xavierarnau/E+ via Getty Images

Dear Readers,

Since my last bullish article on KION (OTCPK:KIGRY), the company has declined by about 17.5% to a market that’s gone up about 5%. Not the best investment track record on a buy in 2022 – but unfortunately not the worst either. The year has certainly been one of surprises and headwinds.

Does this make KION Group a bad company?

No, it does not.

Let me show you why.

KION Group – Looking at the company again

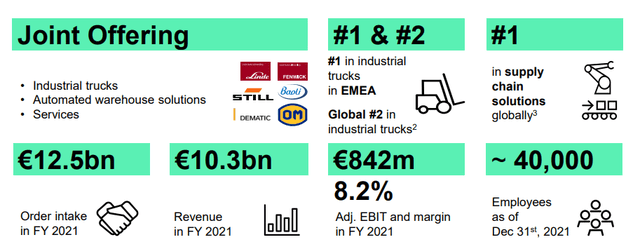

So, looking at KION, and reminding you what the company does, KION is the world leader in industrial truck solutions in EMEA, and the global #2 in the same segment. It’s #1 in global supply chain solutions, and can report an annual order intake climbing toward the €13B on an annual basis. On that €12-13B, the company ekes out a profit (EBIT) of around 8-10% conservatively. The company employs 40,000 people, and represents a very attractive portfolio of:

- Industrial Trucks

- Automated Warehousing/Supply Chain Solutions

- Services

There is, on a high level, a lot to like about KION. It’s a very mature company with already-developed synergies and turnkey solution capabilities, with 2,100 sales and service locations across its 100-country market. Its revenues are very EMEA-centric, with only 27% in the Americas and 11% in APAC, leaving plenty of room for industrial expansion.

The company has over 8,000 running installed systems at customer locations and has 1,600,000 trucks currently running in the field.

Furthermore, it has a very appealing sales and service split, with 41% of the company’s revenue being service-oriented.

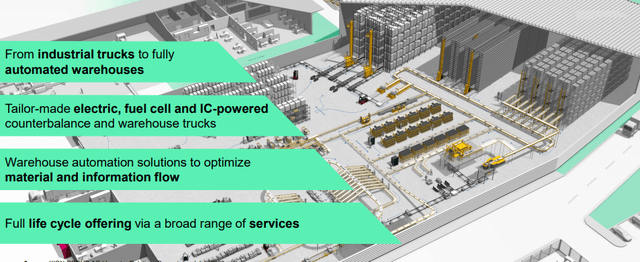

The company offers near-complete solutions to warehouse systems.

And in today’s highly digitized and automated world, this is of course an appealing thing.

Peers do exist, of course – and these peers aren’t weak either. Toyota Industries is the market leader in Industrial trucks, and Honeywell (HON) are the closest competitor in Automation systems.

On a high level, the company’s operations are split into trucks and solutions. Trucks make up about a 57% EBIT Split, the rest being solutions. The company is targeting a higher EBIT Split from its solution segments, and target growth in accordance with this. Margins in services are higher than in trucks (about 3-4% on an EBIT basis).

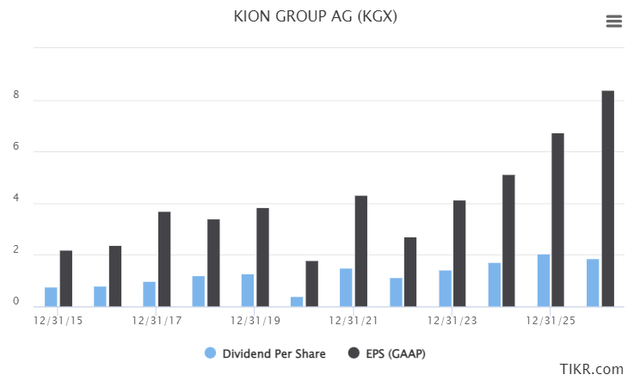

The company pays a 25-40% dividend payout ratio, which currently comes to an appealing 4.33% for the native share, very attractive for the industrial sector overall.

The company has applied a 2027E growth strategy based on a number of levers, including but not limited to:

- Expanding production capacities to Poland and China

- Expanding the product range

- Expanding sales capacities in NA/CH

- New generation of trucks, including connected trucks

- Expanding mobile automation offerings, with software as a differentiating factor.

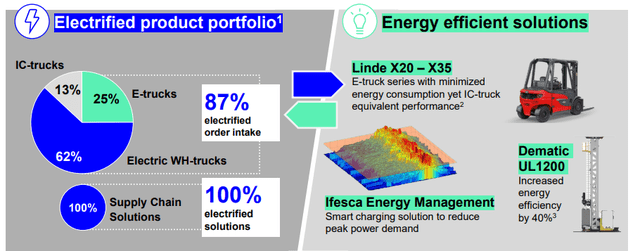

- Heavy R&D commitments in the fields of energy, digital and automation, with fuel cell technologies and AI

- Adapting indirect costs, increasing flexibility, and optimizing production capacity.

The basic thesis for investing in KION is sound. It benefits from structural trends and demand drivers such as demographics and sustainable solutions, it’s well-placed to grow as a result of increased demand in materials handling and investment into new technologies. It’s already in the field of sustainable ESG with its contributions from services and solutions and push for energy efficiency.

Also, take a look at some of the customers KION has. Not exactly small potatoes in any sense – and did I mention that the client retention rate for KION GROUP is 99.98%?

Not exactly bad numbers. So you may start to see why I don’t really care that the company dropped 17.5% – unless there is a fundamental reason for that drop. To that end, I’ve looked, and there isn’t really one.

Oh sure – we have geopolitical macro. But overall, growth targets and market expectations for the long term are very much intact. 2Q22 confirmed this – despite being heavily impacted by the macro. EPS dropped close to 50%, and the company made it clear that there will be a new outlook posted further this year.

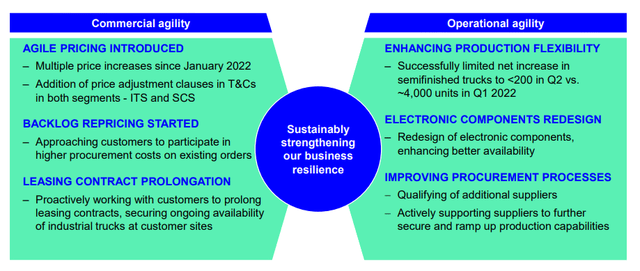

The main issues are as you might expect – inflation, procurement, and input, as well as supply chain challenges. The company is addressing all of these issues.

Despite issues, the company recorded increased market share during early 2022, and despite momentum slowing in 2Q22, this overall development has still not changed entirely, with near-double-digit market share gains in the Americas and solid order intake for at least the Americas. The company’s current backlog of orders secures more than one year of new business revenues, and could by itself be enough to secure the company for the 2023-2024E Period.

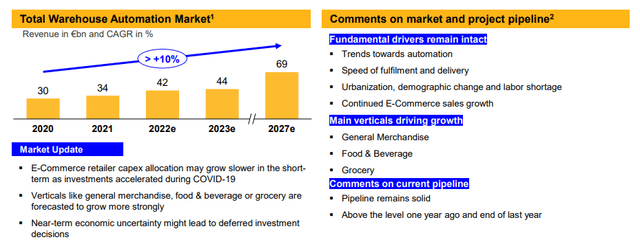

Furthermore, the pipeline for the company’s higher-margin segment remains very attractive.

Because no matter what the world does – these are services and “things” that the world needs. Structural demand drivers for the SCS segment are completely intact, and EBIT margins did not even drop below 7% for 2Q22. the YoY margin changes are massive still, but this will normalize once supply chains normalize in turn.

Margins are really the problem at this time. And this problem is, in turn, driven by macro which the company has very limited control over. Net income remains quite stable, and the company continues to report an EPS of around €0.6 on a quarterly basis, bringing us to a run rate of €2.4.

This would ordinarily imply that the company’s dividend might be cut to be right-sized to the business’s payout ambitions. however, if we look at the records, this company is no stranger to allowing for a higher dividend even during times of lower earnings. I would say that there is the possibility that the dividend might remain stable for 2022 fiscal – but I would not count on it, nor do I invest in KION for the dividend alone.

The recent setbacks or issues have not changed my mind on this.

I remain very positive about KION as an investment, even in light of 2Q22.

Let’s look at valuation.

KION – The valuation

I already market KION as significantly undervalued in my last article. This stance has only increased, and I’m getting ready to “pound the table” more on KION as an investment.

This is a combination of the company coming down from pandemic highs, which it saw for its results, and going well below where it should be, to close to COVID-19 pricing levels.

Current analyst estimates call for the company to deliver revenues 10% above 2021. While margins will go down, with EBIT expected to touch 6-7%, this does not to my mind justify a 50%+ price drop. Note that the margin expectations of 6-7% are still very much the same as they were in the article.

KION will continue to sell product – just at a lower margin for as long as SCM remains impacted and input variables remain unfavorable. But this does not change the company’s overall appeal. Beyond 2022, the company is expected to grow earnings and revenues to around double that of 2022E by the time of 2026, as we saw above. (Source: FactSet)

For KION, I use DCF, NAV, and peers as a method of evaluating. I’m not too keen on the ADR as I view it as too thinly traded – so I believe you should go for the native. Nonetheless, the ADR is of course an option.

For my DCF, I now employ a 7.5% WACC with a 3% risk-free rate and a 6% market risk premium with a beta of around 1.1. Based on that, and expecting sales growth around 3.5-4.5% and EBIT growth around 9-10% based on strong trends, we reach an implied EV value of close to €17B, which net of debt comes to a fair-value share price of around €95 – now impaired by about 10% by me.

Even with this impairment, this still implies a massive upside to where the company is currently trading – more than twice as high – but in case we do see this growth, that’s what the company, to my mind is worth.

I’m not the sort of analyst to back down from valuations because the company happens to be trading at close to 33% of them. I view a realistic long-term target for KION to be that high.

Peers remain overvalued to KION. KION is trading at an NTM revenue multiple of 0.4X, while we look at peers like Toyota (OTCPK:TYIDF), Jungheinrich (OTC:JGHHY), Cargotec (OTC:CYJBY), and others which are trading at higher multiples. Toyota is still more than twice as high as this business, which does not compute for me in terms of what sort of upside Toyota’s limited market leader in industrial trucks grants the company.

The expectation here is based that the company’s operating EBIT margin actually increases once these troubles are over, from 2024 onward, and we assume a 1% FCF growth rate for the period beyond 2026 and onward.

KION still trades at what I view as a material discount to any historical multiple or number.

S&P Global analysts give the company a target range of €52 on the low point to €130/share on the high point.

I combine my peer targets, book/NAV targets, and DCF targets and come to around €85/share, but that’s as low as I’m willing to go on the KION Group – and that’s discounting it already.

The average S&P Global target for the company is €74, which implies a current upside of 80%+. I consider as I said, the company upside to be higher. Anything below €80/share is a bit too conservative even for me. 14 out of 19 analysts have either “BUY” or “Outperform” ratings on this company here, an increase of 2 analysts since my last article.

Based on this, I’m considering KION a “BUY” with an €85/share PT.

Thesis

My thesis on KION is as follows:

- KION Group is an attractive capital goods play with an emphasis on intralogistics solutions, automation, and warehouse technologies – things like forklifts, to put it simply.

- The company is undervalued and forecasts imply a significant upside over the coming 5 years, with an upside of over 100%.

- KION is a “BUY” with a price target of €85/share.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment