SIphotography

Sea Limited (NYSE:SE) recently reported a challenging Q2 with revenue and adjusted EBITDA coming in below expectations given the ongoing macro pressures on their business.

The biggest disappointment during the quarter was the company suspending guidance for their E-Commerce segment in addition to the company reported ongoing declines in their Digital Entertainment quarterly active users and quarterly paying users.

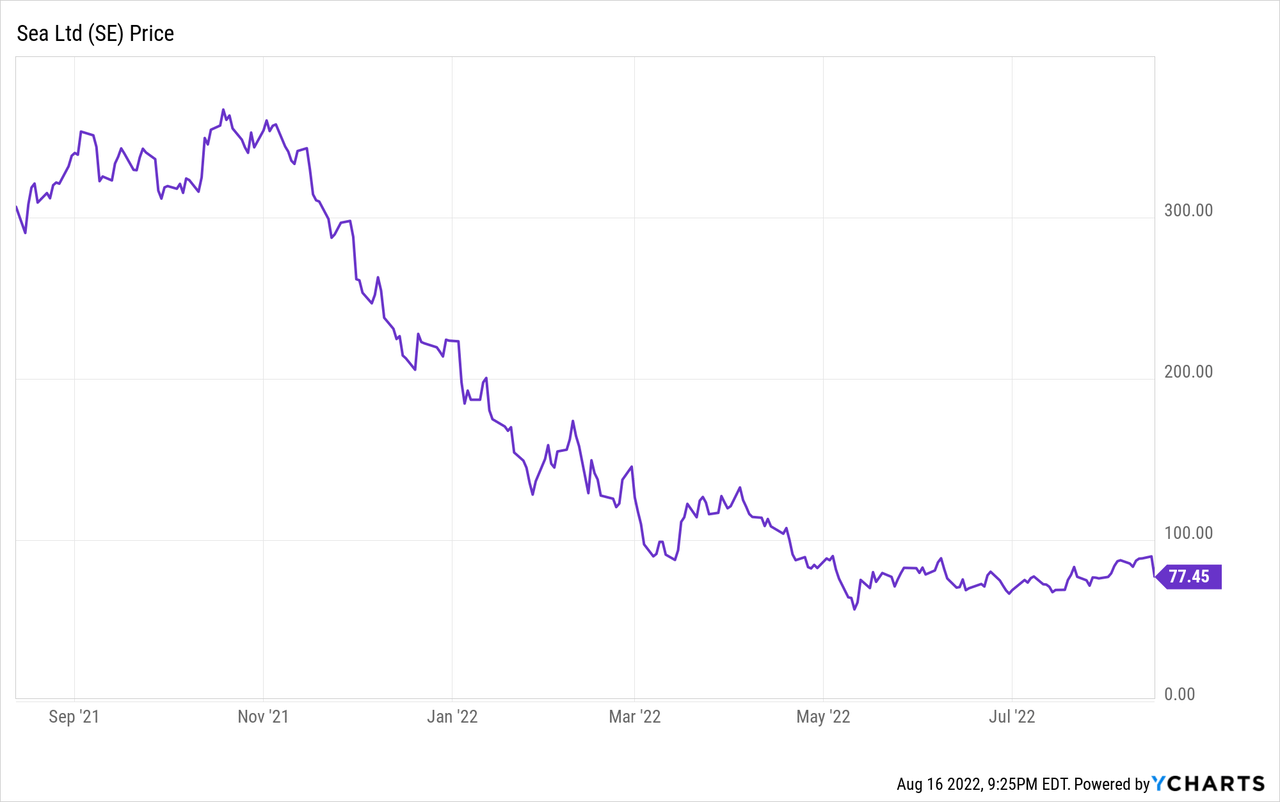

To no surprise, the company’s stock was down over 10% on disappointing earnings and guidance suspension, which brings the year to date pulldown to 65%.

Yes, the macro environment remain very challenged and there is still a lot of uncertainty that may take several quarters or months to play out. However, I believe much of this is currently priced into the stock.

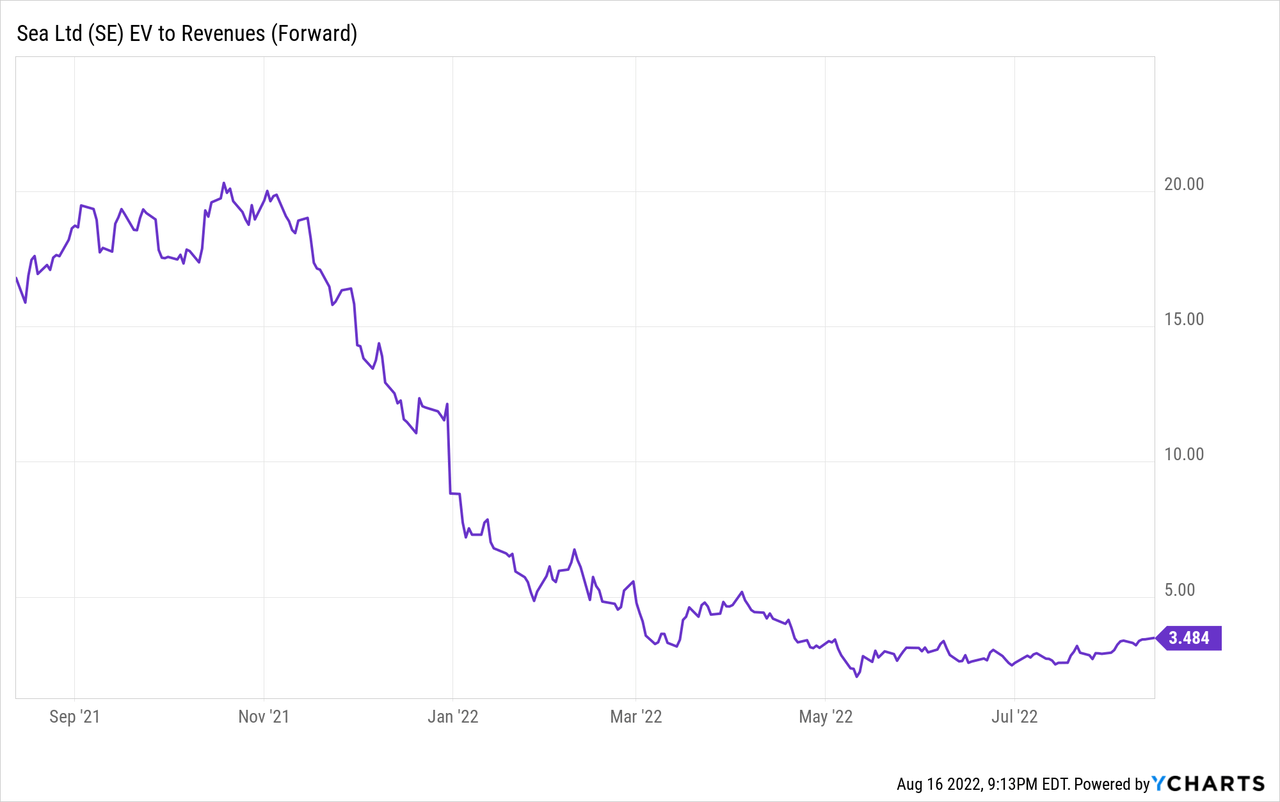

Currently, Sea trades at 3.5x forward revenue, which is pretty similar to the recent range of 3-4x forward revenue. The combination of challenging macro, revenue deceleration, and ongoing adjusted EBITDA losses makes it difficult to see multiple expansion in the near-term.

However, long-term investors should remain confident in the outlook and could view this recent pullback as a buying opportunity. Given the recent stock weakness and ongoing negative sentiment, I do believe we may be near a bottom for the stock. Even though the stock remains a show-me story, I continue to believe the long-term outlook remains healthy and long-term investors will be rewarded over time.

Financial Review and Guidance

During the quarter, revenue grew 29% yoy to $2.94 billion, which actually missed expectations by $90 million. While results were certainly weighed down by the macro environment, the underlying trends seemed to be okay. Heading into earrings, I was a little more cautious given the challenging macro environment and warned that upcoming results could disappoint.

Sea Limited

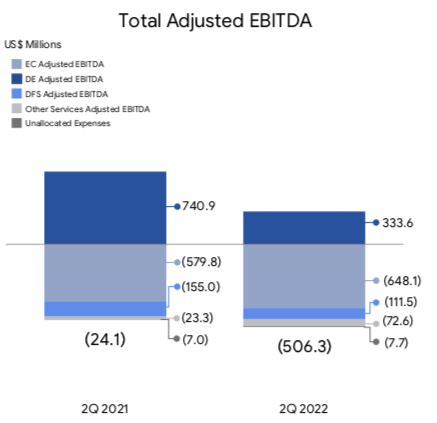

On top of the revenue shortfall, the company reported total adjusted EBITDA loss of $506 million, which is worse than the $24 million last in the year-ago period. Ultimately, this led to the company reporting non-GAAP EPS loss of $1.03, which was worse than expectations.

E-Commerce

E-Commerce revenue during the quarter continued to decelerate, with revenue growing 51% yoy to $1.7 billion. I previously warned of the difficult growth comparisons coming up with revenue growth being 250% yoy in Q1-2021, 161% yoy in Q2-2021, and 134% yoy in Q3-2021. Not surprisingly, the challenging growth comparable caused another quarter of E-Commerce revenue deceleration.

In addition, consumers were faced with a high inflationary environment with wages not keeping pace, thus the real cost of goods has increased quite significantly, placing pressure on discretionary spending.

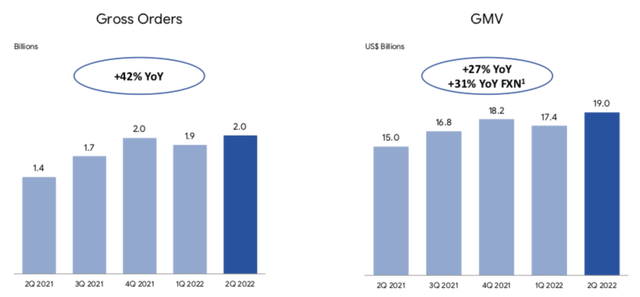

Also during the quarter, gross orders grew 42% yoy to 2.0 billion, and while this is up sequentially from 1.9 billion last quarter, the past three quarters have not seen much sequential growth.

While the company’s Shopee platform continues to receive high marks across the globe as one of the highest ranked apps, profitability has struggled to gain traction. In fact, adjusted EBITDA loss during the quarter was $648 million, which is almost $70 million worse than the year-ago period. Focus needs to rapidly shift to profitability improvement.

And management took this first step during the quarter with adjusted EBITDA loss per order improving 21% yoy. While disappointing to see, it was not overly shocking to see management pull guidance for their E-Commerce segment for the remainder of the year given the several macro headwinds the company is currently experiencing.

Given our strategic shifts, coupled with the various macro factors that are hard to predict as mentioned before, we believe it is prudent to maximize our focus on efficiency across our business rather than over-committing which we believe would be ill-advised at this time of uncertainty. As such, we are suspending the full year guidance for Shopee, which we last provided in May. Even though we have stopped providing guidance, our focus for the rest of the year remains very clear, which is to continue to improve efficiency by both deepening monetization and optimizing our cost structure. We will be more tightly managing our operating expenses, such as marketing costs and logistics costs, while also gradually increasing monetization across various income streams with a focus on the high margin ones.

Remember, last quarter management downward revised their E-Commerce revenue expectations given the increased uncertainties in the macro environment, especially around the Asia-Pacific regions. And rather than lowering guidance again and remaining uncertain, I think management did the right thing in not providing any guidance.

While sentiment likely remains negative around this segment for some time until the company can show improving revenue and profitability trends, I do believe the long-term outlook remains healthy in a normalized environment.

Digital Entertainment

Digital Entertainment revenue during the quarter came in at $900 million, which actually declined from the $1.0 billion reported in the year-ago period, largely driven by lower quarterly active users. In addition, bookings during the quarter were $717 million, declining around 40% yoy compared to $1.2 billion in the year-ago period.

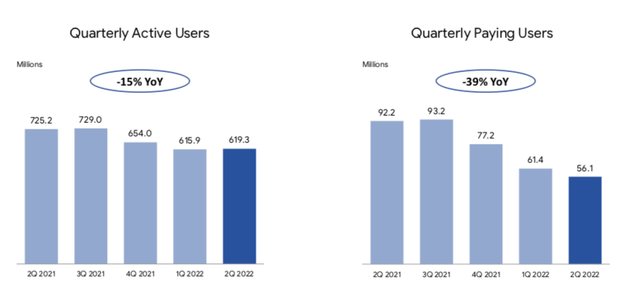

Last quarter, management commented on a slowdown in user engagement with quarterly active users declining 5% yoy and quarterly paying users declining 23% yoy. And in Q2, trends continued to deteriorate.

During the quarter, quarterly active users declined 15% yoy with quarterly paying users declining 39% yoy. While the company noted that Free Fire continues to be the highest grossing mobile game in Southeast Asia and Latin America for the 12th consecutive quarter, they also talked about some of the macro headwinds they are seeing in the business.

While short-term gaming industry trends remain relatively uncertain due to reopening trends as well as the potential impact from macro volatility, we are highly confident in the long-term structural tailwinds of the segment. We expect this to be even more apparent across our markets where we are well positioned and the growth runway for digital entertainment is substantial. We also expect this to support the long-term sustained life span of our existing franchises and platforms.

Yes, user engagement trends can move around from quarter to quarter, but these underlying trends are worrisome and the uncertain macro environment paints a challenging picture. With ongoing pressure in quarterly active users and even worse trends in paying users, I believe this part of the business remains a show-me story.

In addition, adjusted EBITDA for this segment during the quarter was $334 million, down from $741 million in the year-ago period. This represents 46.5% of bookings during the quarter, which is also down from 62.8% in the year-ago period.

Digital Financial Services

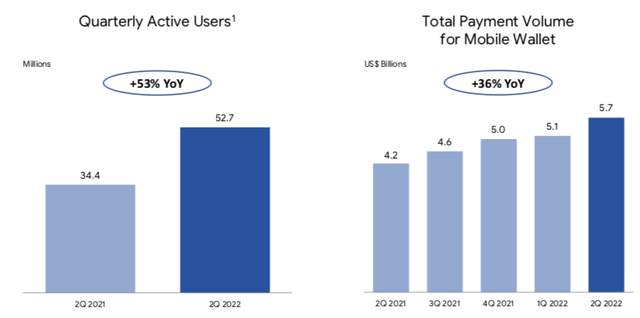

One area of strength during the quarter was within their Digital Financial Services business, which continues to post impressive growth. Revenue during the quarter grew 214% yoy to $279 million and the company actually improved their adjusted EBITDA loss to $112 million, up from the loss of $155 million in the year-ago period.

What drove this strength during the quarter was the combination of ongoing success with quarterly active users and TPV within their mobile wallet.

Quarterly active users grew 53% yoy to 52.7 million and TPV for mobile wallet grew 36% yoy to $5.7 billion, which also showed a nice sequential uptick.

As they continue to roll out more SeaMoney offerings across their markets, I believe the company will continue to report sequential improvements in TPV, much like we saw during Q2. With the company noting that 40% of quarterly active buyers on Shopee in Southeast Asia having used SeaMoney products or services during Q2, I believe there continues to be a long runway of penetration left in the existing customer base. Not to mention the significant growth opportunity with new users and markets.

Valuation

Given that management pulled their E-Commerce for the remainder of the year, it was no surprise to see the stock down over 10% the day of earnings. This means the stock is now down over 65% so far this year, and I believe the ongoing weakness may persist over the coming months until the macro environment clears up a bit.

Despite the ongoing macro impacts, the strength within the company’s Digital Financial Services was encouraging, though the underlying profitability trends remain questionable for the total business. I believe the company will need to start executing on operational efficiencies to help improve profitability before investors become more comfortable with the company.

While estimates for 2022 and 2023 revenue likely come down over the next few weeks given the macro uncertainties, valuation has pretty much stalled at 3-4x forward revenue. The stock currently trades around 3.5x forward revenue and it seems possible that valuations remains stuck in this recent trading range until the company executes on their improved efficiency strategy.

By no means is 3-4x forward revenue an expensive multiple to pay, the combination of decelerating revenue, a challenging and uncertain macro environment, and ongoing adjusted EBITDA losses makes it challenging to justify a higher multiple.

I do believe that long-term, the company is poised for strong growth trends and improved profitability. However, the stock may remain in the penalty box for now until the company can show progress around these initiatives.

Longer-term investors are likely to remain rewarded if they hold onto their position throughout this volatility, but indeed there is likely to be ongoing volatility over the coming months and quarters.

For now, I believe much of the challenging macro factors are priced into the stock and would not be surprised if we saw the bottom approaching. Thus, I believe long-term investors should find this pullback as a good buying opportunity.

Be the first to comment