Design Cells/iStock via Getty Images

Sana Biotechnology (NASDAQ:SANA) is a preclinical stage company focused on engineering human cells to act as therapies. It has generated a lot of excitement and so has a relatively large market capitalization for a pre-clinical (not yet tested in humans) company. Sana has a long path ahead of it as it needs to complete its preclinical work and then have at least one of its therapies get positive results in Phase 1, Phase 2, and Phase 3 trials before it can submit its data to the FDA in hopes of getting an approval that will generate revenue and, eventually, profits. It is only an appropriate investment for those who understand the risks and potential rewards and take a long-term view, or who want to speculate on shorter term fluctuations in its stock price. My view, as will be expanded below, is that the rewards could be substantial, so that the risk is acceptable in a well-thought-out biotechnology portfolio.

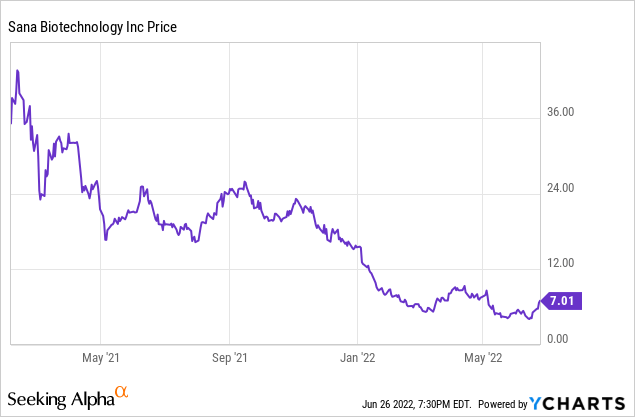

Sana had its IPO in February 2021 at $35.10 per share, but it has since fallen as low at $3.93 per share and closed on Friday, June 24 at $7.01. That makes its current market capitalization $1.25 billion, compared to an IPO market cap of $6.25 billion. Partly that reflects the general fall in biotechnology stocks this last year. Likely partly it is a result of investors realizing the long timeline, and potential for failure, before any payoff. However, the IPO did generate significant cash that can be used to get through at least the first part of the journey. Before discussing the science and pipeline, I will summarize Q1 2022 results.

Sana Biotechnology Q1 2022 Financial Results

Sana reported Q1 2022 results on May 10, 2022. The headline was that the cash position ended at $657 million. However, cash burn in the quarter was $89.5 million. That was considerably more than the reported GAAP net loss of $31 million (or $0.17 per share) because of a $55 million R&D contingent consideration. The main expense was $73 million for R&D, with General and Administrative expenses adding another $14 million. There was no revenue, as is usually the case for a preclinical stage biotech company. The footnotes are of more than usual interest, showing that success and contingent liability payments are due to Harvard College and Cobalt Biomedicine. But Cobalt was acquired by Sana in 2019; the payments are part of the acquisition deal.

Science

Sana has two distinct sets of technologies under development. The first is hypoimmune technology, in which cells are engineered to not cause immune system reactions in patients. Sana also labels this ex vivo cell engineering. Taking cells from donors, the MHC (major histocompatibility complex), which presents antigens to T cells, is disrupted. Then the cells are induced to overexpress CD47, which then signals the immune system, particularly macrophages, to leave the cell alone. These hypoimmune cells can then be differentiated into various cell types and cloned to make off-the-shelf cell therapies. Among the hypoimmune cell types being created by Sana are T cells, pancreatic islets, cardiomyocytes, and glial progenitor cells.

Fusosome technology is Sana’s second platform. Fusosomes can act as vehicles to introduce DNA, mRNA, or other payloads into cells. They are inspired by virus envelopes and were first developed (and called fusogens) at FL39, which then became Cobalt Biomedicine before becoming Sana. They are more effective delivery agents than lipid nanoparticles. Fusosomes can target cell types that display specific ligands. By adding a payload to a T cell, a CAR T cell can be generated that has a specific cancer cell target. The CAR T cell is then cloned to produce large numbers of cells for the therapy. This therapy has been demonstrated by a CD19 CAR delivered by fusosome clearing B cell tumors in humanized mice.

For a deeper dive check out the Sana Biotechnology June 2022 Presentation.

Preclinical Pipeline

The latest news from the pipeline was a presentation at ISSCR showing survival of transplanted hypoimmune iPSC-derived cell types without immunosuppression, in non-human primates, on June 17, 2022. This is strong evidence that Sana can engineer hypoimmune cells that survive in living organisms. The data included the modified pancreatic islet cells that could potentially treat type 1 diabetes, which are listed on the Sana pipeline as SC451. SC187 also passed this test. It is a potential therapy using cardiomyocytes to treat heart failure. Retinal pigmental epithelial cells were the third type of cell demonstrating hypoimmunity in a non-human primate. They do not correspond to any product currently listed in the pipeline.

Additional hypoimmune, ex vivo engineering product pipeline candidates include SC291, targeting CD19, potentially for NHL, ALL, and CLL lymphomas and leukemias. SC276 targets CD22 and CD19, potentially for the same three blood cancers. SC255 targets BCMA and is a potential therapy for multiple myeloma. SC379 uses glial progenitor cells for nervous system therapies, possibly Huntington’s disease, Pelizaeus-Merzbacher disease, and multiple sclerosis.

Moving to the fusosome/in vivo cell engineering platform, we again see engineered T cells focused mainly on blood cancers. SG295 targets CD8 and CD19, and SG242 targets CD4 and CD19, for NHL, ALL, and CLL. Then adding a target for the same set of diseases is SG233 targeting CD8, CD22, and CD19. SG239 targets CD8 and BCMA for multiple myeloma. SG221 also goes after multiple myeloma but targeting CD4 and BCMA.

Fusogen tech can also target non-cancer diseases. SG328 uses hepatocytes to treat ornithine transcarbamylase deficiency, a liver disease caused by a genetic disorder. SG418 hematopoietic stem cells are being engineered to act as therapies for sickle cell disease and beta-thalassemia.

There seems to be some duplication but remember that not all cancers with the same name have the same mutations. They can exhibit different surface proteins for CAR T therapies to target. There are CAR T therapies already available, and in other companies’ pipelines, for the blood cancers. Sana believes its technology will create best in class therapies. Therapies are approved by regulatory agencies for sickle cell and beta-thalassemia, and other companies are working on gene therapies, so again Sana hopes its technology will create best-in-class products.

Sana has announced (as of Q1) that it expects to file INDs with the FDA for permission to begin human trials, this year, for one ex vivo hypoimmune allogeneic CAR T therapy and one in vivo fusogen CAR T therapy. That likely means the Phase 1 trials will start in 2023 and we can begin waiting for the earliest, preliminary data on safety and efficacy.

Conclusion

Sana Biotechnology presents the usual dilemma for potential investors: invest at a low stock price now or wait until more data has partly derisked the long march to FDA approval. I believe Sana is still in the high-risk category and will remain that way at least until there are positive Phase 1 clinical results. But I think the technology is marvelous, and so I have begun accumulating the stock.

Be the first to comment