Melpomenem

A deterioration in growth prospects and the lack of profitability, combined with terrible momentum, not to mention a poisonous macro-economic environment that punishes long-duration equities, seem to make the bearish case on UiPath Inc. (NYSE:PATH) that much more compelling. But a number of factors including new management, a solid balance sheet, much more favorable financials than it seems, and technical product leadership, lead us to believe that the stock is a strong buy, not a sell.

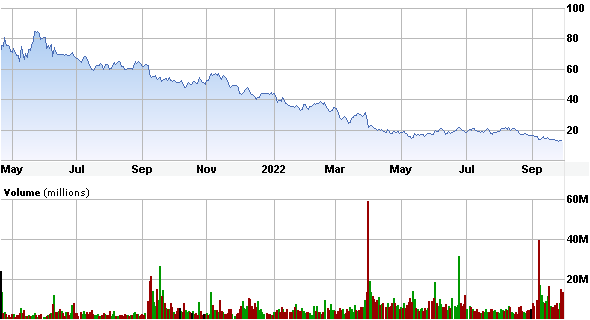

Check out the graph below.

E*Trade

Since going public in 2021, the stock has lost 82.8% of its value (as of 9/30/2022). Can the share price regain altitude? Not only do we believe it can, but we argue that now is a great time to start accumulating. The bear market is inflicting tremendous pain to unprofitable ventures. But these kinds of bargains won’t last, and we’re clearly well into the downtrend. Remember that the average length of a bear market for the S&P 500 is 289 days, or just about over 9 months, during which stocks lose 36% on average. The current one started at the beginning of the year; we’re past 9 months. (The Nasdaq bear started a couple of weeks earlier.) Once the market turns around, the average bull market runs for 991 days, or 2.7 years, during which stocks gain 114%. We’re likely getting closer; the more depressed the outlook right now, the closer we’re getting to a major trend reversal.

At First Blush, UiPath Shows Major Negative Trends in Both Top and Bottom Lines

UiPath serves customers in more than 115 countries, including across eastern Europe and Russia. Adverse conditions in the global economy, increasing foreign exchange headwinds, and geopolitical turmoil caused by the Russian military operation in Ukraine, have hampered the firm’s ability to grow its business and negatively impacted its financial results.

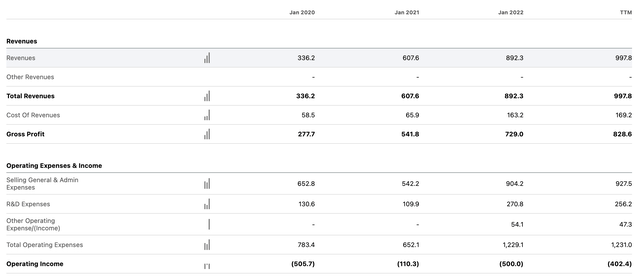

In (fiscal, not calendar) Q2 2023 UiPath reported its operations hemorrhaged $23.7 million in cash. Non-GAAP adjusted free cash flow was negative $23.3 million. Q2 Revenue of $242.2 million still managed to increase 24 percent year-over-year; it doesn’t sound so bad, except that the top line used to grow much faster just a year ago. Q4 ’22 shows revenue of $289.7 million increasing 39 percent year-over-year, ARR of $925.3 million up 59 percent, and net new ARR of $106.9 million up 72 percent. Likewise, full year fiscal 2022 shows revenue of $892.3 million up 47 percent year-over-year and Net new ARR of $344.8 million up 51 percent year-over-year.

The statement below gives more perspective. Revenue growth is clearly decelerating. Look no further than the top line, which goes from nearly doubling to increasing 50% to increasing 10% (trailing 12-month).

Seeking Alpha

Seeking Alpha UiPath Financials

The bottom line likewise shows significant stress, as is illustrated above. So does operational cash flow. Both the operating income and earnings from continuing operations (both January 22 and TTM) are deep into negative territory. Clearly, there are red flags. Conservative investors may stay away. Put it another way, Warren Buffett does not own PATH.

Shares Aren’t Even That Cheap. Let’s Have a Look at Valuation

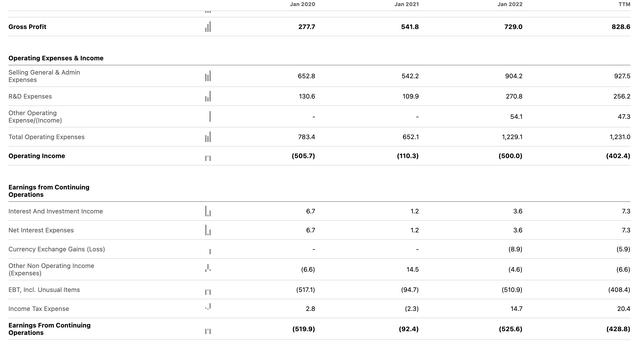

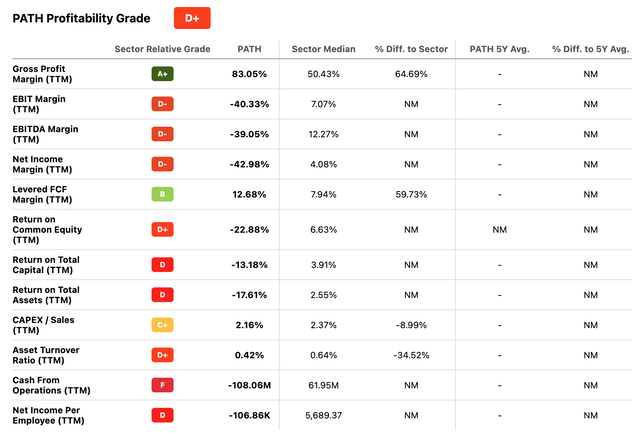

Seeking Alpha assigns PATH a profitability grade of D+. A net income margin of -43%, a return on common equity of -23%, and a return on total assets of -17% sure fail to impress.

Seeking Alpha – Valuation

The list, alas, goes on.

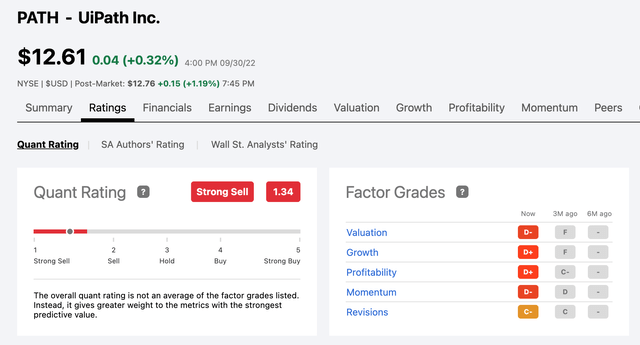

A ‘Strong Sell’ quant rating adds to poor metrics on the growth, profitability, and valuation fronts, to nail the case.

It must be a Sell.

Seeking Alpha

Market Sentiment Reflects the Extent of the Damage Done

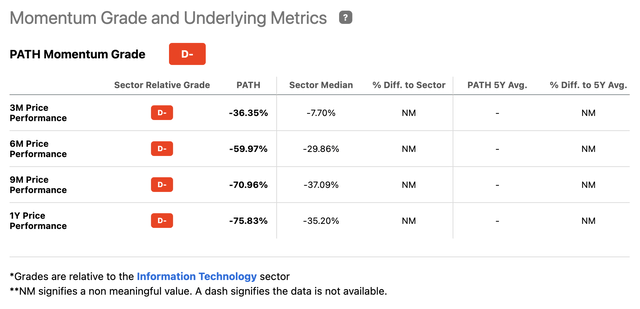

No wonder then that momentum is to the downside.

Seeking Alpha – Momentum

All recent time capsules reflect heavy distribution. The stock has shown continued deterioration and underperformed its sector median by a wide margin during all four time periods referenced. Whoever has been holding PATH over the past few months or years has, alas, incurred steep losses.

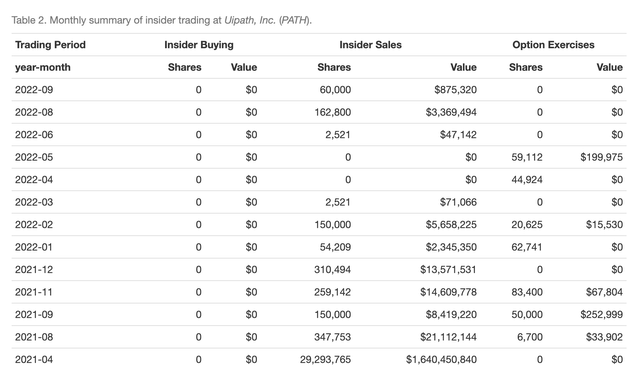

Unsurprisingly, insiders aren’t buying the stock either. At least so far. Since the company went public, not one insider has committed to buying shares.

Insider Monitor

However, while insider sales were heavy in 2021, it is interesting to note they have rarefied in 2022. Only CFO Ashim Gupta (and to a lesser degree CAO Hitesh Ramani) have sold in any meaningful fashion over the past 6 months. Gupta still owns in excess of 1.3 million shares.

This may very well qualify as a first clue that not everything is lost. We’d expect sustained insider selling if the company were such a disaster.

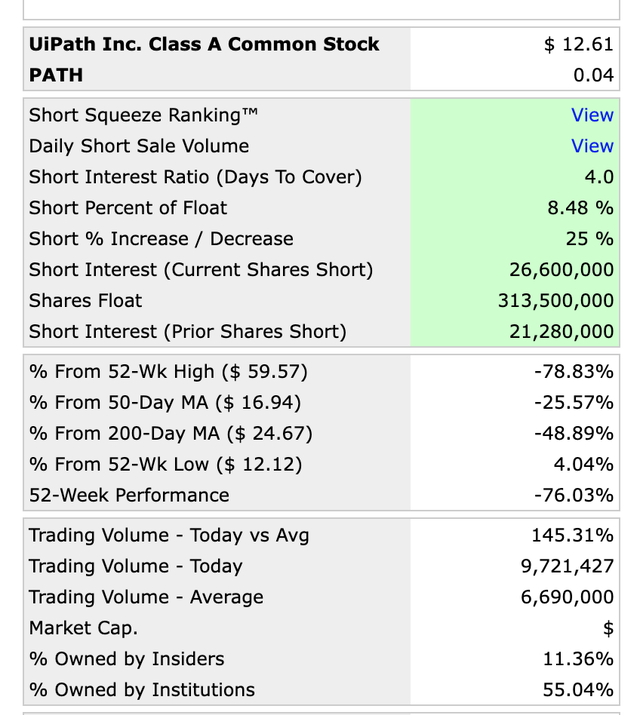

Likewise, a short percent of float of 8.48% shows PATH shorts are active, but the ratio sure does not come to close to the 20% (and well above) rates commonly found on highly controversial or risky investments.

ShortSqueeze

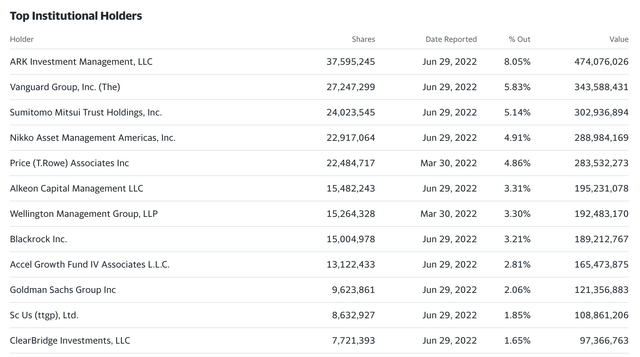

Even better, Cathy Wood of the famed ARK family of ETFs keeps adding to her already substantial PATH holdings, and this across several ETFs. PATH constitutes a top 12 holding in, not only the flagship ARK Innovation ETF (ARKK with 4.32% of total portfolio, as of 9/30/22), but also ARK Next Generation Internet (ARKW, 4.02%), ARK Fintech Innovation (ARKF, 5.93%), ARK Autonomous Tech. & Robotics (ARKQ, 6.03%), and PATH even figures in the ARK Space Exploration and Innovation ETF (ARKX) and the ARK Genomic Revolution ETF (ARKG), but unsurprisingly at a lower commitment level (ARKX, 2.75% and ARKG, 1.62%, respectively). What does she see that the market does not (yet)?

Both Vanguard and Sumitomo Mitsui also own more than 5%, and Nikko Asset Management and T. Rowe Price just under 5% of UiPath. Wellington Management and BlackRock own more than 3%.

Yahoo Finance

Institutional ownership is not particularly high (at around 60%, depending on source considered), but this is a positive. The moment the company turns around, there’ll be plenty of buying power to propel the shares higher.

The question remains then and seems all the more intriguing. What does Cathy Wood, other funds, and even, to an extent, insiders (who’ve mostly sold selling shares), see that most don’t?

(Admittedly, co-CEO and co-Founder Daniel Dines, who already owns 20% of shares, may not need to add; good thing too, his interest and shareholders’ are well-aligned.)

New Management May Rock the Boat

Never a bad idea to start with the people who steer the boat. As it happens, there is fresh blood.

Co-CEO Robert Enslin joined UiPath in May 2022 from Google Cloud, where he served as President of Cloud Sales, led global field operations, and tripled the size of the sales organization. Enslin also spent 27 years at SAP in various leadership roles across sales and operations including, in his final role, President, Cloud Business Group and Executive Board Member (leading the delivery of SAP’s entire portfolio of cloud applications/services). He sure adds depth to the management bench and looks like a nice counterweight to co-CEO Daniel Dines’ perspectives and contributions.

To quote Daniel Dines himself:

Rob brings the right balance of experience and skills to scale our operations, allowing me to focus on our company culture, vision, and product innovation, areas I am passionate about – and that bring considerable value to our employees and customers.

Chief Business Officer Chris Weber (who comes from Microsoft) started at around the same time. He leads global go-to-market strategy and execution, thus guides worldwide sales, services, and the firm’s partner organization.

These two executives started work at UiPath nearly six months ago. We should start to see the impact of their leadership soon. Perfect timing to consider the shares. Nothing like fresh blood to help reboot management and turn a ship around.

UiPath Remains the Leader in Robotic Process Automation

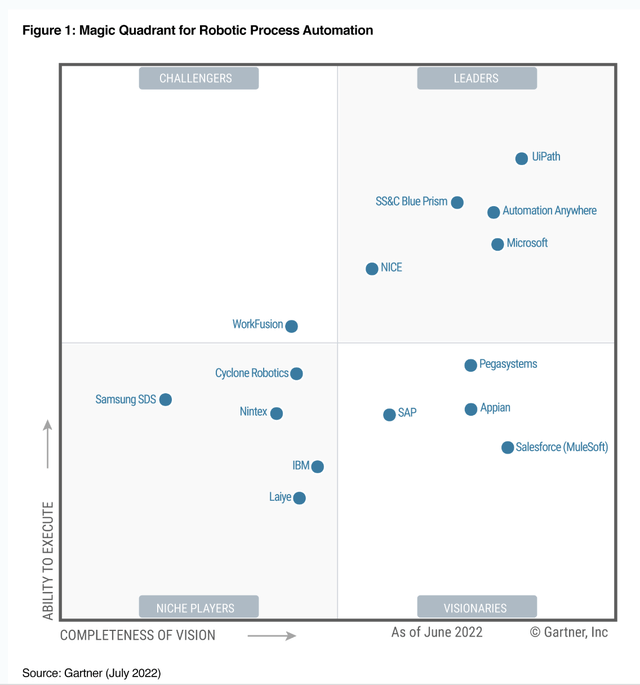

To a refreshed management team, add a superior product/technology stack. UiPath remains positioned by Gartner, Inc. as a Leader in the 2022 Gartner® Magic Quadrant™ for Robotic Process Automation research report. UiPath has actually been named a Leader for the fourth year in a row. Gartner positions UiPath as highest for Ability to Execute and furthest for Completeness of Vision.

UiPath Website

To quote Co-CEO Robert Enslin:

We believe UiPath will be a leader in automation, artificial intelligence, and machine learning, which all companies will embrace over time. We believe this recognition affirms our position at the leading edge of the market as we help customers navigate the challenges facing companies around the world today. We are dedicated to innovating our automation platform, driving our market segmentation, and delivering world-class customer experiences. Earlier this year, we delivered new features within the UiPath automation platform, including general availability of Automation Cloud Robots, which, in our opinion, continues to widen our Leader position. We now have more than 10,330 customers, and are seeing customers taking advantage of offerings such as UiPath Test Suite to accelerate the time-to-value for new automations, and UiPath Integration Service to combine the power of both UI Automation and API integrations in a single workflow. Our customers and prospects are accelerating their digital transformation initiatives to achieve their business outcomes (…)

The list of technical accomplishments goes on.

The company may compete against large software vendors that offer RPA solutions as part of their suite of products or modules, such as SAP and Microsoft (Power Automate), a number of specialized RPA vendors, such as Automation Anywhere and Blue Prism, and Business Process Management providers, including Appian and Pegasystems. But UiPath has so far been able to fend off competition on the strength of its offerings and overall customer success. It has also built a strong community of close to 2,000 resellers and software partners, and tens of thousands of developers. Add an ecosystem of 300+ apps and the trailblazer no doubt enjoys quite an installed base of both customers and partners.

No wonder UiPath is grabbing rather than losing market share. Per the same 2022 Gartner® Magic Quadrant™ for Robotic Process Automation’s Market Share Analysis: Robotic Process Automation, Worldwide, 2021, “[UiPath is the] only vendor to grow its market share in 2021, from 28.5% in 2020 to 34.1% in 2021….”

An improved management team can leverage technical product leadership and a leading edge over its rivals, but still sink if the market overall fails to expand. We indicated earlier that sales growth has been decelerating, a major area of concern.

The Global Robotic Process Automation Market Is Expected to Grow at a Fast Clip

If the aforementioned challenges to the top line are a concern, let’s address them next. As it happens, they are likely temporary. The RPA market is expected to expand at a fast clip and the opportunity ahead seems more than promising.

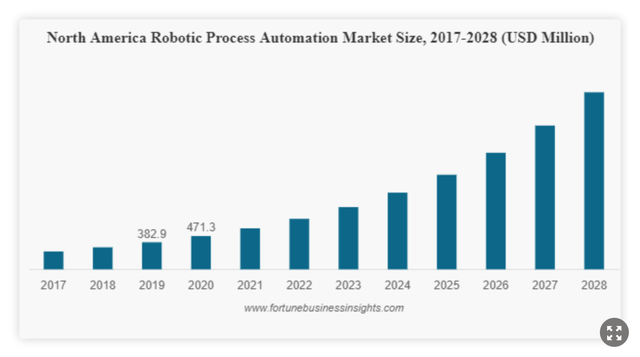

In its report titled “Robotic Process Automation (RPA) Market Share, Size & COVID-19 Impact Analysis, By Deployment, By Operation, By Application, By Industry and Regional Forecasts, 2021-2028,” Fortune Business Insight stipulates:

The global robotic process automation market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 25.0% during the forecast period [2021-2028], to Reach USD 7.64 Billion by 2028, from USD 1.29 Billion in 2020. (…) As RPA technology allows quick automation of processes in less time, it is considered one of the finest software to boost work from home and remote location productivity and is expected to boost the market growth during the forecast period.

Fortune Business Insights

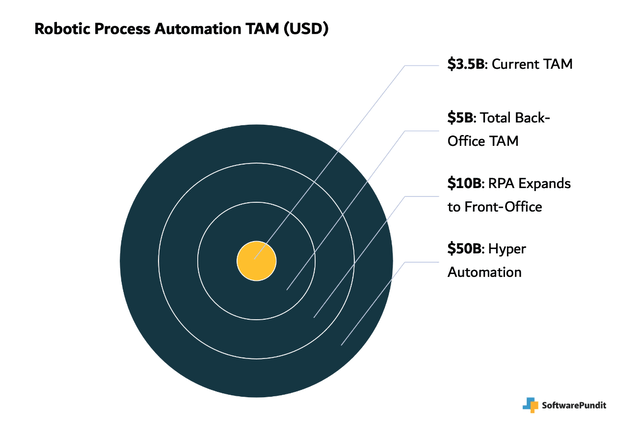

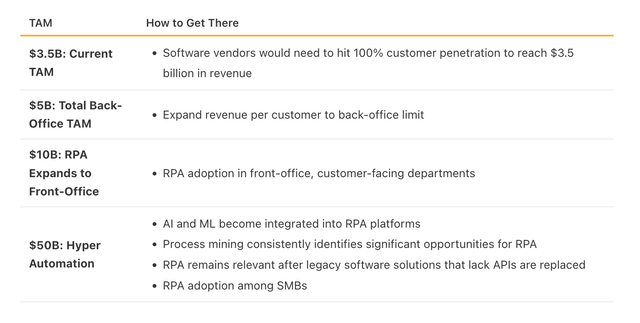

The take above, as instructive as it is, only provides us with the beginning of an understanding of RPA’s prospects. The total addressable market is much larger. Per Bruce Hogan at SoftwarePundit:

Based on a bottoms-up analysis using revenue data from RPA software vendors and market share data from ETR, we estimate the current total addressable market (TAM) for robotic process automation to be $3.5 billion. This TAM for robotic process automation software can grow to as much as $50 billion by 2030. An aggressive estimate from Forrester predicts that Intelligent Automation (RPA plus artificial intelligence) will release $134 Billion in labor value as early as 2022.

However, reaching a TAM of $50 billion, roughly the same size as CRM software today, will require that RPA software overcomes challenging obstacles. Specifically, this will require RPA software to expand into customers’ front offices, and integrate with technologies like AI, ML & process mining to automate more complex processes. In addition, RPA must remain relevant after legacy enterprise software solutions that lack APIs are replaced by software solutions that can interface directly.

SoftwarePundit

SoftwarePundit

The slowdown in sales experienced by UiPath is thus not related in any shape or form to the market potential for RPA solutions globally. The firm’s top line deceleration is most likely circumstantial, primarily related to macro-economic and geopolitical concerns. The Ukraine conflict may have exacerbated short-term market volatility and the disruption of Russian energy exports may have fueled inflation, but the resulting downtrend in demand may not last much longer.

Per Dirk Hofschire of Fidelity’s Asset Allocation Research Team:

Geopolitical crises don’t tend to have significant and lasting impacts on global financial markets unless they have a sustained macroeconomic impact on major economies.” Russia’s economy ranks as the world’s 11th largest, according to the International Monetary Fund, at only 1/20th the size of the US and 1/15th the size of China, so while Russia has been battered by sanctions against it by the US and Europe intended to punish it for its actions in Ukraine, it is likely not big enough by itself to affect global markets or economic growth.

This not to say that it’s all smooth sailing from here. Per the same team:

But because Russia is also the source of nearly 50% of the energy consumed in Europe—the policy responses from the US and Europe that have disrupted energy and other commodity supplies are raising risks beyond the 2 countries’ borders. The issue is particularly significant in Europe. Analyst Cait Dourney says that while Europe’s economy is still growing, the outlook for the near future now shows a rising risk of recession.

The implications are clear. There is instability and the prospects of a recession, especially in Europe, are heightened. But the US economy is relatively insulated from the war and related vicissitudes, and Europe’s economic winter will eventually recede. Further, the moment the situation relaxes, pent-up demand for RPA is likely to drive a major recovery.

A Different Take on Valuation: UiPath Financials Show Major Rerating Potential

UiPath qualifies as the leading RPA provider worldwide. The firm’s long-term value proposition is all the more compelling because, especially in an inflationary world, customers are increasingly likely to face major labor woes, and turn to automation to preserve margins.

As indicated above, despite heavy (but lagging) competition, UiPath’s market share has recently increased to 34.1%. Co-CEO Daniel Dines’ refocus on product development is likely to help maintain, if not further elevate, this share (to possibly as much as 37-40% within a couple of years). TAM is in the $50 billion range, assuming RPA combines with AI and ML to address all business processes. UiPath thus has a shot at becoming a $20 billion business in seven years. If you apply an EV/ sales valuation ratio of 6.7x, you get close to $140 per share. However aggressive (but certainly not unlikely) this may seem to some, it sure provides us with a better sense for the disconnect that exists between current share price and UiPath’s business prospects (and the order of magnitude of the prevalent gap) and is not too difficult to imagine a major rerating of shares to materialize within the next 1-3 years, if not within the next few weeks.

UiPath has a global footprint; while it constitutes a major competitive advantage, it also exposes the business to macroeconomic forces including foreign exchange volatility. After accounting for adverse near-term FX impacts in the $25M range in ’22, UiPath still manages to maintain very high gross margins – in the vicinity of 85% (see above for detail).

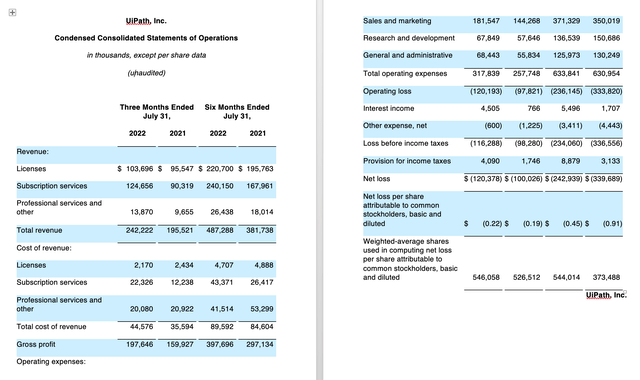

Now have a look at the consolidated statement of operations below:

UiPath Website, Consolidated Statements of Operations

In the six months ended July 31, gross profit increased just about 33%, but both R&D and general and administrative expenses decreased, while sales and marketing expenses increased a mere 6-7%. UiPath has its roots in Eastern Europe (it was founded in Bucharest, Romania, where it is the largest IT vendor), a lower-wage area, where the company deploys a large operation, and is thus able to maintain good control over labor costs, particularly R&D and G&A. Indeed, R&D expenses and G&A expenses constitute about 28% and 25.5% of revenue, respectively (for the 6 months ended July 31). Best-in-class, fast-growing software outfits typically spend more than 20% of their revenues on R&D and as much as 40% to 50% when trying to expand beyond their core products. UiPath seems to be spending just about the right amount and have a good command over these cost items. Further, the appreciation of the dollar is more likely to impact revenue numbers than cost numbers, as UiPath has a higher proportion of costs coming from the EU than is typical of most rivals. It is thus possible that gross profit will outperform major line-item expenses over the next few years. The valuation call above (based on EV/S, not DCF) may ultimately underestimate share price.

Co-CEO Robert Enslin’s focus on repositioning go-to-market dynamics should boost both efficiency and sales (including via pricing). While free cash flow may approach quasi-neutrality over the next couple of quarters (FY 23), it’s likely to rerate significantly higher in FY 24, as the firm’s investment cycle cools off, and the company reaches a better balance between growth and profitability

Our go forward priority will be to balance investing for long-term growth while managing the business to consistently expand non-GAAP operating margin and deliver sustainable positive non-GAAP adjusted free cash flow in fiscal year 2024 and beyond.

A blended analysis seems best to capture both growth and profitability dynamics, but assigning a higher weighting to DCF (say, 60-65%) than to EV/sales (40-35%) might push valuation calls higher (given the gross profit/operating expenses leverage and optionality). Once sentiment changes and growth stocks start to outperform again, the rerating of PATH shares may be of quite some magnitude.

Risks Are Primarily Macro, not Micro – All the Better from an Investor’s Standpoint

A realistic assessment of risks to our rating surely starts with the unfavorable macro factors mentioned above, clearly out of the firm’s control as clients delay purchase decision-making cycles in particular geographies (i.e., Europe).

Adverse conditions in the global economy and geopolitical turmoil caused by the Russian military operation in Ukraine, have so far hampered the firm’s ability to deliver better financial results.

Increasing foreign exchange headwinds constitute another key parameter. During the fiscal year ended January 31, 2022, approximately 53% of revenues and approximately 32% of expenses were denominated in non-U.S. dollar currencies. (This, of course, is a plus when the dollar appreciates and the firm has its headquarters in the U.S.)

Inflation, increasing costs of skilled labor, may constitute another notable challenge.

As indicated above, while the prospects of a recession, specially in Europe, are heightened, the US economy remains relatively insulated from the war, and Europe’s economic winter will eventually recede.

Further, the moment the situation relaxes, pent-up demand for RPA is likely to drive a major recovery.

Limited appetite for high-growth and long-duration names is another factor to consider. Rising interests punish cash flow expected way into the future. The further out, the worse. But after losing >80% of their value, seems like the shares are well-discounted and the bulk of the damage is behind us.

Further, a strong balance sheet ($1.6 billion in cash, very reasonable amounts of debt) and recently diminishing cash burn, help weather the storm and likely put a floor under the stock.

The dual class structure of UiPath’s common stock has the effect of concentrating voting control with the firm’s CEO, Co-Founder, and Chairman, which constrains public shareholders’ ability to influence the outcome of key decisions.

Conclusion

UiPath may constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- a market and technology leader gaining market share in an expanding space,

- Endowed with financials much more favorable than it seems at first blush, including a strong balance sheet and some cost advantages.

- Negative momentum and market sentiment have punished the stock, presenting bargain hunters with an opportunity.

Solid appreciation potential exists within the next five years. Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for greater visibility into UiPath’s future cash flow and earnings – might want to dollar average.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment