ljubaphoto

Ideal Power (NASDAQ:IPWR) is a debt free fabless power semiconductor company with only 1 sell-side firm covering it. 5.9 million shares with 786,000 million warrants with fully diluted (including options, etc.) shs of 7.5 million.

IPWR has an innovative architecture that enables circuitry to be designed that is more efficient than conventional circuits. By that, I mean – less heat & less power loss with what should be produced at lower cost than alternatives. The cost savings is a result of a reduction in number of components is a finished system. Fewer components also should result in greater reliability.

IPWR’s initial product line is called B-TRAN and one B-TRAN replaces 4 conventional devices to provide a bidirectional switch. The 4 parts that B-TRAN replaces are insulated bipolar transistors which have wide usage in systems due to their ability to handle a large range of current. Applications span diverse areas but tend to center on power supplies, traction motor controls, and circuit breakers. A complete IGBT (insulated gate bipolar transistor): see here – Power Electronics – IGBT

A complete switch also includes diodes, so the complete switch has 2 IGBT’s + 2 diodes. The apples-to-apples comparison of B-TRAN vs. an IGBT switch shows a much more efficient product. IGBT’s conduct current in one direction whereas B-TRAN switches are bidirectional.

IPWR uses a double-sided manufacturing system with the first foundry being Teledyne. I found it tough to get my mind wrapped around the notion of power semiconductors not using 100% of the available real estate on substrate. In a call with management, I asked about simply mirroring two sides back-to-back for bidirectionality. The response was that it has been tried with the results showing tremendous heat generation & power loss. An additional plus is that B-TRAN can be fashioned in silicon carbide or standard silicon. Another main area of inquiry was I.P. When they reported the September quarter, they had 71 patents issued, with 22 pending covering B-TRAN architecture, the mfg. techniques and uses of B-TRAN.

As a pre-revenue company with partners under NDA’s, coming up with financial forecasts is back of the envelope at best. As partners are released from NDA’s, the range of outcomes is narrowed, and the risk profile is more clearly defined. So, you could argue that owning the stock at this point is at the point of highest risk. That might be the case if not for the fact that IPWR is debt free with 2 years’ worth of cash assuming they do not turn a profit before then. In addition, due to the very small number of shares outstanding and microcap status, very few actively managed funds can even look at the stock. So, the shares are owned by management, retail, and I assume – some institutional portfolio managers in their own accounts as opposed to client accounts.

Who are the first customers? When it comes to electrification, the general public is fixated on automotive. But the great thing about IPWR’s B-TRAN is that in addition to already working with 2 of the top 10 auto companies, their B-TRAN enabled circuit breakers and switches have broad use outside of automotive. If people care about green energy, they have to also look at wind power, the utility grid, solar, and home battery backup systems – and B-TRAN has a role in each area. A small company called Aspen Aerogels (ASPN) had at its peak, a market cap of a few billion dollars. What Aspen has is a thin aerogel divider that will be used to separate lithium-ion battery cells to protect against fire. Aspen is spending a massive amount on capex for manufacturing. With the battery packs, IPWR’s role would be with automotive OEMs to use their B-TRAN enabled circuit breakers to cut off electric current much faster than is available now. The current would be cut at the first inkling that something was going wrong. That would reduce fire risk of lithium-ion batteries. Would there still be a role for aerogel? Probably. But the point is that automotive OEMs are very aware that IPWR can do this, and the market cap of the company reflects none of it. The company is so lightly covered that not even the one firm that does have coverage of it has mentioned the battery pack application in any of their reports. But even ignoring the battery pack application, there is a lot more meat on the bones.

Their replacements for IGBT switches will save OEM’s money on raw COGS while at the same time giving the vehicle better miles per charge. It becomes a no-brainer for any automotive company to use. I would expect to see news of another major automotive company starting to evaluate B-Tran in the new year. NDA’s typically last for up to 3 years, but it is possible than an OEM could give IPWR permission to name them as they exit the evaluation/testing phase and move into design. That would be a tremendous material catalyst for the stock. Just the release of one name could add 1/3 or more to the current market cap. That may sound aggressive, but when you realize that the float is only a few million shares with a market cap of about $75 million, I am likely being more conservative than aggressive.

I want to refer readers to this webpage: Advanced Manufacturing in Texas | TxEDC – ( click on Texas automotive)

I do not know which 2 automotive companies are already working with IPWR, but I suspect that at least one has operations in Texas. You can narrow it down by a process of elimination and looking at the map.

The broad theme to the circuit breaker program is that B-TRAN based circuit breakers are blazingly fast – faster than what is currently available – and less complex. The US Military has funded the initial programs as part of a long-term focus on electrifying ships. As the move from ships to land vehicles is obvious, the company in its own presentations has it laid out at the end of March – collaborations for testing and evaluation with:

- A top 10 global automaker

- A top 10 solar power conversion provider

- EV manufacturer

- EV charging company

In March, IPWR was working with only 1 top ten global automaker. Now, there are two. Their program with the US Navy has hit milestones, and I am expecting more news on expansion of the relationship in the short term. So, what has the company accomplished since the end of March when the company had a market cap of roughly $60 million?

On May 16, they announced their March quarter results with the addition of:

-

A Fortune 1000 semiconductor manufacturer interesting in evaluating B-TRAN for its low losses and bidirectional capability,

-

A space applications systems developer interested in evaluating B-TRAN for use in circuit boards, and an aerospace and defense systems integrator.

-

They also qualified a second US semiconductor fabricator and began qualifying a large non-domestic fab.

-

Announced a project with an aerospace and defense systems company

What is obvious is that qualifying more fabs for quantities of production is not something you do unless you think you will need it. Although not even necessary to justify a much bigger valuation for the company, note that they announced two items related to aerospace on May 16. B-TRAN based circuits reduce the number of parts, so you have less weight, and weight matters when you are flying within the atmosphere or trying to leave it. Without getting too technical, B-Tran also allows you to operate at higher voltages in standard silicon or silicon carbide – another reason why defense and aerospace is keenly interested.

Aug 15, 2022, they announced June quarter results with the addition of:

-

Continued forward progress with the US Navy

-

Partnered with a non-domestic designer and manufacturer of grid solutions interested in evaluating B-TRAN

-

Partnered with two universities evaluating B-TRAN for EV charging applications.

Nov. 14, 2022, they announced the September quarter results with the addition of:

-

Product development agreement with a new top 10 global automaker for EV drivetrain inverters

-

Continued forward progress with the Navy and B-TRAN based circuit breakers

The company has only added about $10 million in market cap even though they have achieved a lot of progress in 9 months.

Most Interesting People at Ideal Power

CEO Daniel Brdar – Experience at FuelCell Energy, growing it tremendously. He also was COO of a private solar energy company called Petra Solar and was the Gas Turbine Product Manager for GE’s Power Systems Division. He also worked at the US Department of Energy.

Drue Freeman – Independent Director

Most of his career spent at NXP Semiconductors, then VLSI Technology. He launched and served on the Board of Directors for Datang-NXP Semiconductors, the first Chinese automotive semiconductor company, and finished at NXP as Senior VP of Global Automotive Sales and Marketing. He was essential in locking in Tier 1 automotive customers for NXP. He provided strategic and advisory service to DeepScale.ai which happened to be acquired by Tesla.

Greg Knight – Independent Director

I find Greg to be the most interesting member of the board. They are all absurdly smart and have connections to each essential end market for IPWR, but Greg worked at a company after it went bankrupt. That happened to be GT Advanced Technologies, old stock symbol was GTAT. As opposed to participating in the collapse, he was brought in to turn around the fossil shell of GTAT, and he did it with flying colors. From Bankruptcy to a $441 Million Exit Greg has a few decades of experience in the solar industry. He has a BA in Chemistry from Cornell and studied nuclear engineering from the Naval Nuclear Power School.

Ted Lesster – Independent Director

His experience resides in designing components and systems for both automotive and marine applications. He has done that for Westinghouse, Chrysler, Northrop Grumman, and SatCon Applied Technology. At any given Christmas party, he may also likely be the “smartest guy in the room”

The experience of the CEO and independent members of the board center around automotive, solar, and marine propulsion. The common thread weaving between the three areas is core to the story. B-TRAN based designs result in less power loss due to less energy loss in the form of heat and current leakage. Result is a more efficient circuit that redefines cost-effective. In a world where every electron counts, that is a game changer. And for circuit breakers where current is flowing in only one direction? Speed to break a circuit when required and less power loss for the same above reasons.

Hiding in Plain Sight

Investors behave like a flock of birds and shares in companies that will produce electric vehicles have received robust valuations. Rationality has arrived to valuations of the EV OEM stocks. Broaden the theme to solar, wind, and battery technologies. We have become painfully aware of the need for resilience of the grid, and part of that means the ability to segment pieces that are having issues as fast as possible. In your home, you have mechanical circuit breakers. Fred Flintstone had them in his car. Time for a change. B-TRAN enabled solid state breakers are intended to be used in power distribution and renewable energy/microgrid connection to utility power grids. Is this a decade away? No, solar cells and windmills create DC current but your home needs AC. Auto battery packs create DC. But some things in a car use alternating current. So, you need the inverter. IPWR has announced that they are working with a major solar company and as the B-TRAN patent estate broadens to include more in both AC and DC applications/claims, I would expect to see more partnering with solar and wind companies.

Solar and battery backup companies are designing systems now to enable homeowners to push power back to the grid that they don’t need. B-TRAN bidirectionality and use in inverters makes intuitive sense when viewed for this. Enphase has done exceptionally well vs. other solar companies and one reason is their inverter design. Solar creates DC current, and cities and homes run on AC. Inverters are in the middle of that. At the moment, IPWR is not working with Enphase, but another major solar company. Will the result affect the competitive advantage of Enphase? Obviously, whoever IPWR is working with hopes so.

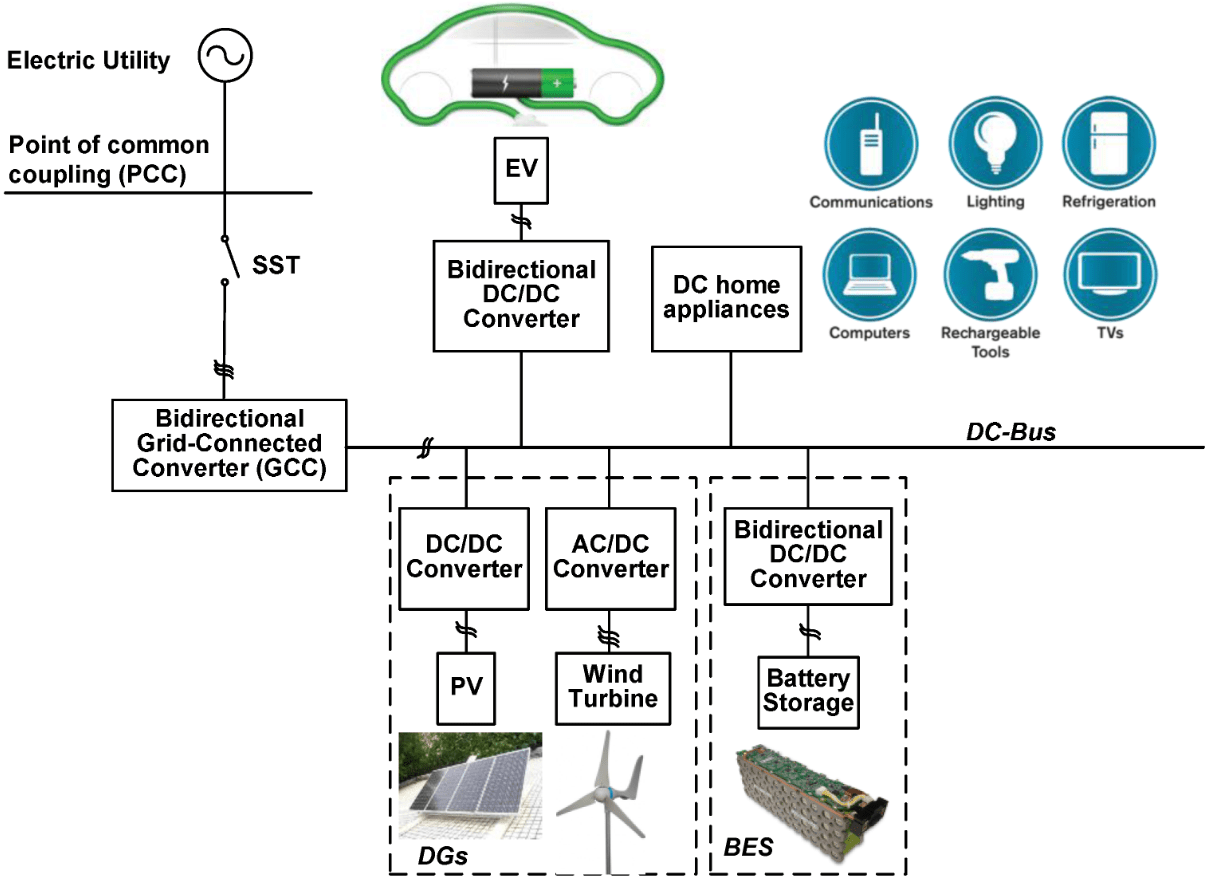

With the world focused on electrification of cars and trucks, why care about what IPWR is doing with the Navy? B-TRAN enabled circuit breakers are important for the military in the event of a disruption in the electrical grid of a ship, jet, or other system. With the ability to cut off current much faster than alternative breakers, an outage is more easily contained to the damaged area. And, military vehicles are targets, so best to contain damage asap when the enemy is trying to sink your ship. Circuits with B-TRAN will also generate less heat and have less power loss. In the case of an electrified ship, that means using less power for the mundane things while saving power for when you need it the most. The speed of B-TRAN enabled circuit breakers once proved by the military should migrate to the civilian electrical grid. That evolution of a smart civilian electric grid will happen, but will be hampered for example, if my house puts out inconsistent/spiky current, which screws up the current of my neighbor. Each house becomes a node and is alive and communicates to the network. Those toggle switches in your garage that you flip when you were running too many power-hungry appliances from the same outlet will slowly disappear and be replaced with solid state breakers. Although investors have thrown money at companies in each “vertical” of green energy such as solar, wind, battery, etc., have we had the opportunity to invest in a company that will span across all of them? There it is, waiting for IPWR. The below graphic is why when I talk to the CFO or CEO, they are absurdly busy and their biggest issue is handling all the incoming inquires of how various firms, municipalities, etc. can work with them. It is a matter of weighing which opportunities to prioritize first.

Source: mdpi.com

What is the fuss about silicon carbide?

Wafers and semiconductors made with a silicon carbide substrate in theory can handle higher voltages than those made from standard silicon. Right now, they are very expensive, and have a high failure rate. When silicon carbide technology gets to where it is easier to fabricate, B-TRAN can be made with it. An additional advantage of B-TRAN is that because it enables more efficient circuits, with less power loss – you can crank up the voltage of a B-TRAN standard silicon component where without it, you might have to switch over to silicon carbide. It extends the working range of standard silicon and when IPWR moves to silicon carbide, it will do the same. The most recent automotive OEM was certainly aware of silicon carbide but chose to work with IPWR due to reliability and cost.

The most expensive parts of EV’s are the battery pack, electric drive system, and charger. When you realize that B-TRAN reduces complexity and cost and can be used in multiple systems in an EV and is agnostic to the brand of EV you care about, the investment concept should hit you. Although I cannot point to who it is going to be, I would expect to see an additional major automotive OEM sign on to evaluate B-TRAN for EV’s within the next 6 months. That would give IPWR 3 of the top 10. As to when IPWR can name who they are working with, that is up to their OEM partners. Because incorporating B-TRAN by one OEM gives a competitive advantage, I expect to see a domino effect since the ability to get more miles per charge, smaller battery pack, increase reliability, etc. is so profound that it is a no-brainer for any automotive company to “get with the program”.

Backup Power Supplies:

Many homes have installed backup generators that run on natural gas or gasoline. Generac is the brand name that is most associated with this product. The area of growth is having a battery backup system tied into your solar roof, with the entire system having the ability to send excess power back to the grid. Bidirectional ability with low loss makes this growth area tailor made for B-TRAN.

Electric Vehicles:

Within an EV, the need to convert current is needed in multiple components. Some systems use AC while others use DC. There are multiple voltages needed – to summarize it is a heterogenous system with multiple points of electric power transformation. What is startling is that the largest cost component of the drivetrain is the power semiconductor switches which make up 8-10% of the total vehicle production cost. Because B-TRAN reduces the number of devices needed in bidirectional circuits by 75%, as mentioned at the outset – you have a more reliable system that is wasting less power. IPWR came up with an estimate increase in EV efficiency and range of 7-10% based on data from Toyota. IGBT’s in Hybrids and EV’s are basically all over the place. When I first began work on IPWR about 2 years ago, I thought that their B-TRAN systems would have a use in EV’s, but the reality is that as the vehicle companies have familiarized themselves with the technology, they are working on ways to use B-Tran in more places than I originally contemplated. During the December 2021 qtr. conference call, the issue of pricing came up. Here is a quote from Dan Brdar (CEO)

“Our expectation is that a B-TRAN module would have about 25% premium to an IGBT module when it has some volume, because it’s really replacing what would be done with multiple modules to use the conventional IGBTs. So, it should actually have a cost savings for the end user in terms of the up-front cost, plus the efficiency savings, plus the reduced thermal management. It should be a compelling, cost equation, so that even though we’re making them in relatively small volume compared to IGBTs, it should be attractive for them, and still allow us to move into some attractive margins.”

That explanation simplifies why automotive OEM’s and end users in other markets should gravitate towards B-TRAN. In the move from fossil fueled boats, airplanes, cars, trucks, etc., removing multiple pieces of …” whatever” with one which is more reliable, faster, etc. is a compelling proposition.

Where are we now? A lot of development has been funded by the Navy and as milestones are met, the technology is more able to be ported to non-military markets. First revenues should be in early 2023. Profits should be highly sensitive as volumes ramp.

Additional end markets that use a lot of power semi switches: Windmill Farms, Data Centers. And of course, I want the circuit breakers in my home to be replaced with B-TRAN.

Dollars and Sense

An extra 10% driving range per charge – what’s the impact? Using average 12,000 miles driven per year and 350 miles per charge now requires 34 charges per year. If you substitute IPWR in the vehicle you need to charge it only 31-32 times. The cost to charge is subsidized in some states but will vary over time. When EV’s become dominant, it would make no sense to subsidize charging, and unsubsidized charging based on my internet searches can range from $25-$40 now. So, using the low figure, the EV owner can save up to $75 (current dollars) per year and reduce the hassle of charging the vehicle. The vehicle will be more reliable due to fewer electrical parts.

To the automotive OEM, what does it mean? Using IPWR reduces the number of bidirectional circuits by 75% to the OEM. Although priced at a premium to standard IGBT circuits, the reduction of the number of parts saves the OEM money on raw cogs. It may not seem like a big deal reading that, but if you can reduce cogs by an average of $100 per unit – if you are selling 6 million units per year, that is a lot of money.

Using the low number of 8-10% range of the cost of power semiconductor switches making up the cost of an EV, assume $25K as the total COGS. So, power semiconductors cost 8% x $25k = $2000 per vehicle. If the current cost of bidirectional semi components in vehicles is $500, does that mean that the potential content per vehicle for IPWR is 25% of that (to account for fewer semis due to B-TRAN) plus a premium for the added performance of B-TRAN? No, because even circuits with current flowing in one direction benefit from B-TRAN due to less heat generation and current loss. As a reminder, circuit breakers have current flowing in only one direction, and both automotive OEM’s and the US Navy are excited about B-TRAN based circuit breakers. So, just lowballing the content per vehicle to $150, on 1 million vehicles, IPWR would generate $150 million in revenue @ 50% gross margin. $75 million gross profit. Headcount of 60 people (yes, only 60) at all-in cost of $300k each = 18 million personnel cost. Rent, insurance, maintenance capx of $10 mil. Results:

$75 mil gross profit – $28 million = $47 million ebitda and for conservatism assume that an investment bank gets them to sell 1 million shares at $40 (which would only give IPWR a $360 million market cap). You get ebitda per share $5.50 per share. For each additional 1 million vehicles, add $5.50 per share in ebitda. They are working with 2 of the top 10 global OEM’s now who combined likely sell in excess of 10 million vehicles per year globally. If they announce a third automotive OEM in 2023, the numbers get so big that you stop trying to calculate what they could earn, and just try to buy as much stock as you can.

As a reminder as non-automotive markets for IPWR, go back to the link on pg. 6 and review the industry background of the board.

“But the stock hardly trades and technically looks dead.”

Pobrecito, que lastima

Sorry, I know everyone wants to find a liquid stock that is debt free, trades at $20 per share, which will earn $2.50 in earnings and grow that at 20% for the next decade. And be the one to do the cleanup print so that everyone else will have to chase it. Not this one. If you are waiting to buy it on a stock offering, realize that there are about 786,000 warrants with a weighted avg strike price of $5.19. The weighted average remaining life of the warrants is 3.2 years meaning they expire on average in the early spring of 2025. Any whiff of success with the Navy projects should translate into increased confidence in what B-TRAN can do outside of our ships. I fully expect the warrants to be exercised which would bring in an additional $4 million in cash to the company. With only 7.5 million shares diluted on IPWR, the stock should be almost impossible to buy at levels near where it is now when positive news flow kicks in. Current investors in the stock are aware of the potential and that is why the daily trading volume is so small – only an idiot would sell at these levels.

Forward Numbers – If the one firm with sell side coverage had any forecasts, I would ignore them. I am involved in the company due to: balance sheet, tiny cash burn with additional funds coming from warrant exercise, great technology that should be incorporated into multiple verticals which itself provides diversification from over exposure to any one sector.

I have studied the EV area and have watched with amusement as investment banks hyped their IPOs of new EV car companies. The fact that EV’s have fewer moving parts, should last longer or that everyone will be making them did not seem to matter. I was never smart enough to figure out why the sale of one EV car was worth more in market cap than the sale of one ICE car. Instead, I asked myself what the common needs will be regardless of brand. B-TRAN can be used by all EV oriented firms. And it is their strong financial position which explains why the sell side is ignoring them. So, the hype is around companies burning through gazillions of dollars a year, knowing that underwriting fees are warm and fuzzy.

Where can the stock be in a year or two?

I have told a few friends in the investment business about IPWR and one person with high net worth clients has told me he can’t put it in client accounts due to its market cap and lack of current revenue. Revenue should begin modestly in the beginning of 2023.

Chicken Meet Egg:

The rationale of my friend who cannot buy it in client accounts is likely based on rules of his employer. IPWR and its stock are like an egg and everybody wants to wait until it grows up to be a chicken to buy it. Last time I checked, a fully grown chicken costs many times more than an egg, and with first revenues within sight, the egg is about to hatch. I am going to set up a call for that friend with the company so that after IPWR releases the names of an OEM or more Navy news, he will familiar enough with the company to buy it if he wants to. I am sure the market cap will be high enough at that point, so he won’t get any pushback.

What creates opportunity is that this structural barrier for many investors buying the stock right now creates a form of rules-based arbitrage. As more investor types are allowed to buy the stock over time, with a limited share count and nutty operating leverage, I would be irresponsible to state where the price could go in a year or two.

My sense is that the revenue ramp will be impossible to ignore by the end of 2023. With an asset light business model, I would not be surprised to see the company be breakeven in the middle of 2024. The employee head count will remain small, enhancing operating leverage. With the technology fully patented with more coming, I also expect the company to begin licensing the technology, which of course is pure margin. It is easy to get excited each time the company announces an additional automotive OEM, but what strikes me as being ignored by the market is that B-TRAN has the potential to be ubiquitous as it seeps into multiple aspects of our electric lives.

Catalysts for 2023

-

Automotive OEM’s exiting development phase, does an OEM give them permission to use their name?

-

Additional news of their program with the Navy

-

Additional news on work with their existing solar client and/or an additional client

-

Any of the above place the company closer to breakeven and profitability, leading to a step function higher in market capitalization. That releases addition potential buyers from their rules-based blackout on buying due to market cap constraints.

-

Announcements of qualification of additional foundries to make the B-Tran products. The first foundry was Teledyne, not one of the big names associated with massive chip sales by the investing public. I have shown that due to the performance of what IPWR has, adoption should be a no-brainer for customers. How to gauge whether this will be a modest success or a monster? If the company announces a global foundry known for massive production like a Taiwan Semi, then that to me is an indication of a tidal wave of demand on the horizon.

-

NO Green ETFs or funds own the stock. When the market cap rises as I believe is inevitable, they will attempt to incorporate IPWR in portfolios. With the small float, even a small amount of buying would be an additional catalyst. Beyond Green ETF’s trying to buy, active smallcap managers will start looking at the stock when the market cap hits $300 million or so, which is not tough to imagine.

But what about the liquidity problem? The stock is absurdly tough to buy. I know a few of the major investors and none are interested in selling anywhere near current levels. We understand the potential. However, investment banks are laying off people due to underwriting being poor and I have little doubt that once the company has a market capitalization of a few hundred million, some investment bank will persuade them to issue a modest number of new shares. If an offering of 1 million shares were done at for example, $40 each, if investors really understood the story, the deal would be oversubscribed and the additional liquidity and modest bump in market cap could also serve as a positive catalyst, which is counterintuitive.

After warrant conversion, they will need very little money from external sources – forever. But even using 9 million shares, using external foundries and keeping headcount below 75, the numbers can get absurdly large with 50% gross margins on their own and layering on licensing, the numbers get to be obscene. I think in 2-4 years, the decimal point on the stock price will be in a different place. If the situation is that good, then why is the stock where it is? The answer is multifactor – are there any active microcap funds left in the world? Is the stock a member of any ETF? Who even knows about it? And finally, it is the fact that like it or not – most people who call themselves investors like to see a stock moving upward and to the right before buying – fundamental analysis and the search for idiosyncratic situations is a lost art.

To back that up, I will copy and paste from another company’s conference call transcript – Richardson Electronics (RELL) call from April 7, 2022

“And our next question will come from the line of David Schneider as a private investor. Your line is open.

David Schneider

Hi. Can you hear me okay?

Edward Richardson

Yes.

Wendy Diddell

We can hear you, David.

David Schneider

Okay. Yes. Just a quick question, an earlier person on the call, couldn’t figure out why the stock was where it is now. And it’s just – this is just my opinion, and then I will ask questions. I just think people nowadays the – I think people will like the stock more at $17 than $11.62. It’s just human nature. And so, the fact that it’s $11.62 now, to me, doesn’t bother me at all…”

As for IPWR, it is the same situation. It is a strange coincidence that on the day I am submitting this report to Sumzero, IPWR is about the same price that RELL was when I made that comment on their conference call. The psychology is intact – investors will like it more at $17 than $11. And beyond that, the company should garner enough attention from people on both sellside and buyside to take it dramatically higher.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment