CloudVisual

Schlumberger Limited (NYSE:SLB), the largest oilfield service firm, nonetheless was as challenged as all other OFS companies during the 2019-2021 downturn. However, both demand increases and supply deficits — coupled with a new emphasis on energy security-of-supply risk — have been setting the stage for Schlumberger to profit not just in 2Q22, as it did, but for several quarters forward also.

The company’s global diversification stands it in good stead, with national and international companies seeking its expertise to line up new reserves outside of Russia.

Examples of drilling projects with which Schlumberger is involved include some in the Middle East, the North Sea (Norway), Africa (Namibia) and offshore South America, particularly Brazil and Guyana. Russia-where it has now suspended operations-accounted for only 5% of the company’s revenues.

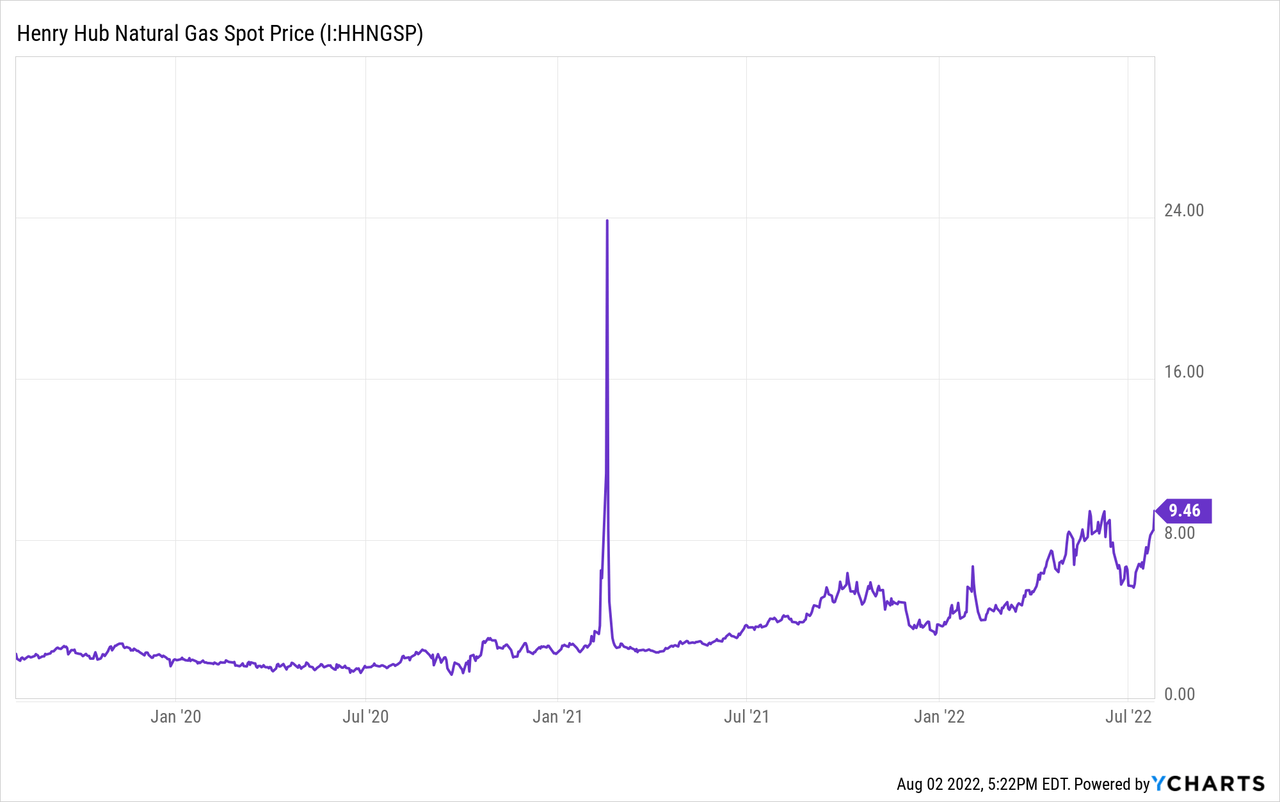

Moreover, the need is double-barreled, e.g. not just oil, but also natural gas. Natural gas was already gaining ground as a lower-carbon transition fuel, but the near-total loss of natural gas into Europe from Russia has exposed just how necessary that fuel is for heat, for electricity, and for manufacturing in the EU and the UK. So, there is a quickened rush to meet the desperate demand.

The company achieved stellar growth in 2Q22 and expects an equally strong remainder of 2022 and 2023. Having cut its dividend during the downturn, it has begun raising it and expects to raise it further. Share buybacks are also an eventual possibility.

I recommend Schlumberger’s stock to investors interested in oilfield services growth, particularly internationally.

Schlumberger Second Quarter 2022 Results and Guidance

Schlumberger’s second-quarter 2022 revenues derived 77% from international operations and 23% from North America. In the second quarter, the company earned:

- $6.7 billion of revenues, the largest sequential increase–14%–and a 20% year-over-year increase;

- $959 million of net income ($0.67/share);

- adjusted EBITDA of $1.5 billion at a 22.6% margin;

- pretax segment operating income of $1.16 billion at a 17.1% margin.

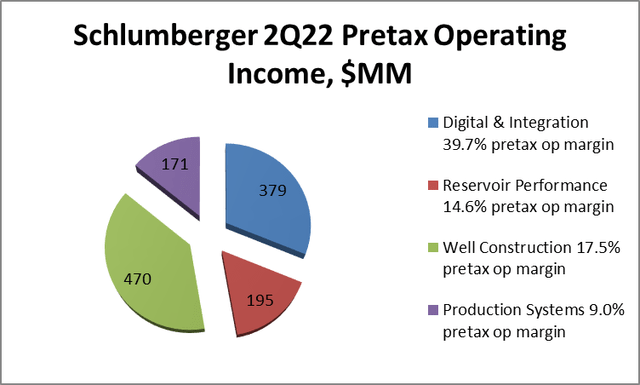

Schlumberger is organized by four operating divisions and four geographical regions. Operating divisions are 1) digital & integration, 2) reservoir performance, 3) well construction, and 4) production systems. The company’s second-quarter pretax operating income by division, with margin, is shown below.

slb.com and Starks Energy Economics, LLC

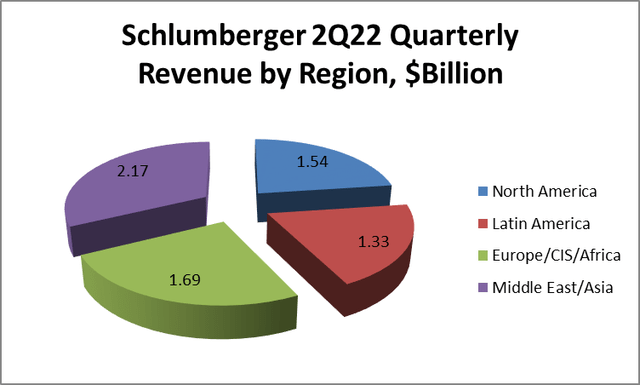

The importance of the European and the Middle East/Asian operations are illustrated in the graph of 2Q22 revenue by region.

slb.com and Starks Energy Economics, LLC

Discussing growth ahead, in the company’s 2Q22 conference call CEO Olivier Le Peuch said,

The second quarter market a significant inflection point for Schlumberger with a strong acceleration of revenue and earnings growth… Growth was broad-based, driven by an increase in activity internationally, in North American, and across all Divisions.

The company has $1.5 billion in senior notes due in 2023, and the company expects further dividend increases and, eventually, share repurchases.

The company’s Russian exposure was about 5% of total worldwide revenue. It has suspended new investment and technology deployment into Russia.

Expected full-year 2022 revenue guidance has been increased to at least $27 billion. According to Le Peuch,

I think the quarters to come will be definitely quarters to be replenishing and securing enough spare capacity to avoid the exposure, the overexposure to risk on the energy supply. I think we are living through a supply-led unbalance. I think it’s quite unique and it will take time before it recovers towards a demand supply balance.

Macro and Oil and Gas Prices

For European natural gas, the 2021 shortage was made much worse after reactions to the February 2022 Russian invasion of Ukraine. While Russia appears to be selling its oil (10% of world supply) and coal to non-European buyers, it has simply throttled back its natural gas exports to Europe, which had accounted 40% of Europe’s consumption. The EU and the UK now desperately need natural gas.

In the US, the Biden administration’s energy policy is an anti-hydrocarbon “keep it in the ground” series of directives, which has limited supply and driven prices higher. The Biden administration has called on Saudi Arabia (but not US producers!) to increase production, particularly of oil.

Incentivized by higher prices, US oil companies have stepped up drilling on non-federal lands from the pandemic lows. National oil companies, like Saudi Aramco, are also drilling more-a benefit for Schlumberger as the largest international oilfield service company. And international oil companies, like Chevron (CVX) and Exxon Mobil (XOM) have intensified acquisitions and drilling in the US and as well as drilling abroad. Notably, in its 2Q22 report, Schlumberger mentions increased work in Guyana (it already has facilities there). ExxonMobil has announced it will drill 60 exploration wells offshore Guyana in the next six years, including 37 in the Stabroek block.

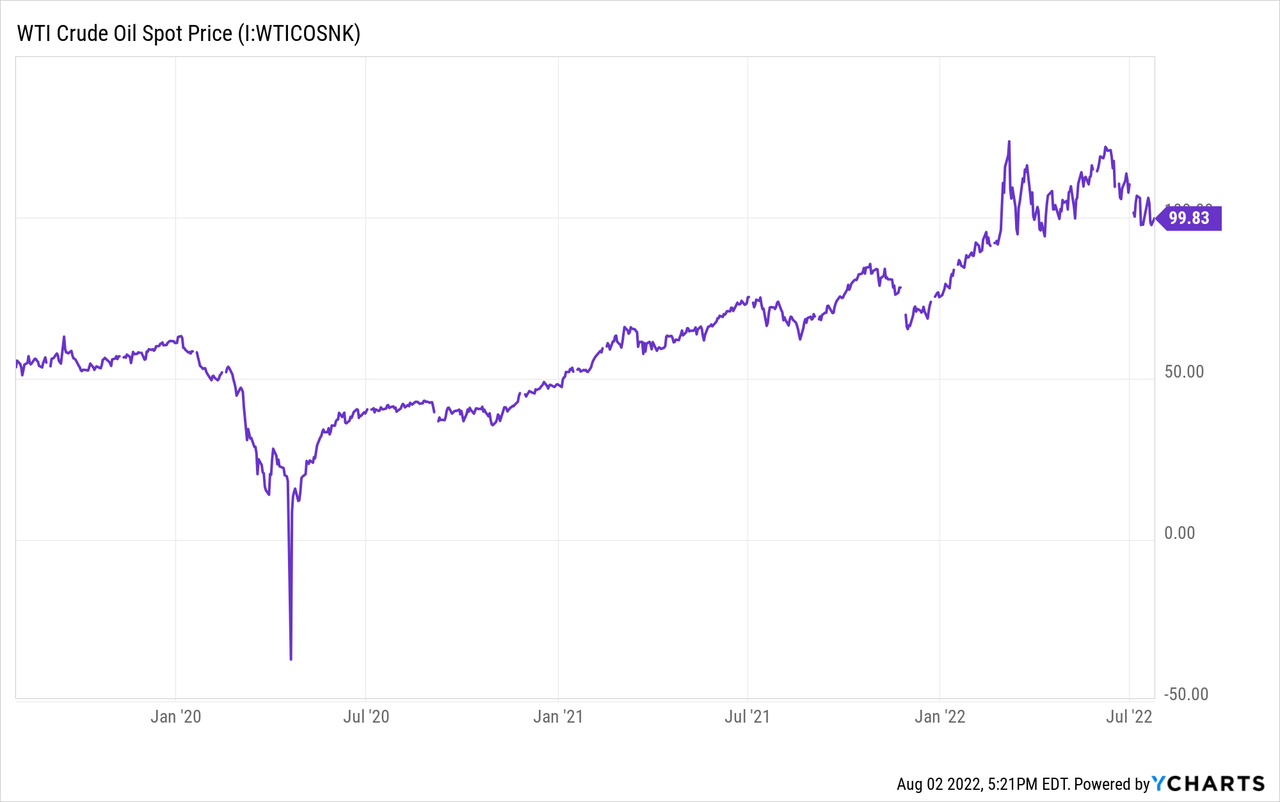

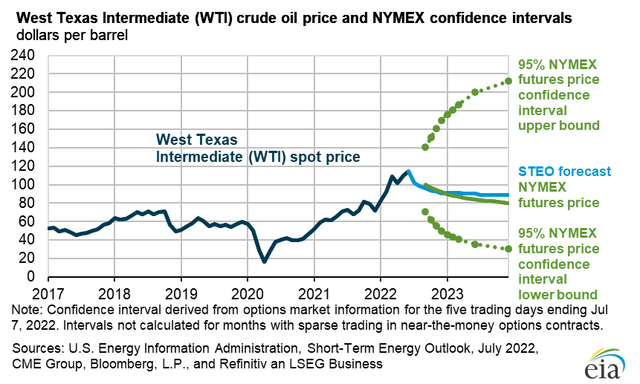

The August 2, 2022, Brent NYMEX oil futures price (for October 2022 delivery) was $99.74/barrel. On August 2, 2022, for September delivery:

- the West Texas Intermediate (WTI) oil price was $93.81/barrel,

- the Henry Hub (Louisiana) natural gas price was $7.67/MMBTU, and

- the Dutch Title Transfer Facility (TTF) liquefied natural gas price was (an astonishing) $60.69/MMBTU.

While prices are indeed down from the peaks in early July, the 5-95 confidence interval for future oil prices remains quite wide.

Energy Information Administration

Competitors

Schlumberger’s head office is in Houston, Texas; however, it is administratively headquartered in Paris, France. Tellingly, its 2Q conference call was scheduled on Greenwich Mean Time.

Schlumberger’s largest oilfield service competitors are Baker Hughes (BKR), Halliburton (HAL), and NOV Inc (NOV). As a leading oilfield services provider to national oil companies (NOCs), it also competes with Middle East/North Africa oilfield service company National Energy Services Reunited (NESR).

Liberty Oilfield Services (LBRT), of whom Schlumberger now owns 12% (down from 37% initially in 2020), competes with several other US onshore fracking and pumping service companies.

Governance

Institutional Shareholder Services (ISS) ranks Schlumberger’s overall governance on July 31, 2022, as an excellent 1, with sub-scores of audit (1), board (5), shareholder rights (4), and compensation (1). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

Schlumberger’s ESG ratings from Sustainalytics during May 2022 were “medium” with a total risk score of 24 (41st percentile). Component parts are environmental risk 8.4, social 9.4, and governance 6.5. Controversy level is 1 (low) on a scale of 0-5, with 5 as the worst.

Shorted shares were 1.8% of floated shares on July 15, 2022, and insiders own a tiny fraction (0.15%) of the outstanding stock.

At 1.94, Schlumberger’s beta is quite high given the company’s large size: its stock moves directionally with the overall market but with far more volatility. However, this reflects the large supply and demand uncertainties in the oil services sector during the past four years.

On March 30, 2022, much of Schlumberger’s stock was held by institutions, some of which represents index fund investments that match the overall market. The six largest institutional holders were Vanguard (8.6%), BlackRock (7.75%), State Street (6.5%), Norges Bank (2.2%), Dodge & Cox (2.2%), and Amundi (2.1%).

Vanguard, Blackrock, State Street, and Amundi are signatories to the Glasgow Financial Alliance for Net Zero, a group that, as of May 31, 2022, manages $61.3 trillion in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

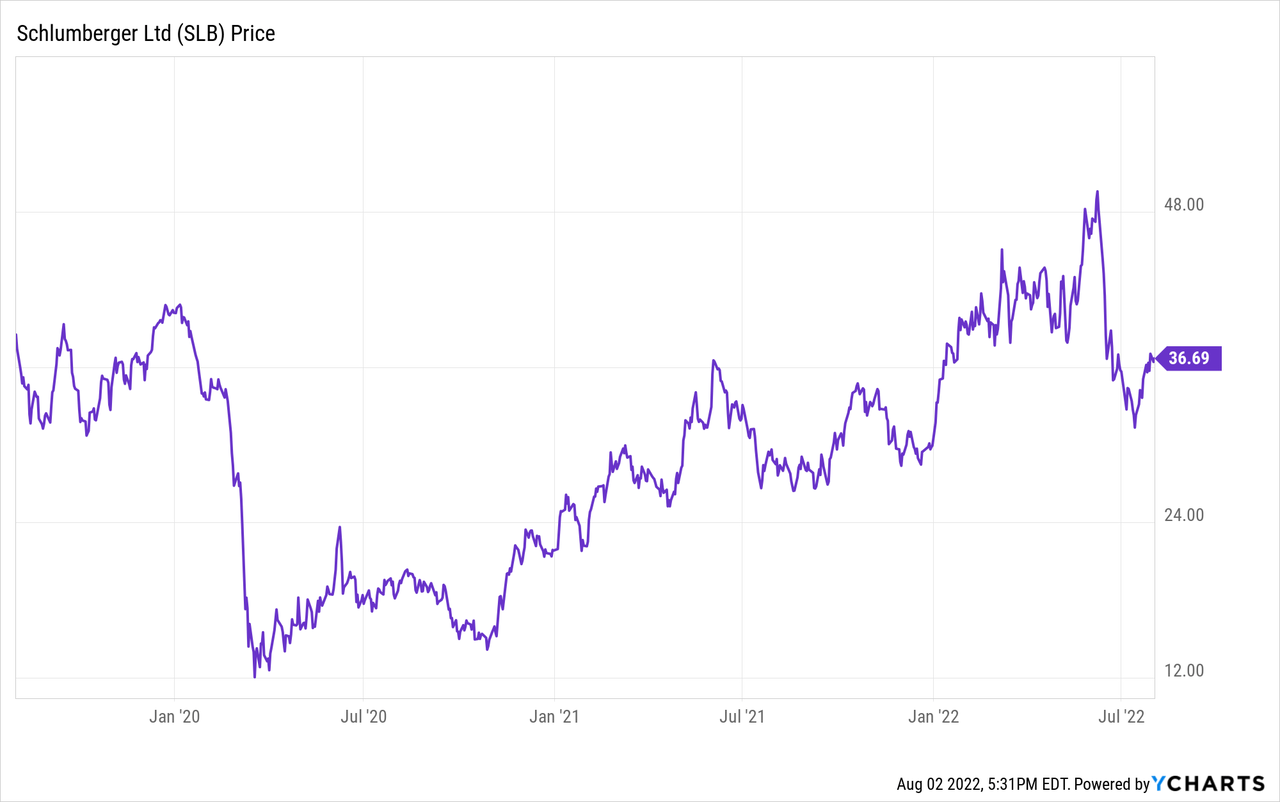

SLB Financials and Stock Highlights

At an August 2, 2022, closing price of $36.69/share, Schlumberger’s market capitalization was $51.9 billion.

The 52-week price range is $25.90-$49.83 per share, so the closing price is 74% of the one-year high.

Trailing twelve-months’ (TTM) earnings per share (EPS) is $1.83 for a current price/earnings ratio of 20. The average of analysts’ estimates for 2022 and 2023 EPS is $1.98 and $2.72 respectively, giving a forward price/earnings ratio range of 13.5 to 18.5.

Trailing twelve months’ EBITDA, cash flow, and levered free cash flow were $4.99 billion, $3.54 billion, and $633 million respectively.

At June 30, 2022, Schlumberger had $26.2 billion in liabilities-of which $12.9 billion was long-term debt–and $42.8 billion in assets resulting in a liability-to-asset ratio of 61%. This is down (improved) from 69% a year ago.

The company’s debt/EBITDA ratio is 2.8 and its debt/market capitalization is 0.27.

Schlumberger’s dividend of $0.70/share yields 1.9%.

The company had cut dividends during the downturn. In the last year it reduced debt and also was able to increase its dividend.

Book value per share is $11.54, less than a third of the current market value per share.

Mean analyst rating is a 2.1, or “buy,” from 37 analysts. However, the ratio of enterprise value to EBITDA is 12.7, above the level of 10.0 or less that would suggest a bargain.

The company will host an investor day in November 2022.

Positive and Negative Risks

Schlumberger’s major medium-term exposure is to changes in oil and natural gas prices and thus changes in worldwide drilling budgets.

As an international operator, it has political and currency risk in every country in which it operates, including the US.

Recommendations for Schlumberger

Schlumberger has paid down some debt and will pay down more. It has increased its dividend and plans to increase it further, with share buybacks a possibility.

Virtually alone among energy-sector companies it has a stellar governance score of “1.”

While the stock is not a bargain with a current price-earnings multiple of 20 and a 2023 price-earnings multiple of 13.5, its price is nonetheless only 75% of the 52-week high, despite its very strong 2Q results.

As energy-sector companies must do, Schlumberger rolled with the punches by making strategic changes and cutting costs. This has enabled it to return as sharply as the need for oilfield services has escalated.

Schlumberger may not appeal to dividend investors (yet) but I recommend it to growth investors interested in globally diversified, large-scale oilfield services.

slb.com

Be the first to comment