ipuwadol

Thesis

Amid a broader tech sell-off that has taken Nasdaq down more than -23% this year, DocuSign (NASDAQ:NASDAQ:DOCU) rallied hard on Friday, on the back of better Q2 results and forward guidance. A former tech darling, DOCU has seen its shares plummet by more than -77% since their 2021 peak. Amidst higher rates for longer, tech is going to continue to be under pressure with valuations re-setting to more normalized P/E ratios in the new environment. However, Friday’s hard rally might represent the start of a bottoming out process for DOCU. From a technical perspective, in our view, DOCU is back in its wider trading range of $40-$80 per share, as seen prior to the COVID crisis share rally. We feel the two factors pulling the price (i) downwards (higher rates, flight of capital from speculative pockets) and (ii) upwards (better guidance, still strong growth) are about to balance themselves. We are of the opinion that DOCU is now back in its pre-COVID trading range, and it will stay there in the next six months. The path was not a pretty one, exposing massive volatility during the move. The DOCU January 2023 options now trade with an implied volatility of 68% versus only 23% for the S&P 500. In our view, the best way to monetize the high implied volatility and reversion to the old range is via options. Expecting the $40 to $80 range to hold in the next six months we outline how selling a $80 January 2023 call and a $40 January 2023 put concurrently can result in yields above 33% when annualized. In technical options trading terms, the proposed strategy is called a “Short Strangle” trade.

What is the trade?

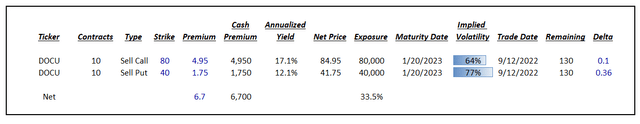

The proposed trade is to Sell $80 strike calls with a January 20, 2023 maturity date while concurrently to Sell $40 strike puts with the same tenor:

Effectively, the investor is selling two options and thus monetizing the high implied volatility and expecting the historic range to hold:

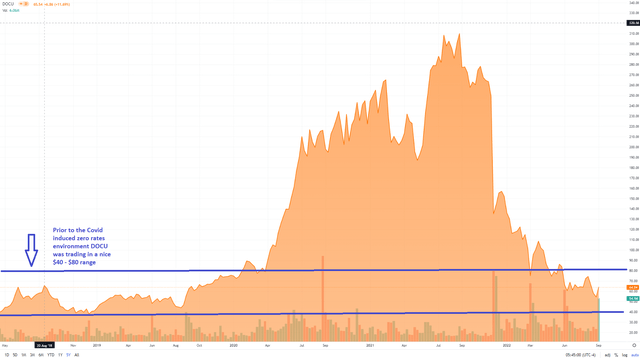

Historic price (Seeking Alpha)

We can see that prior to the COVID crisis the stock had a nice established trading range. When zero rates and a hyper-speculative environment came about thanks to the Fed, DOCU rallied hard. All those gains have now been lost and we feel the stock is re-asserting itself in its historic range.

The proposed trade basically monetizes via options the two barriers present in the graph. Selling 10 contracts for DOCU for a $80 strike provides an investor with a $4.95 premium per contract, while the selling of put options with a $40 strike provides a more modest $1.75 premium given the option’s lower delta. The net premium received by the investor is $6.7 per contract, or $6,700 for 10 contracts as in our example. When annualizing the premium based on the potential cash outlay on the put side, the un-triggered yield exceeds 33%.

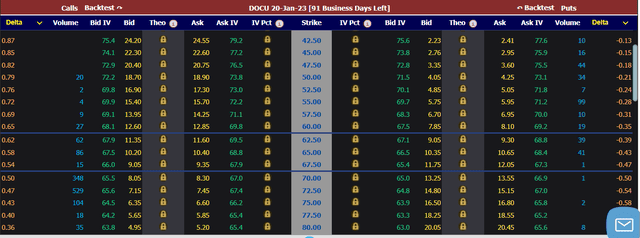

The recent move up in DOCU has allowed for the Call premium to be bumped up:

Options Chain (Market Chameleon)

The potential outcomes for the proposed trade are as follows:

Scenario 1

- Upon expiration date on January 20, 2023, the DOCU stock price is above $40 but below $80

- Both options expire without being triggered

- The investor pockets the full premium of $6,700

- When annualized, the yield exceeds 33%

Scenario 2

- Upon expiration date on January 20, 2023, the DOCU stock price is lower than $40

- The investor ends up buying the DOCU stock, but at a much lower price

- If the stock ends up at $40, the investor will buy it at a $33.3 cost ($40 – $6.7 premium)

- The maximum downside here is capped at 10 x 33.3 x 100 = $33,300 (if DOCU goes to zero)

Scenario 3

- Upon expiration date on January 20, 2023, the DOCU stock price is higher than $80

- The investor would start losing money if the price goes above $86.7/share (strike plus premium)

- The losses are uncapped here (you are short a naked call)

- We would think about an active management here where an investor would actually outright start purchasing DOCU stock if the price goes above $75 share

Conclusion

A former tech darling, DOCU has fallen more than -77% from its 2021 peak. Last Friday saw a violent +10% rally in the stock on the back of better results and guidance. The volatility exposed by DOCU allows for attractive options premiums. We feel the DOCU stock is starting to form a bottom and is back in its pre-COVID well-established range. The article puts forward a Short Strangle options trade that can result in yields exceeding 33% if DOCU stays between $40 and $80 per share upon trade maturity in January 2023.

Be the first to comment