DaveAlan/E+ via Getty Images

Introduction

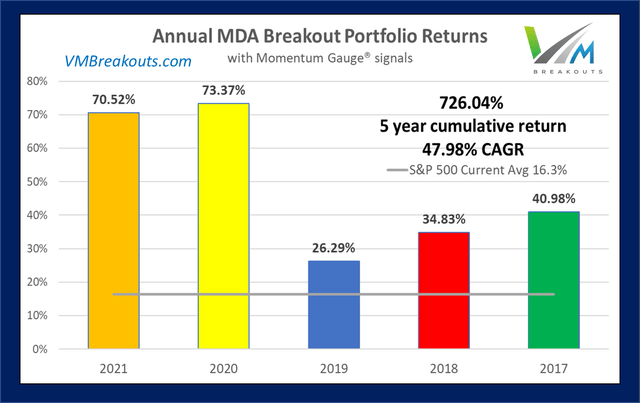

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 7 years. This subset of the different portfolios I regularly analyze has now exceeded 250 weeks of public selections as part of this ongoing live forward-testing research. The frequency of 10%+ returns in a week is averaging over 4x the broad market averages over the past 5+ years.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members’ request since 2020, I now generate only 4 selections each week. In addition 2 Dow 30 picks are provided, as well as a new active ETF portfolio that competes against a signal ETF model. Monthly Growth & Dividend MDA breakout stocks continue to beat the market each year as well. I offer 11 top models of short and long term value and momentum portfolios that have beaten the S&P 500 since my trading studies were made public:

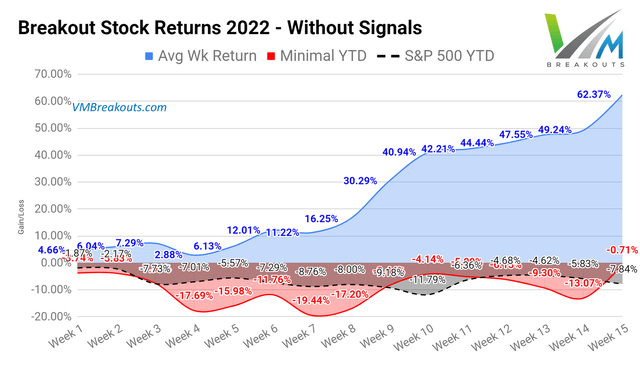

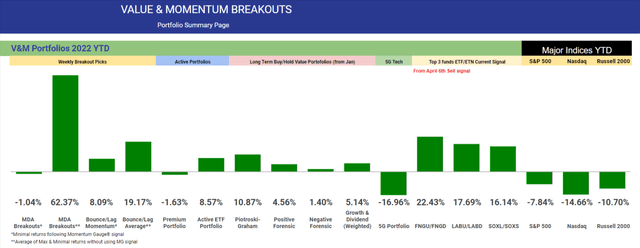

The cumulative average breakout returns for 2022 is up to +62.37% not using the gauge signal. Officially, for trading safety, there has only been one full week of a positive signal in 2022 with the 2nd worst start to the stock market since the global financial crisis. Despite high negative momentum conditions all year, 23 picks (38.3%) in 15 weeks are up over 10% and as high as 172.3% (RES), +120.5% (IPI), +94.7% (TDW) and +58.5% (GNK) significantly beating the major indices YTD.

Additional background, measurements, and high frequency breakout records on the Weekly MDA Breakout model is here: Value And Momentum MDA Breakouts +70.5% In 52 Weeks: Final 2021 Year End Report Card

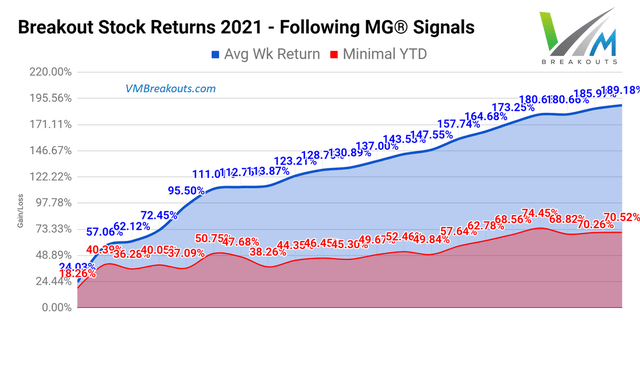

Returns from 21 Weeks of Positive Momentum Gauge signals in 2021

Last year there were only 21 positive trading weeks to achieve +70.5% returns. For 2022 we have only had one official positive weekly signal so far despite strong returns.

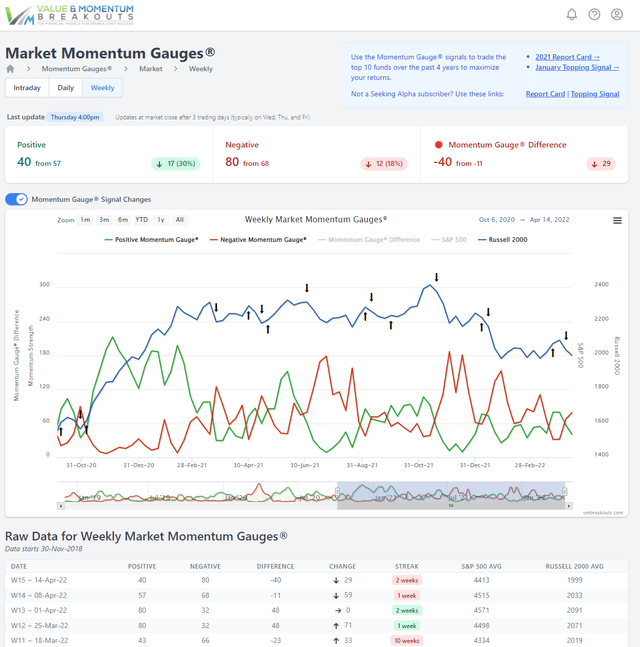

Momentum Gauge® trading signal: Negative conditions ahead of Week 16

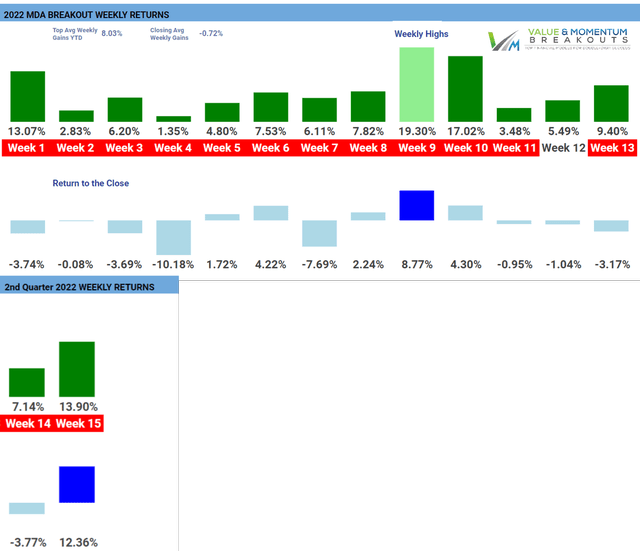

Weekly return measurements have started for the 2nd quarter of 2022.

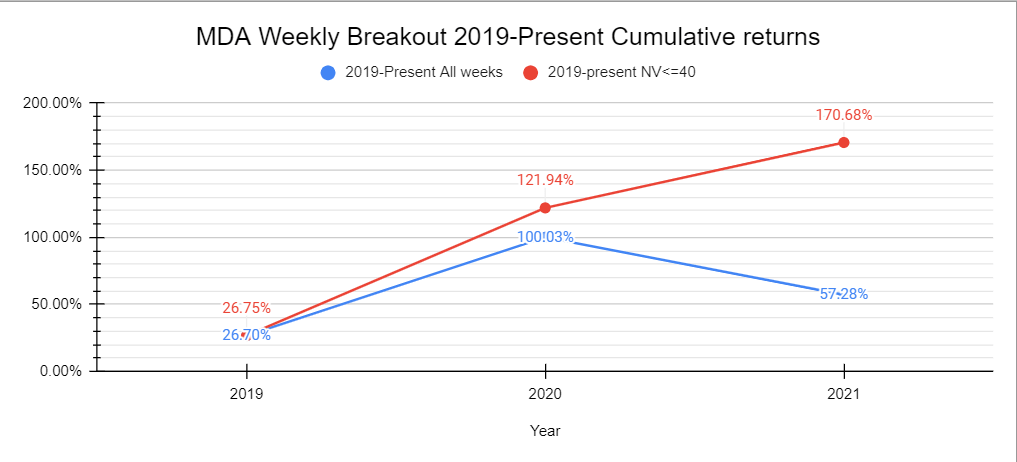

Red weekly color indicates negative Market Momentum Gauge signals. MDA breakout selections tend to outperform when the market signal is positive and negative values are below 40 level. This was an especially strong factor in 2021 showing cumulative returns below with and without the signal.

VMBreakouts.com

Historical Performance Measurements

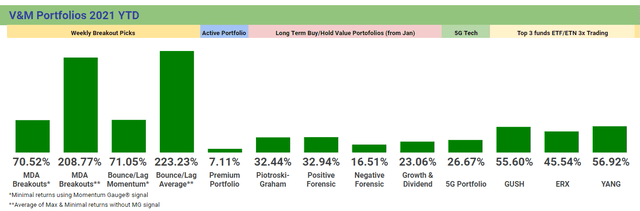

The MDA Breakout minimal buy/hold returns are at +70.5% YTD when trading only in the positive weeks consistent with the positive Momentum Gauges® signals. Remarkably, the frequency streak of 10% gainers within a 4- or 5-day trading week continues at highly statistically significant levels above 80% not counting frequent multiple 10%+ gainers in a single week.

Longer term many of these selections join the V&M Multibagger list now up to 133 weekly picks with over 100%+ gains, 61 picks over 200%+, 22 picks over 500%+ and 9 picks with over 1000%+ gains since January 2019 such as:

- Intrepid Potash (IPI) +3,182.9%

- Houghton Mifflin Harcourt Company (HMHC) +1,413.8%

- Enphase Energy (ENPH) +1,277.5%

- Celsius Holdings (CELH) +1,044.3%

- Trillium Therapeutics (TRIL) +1008.7%

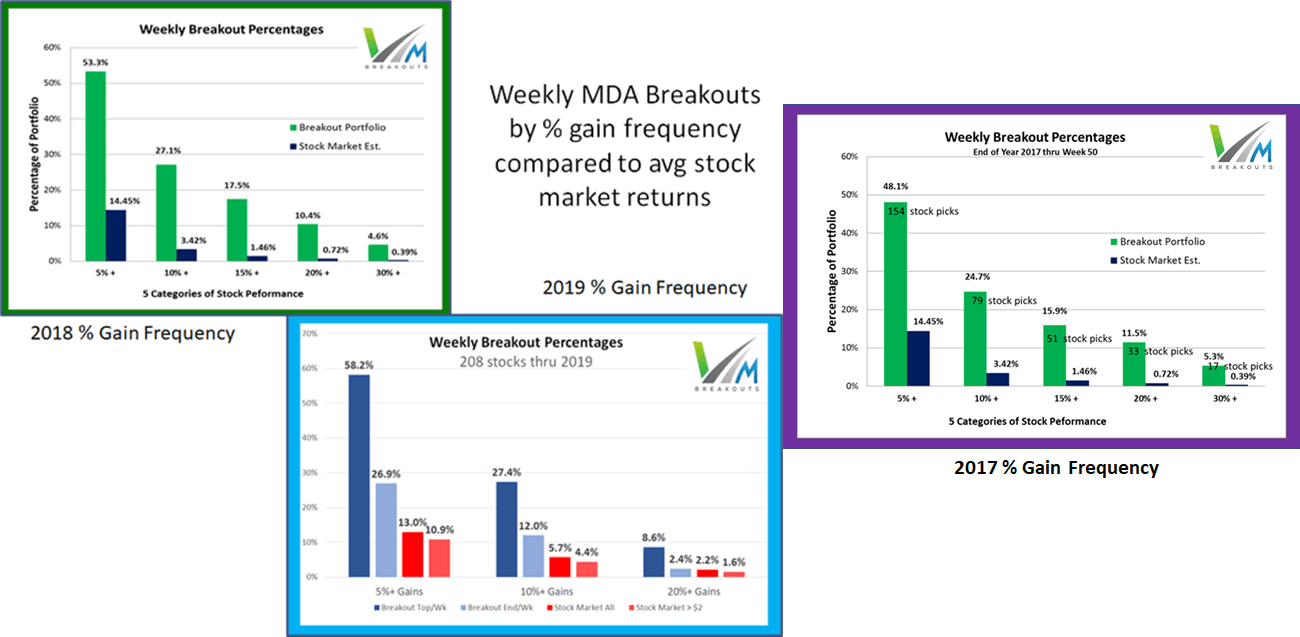

More than 200 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017. A frequency comparison chart is at the end of this article. Readers are cautioned that these are highly volatile stocks that may not be appropriate for achieving your long term investment goals: How to Achieve Optimal Asset Allocation.

2022 Breakout Portfolio Returns

The Momentum Gauge® conditions continue negative with only one full week of positive conditions in week 12 of 2022 with minimum returns of -1.0% following the signals and avoiding the 2nd worst quarter to start the year since 2009.

The Breakout Picks are high volatility selections for high short-term gains, but with no selections below $2/share, under 100K average daily volume, or less than $100 million market cap. Prior returns are documented here:

2022 marks the worst start to the stock market since 2009 and the Momentum Gauge® MDA buy signals have turned negative ahead of It is best to follow the signals and avoid momentum stocks until conditions turn positive.

Market Momentum Conditions

The Daily Market Momentum Gauges® based on 7,500+ stocks continue negative this week at Negative 71 and Positive 47. The negative value continues above 40 warning level of adverse market conditions.

The Weekly Momentum Gauges® continue negative with only three weeks positive in the past 21 weeks since November.

Two conditional signals that are very important to watch:

- Avoid/Minimize trading when the Negative score is higher than the Positive momentum score.

- Avoid/Minimize trading when the Negative score is above 40 on the gauge.

The Week 16 – 2022 Breakout Stocks for next week are:

The picks consist of 2 Industrials and 2 Basic Material sector stock. These stocks are released to members in advance every Friday morning near the open. Prior selections may be doing well, but for research purposes I deliberately do not duplicate selections from the prior week. These selections are based on MDA characteristics from my research, including strong money flows, positive sentiment, and strong fundamentals — but readers are cautioned to follow the Momentum Gauges® for the best results.

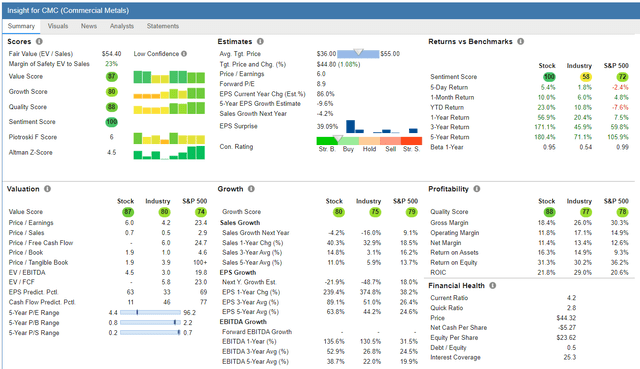

- Commercial Metals Company (CMC) – Basic Materials/ Steel

- Star Bulk Carriers Corp. (SBLK) – Industrials / Marine Shipping

Commercial Metals Company – Basic Materials/ Steel

Finviz.com

Price Target: $50.00/share (See my FAQ #20 on price targets)

(Source: FinViz)

Commercial Metals Company manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally. The company processes and sells ferrous and nonferrous scrap metals to steel mills and foundries, aluminum sheet and ingot manufacturers, brass and bronze ingot makers, copper refineries and mills, secondary lead smelters, specialty steel mills, high temperature alloy manufacturers, and other consumers.

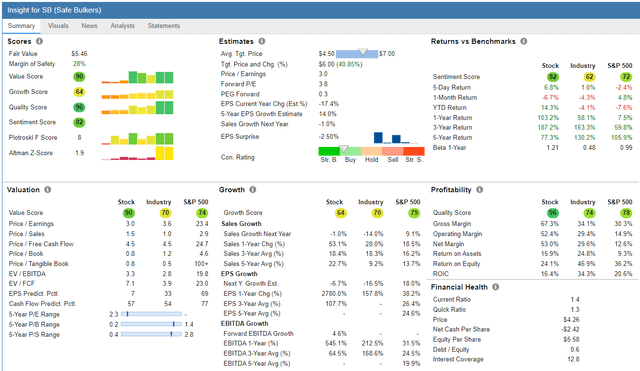

Star Bulk Carriers Corp. – Industrials / Marine Shipping

FinViz.com

Price Target: $47.00/share (See my FAQ #20 on price targets)

(Source: FinViz)

Star Bulk Carriers Corp., a shipping company, engages in the ocean transportation of dry bulk cargoes worldwide. The company’s vessels transport a range of major bulks, including iron ores, coal, and grains, as well as minor bulks, such as bauxite, fertilizers, and steel products.

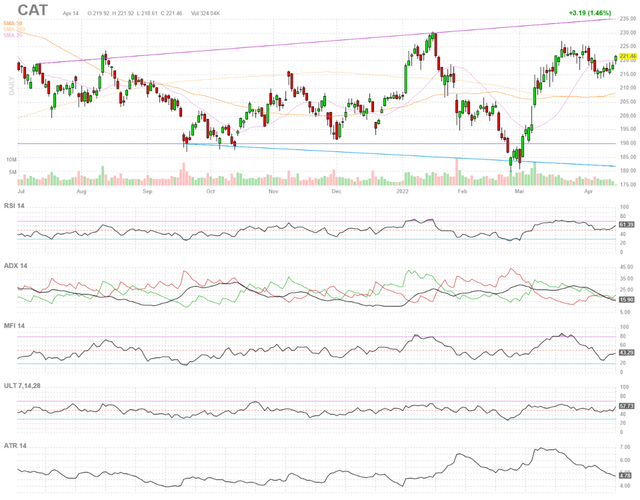

Top Dow 30 Stocks to Watch for Week 16

First, be sure to follow the Momentum Gauges® when applying the same MDA breakout model parameters to only 30 stocks on the Dow Index. Second, these selections are made without regard to market cap or the below-average volatility typical of mega-cap stocks that may produce good results relative to other Dow 30 stocks.

While I don’t expect Dow stocks to outperform typical breakout stocks over the measured five-day breakout period, it may provide some strong additional basis for investors to judge future momentum performance for mega-cap stocks in the short- to medium-term. The most recent picks of weekly Dow selections in pairs for the last 5 weeks:

| Symbol | Company | Current % return from selection Week |

| CVX | Chevron Corporation | +1.05% |

| (UNH) | UnitedHealth Group | -1.18% |

| KO | Coca-Cola Company | +4.42% |

| (MCD) | McDonald’s Corp | +1.16% |

| (KO) | Coca-Cola Company | +6.16% |

| (JNJ) | Johnson & Johnson | +1.98% |

| (HD) | Home Depot | -8.79% |

| (CVX) | Chevron Corporation | +8.93% |

| (TRV) | The Travelers Companies | +6.05% |

| (CAT) | Caterpillar | +6.04% |

If you are looking for a much broader selection of mega-cap breakout stocks beyond just 30 Dow stocks with more detailed analysis and strong returns I would recommend the Growth & Dividend MDA Breakout picks.

These selections are significantly outperforming major Hedge Funds and all the hedge fund averages since inception. Consider the actively managed ARK Innovation fund down -37.64% YTD and Tiger Global hedge fund and the Tiger Crossover hedge fund down over -34% YTD: Tech Rout Leads To Record 34% Loss At Tiger Global’s Hedge Fund

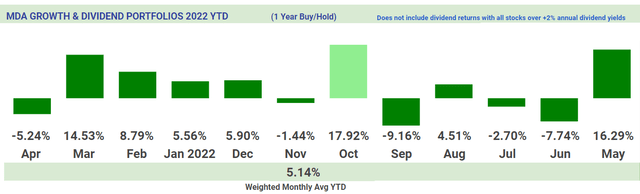

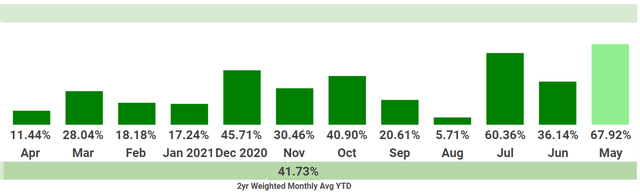

These picks are released monthly for long term total return with strong returns that are leading the S&P 500 by +13.0% through 2022. The March selections are heavy in energy up +14.5% and the new April picks are heavy in undervalued financial stocks. All the major market indices remain negative YTD and the 2-year returns of monthly portfolios are also shown below:

VMBreakouts.com VMBreakouts.com

The Dow pick for next week is:

Caterpillar Inc.

Caterpillar resumes strong breakout conditions from the last selection in March ahead of earnings April 28th. Institutions are net buyers and all the sentiment and money flow indicators are turning the positive again for the first time since March selection. Next move is to at least 235/share resistance at the top of the channel.

Background on Momentum Breakout Stocks

As I have documented before from my research over the years, these MDA breakout picks were designed as high frequency gainers.

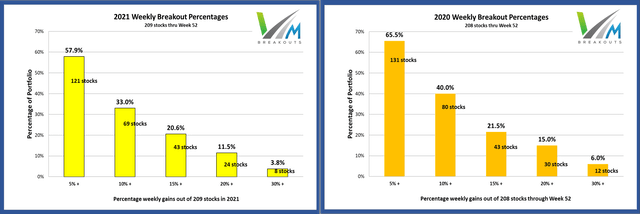

These documented high frequency gains in less than a week continue into 2020 at rates more than four times higher than the average stock market returns against comparable stocks with a minimum $2/share and $100 million market cap. The enhanced gains from further MDA research in 2020 are both larger and more frequent than in previous years in every category. ~ The 2020 MDA Breakout Report Card

The frequency percentages remain very similar to returns documented here on Seeking Alpha since 2017 and at rates that greatly exceed the gains of market returns by 2x and as much as 5x in the case of 5% gains.

VMBreakouts.com

The 2021 and 2020 breakout percentages with 4 stocks selected each week.

MDA selections are restricted to stocks above $2/share, $100M market cap, and greater than 100k avg daily volume. Penny stocks well below these minimum levels have been shown to benefit greatly from the model but introduce much more risk and may be distorted by inflows from readers selecting the same micro-cap stocks.

Conclusion

These stocks continue the live forward-testing of the breakout selection algorithms from my doctoral research with continuous enhancements over prior years. These Weekly Breakout picks consist of the shortest duration picks of seven quantitative models I publish from top financial research that also include one-year buy/hold value stocks. Remember to follow the Momentum Gauges® in your investing decisions for the best results.

All the V&M portfolio models are beating the S&P 500 that is down -7.84% for 2022. The new active ETF portfolio is up +8.57% YTD and value portfolios of Piotroski-Graham picks are up 10.9% through one of the worst quarters and starts in stock market history.

The final 2021 returns for the different portfolio models from January of last year are shown below.

All the very best to you, stay safe and healthy and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS

Be the first to comment