HT Ganzo

Dear readers/followers,

The metal markets and the companies within these markets have become a home to me for the past couple of years. Aluminum, Iron, Steel, Nickel and other metals – I’ve begun becoming involved with several of the companies that work with them, in particular companies in Europe.

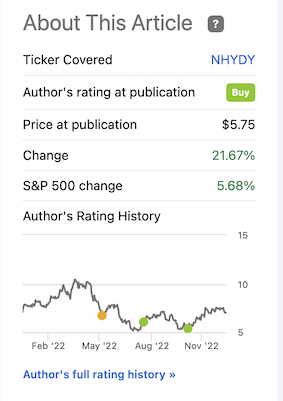

Norsk Hydro (OTCQX:NHYDY) has long been one of the foremost on my list of metal companies you should consider at the right price. In my last article, I shifted my thesis, not only going to “BUY”, but actually buying a portion of shares in the company.

The results, as things go, have been very impressive.

Norsk Hydro Article (Seeking Alha)

Revisiting Norsk Hydro

It’s no secret that Norsk hydro has significant upside in this sort of scenario which we’re currently in. The company is a commodity business in many commodity segments and sub-segments, including recycling of their own product, and with an international production basis. The production, while expensive on an international comparative basis, is hedged against downsides due to the way that EU policy is developing on metal companies and production, essentially punishing those that don’t follow relatively stringent and harsh ESG guidelines.

On a theoretical basis, this means that the upside, despite a more expensive valuation, could still be there.

In this article, I’m going to take a look at 3Q22, and I’m going to re-emphasize the advantage of owning Hydro both for the long term and as more of a short-term play.

Because here is the good thing.

I know at what valuation this company is “expensive”, and where it becomes “cheap”. This is one of the companies where I am very much at “home”. While markets and trends may go up and down, and a thing like Alunorte may derail the company for years, the fundamental appeal of the business and the demand for aluminum coupled with the company’s metal markets and energy segments guarantees a very good long-term potential RoR.

When someone asks me about Hydro, it takes me all of 3 seconds whether this one is a “BUY” or not here.

So, 3Q22.

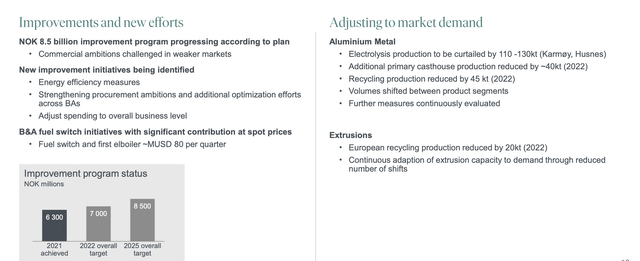

The company is responding to challenging markets and cost increases with its own efficiency program, which is very much on track. The company also reports strong results in almost every single segment – such as Aluminum, Metal markets, and extrusions.

Hydro also distributed an extraordinary dividend above the dividend floor of 1.45 NOK per share and initiated a buyback program.

To say that the world has become more chaotic would be an absolute understatement.

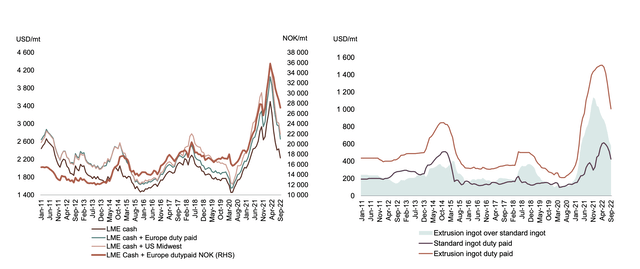

The current regulatory environment is driven by two things. First, the Russian invasion of Ukraine, and second the energy crisis which has been driven by these conflicts. These factors are threatening the competitiveness of EU business and industry – and the EU is responding to this. The economic outlook for the markets is challenging, but the company has an inherent advantage due to its energy segment. Ex-energy, the demand flow is looking negative for 2023. In 2022, there was more demand than supply, but in 2023 and excluding china, there will be an imbalance of 1% towards supply, implying price shifts if China’s demand decreases – which I personally believe that it will.

This is already starting to happen, with aluminum prices normalizing – which will of course impact Hydro.

Norsk Hydro IR (Norsk Hydro IR)

In terms of costs, Hydro isn’t the best – but it’s up there, at the 17th percentile for smelters and the 30th percentile for refineries.

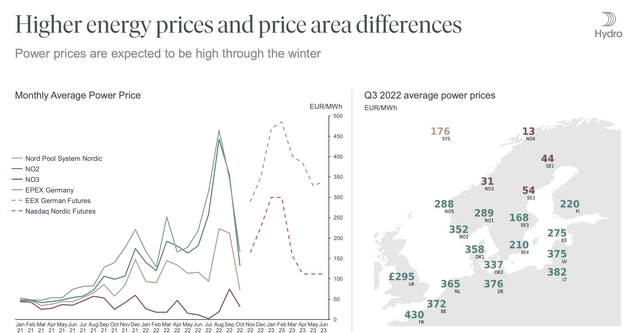

On a segment basis, the company is seeing stronger sales, but lower prices, which means that YoY results are actually lower. Also, demand is slowly softening across Europe, with real strength only in automotive and renewables. Power prices are very much driving the thesis for Hydro here.

Norsk Hydro IR (Norsk Hydro IR)

There has been a strained energy situation in Southern Norway, where some of the company’s production is – but that is now lifted, and we’re back to normalized levels across Norway, with the exception of the south, which is down to “pressed”.

Hydro’s long-term power contracts and strategic aluminum hedges through the use of futures and contracts, currently ensure to robustness for the company’s sales. Even for 2024, the company still has hedges for 20%of the production at levels of $2,400/t, and Hydro uses derivatives or contracts to secure the raw materials as well.

overall, Hydro is taking several steps to ensure smooth operation and profitability across the board, despite a more complex situation than for the past decade and more.

Norsk Hydro IR (Norsk Hydro IR)

As I’ve said in previous pieces, this is also a good opportunity to really shore up renewable/green aluminum pushes, as the company is doing, and has done. The company’s EBITDA is down on lower upstream and seasonality – pricing declines for aluminum and alumina, which overall despite positive FX and raw material cost advantages, sees us down below 10B NOK for the quarter on an adjusted basis.

This is not worrying as such – the company is seasonal, and you know when it’s as high as it’s been, it’s always coming down again. However, the market response to 3Q and the way the company has been trading suggests that Hydro is being viewed more favorably than some of its immediate peers.

Also, there is segment-specific strength to point at, with good results in Aluminum metal due to Co2-comp and pricing, as well as sales of electricity. Metal market results are also good – Hydro is recycling a lot more – even while commercial markets are falling somewhat.

Despite issues, Hydro managed to generate 2B NOK of free cash flow, which is being pushed out in the form of shareholder dividends, net investments, and changes in NOC. This drives to an adjusted net cash debt of 7.8B NOK- though this includes pensions as well.

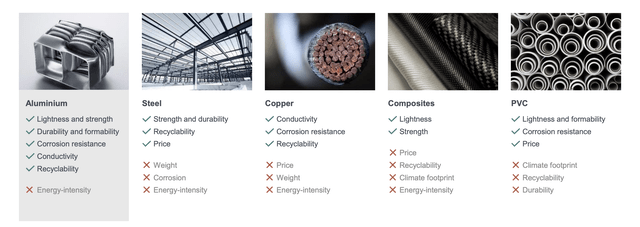

The fact is, the entire world needs aluminum and what the company offers. The only disadvantage to the metal is the energy intensity of its production – but there’s not that big a difference from Steel, Copper, or composites, as these are also pretty intensive to produce in terms of energy.

Norsk Hydro IR (Norsk Hydro IR)

So what I will tell you is the following.

The company’s foundational thesis of becoming a world leader in green aluminum is still very much intact. The company’s near-term results might be in jeopardy, and we have volatility and uncertainty to expect for 2023-2024. However, with the company’s current dividend floor and the way things have been going, I don’t foresee any fundamental issues, barring some sort of catastrophe.

Because of that, I’m willing to assign Hydro a bit more of a premium than i might have been willing to 1-2 years ago.

Let’s look at how this influences valuation.

Norsk Hydro Valuation

We’re still down from highs of over 80 NOK and are currently hovering around the 70 NOK mark. That’s a 10 NOK rise from my last article.

I wrote in my last article about potential catalysts, and the funny thing is that the company didn’t see any improvements in pricing or EBITDA here – but the share price is still up. This implies people see the quality of this business as a whole.

The volatility in forecasting Hydro is very evident when you look at the analysts’ accuracy here – because analysts usually (50%+) miss negatively on their forecasts for the company – but this business is still a market-leading aluminum company, with a few others. Peers do exist – I wrote about a NA-based one a few weeks back, but even being generous, it and these others do not measure up to Hydro in the ways the company has set up its production and upside for the future.

Remember, analysts, even many of my colleagues did not like this stock when it was priced at 25-35 NOK/share. That’s when I bought it, knowing the fundamentals and the substance of this company and going against the grain. I bought a base position in the tens of thousands of dollars, which I have since then carved away at with profit, buying more when the price dropped below 58 NOK, and in my last article, I gave the company a 60 NOK share price.

As of this article, I’m raising it.

Remember, less than 6 months ago, this company still had an average PT of 93 NOK, owing to a range from 67 NOK to 120 NOK and analyst exuberance. We’re down from that today, and currently, analysts are at a range from 55 to 93 NOK, with an average of no more than 73.3 NOK.

As of this morning, we’re at around 69.2 NOK.

I’m giving this company a conservative target of 70 NOK. I don’t believe the volatility is over, and I’m admitting here that I might be premiumizing the company somewhat – maybe even more than it deserves.

But you can’t underestimate Hydro being in a future-oriented market and being positioned to take advantage of it, both on a local EU level, and on an international level.

For that reason – and many of the other fundamental reasons I’ve been through in the past, this is my thesis for Hydro.

Thesis

My current stance on Norsk Hydro is the following:

- Norsk Hydro is currently fairly valued to normalized future earnings and my new improved price target going into 4Q22.

- The potential returns from today’s levels are now acceptable compared to what other investment alternatives in the market offer us.

- At its current valuation, Norsk Hydro is a “BUY” with at least the beginnings of what I consider to be an attractive upside. The price target is 70 NOK.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I can’t call Hydro “cheap”, but I am calling it “attractive”.

Be the first to comment