sefa ozel

Full of zeal

The U.S. stock market has had a phenomenal past month. After bottoming on July 14 not far above the calendar year lows set in June, the S&P 500 has surged over +15%. Is the worst of the 2022 stock market decline now behind us?

Overzealous

While the rebound over the last several weeks has certainly been a welcome development, I remain cautious on the prospects for further market gains once we move past Labor Day and into the fall for key reasons.

Fundamental challenges

The first cause for market concern is the accumulating fundamental headwinds.

While the economy continues to exude numerous signs of strength such as continued strong employment growth and a historically low unemployment rate, the pace of output growth appears increasingly languid. We’ve already booked two consecutive quarters of negative GDP growth in 2022 Q1 and Q2 (which typically has been the textbook definition of an economic recession, but the jury is still out about whether we have officially entered recession at this point), and the early projections for Q3 growth are an unexciting 1.8% according to the Atlanta Fed GDPNow forecast. This is hardly the basis for a robust advance in stock prices in a market that has spent the last thirteen years and counting running ahead of itself.

Corporate earnings have also taken a notable hit in recent weeks. Entering 2022 Q2 earnings season on June 30, the S&P 500 was projected to post quarterly GAAP earnings per share of $51.61 per share, which represented a respectable year-over-year increase of more than +6%. But with more than 90% of 2022 Q2 earnings having now been reported, quarterly GAAP earnings per share ended up a significant lower at $42.53 per share, which is -18% lower than initial expectations at the end of June (yet 75% of companies that reported earnings managed to “beat” analysts’ estimates – insert thinking face emoji – how does it make any sense that 75% of companies “beat” analysts’ estimates yet earnings ended up -18% below analysts’ estimates? – highlighting once again the uselessness of this information). Moreover, estimates for quarterly GAAP earnings were also slashed by -12% for 2022 Q3 and by more than -8% for 2022 Q4 and all of 2023. This meaningful decline in forward “E” coupled with the sharp pick up in the S&P 500 “P” have suddenly returned stocks to a much more expensive 22 times earnings.

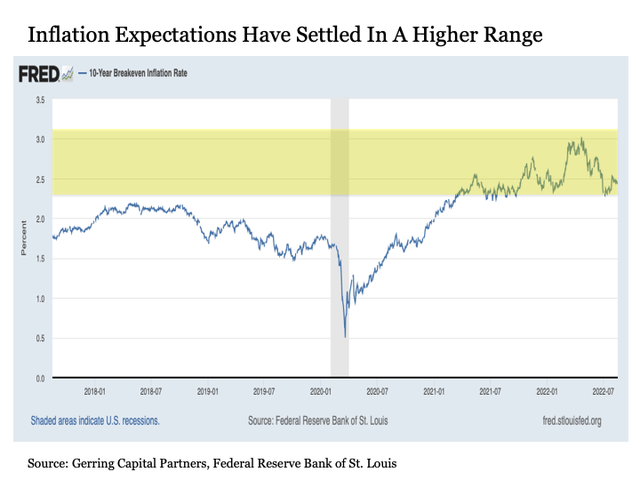

Federal Reserve Bank of St. Louis

Inflation expectations have also settled into a higher range. After peaking in late March and early April, inflation expectations as measured by the 5-Year Breakeven and 10-Year Breakeven inflation rates had been steadily falling for months. But in recent weeks, these readings have steadied at a measurably higher level versus what we have seen for many years. As a result, the notion that inflation may run higher going forward versus what we saw during the post Great Financial Crisis (GFC) period may actually play itself out if current data holds. And higher inflation leads to higher interest rates, leads to lower stock valuations, and thus a headwind on stock prices all else equal.

Putting this all together, the current economic and corporate earnings backdrop is not one where I am eager to go into the stock market guns a blazing. To the contrary, the strength of the recent stock market rally is one that raises thoughts about another round of profit taking within the stock segment of my broad asset allocation strategy.

Technical resistance

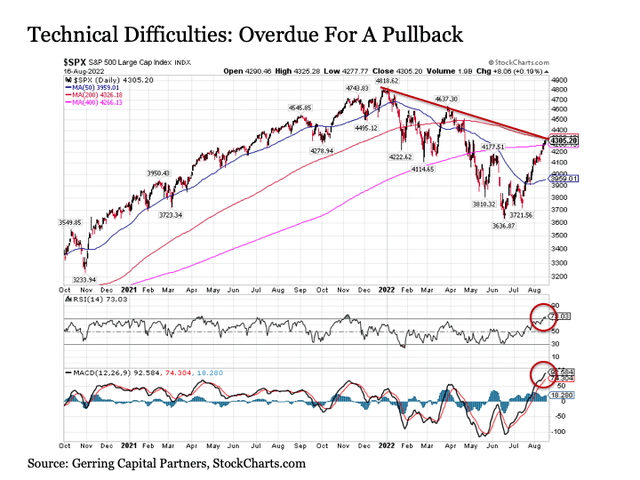

After a strong rally over the past month, stocks are now not only arriving at key resistance levels, but they are also overbought and overdue for some sort of pullback. Let’s dissect the various readings signaling this outcome.

StockCharts.com

First, the S&P 500 has now arrived at its downward sloping trendline resistance dating back to the start of 2022. It just so happens that this level coincides almost exactly to the S&P 500’s now downward sloping 200-day moving average resistance. This convergence is taking place at the same time that the Relative Strength Index (RSI) on the S&P 500 has moved meaningfully above a reading of 70, which represents an overbought reading for stocks. In other words, stocks have risen very far, very fast and may need to cool off a bit with a pullback. In addition, market momentum readings according to the MACD have surged to unusually high levels, also signaling that a consolidation period may be overdue.

Central bank withdrawal

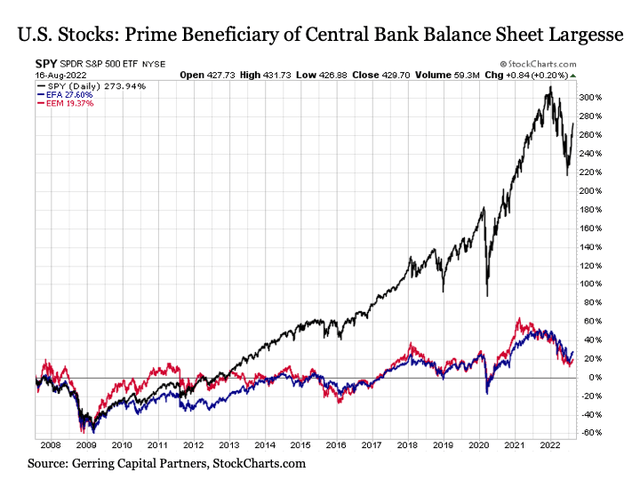

While short-term interest rates are certainly rising at a blistering pace in many parts of the world including the U.S, another arguably more important factor working against the market today is the increasingly determined shrinking of central bank balance sheets worldwide. While the U.S. Federal Reserve’s balance sheet has still held relatively steady having only shrunk by less than $90 billion since early April, major central banks from around the world have been offloading their balance sheets far more assertively. For example, both the European Central Bank and the Bank of Japan have decreased the sizes of their balance sheets by roughly $1 trillion or more since the start of the year with further declines to continue. The same can be said of the People’s Bank of China, which has also contracted its balance sheet by more than $500 billion.

Why does this matter? Because central bank asset purchases were the lifeblood that helped propel stocks into the stratosphere for so many years during the post-GFC period despite otherwise lackluster economic growth prospects. And nowhere in the world was this truer than the U.S. stock market, which seemed to benefit disproportionately to the upside relative to its developed and emerging market peers.

StockCharts.com

Thus, if what was once a critical tailwind when the central banks were expanding their balance sheets logically becomes a meaningful headwind now that central banks are shrinking their balance sheets back down.

Bottom line

Putting this all together, the market rally over the past month appears to have become overzealous from a fundamental, technical, and mechanical perspective and is at increasing risk of getting shot down in the days and weeks ahead. And given the underlying forces currently at work, a U.S. stock market decline back below the June lows should not be ruled out between now and Thanksgiving Day.

Important caveat

A key point should be noted that may enable U.S. stocks to continue to climb or at least hold their own at current levels over the next few weeks through the end of the first full week in September. August is a historically light trading volume month of the year for the U.S. stock market, and 2022 has been no exception. Only the week between Christmas Day and New Year’s Day sees lighter trading volume on average than the month of August. And while this can prove problematic if an unanticipated stress suddenly arises that market trading volume cannot sufficiently absorb, it can also generate an added and more prolonged boost to stocks when the market backdrop is otherwise quiet.

Put simply, while the institutional trader cats are away for vacation in the Hamptons and other swank summer locales, the retail trader mice will play. And play they have so far in August. An otherwise continued placid environment may allow stocks to continue their drift higher for a few more weeks despite all of the headwinds noted above.

Bottom line, revisited

Investors that may be inclined to further reduce stock allocations on the margin within a broad asset allocation strategy as we head into what historically can be a far more volatile and unforgiving period from Labor Day through just before Thanksgiving Day may be well served to exercise patience at least for a couple more weeks to see how much upside juice remains in the stock rally orange. But if one is inclined to incrementally dial back risk, the reasonable time to do so is likely sometime between now and the start of September, ahead of the U.S. holiday weekend.

Be the first to comment