zimmytws

In May of this year, we gave you our rationale as to why America First Multifamily Investors, LP (NASDAQ:ATAX) was a far superior alternative to mortgage REITs and municipal bond ETFs. While the stock did not fit the exact characteristics of either comparative, it did have a lot of similarities, including a play on real estate loans and the tax-shielded nature of most of its income. It has been an amazing success story.

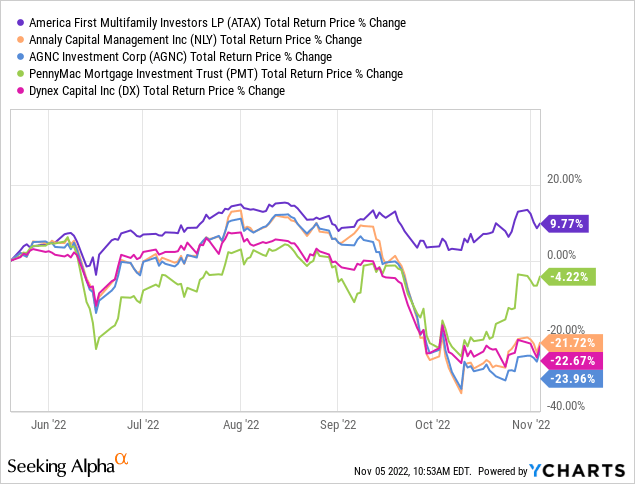

ATAX outperformed the mortgage REITs by a huge margin and the trio of Annaly Capital Management Inc. (NLY), AGNC Investment Corp. (AGNC) and Dynex Capital (DX) lost out by over 30%.

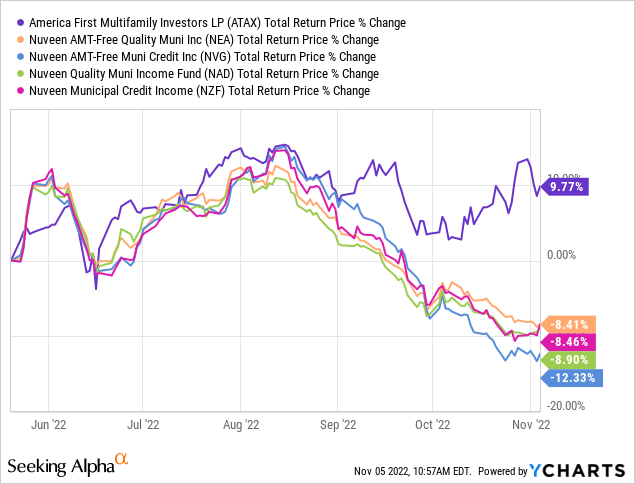

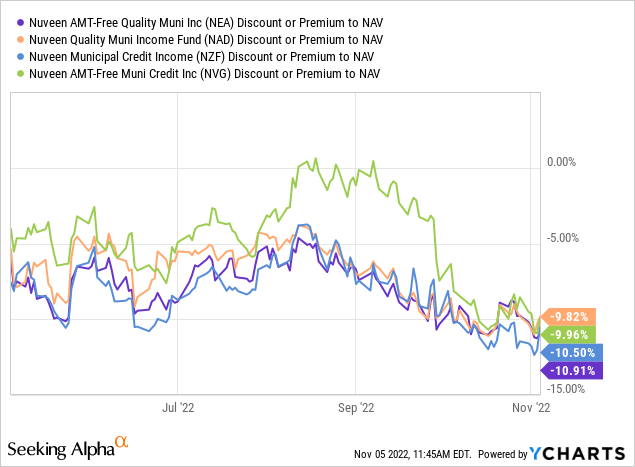

ATAX was far less brutal on the muni bond funds that we suggested would lose out. Nonetheless, our 4 comparatives in that space, Nuveen AMT-Free Quality Muni Income (NEA), Nuveen Quality Muni Income (NAD), Nuveen AMT-Free Muni Credit Income (NVG) and Nuveen Municipal Credit Income (NZF), underperformed enough to make investors take notice.

What Worked?

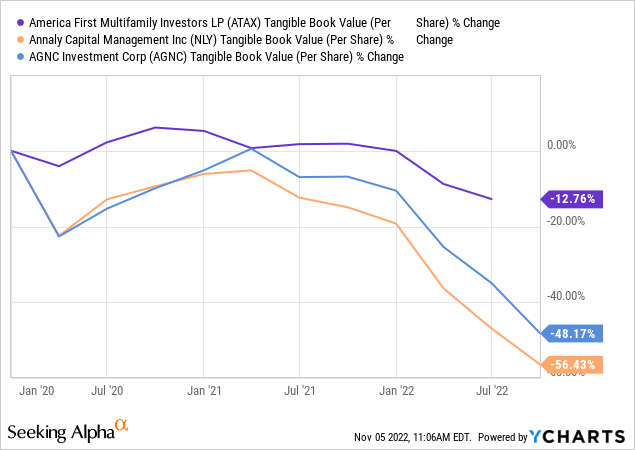

The biggest advantage that ATAX had versus the mortgage REIT peers was simply a relative lack of leverage. Less leverage means less volatility in stressful times. Less leverage means less decrease in tangible book value, a metric every investor should care about. Over the last 3 years, ATAX’s lower leverage has helped quite a bit in this arena.

We will get to why ATAX did better than muni bond funds, after we see the Q3-2022 results.

Q3-2022

The recent press releases from ATAX had plenty of good news for the bulls. ATAX delivered its second special distribution this year.

America First Multifamily Investors, L.P. (the “Partnership” or “ATAX”) announced that the Board of Managers of Greystone AF Manager LLC (“Greystone Manager”) declared a distribution to the Partnership’s Beneficial Unit Certificate (“BUC”) holders of $0.57 per BUC. The distribution consists of a regular quarterly cash distribution of $0.37 per BUC plus a supplemental distribution payable in the form of additional BUCs equal in value to $0.20 per BUC. The supplemental distribution will be paid at a ratio of 0.01044 BUCs for each issued and outstanding BUC as of the record date

Source: ATAX Press Release

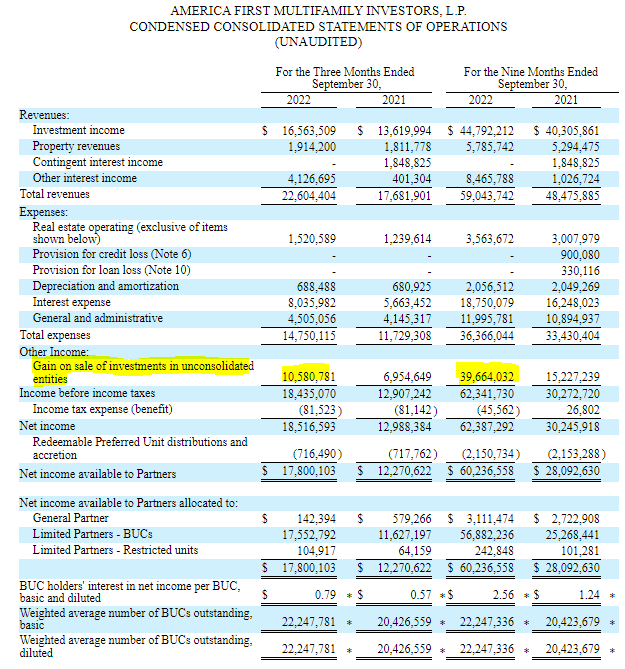

These special distributions have come as ATAX has sold a lot of its real estate at favorable prices. Looking at the 10-Q, we can see that gain on sale totaled $10.6 million this quarter and $39.7 million in the first 9 months.

ATAX Q3-2022 10-Q

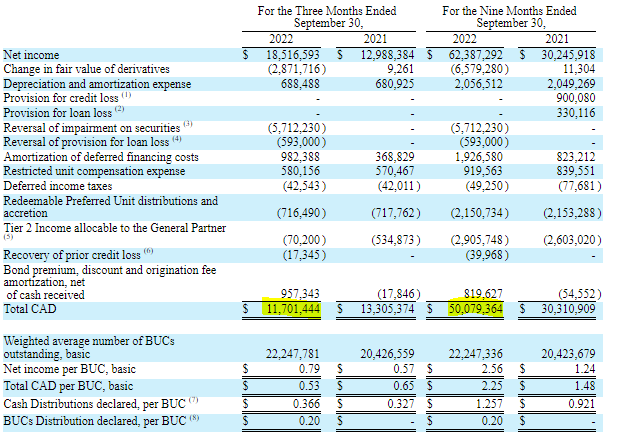

These are massive amounts in relation to the company, with just 22.2 million units (or BUCs as they like to call them) outstanding. One other way to examine the impact is to look at cash available for distribution or CAD per unit. ATAX starts from net income in getting to this CAD figure. You will note that they don’t subtract out the gain on sale in reaching CAD.

ATAX Q3-2022 10-Q

This paints a more problematic picture for the company. If you take out gain on sale amounts, ATAX would have a virtually flat CAD in Q3-2022 ($11.7 million minus $10.6 million). Year to date CAD excluding gain on sale would be about $11 million. With 22 million units outstanding, we are looking about 50 cents in CAD. This has big implications for the stock and the distribution in the year ahead.

Outlook

ATAX is seeing a massive drop in normalized (excluding all the gains on sale) CAD. The question is whether they can continue selling real estate assets at gains while their mortgage bond side income remains weak. The bigger question is whether they would want to. One advantage of ATAX over the muni bond funds was the actual physical real estate which they owned. These apartment values were, and still are, positively correlated with inflation. This provided it with a natural hedge, a hedge that allows it to outperform the muni bond funds. We think these sales will drop and that likely allows for a far lower CAD, and distribution, in the year ahead.

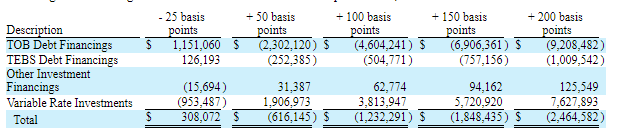

ATAX is also interest rate sensitive, both on its balance sheet and income statement. On its income statement side, further rate hikes will dent its already tight normalized CAD.

ATAX Q3-2022 10-Q

This sensitivity is despite ATAX adding significant hedges.

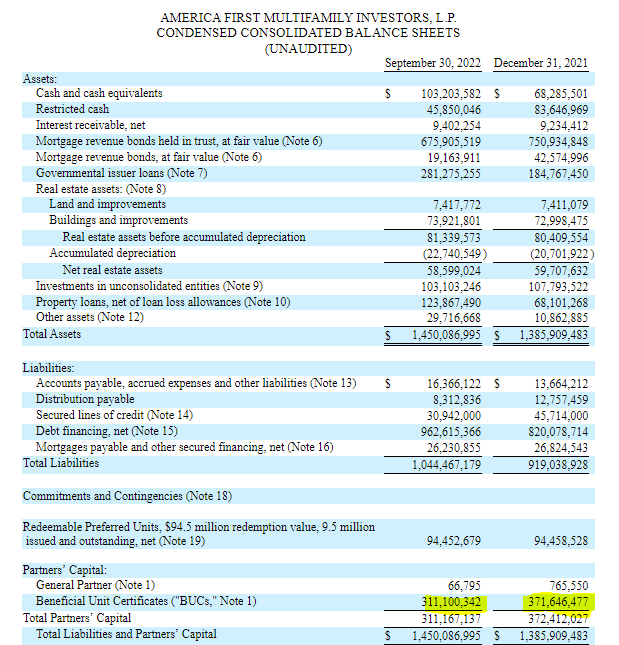

On the balance sheet side, total equity has been consistently dropping, even though it has been boosted by a large gain on real estate sales.

ATAX Q3-2022 10-Q

This drop is now changing the equity to asset ratio into an unfavorable zone.

Verdict

Outperformance versus mortgage REITs and muni bond funds was driven by lower leverage and perhaps crystallization of its physical real estate values. We think both these advantages are coming to an end.

ATAX’s leverage is rising as the rate hike cycle is taking a toll on even its equity values.

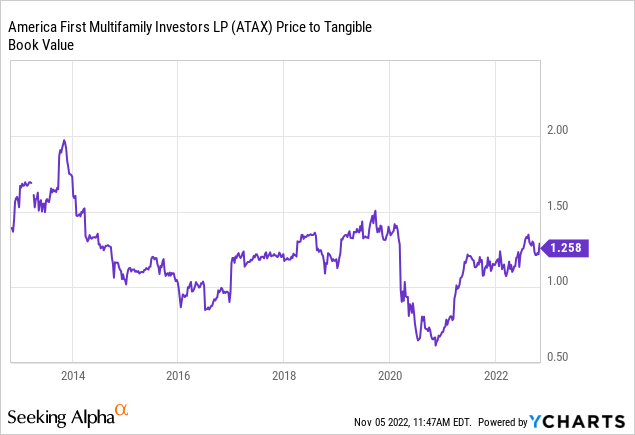

Investors focused on the big hikes have pushed ATAX to a big premium to tangible equity.

The chart above does not incorporate the book values from Q3-2022 results, which would push the ratio to 1.35X. Further increases in interest rates at the long end will drop the value of ATAX’s Mortgage Revenue Bonds even further. This could be offset to some extent by spread compression, but the risks remain high at these levels. Examining our relative call here tells us that muni bond funds are now also trading at wide discounts to NAV. This has been a driver of ATAX’s outperformance as well.

Hence, we think this is a time to no longer press the call of ATAX outperforming either mortgage REITs or muni bond funds. In fact, in light of the very large premium coupled with far lower CAD in the year ahead, we are downgrading ATAX to a Sell Rating on valuation. We would look to shift to neutral perhaps 15-20% lower.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment