AlexanderFord

Introduction

As mentioned in a previous article, I acquired a long position in Sachem Capital’s (NYSE:SACH) 2027 notes with a 6% coupon, trading with (NYSE:SCCE) as ticker symbol. While I understand most income investors are very charmed by Sachem’s 10% dividend yield, I don’t mind locking in a lower yield in return for more safety (as debt is obviously senior to equity on a balance sheet). While I will focus on the traded notes, this article is not about an ‘or/or’ situation as it is perfectly acceptable to own both the bonds and the common units. In my case, I only own the debt securities and that’s just a personal preference.

A strong set of results in the second quarter made shareholders happy

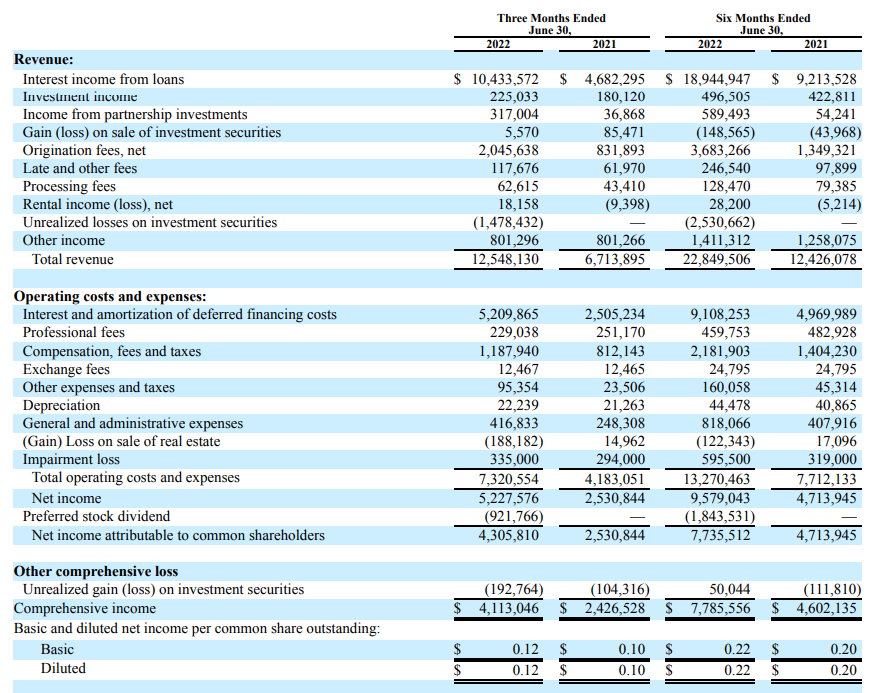

As Sachem Capital expanded its balance sheet, the interest income and origination fees increased quite substantially. The total revenue came in at $12.5M, which is almost twice the total revenue generated in the second quarter of last year, despite recording a $1.5M unrealized loss on the portfolio of investment securities. Excluding this, the total revenue would have come in at about $14M.

Sachem Investor Relations

Of course the operating expenses also increased but at a rather moderate pace. The total amount of expenses increased from $4.2M in Q2 2021 to $7.3M in the second quarter of the current financial year resulting in a net income of $5.2M compared to $2.5M last year. Sachem issued preferred shares in 2021 and this is now costing SACH just over $0.9M per quarter. But even after taking this into account, the net income still increased by about 60% to $4.3M. The impact on the per-share performance was a bit more subdued as Sachem’s share count increased by almost 50% compared to last year but an EPS of $0.12 for the quarter is excellent.

Keep in mind the EPS is based on the average share count of 36.4M shares during the quarter. The share count currently stands at 38.5M shares and this would result in an EPS of approximately $0.11 per share if the current share count would be used instead of the average share count during the quarter.

That doesn’t really matter from the perspective of preferred shareholders and baby bond investors. I am positively surprised by the good coverage ratio of the preferred shares as Sachem needs to use less than 20% of its net income to cover the preferred dividends. As you may remember from my previous article, I do have the preferred shares on my ‘wish list’ but haven’t pulled the trigger yet. But seeing how well the preferred dividend is covered, I may have to initiate a long position in Sachem’s preferred shares as well.

I still like the debt securities as the risk/reward ratio remains quite favorable

I own the SCCE baby bonds. That doesn’t mean I don’t like any of the other debt securities issued by Sachem Capital, but SCCE just made the most sense for me at the time. I can’t rule out adding different issues from Sachem Capital but at this point, I only own the SCCE securities.

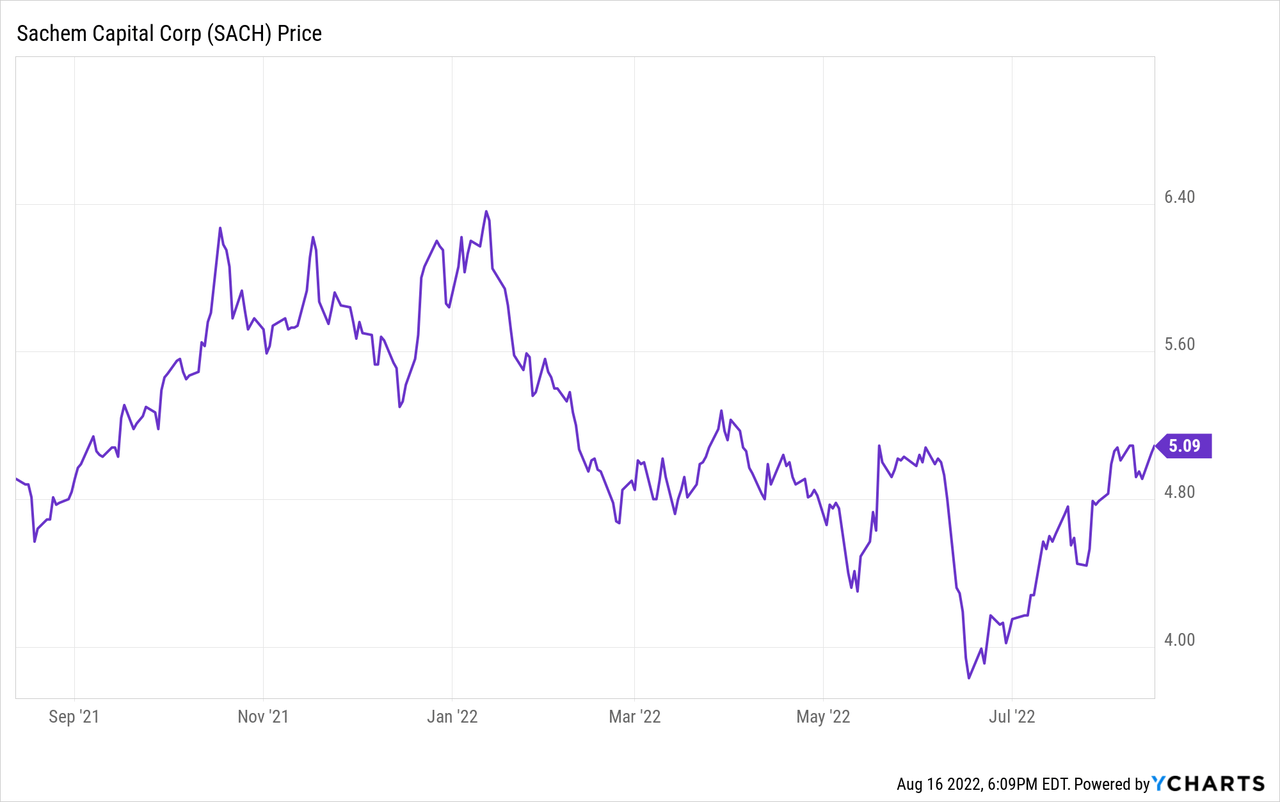

These securities can be called from March 9, 2024, on and have a maturity date of March 30, 2027. They are currently trading at just under $24, a discount of just over 4% compared to the $25 issue price. The total size of this offering was just under $52M. Based on the current price, the yield to maturity is approximately 7.07% while the yield to call is approximately 9%. As there are other debt securities with a higher coupon, I doubt Sachem will call SCCE in 2024 as it makes more sense to retire securities with a higher interest cost first.

We already know Sachem’s net income came in at $5.2M in the quarter (including that unrealized loss on securities), and we also know Sachem paid about $5.2M in interest. Which means the interest coverage ratio is pretty good.

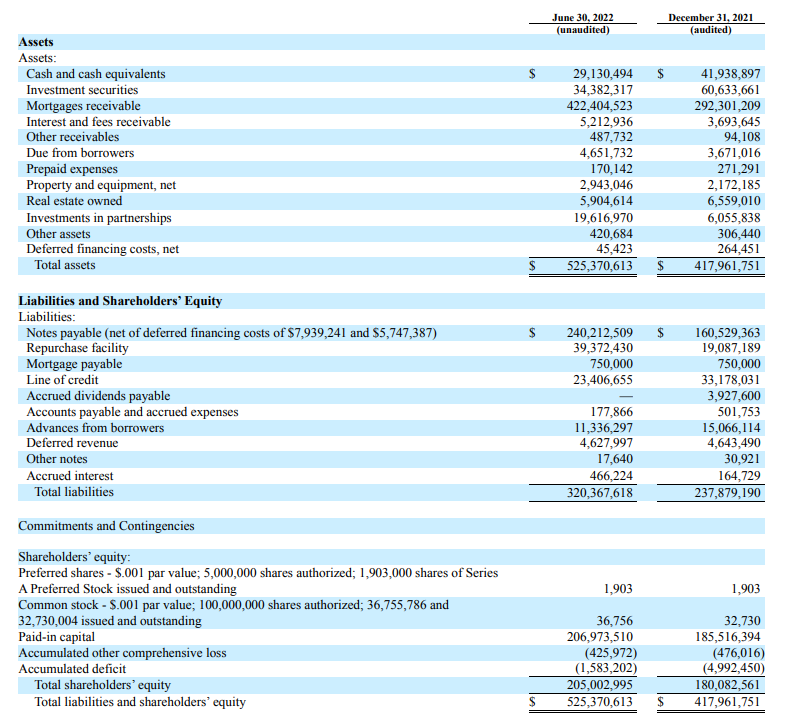

More importantly, I also like Sachem’s balance sheet. As of the end of June, the total size of the balance sheet had increased to $525M of which about $320M consists of liabilities. The vast majority of these liabilities consists of $240M of notes which all rank equal, and junior to the $23.4M line of credit debt and the repurchase facility (I assume).

Sachem Investor Relations

The combination of cash and investment securities should be sufficient to cover the repurchase facility and the line of credit which essentially means the $240M in notes are backed by $422M in mortgages (I’m cutting a corner here but that’s basically what it comes down to).

We also know Sachem targets a maximum LTV ratio of 70% which basically means the $422M in mortgages is backed by at least $600M in real estate (and likely even higher). And thanks to Sachem’s smart approach to request a personal guarantee from borrowers it has been able to keep foreclosures and loan losses very low.

So while $240M in debt versus $422M in mortgages resulting in a 60% leverage doesn’t sound ideal, we should apply the ‘look-through’ approach. Considering the loans are backed by in excess of $600M in real estate, the assets can decline in value by about 60% yet the baby bond owners would still be made whole.

Investment thesis

I’m very satisfied with the risk/reward ratio offered by Sachem’s baby bonds and I will be happy to add to my existing position in the 2027 6% bonds. I am also warming up to buying the preferred shares as the preferred dividend coverage level and asset coverage levels are strong. While I understand I am leaving potential capital gains on the table by not investing in the common units of Sachem Capital, I’m fine with the income-oriented approach here.

Be the first to comment