Marko Geber/DigitalVision via Getty Images

Thesis

Teladoc (NYSE:TDOC) was everybody’s darling in 2020 up until February 2021 and has been crashing ever since, dropping as much as 82% at the bottom. The company shed off its bubble valuation and is now a buy at these attractive long-term levels.

Teladoc is the leader in virtual care and virtual mental health treatment. The company is starting to develop a moat with its services ecosystem and data leadership, striving to be what Adobe is for creative work, for the healthcare space.

Macro Tailwinds

According to Fortune Business Insights, the global Telehealth market will grow at an astounding 32% CAGR from $90b in 2021 to around $640b in 2028. We have to keep in mind that 2020 saw a massive acceleration for Telehealth and the market peaked at $144b in 2020 and declined almost 40% in 2021.

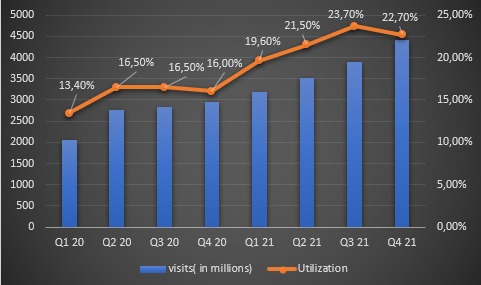

As you can see in the graphic below, Teladoc showed a lot of strength during this massive decline in the overall market. They had continued strong performance in total visits and their utilization rate, while competitors had negative visit growth.

TDOC visits and utilization growth (Authors model, Data from Teladoc IR)

Levers of growth

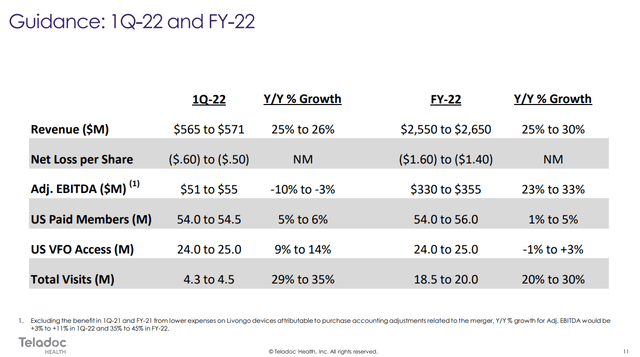

Teladoc has several levers of growth, but for some reason, management keeps on communicating less important metrics. They keep guiding for revenue and adjusted EBITDA in absolute numbers, but then reference EPS? Due to their historical dilution, they should guide all of these in per-share metrics.

TDOC Q4 21 guidance (TDOC Q4 21 earnings presentation)

They also guide for US Paid Members, the metrics Wall Street likes to reference the most. I firmly believe that there are better metrics to evaluate TDOC’s growth:

- Utilization – The percentage of paid members that actively use their services

- PMPM – revenue per month per member

- “Using members” – a metric I personally use – Paid members * Utilization

These KPIs paint a more accurate picture in my opinion, because it takes into account the actual usage of the products and how much revenue every member contributes.

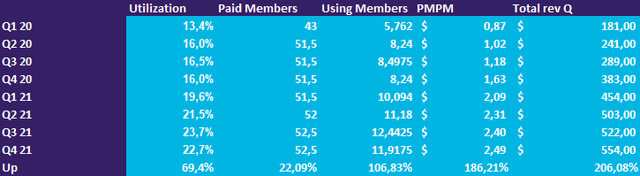

In the graphic below you can see my model for Using members. We can see that paid member growth only increased by 22% during the last 8 quarters. Every other metric far outpaced it though. Utilization is up 870 bps or a 69.4% increase. PMPM is up 186% and my using members metric is up 106%. I believe that these KPIs more accurately depict the company’s performance.

Using members calculation (Authors model, data from TDOC IR)

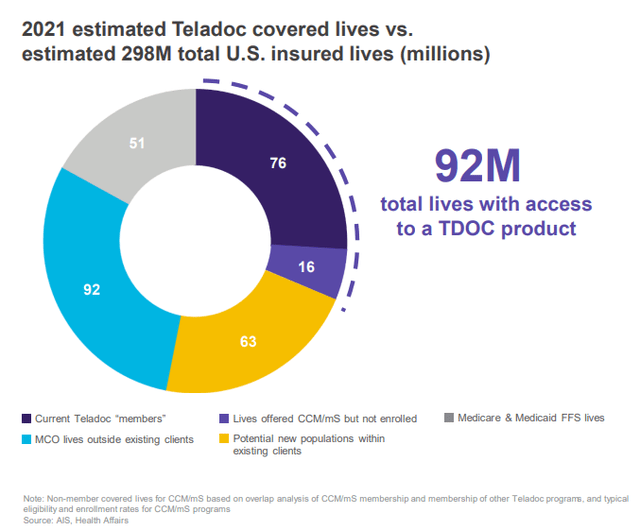

This whole investor relations miscommunication got even worse when Teladoc introduced its new way of measuring members. On their investor day, they grouped another 23 million members into the Teladoc member’s group, including overlaps and then also added 16 million people that had the services offered, but who haven’t enrolled. To conclude this segment: Teladoc is a massively misunderstood company, mainly due to poor investor relations communication in my opinion. The slowdown in paid members’ growth from the pulled forward demand due to COVID does not accurately represent the performance of the company.

TDOC members (TDOC investor day)

Breadth of services

The reason why Teladoc has been able to keep visit retention and increase utilization while the market declined (meaning they took market share) is their unmatched breadth of services in their portfolio.

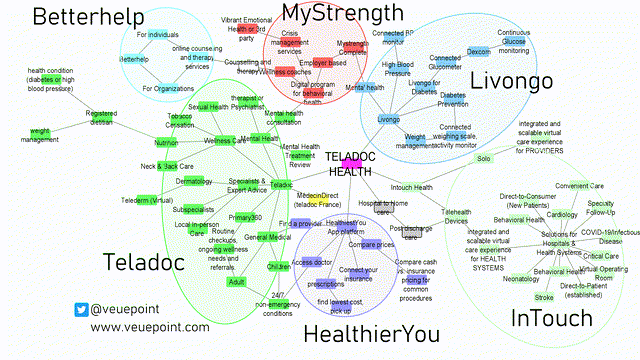

TDOC services portfolio (@veuepoint on Twitter)

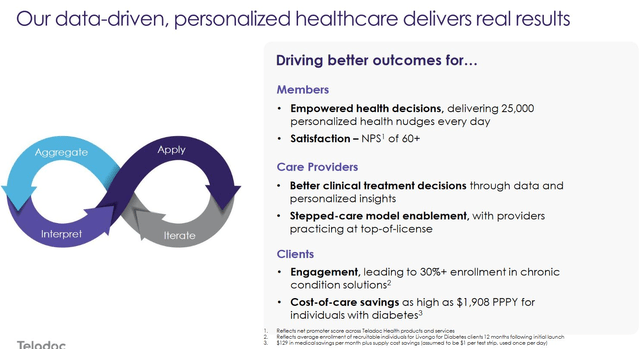

As you can see in the graphic above, Teladoc has six different branches of operations that create an intertwined network of services with lots of synergies. In the utilization chart I shared earlier, you can see an acceleration in the growth of utilization from Q4 20 to Q1 21. This is when Teladoc acquired Livongo Health through a massive $18.5 billion deal, mostly paid in TDOC shares. Livongo offers great cross-selling opportunities and is a great addition to its network of services. Additionally, Livongo enabled Teladoc to harvest billions of data points from patients through Livongo monitoring devices. In the future, these data points can be leveraged to continuously enhance their AI and increase the effect of their services, a flywheel of sustainable growth. A visualization of the data flywheel can be seen in the graphic below.

TDOC data flywheel (Teladoc IR)

Big tech partnerships

In the last year, Teladoc has made partnerships with Microsoft (MSFT) and Amazon (AMZN). These partnerships showcase that Teladoc’s solutions are preferred by some of the biggest companies and they are looking to integrate them into their services.

In July 2021 Teladoc partnered with Microsoft to integrate Teladoc’s Solo platform (acquired with Intouch Health in 2020) into Microsoft Teams. The Solo platform is developed to offer a suite of services for hospitals and other healthcare providers. Microsoft Teams is already used by a large portion of hospitals in the US and will greatly help Teladoc gain market and mind share in this space. The partnership doesn’t end here though, the two companies are working on AI capabilities and Teladoc is looking into creating an API marketplace for healthcare solutions. I believe that Teladoc could leverage its partnership with Microsoft to establish an API marketplace in cooperation with Azure.

In February 2022 Teladoc partnered with Amazon to bring healthcare services onto Alexa. A recurring theme over the last years has been TDOC stock falling after Amazon news regarding healthcare. The narrative that Amazon will compete with Teladoc and take market share from them should slow down with this first step in a partnership of the two companies.

Other big tech companies like Google are also showing interest in Teladoc’s services, even though they invested $100 million into American Well (AMWL) at IPO. This shows the clear advantage in the offering of Teladoc compared to its competition in my opinion.

Valuation

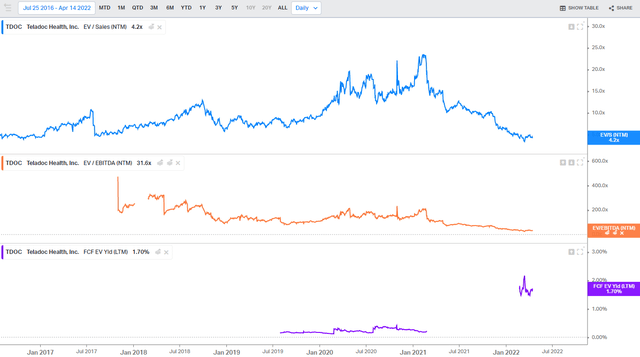

Teladoc is not profitable yet on an earnings basis, due to large losses related to the Livongo merger in 2020. Although they aren’t profitable on EPS, the company is generating growing free cash flows to fund its growth. That is why I prefer to look at enterprise value/sales, enterprise value / EBITDA and the free cash flow yield for Teladoc. During the pandemic, multiples expanded from their pre-pandemic averages significantly. EV/S went from 7 to 17, while EV/EBITDA stagnated around 120 times. Teladoc wasn’t free cash flow positive before the pandemic, so historical values are pretty choppy. In the graphic below we can see that multiples now contracted significantly. EV/S went from 17 to 4, EV/EBITDA from 120 to 31 and the free cash flow yield currently is at 1.7%.

Conclusion

Considering that the company has guided a 25-30% revenue CAGR and my expectation of continued multiple expansion, this offers a compelling buying opportunity for Teladoc Health. Teladoc is already a big part of my portfolio with a 6% allocation.

Be the first to comment