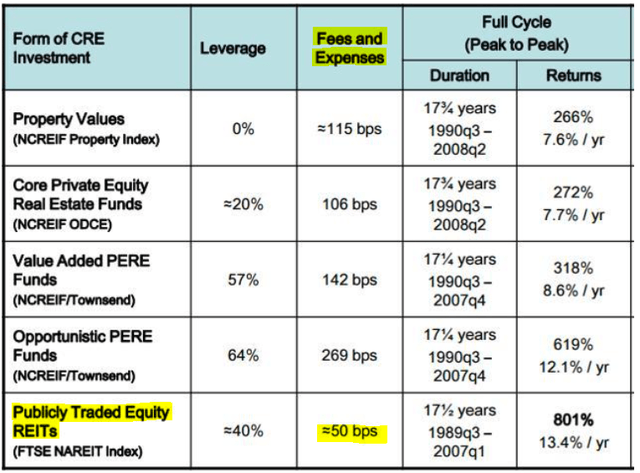

Fundrise uses the following chart as part of its marketing material. It shows that REITs are more rewarding than private real estate, but that private real estate is a lot safer, and therefore, it provides better risk-adjusted returns:

Fundrise

But is that really true?

Yes, it is true that REITs are more rewarding than private real estate. This has been proven by many studies that I discuss in a separate article that you can read by clicking here.

However, it is absolutely false to say that private real estate is safer than REITs. It is very misleading to use volatility as your only measure of risk, and then compare the volatility of a private asset that lacks daily quotation to that of a public asset that’s traded daily.

The reality is that private real estate investments are illiquid, concentrated, and highly leveraged, and in the case of Fundrise, they are also exposed to the conflicts of interest of an external manager, and you lack control over their investment.

On the flip side, REITs are liquid, diversified, conservatively leveraged, and conflicts of interest are better mitigated through an internal management structure.

There is no doubt that REITs are safer.

Investing in a concentrated, illiquid, and highly leveraged property can at times result in higher returns, but you can’t argue that it is safer than a diversified, liquid, and conservatively leveraged investment.

The low volatility of private real estate is a lie. It just isn’t traded daily. If you tried to sell your property every day, you would receive different offers all the time, and since you are heavily leveraged, your equity value would be highly volatile. Much more than that of REITs. Remember that it is the equity value that’s traded in the case of REITs so you need to make adjustments to have an apple-to-apple comparison.

So in short, you can expect to receive higher returns with less risk by investing in REITs in most cases.

Reason #4: No liquidity, no control

We briefly mentioned this previously, but I want to reiterate it once more because it’s important.

Typically, the main advantage of private real estate is having control over your investment, but the main disadvantage is that you lack liquidity.

On the flip side, some people would argue that the main advantage of REITs is liquidity, but the main disadvantage is that you lack direct control over your investment.

With Fundrise, you combine the worst of both worlds: you have no liquidity and no control over your investment. You are completely at the mercy of this one asset manager whose interests are misaligned with yours.

Reason #5: REITs Are A Lot Cheaper

Last but not least, REITs are today deeply discounted.

Their price to net asset value is the lowest in years with many REITs trading at 30%, 40%, or even 50% discounts relative to the value of the real estate that they own, net of debt.

Here are a few examples for you:

- AvalonBay Communities (AVB), the blue-chip apartment REIT is estimated to trade at a 25% discount to NAV.

- Simon Property (SPG), the blue-chip retail REIT is estimated to trade at a 40% discount to NAV.

- STAG Industrial (STAG), the blue-chip industrial REIT is estimated to trade at a 30% discount to NAV.

AvalonBay Communities

This means that you get to real estate at a steep discount in the REIT market.

It also means that you will pay a huge premium relative to REITs if you decide to invest through Fundrise instead. This would likely result in higher risk and lower returns in the long run.

My Real Estate Investment Strategy

Most of the time, I favor REITs over private real estate because I strongly believe that they offer superior returns with less risk.

But on rare occasions, I may invest in private real estate if and when I can’t get something through the REIT market.

To give a few examples:

- Estonian real estate: I am very bullish on the prospects of the Estonian real estate market. Estonia is quickly becoming the Luxembourg of Northern Europe, attracting wealthy European business owners and investors thanks to the #1 ranked tax system in the OECD. However, there are no REITs in Estonia and therefore, I end up buying a private property and I also use a crowdfunding platform called EstateGuru for additional exposure.

- Farmland: Today, there are only 2 farmland REITs (LAND; FPI), and both of them present some issues. LAND is overpriced, and FPI isn’t a pure-play farmland investment since it is also growing an asset management business. But I want to own farmland in my portfolio. It has historically generated higher returns than most other asset classes, despite being one of the safest investments. I could try to buy a property in the private market, but I am not an expert in farmland investing and I wouldn’t be able to build a portfolio that’s well-diversified by geography and crop. Therefore, I use crowdfunding platforms. There are a few of them and my favorite is FarmTogether.

I don’t use Fundrise see because there is nothing exceptional about it. They mainly invest in office buildings, apartment communities, and retail centers. There are plenty of REITs that you can buy to get such exposure with the added benefits of liquidity, diversification, lower management cost, better alignment of interest, and a much lower valuation in today’s market.

Bottom Line

It really seems to me that the main appeal of Fundrise is the perceived safety and stability that comes with illiquid private assets. Investors fear volatility and it is pushing them to look for less volatile alternatives.

But as we explained previously, you are just getting a false sense of stability due to the lack of quotation. In reality, the volatility is just as high or even higher.

Fundrise tries to appeal to unsophisticated investors who don’t know any better. But if you are experienced enough to not be phased by volatility, then REITs are a much better investment in most cases, especially at today’s valuations. If you want to lower your volatility, you can always add some private assets to your portfolio (e.g. Farmland crowdfunding), but Fundrise isn’t the best option in my opinion.

Be the first to comment