Liudmila Chernetska

Rapid7, Inc. (NASDAQ:RPD) expects to deliver 24% sales growth in 2022, and more than 90% of its total revenue includes recurrent revenue. In my view, with sufficient product development and the existing partners, revenue growth in the future can be expected. Most analysts out there do believe that RPD will likely deliver beneficial results. Using very conservative expectations, my discounted cash flow model implied a stock valuation of close to $70 per share. Yes, I identified a list of potential operating risks, including a lack of hiring and a failed revenue forecast. With that, in my view, the current valuation does look cheap. I don’t see a lot of downside risks from here.

Rapid7

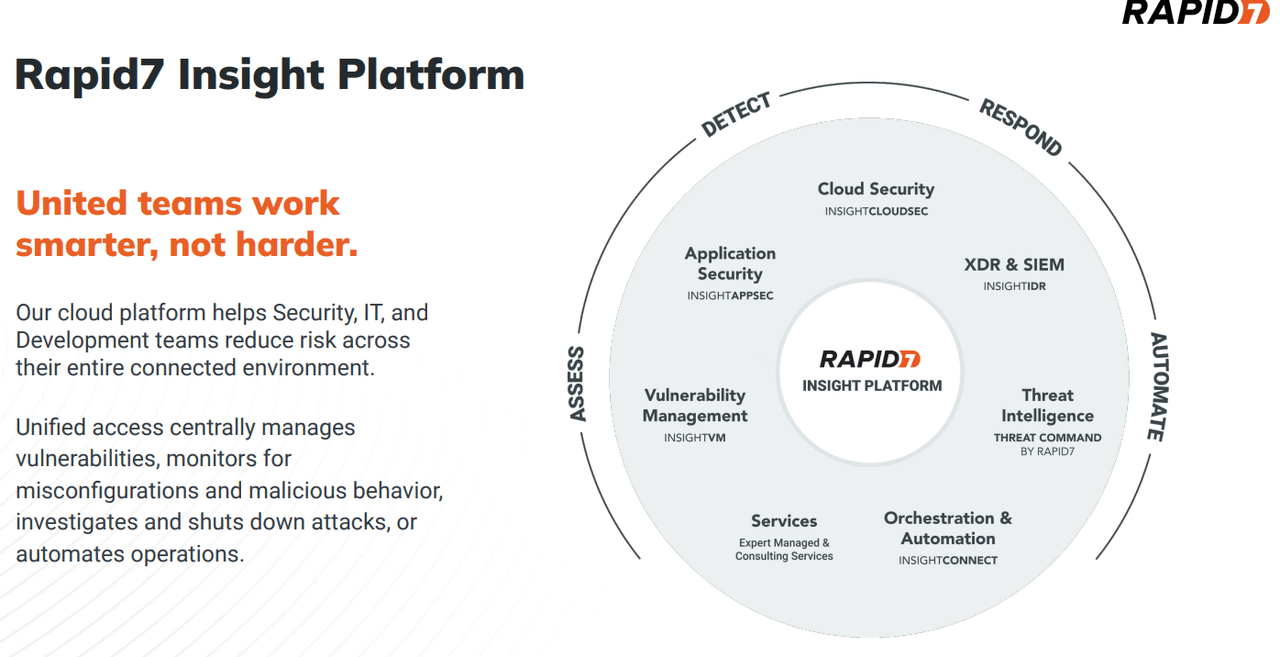

Rapid7, Inc. offers security solutions with visibility, analytics, and automation. IT professionals often use the company’s platform to reduce vulnerabilities, check for malicious behavior, and detect hacker attacks.

Source: Quarterly Presentation

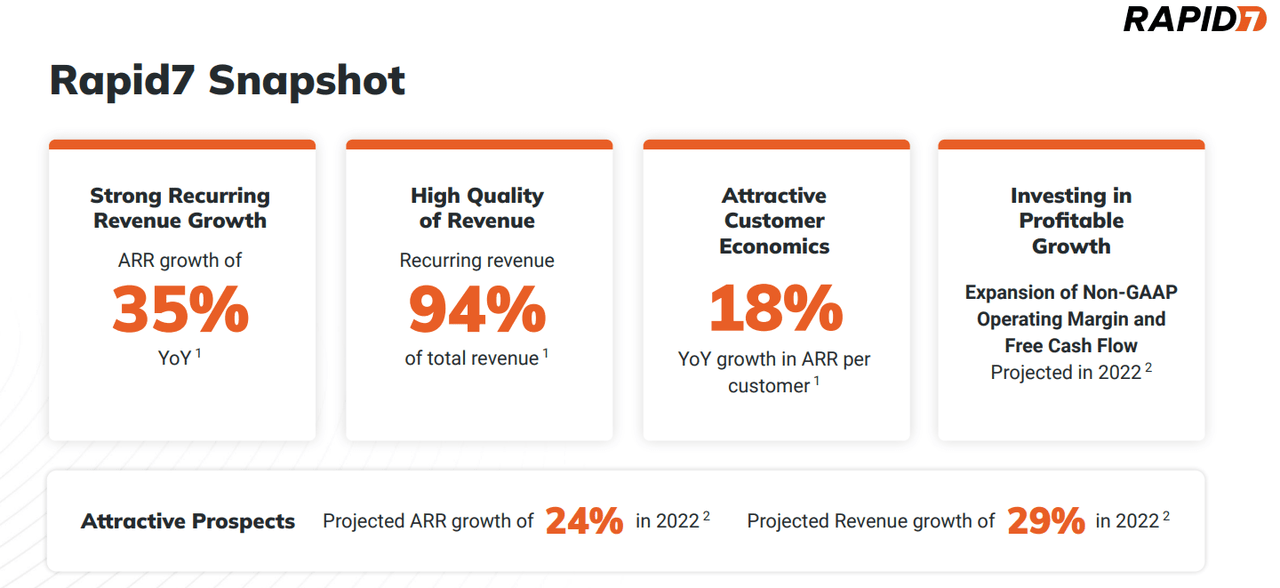

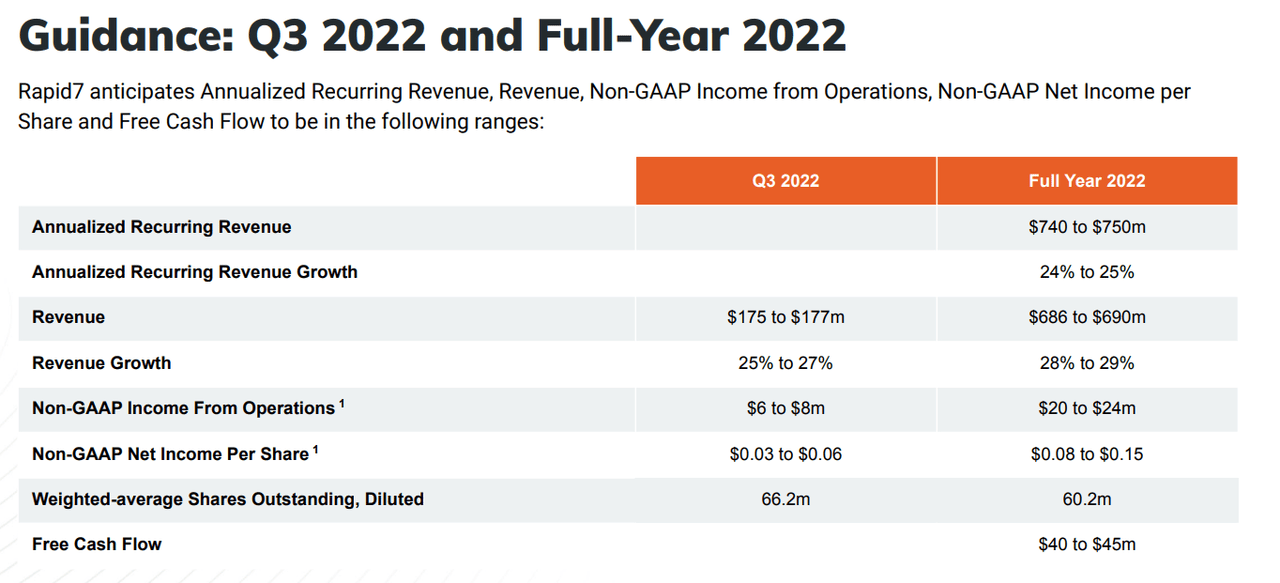

In my view, having a look at the company’s business growth right now is quite appealing. We are talking about double-digit recurring revenue growth. 94% of the total amount of revenue is recurring revenue. Besides, the expectations are quite attractive. Management expects revenue growth to stay at around 29% in 2022.

Source: Quarterly Presentation

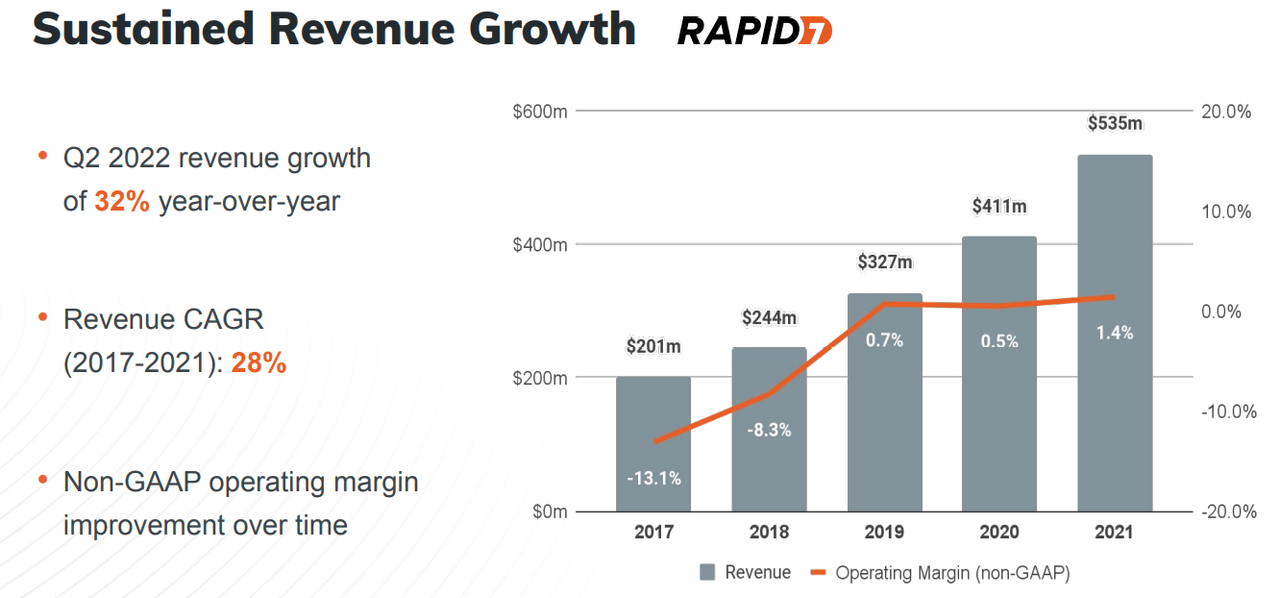

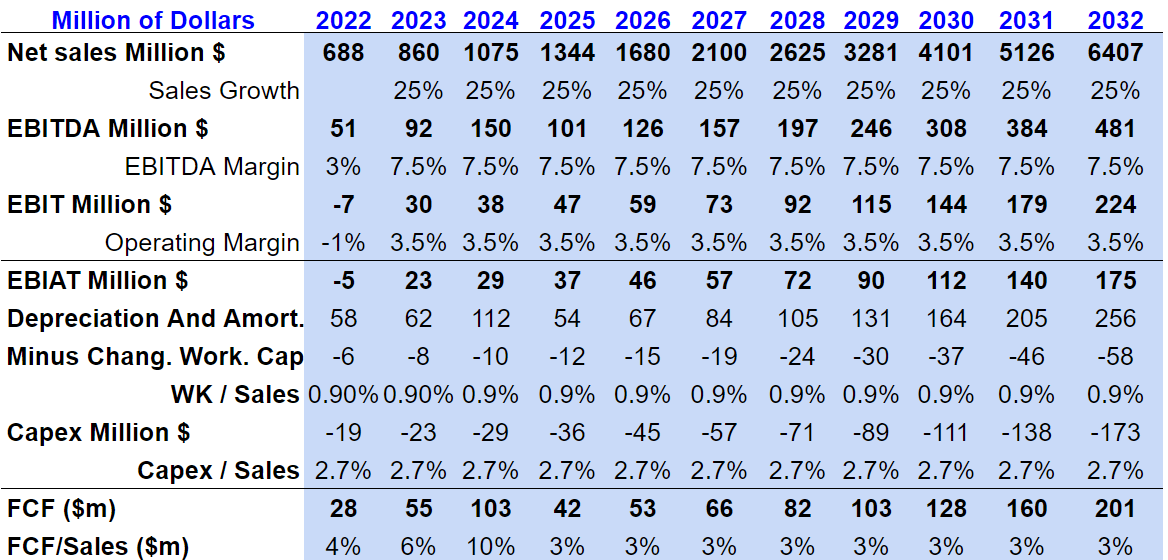

In my view, considering previous growth, expecting significant sales growth for 2023, 2024, and 2025 makes sense. Let’s tell it this way, 24% sales growth in 2022 would be achievable if we take into account the fact that the company reported revenue growth of 28% from 2017 to 2021.

Source: Quarterly Presentation

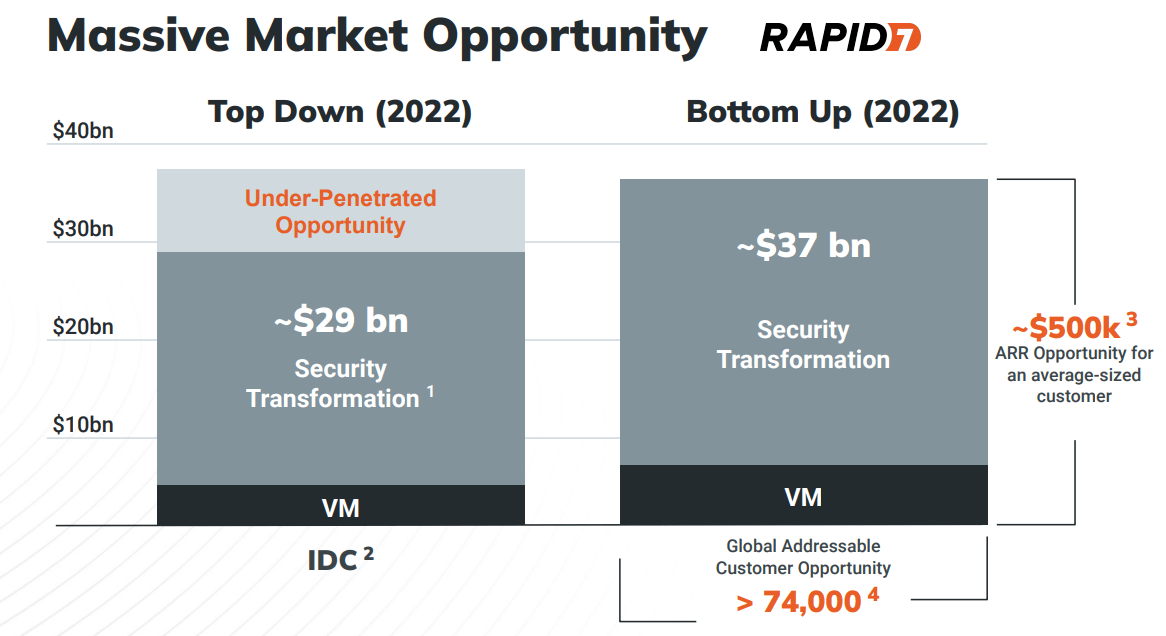

Apart from future prospects, Rapid7 is targeting a massive market opportunity of more than $37 billion with more than 74k potential customers.

Source: Quarterly Presentation

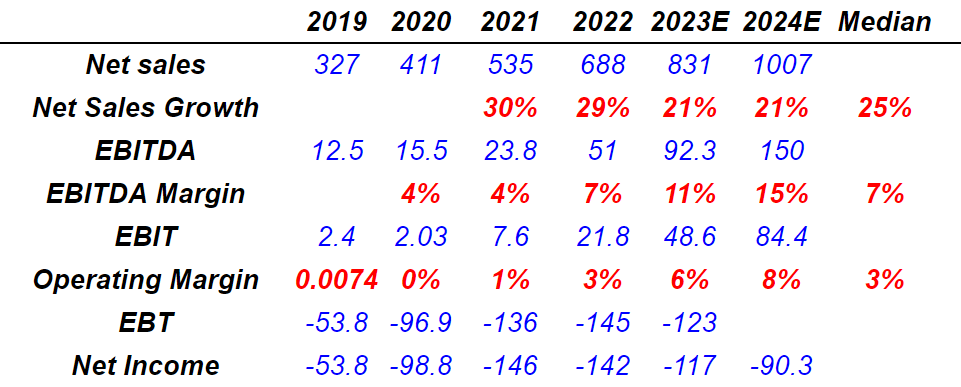

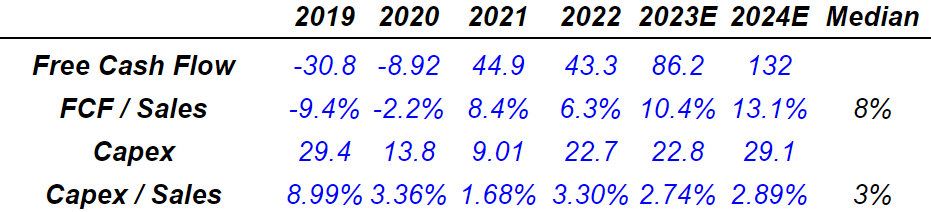

Expectations From Analysts Include Sales Growth Around 30%-21%, EBITDA Margin Around 7%, And FCF Around $40-$45 Million.

Investment analysts believe that Rapid7 could deliver net sales growth around 30%-21% with a median growth around 25%. The median EBITDA margin would also stand at 7%, and a median operating margin may reach 3%.

Marketscreener.com

It is quite appealing that other investment advisors are expecting close to 100% free cash flow growth in 2023 and 2024 FCF of $132 million. The expectations include a median FCF/sales margin of 8%.

Marketscreener.com

Finally, let’s note that the guidance given by management includes numbers that are not far from that of investment analysts. For the year 2022, management expects free cash flow of $40-$45 million and revenue growth around $740-$750 million.

Source: Quarterly Presentation

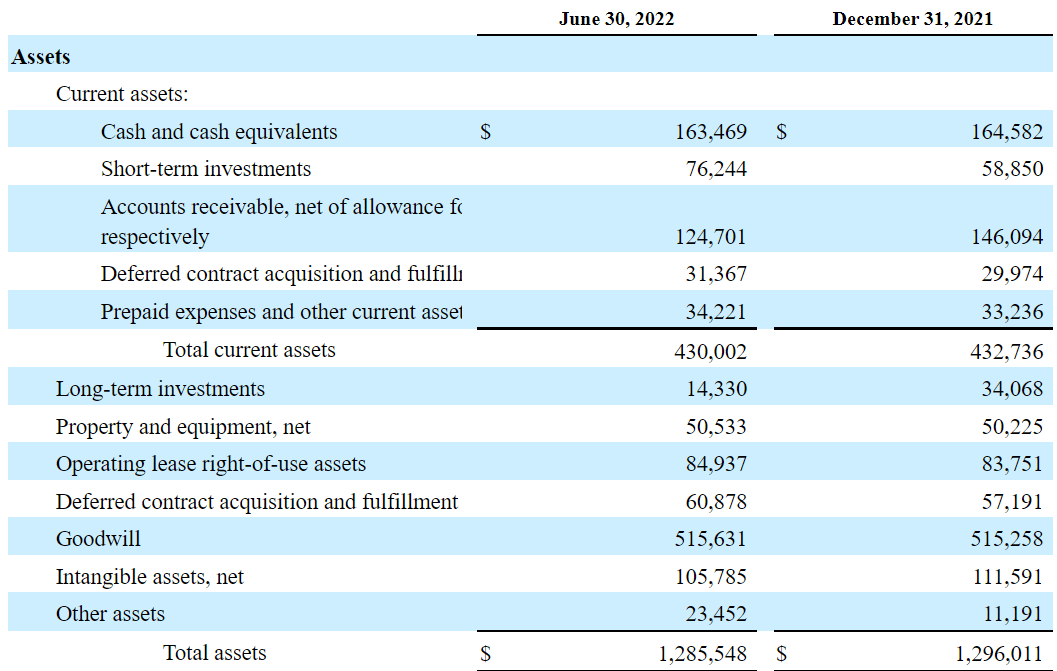

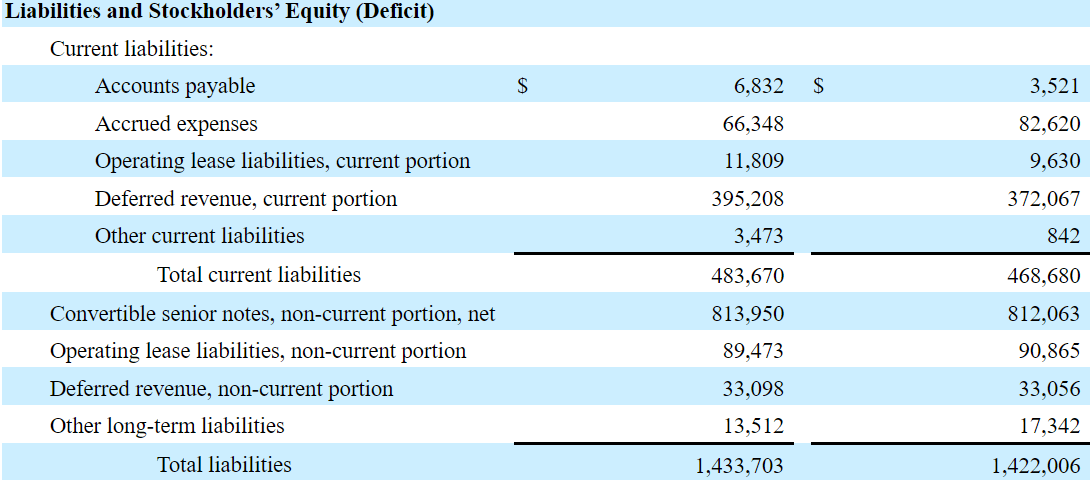

Balance Sheet

As of June 30, 2022, Rapid7 reports $163 million in cash and short-term investments worth $76 million. The asset/liability ratio is under one, but I wouldn’t worry much. If future free cash flow continues to trend north as expected, the accumulation of cash may improve the company’s financial statements.

Source: 10-Q

As of June 30, 2022, the debt includes convertible senior notes worth $813 million. The net debt is equal to $574 million, and the total amount of liabilities stands at $1.4 billion.

Source: 10-Q

My Conservative Case Scenario Implied A Valuation Of $70 Per Share

In my view, new partnerships with other software companies could enhance future sales growth. Let’s note that the company already works with a significant number of well-known partners. Hence, I believe that Rapid7 will be able to sign agreements with new partners as potential clients note the company’s existing partnerships.

Source: Quarterly Presentation

Rapid7 will also deliver sales growth thanks to further product development to enhance the company’s Insight Platform. I also know that management is working on additional features, which may generate additional demand from customers. I believe that with the current company’s financial situation and free cash flow generation, expected development of new products could happen.

Finally, another revenue driver that will likely benefit shareholders in the long run is internationalization. The company already noted in the last annual report that establishing international connections is a top priority. I hope that management would be as successful outside the United States as it is in the country. With know-how accumulated in the United States, I don’t see why the company’s strategies wouldn’t work elsewhere.

We continue to make investments to expand our international presence. These include investments in infrastructure, sales and marketing, and strategic partnerships. Source: 10-k

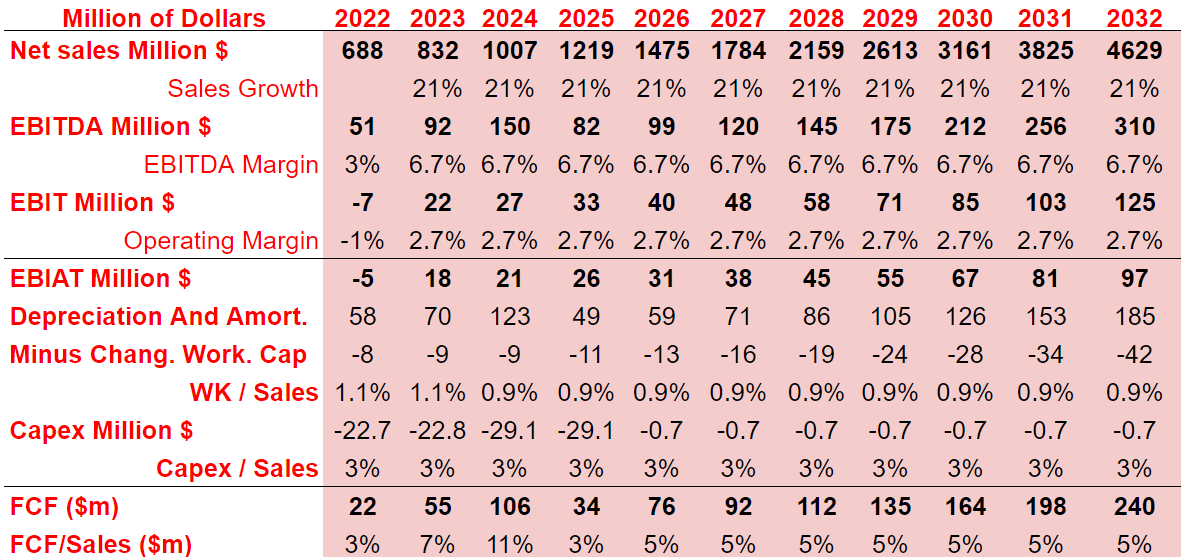

If we use the median EBITDA margin of 25%, an EBITDA margin of 7.5%, and an operating margin of 3.5%, 2032 EBIAT would stand at close to $175 million. Now, with 2032 D&A close to $255 million and 2032 changes in working capital around $55 million, 2032 FCF would stand at $200 million. The FCF/Sales margin would stand at close to 3%, which is more conservative than the figures reported by other analysts.

Author’s DCF Model

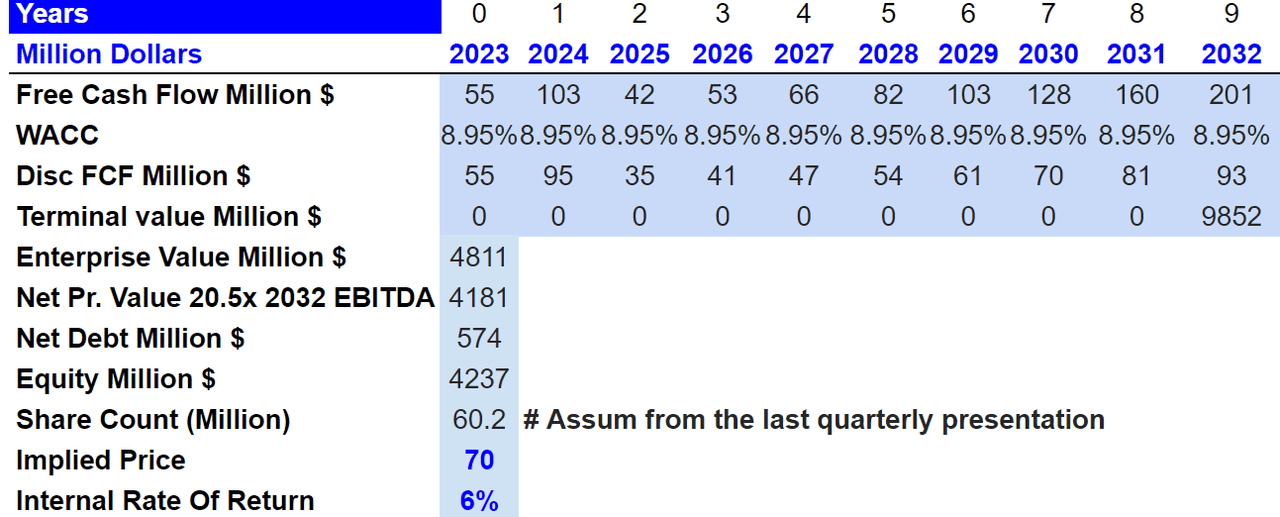

For the discount of cash flows, I used a WACC of 8.95% and a terminal EV/EBITDA multiple of 20.5x EBITDA, which is lower than the current multiple. My results include an implied enterprise value of $4.8 billion, an implied price of $70 per share, and an IRR of 6.5%.

Author’s DCF Model

Lack Of Personnel To Fulfill The Demand And Failed Forecasts Would Imply A Valuation Of $39 Per Share

First, let’s note that Rapid7’s revenue forecasts could be wrong. Management makes a lot of assumptions about future business growth that may not be correct. In the worst case scenario, Rapid7 could deliver lower revenue than expected. As a result, I believe that certain traders would sell their shares, which would lead to stock price declines. Management discussed these issues in the annual report:

Our ability to forecast our future operating and financial results is subject to a number of uncertainties, including our ability to plan for and model future growth. If our assumptions regarding these uncertainties, which we use to plan our business, are incorrect or change in reaction to changes in our markets, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations, our business could suffer and the trading price of our common stock may decline. Source: 10-K

Clients signed a number of contracts with Rapid7 that bring significant recurrent revenue. With that, the company could suffer significantly if clients decide not to renew the company’s product offerings. Let’s note that there are many reasons for which Rapid7’s client could not renew their subscriptions, which include pricing, economic conditions, or customer experience. A sharp decline in sales growth would lead to diminishing free cash flow expectations, and may push the stock price down:

Our customers have no obligation to renew their subscriptions with us and we may not be able to accurately predict customer renewal rates. Our customers’ renewal rates may decline or fluctuate as a result of a number of factors, including their satisfaction or dissatisfaction with our new or current product offerings, our pricing, the effects of economic conditions, including due to the global economic uncertainty and financial market conditions. Source: 10-K

In order for Rapid7 to grow significantly, management will have to hire a significant number of personnel. It may not be easy because in recent years, hiring employees with expertise in the cybersecurity industry has become increasingly difficult. Demand for the company’s services is increasing, but without employees, management will most likely not sign new partnerships, and productivity would decline. The results could include significant declines in sales growth and lack of economies of scale benefits:

In addition, in recent years, recruiting, hiring and retaining employees with expertise in the cybersecurity industry has become increasingly difficult as the demand for cybersecurity professionals has increased as a result of the recent cybersecurity attacks on global corporations and governments. Source: 10-K

Under this scenario, I assumed that 2032 total sales will be $4.6 billion with 21% sales growth. Rapid7 could also have 2032 EBITDA of $310 million and an EBITDA margin of 6.7%. 2032 EBIT will likely stand at $124-$125 million with a margin of 2.7%. 2032 D&A would be $185 million, and capex/sales will be located at 3%. Finally, 2032 FCF will likely be $240 million, and FCF/sales would be 4.9%.

Author’s DCF Model

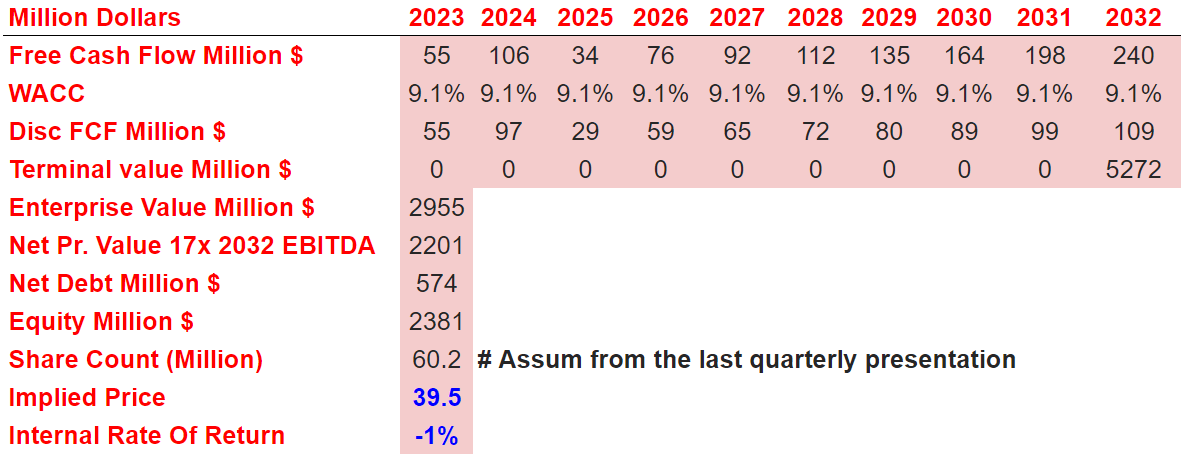

With a WACC at 9.1%, EV/EBITDA around 17x, and FCF between $56 million and $240 million, the enterprise value would be $3 billion. Note that I obtained a net present value of the terminal value of $2.2 billion. Finally, my results include an implied price of $39 per share and an internal rate of return of -1%.

Author’s DCF Model

Conclusion

Rapid7 expects impressive sales growth of 24% in 2022. The company is targeting an impressive target market, and already works with well-known partnerships in the IT industry. In my view, further product development, more partnerships, and internationalization could enhance sales growth in the following years. Under conservative conditions that included sales growth around 25%, I obtained a stock valuation that is significantly higher than the current market price. Yes, I also see risks coming from failed acquisition of partners, lack of successful hiring, or failed revenue forecasts. However, in my view, the downside potential appears quite limited.

Be the first to comment