AntonioGuillem/iStock via Getty Images

Match Group, Inc. (NASDAQ:MTCH) is reeling with shares crashing by more than 20% after hours following the release of its Q2 earnings report. The online dating platform giant missed estimates while issuing poor guidance. From messy financials including a large impairment charge, the real story is weak growth across several key operating metrics with no real sign of a turnaround. While the company remains profitable and generates positive cash flows, the levels are far off from justifying the stock’s lofty premium. The setup here is for a reset in valuation, which keeps the risk in the stock tilted to more downside.

Match Group Q2 Earnings Recap

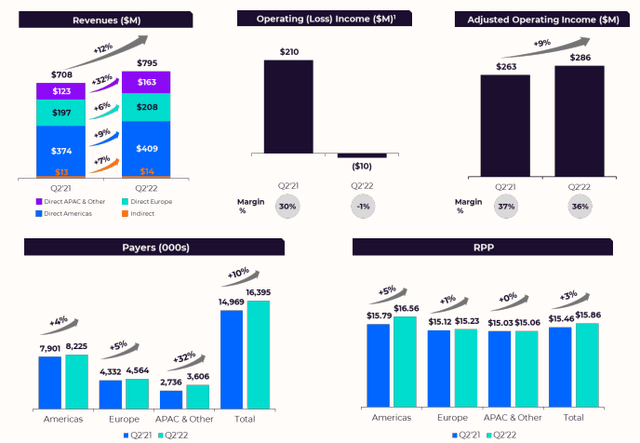

The company reported Q2 revenue of $795 million, which climbed 12% year-over-year, or 19% on an FX neutral basis, but well below the consensus estimate of closer to $805 million. A Q2 GAAP EPS loss of -$0.11 representing a negative net income of -$32 million included a $217 million impairment of intangibles related to the company’s 2021 $1.8 billion acquisition of “Hyperconnect“.

The best way to understand what’s going on at Match is to consider that while the company is still growing, the momentum is coming from regions like APAC, Africa, and LATAM that are simply less valuable in terms of revenue per payer and margins. On the other hand, the trends in both the Americas region and Europe have stagnated. The impact is evident as the adjusted operating income at $286 million in Q2, up 9% y/y and with a 36% margin, compares to a 37% margin in Q2 2021 and even 41% two years ago.

source: company IR

Total payers across all platforms climbed 10% y/y, but again, the 4% growth in payers from the Americas region with just a 3% higher total revenue per payer (RPP) hardly places MTCH in a high-growth category.

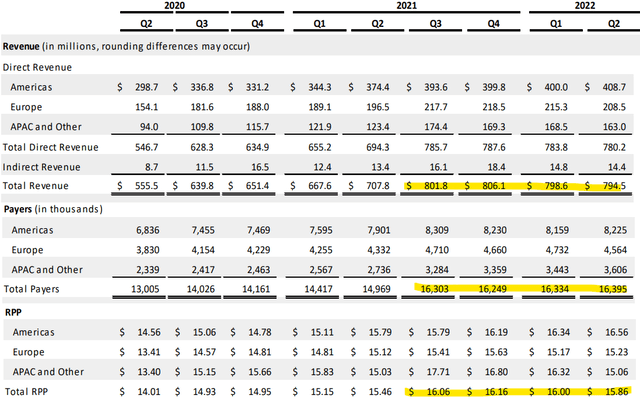

What stands out is the trends on a quarter-over-quarter basis, and from a peak for the company in Q3 2021. Revenue, payers, and RPP have been roughly flat or down over the last four quarters. The context here considers what was a boom for Match across its portfolio of dating sites globally into the second half of last year during the early stage of the post-pandemic “re-opening”. Match has been stuck ever since.

source: company IR

The challenge now for Match is to generate another wave of growth, and it doesn’t look like it’s going to happen anytime soon. Management is guiding for Q3 revenue between $790 million and $800 million, which at the midpoint, would represent a decline from $802 million in the period last year. The market reaction to this update considers that the consensus for Q3 was looking for a much stronger trend towards $887 million. The guidance for adjusted operating income of $255-260 million implies a margin of 32% at the midpoint, which continues to trend lower.

Finally, we note that the company ended the quarter with $463 million in cash and equivalents against $3.8 million in long-term debt. Considering adjusted operating income of around $1.1 billion over the past year, a net leverage ratio of 3x is likely stable over the near term but doesn’t do Match any favors. Management notes the effort over the next few quarters will be to focus on cost controls to improve profitability.

What’s Next For Match?

The attraction of Match is its leadership position in online dating with a portfolio of brands including “Tinder”, “Hinge”, “OKCupid”, and “Plenty of Fish” among others that each target different segments or regional demographics. The important point is that the exposure is global with the company making an effort to expand internationally with services covering over 40 languages.

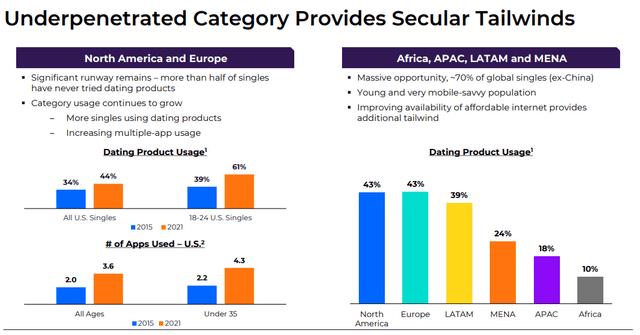

From a high-level perspective, the long-term bullish case is a recognition that several markets and categories of online dating are still underpenetrated and thus provide a secular tailwind. Compared to 43% of single adults in North America and Europe who have used a dating app, the 24% in the Middle East and North Africa (MENA) and 18% in APAC highlight the opportunity for Match to continue expanding.

source: company IR

That being said, our take is that the trends from the last few quarters suggest that online dating has its limits. It appears that a 43% “adoption rate” in North America may very well be a wall, while the other regions will take significantly longer to converge with developed markets. The other lesson for Match is that the growth in revenue per payer has become more difficult to generate. From the total RPP of $15.86 in Q2, we’re skeptical that consumers, on average, are willing to pay significantly more for what are often casual dating services.

We can also bring up what is intense competition. Singles have choices online even from Match competitor Bumble Inc. (BMBL) and a host of other niche startups particularly in foreign markets. All this is against a backdrop of significant macro headwinds between high inflation and global growth uncertainties that end up pressuring discretionary incomes, impacting the more premium dating offerings. It’s a tricky spot for Match.

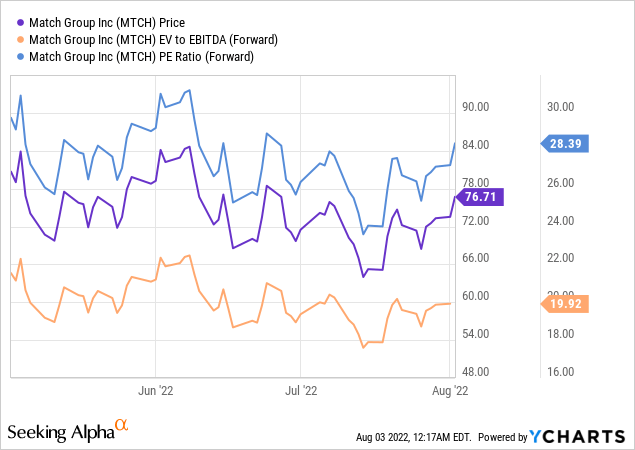

All this comes back to valuation. Heading into the earnings report, MTCH was trading at a forward P/E of 29x and an EV to forward EBITDA multiple near 20x. We don’t see anything to warrant such a valuation premium for a “growth stock” that isn’t growing. Considering the weak guidance, a likely barrage of revisions lower to consensus estimates with a contraction to earnings multiples can open the door for another leg lower.

MTCH Stock Price Forecast

At the time of writing, shares of MTCH are quoted as down 22% after hours and testing the $60.00 level, which is the lowest price since March 2020. While there are examples of stocks with a big miss to earnings that initially crash lower only to stage a heroic rally, our call is that MTCH is not that stock. Again, what we have here is a reset of valuation with the market re-pricing a new reality of weaker growth.

Seeking Alpha

Match Group will survive, but it’s probably worth less than $20 billion. We’ll have to see how big of a haircut the market settles on but it may take several weeks to play out. The only certainty here is to expect continued volatility.

On the downside, our eyes are on the pandemic crash lows around $45.00 which could be on the table as the next level of technical support. If there is a bullish case for the stock, we’ll need to see a confirmation that growth is re-accelerating higher and margins at least stabilize. Key monitoring points for the next few quarters include the trend in payers as well as the RPP.

Be the first to comment