onurdongel/iStock via Getty Images

Investment thesis

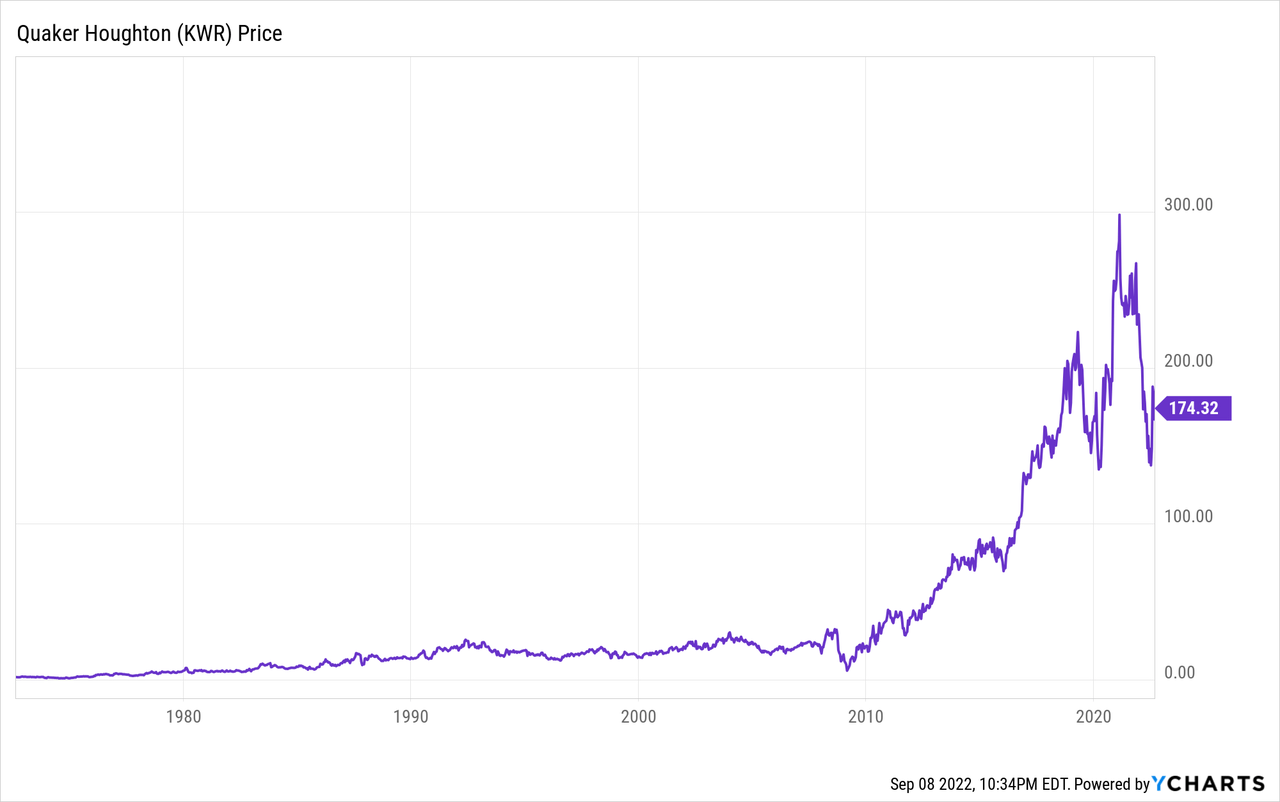

Quaker Chemical (NYSE:KWR), whose name was changed in 2019 to Quaker Houghton, is facing a large number of headwinds that are having a direct impact on its operations. Inflationary pressures are increasing the cost of goods sold, and margins are also being affected by increased labor costs, higher transportation prices, supply chain issues, COVID-19 disruptions in China, and lower raw material availability.

These headwinds caused a recent price decline of ~41%, which represents an opportunity to acquire shares at a reduced price for those dividend growth investors focused on the long term as headwinds are caused by current macroeconomic events and not by the nature of the company’s operations. In fact, the Houghton acquisition has boosted the company’s net sales, and the only problem for the company is that the current headwinds will make the deleveraging process slower than expected.

A brief overview of the company

Quaker Houghton is the global leader in industrial process fluids with operations in over 25 countries. The company was founded in 1918 and its market cap currently stands at $3 billion, employing around 4,700 full-time workers worldwide. Before 2019, the company’s name was Quaker Chemical, but its name changed when it was combined with Houghton, a family-owned distribution and manufacturing chemical company, in 2019, forming Quaker Houghton.

The company develops, produces, and sells a wide range of formulated chemical specialty products and offers chemical management services. These products include metal removal fluids, cleaning fluids, corrosion inhibitors, metal drawing and forming fluids, die cast mold releases, heat treatment and quenchants, metal forging fluids, hydraulic fluids, specialty greases, offshore sub-sea energy control fluids, rolling lubricants, rod and wire drawing fluids and surface treatment chemicals.

Quaker Houghton logo (Quakerhoughton.com)

The company also offers chemical management services for various heavy industrial and manufacturing applications, and its customers include thousands of the world’s most advanced and specialized steel, aluminum, automotive, aerospace, offshore, can, mining, and metalworking companies.

Currently, the share price stands at $174.32, which represents a 40.83% decline from all-time highs of $294.60 on February 22, 2021. This fall in price, however, is not in vain since operations have been weakened as a result of the current macroeconomic landscape, and this is the price that investors must pay in the form of patience in exchange for the discount in the price of the shares.

Recent acquisitions

In August 2019, the company acquired Houghton, a leading global provider of specialty chemicals and technical services for metalworking and other industrial applications, for $170.8 in cash, around 4.3 million shares of the resulting company, and the refinancing of approximately $660 million of Houghton’s net indebtedness. In total, the deal cost Quaker Chemical ~$1.6 billion. Following this transformative acquisition, in December 2020, the company acquired Coral Chemical Corporation, a U.S. provider of metal finishing fluid solutions, for ~$53 million.

The acquisition spree continued in 2021. During that year, the company acquired a tin-plating solutions business for the steel end market for approximately $25.0 million, certain assets for the company’s milling maskants product line for approximately $2.8 million, and the remaining interest in Grindaix-GmbH, a Germany-based high-tech provider of coolant control and delivery systems, for approximately $2.9 million. It also acquired Baron Industries, a U.S. provider of vacuum impregnation services of castings, powder metal, and electrical components for an initial payment of ~$7.1 million, and a business that provides hydraulic fluids, coolants, cleaners, and rust preventative oils for approximately $3.7 million.

And lastly, in 2022 January 2022, it acquired a business that provides pickling inhibitor technologies for the steel industry, drawing lubricants and stamping oil for metalworking, and various other lubrication, rust preventative, and cleaner applications, for approximately $8.0 million, and another business that operates in the sealing and impregnation of metal castings for the automotive sector, as well as impregnation resin and impregnation systems for metal parts for ~$1.4 million.

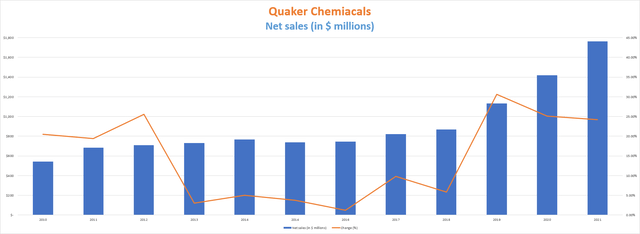

Net sales are skyrocketing thanks to the recently acquired businesses

Using 2021 as a reference, 23.4% of the company’s total net sales are provided by operations of the metal removal fluids product line, whereas rolling lubricants provides 22.2%, and hydraulic fluids 13.6%. The company’s net sales have more than doubled in the past decade, mostly boosted by the Houghton acquisition.

Quaker Chemicals net sales (10-K filings )

The coronavirus pandemic crisis caused a negative impact on the company’s volumes and net sales in 2020, which prevented seeing the impact of Houghton’s operations until 2021. Now, it can be stated that net sales increased by 55.38% from 2018 (before the acquisition) to 2021 (when the acquisition took full effect). During the second quarter of 2022, the company reported a 13.12% increase in net sales, which is attributable to the increase in the prices of its products as volumes actually declined by 4% year over year due to decreasing demand from Russia and minor divestitures resulting from the combination with Houghton. The company’s growth is currently being limited by issues in raw material availability, although this is temporary.

The top five customers account for ~10% of the company’s total net sales, while the largest customer accounts for 3% of total net sales, so the company really does not depend heavily on any one customer thanks to the large number of total customers, which currently stands at ~15,000 worldwide. Using 2021 as reference, 32.52% of net sales are provided by operations within the Americas, 27.26% from EMEA, 22.04% from Asia-Pacific, and 18.18% from the global specialty businesses segment.

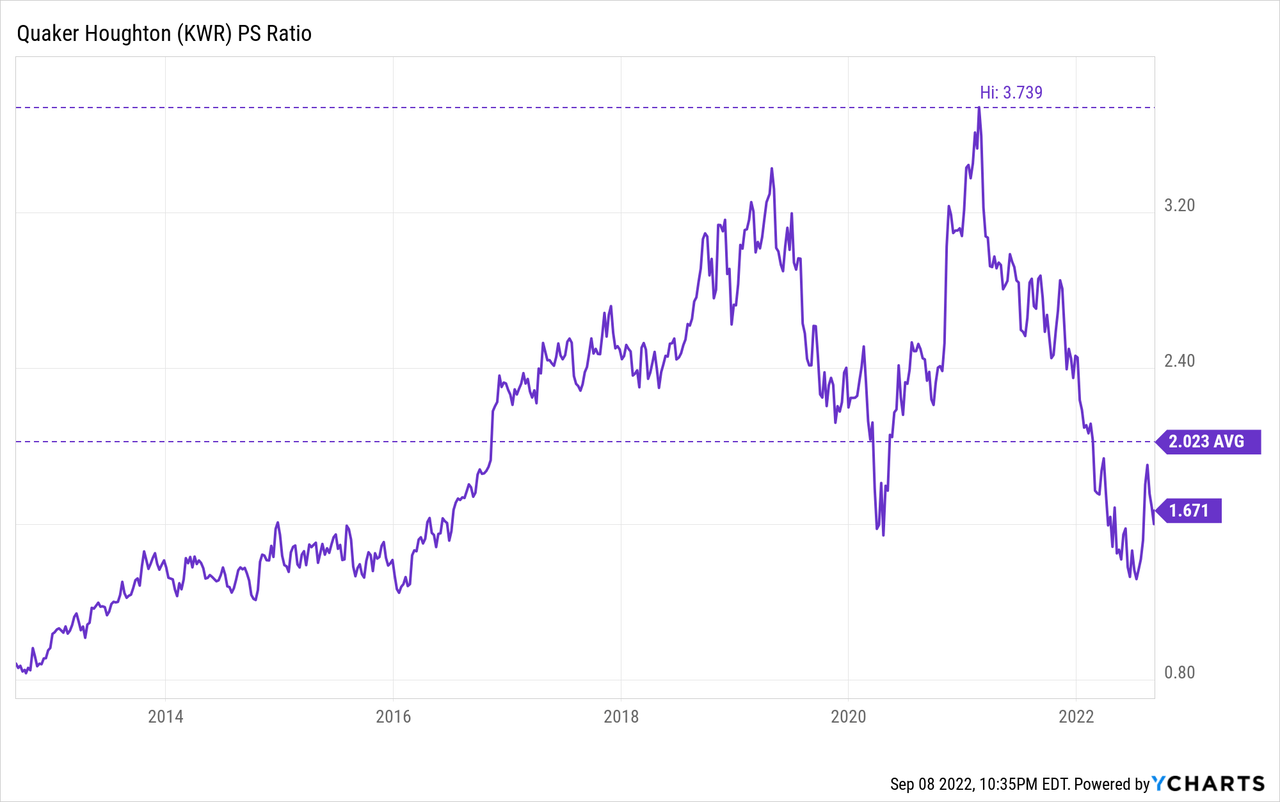

But despite the recent increase in net sales, the recent share price declined due to lower margins, which caused a drop in the P/S ratio to 1.671.

This means that the company currently generates $0.60 for each dollar held in shares by investors, annually. This ratio is significantly lower than the average of 2.023 during the past decade and the highs of 3.739 in the share price spike that took place after the coronavirus pandemic crisis dip. Still, it is very important to understand that investors are willing to pay less for the company’s sales due to Quaker Houghton’s loss of ability to convert those sales into actual cash as a result of the recent decline in profit margins.

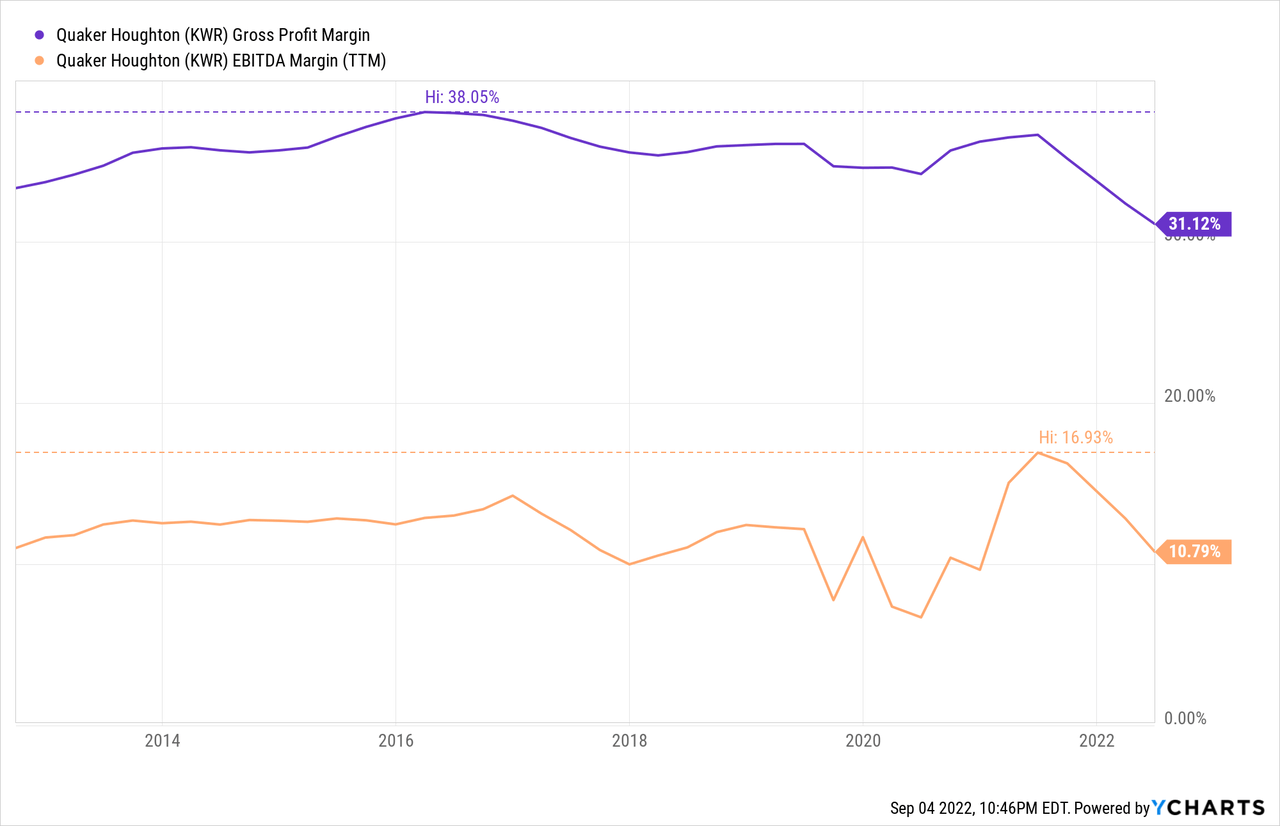

Margins are temporarily weak

The company is currently facing a series of headwinds that are having a direct impact on profit margins, including the increasing cost of goods sold due to inflationary pressures, declining raw material availability, COVID-19 disruptions in China, supply chain and logistic issues, unfavorable FOREX, labor shortages, decreasing demand in some end markets, and the current Ukrainian war.

Trailing twelve months’ gross profit margins of 31.12% is well below the highs of 38.05% reached during the last decade. EBITDA margins of 10.79% also suffered a decline compared to prior years due to the aforementioned headwinds.

Furthermore, gross profit margins of 30.38% during the second quarter of 2022 as the price of raw materials keep increasing represents a slight deterioration, and the same happens with EBITDA margins, which was 8.95% during the quarter. Still, it is very important to note that these margins are more than acceptable and allow the company to continue to be highly profitable. And what is more, these headwinds are, in my opinion, something temporary as they come from macroeconomic issues, and not by the nature of the company’s operations.

Currently, the management is working to take further pricing action to adapt the price of its products to the current costs of goods sold, but it is normal for margins to continue contracted in the short and medium term as long as inflation remains significantly above 2% since prices often take time to update as transferring them to the end customer is a relatively long process.

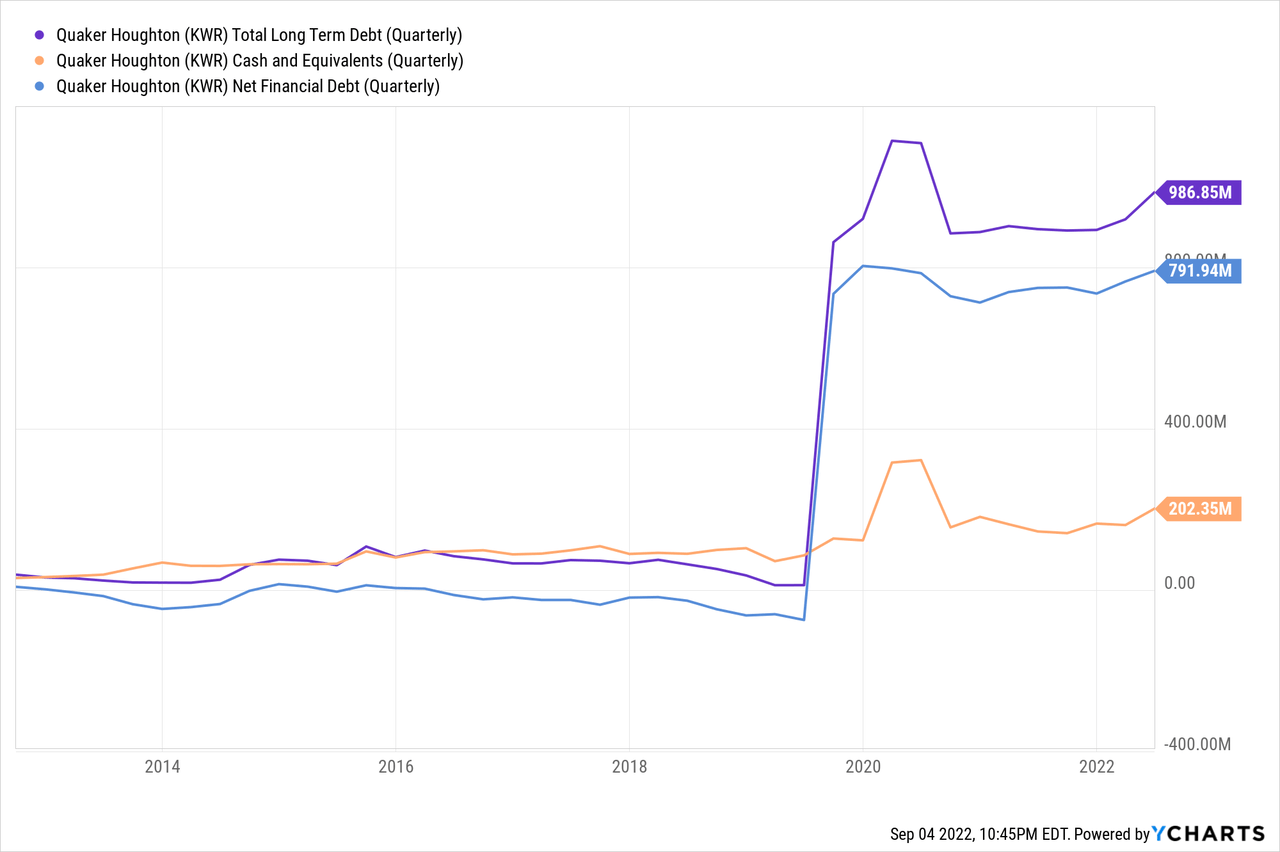

Debt has skyrocketed, and entering a deleveraging phase should soon become a top priority

Before the acquisition of Houghton, the company enjoyed a debt-free balance sheet in terms of net debt, but 2019 closed with long-term debt of $882.44 million. Currently, the long-term debt stands at $986.85 million while the company holds $202.35 cash on hand.

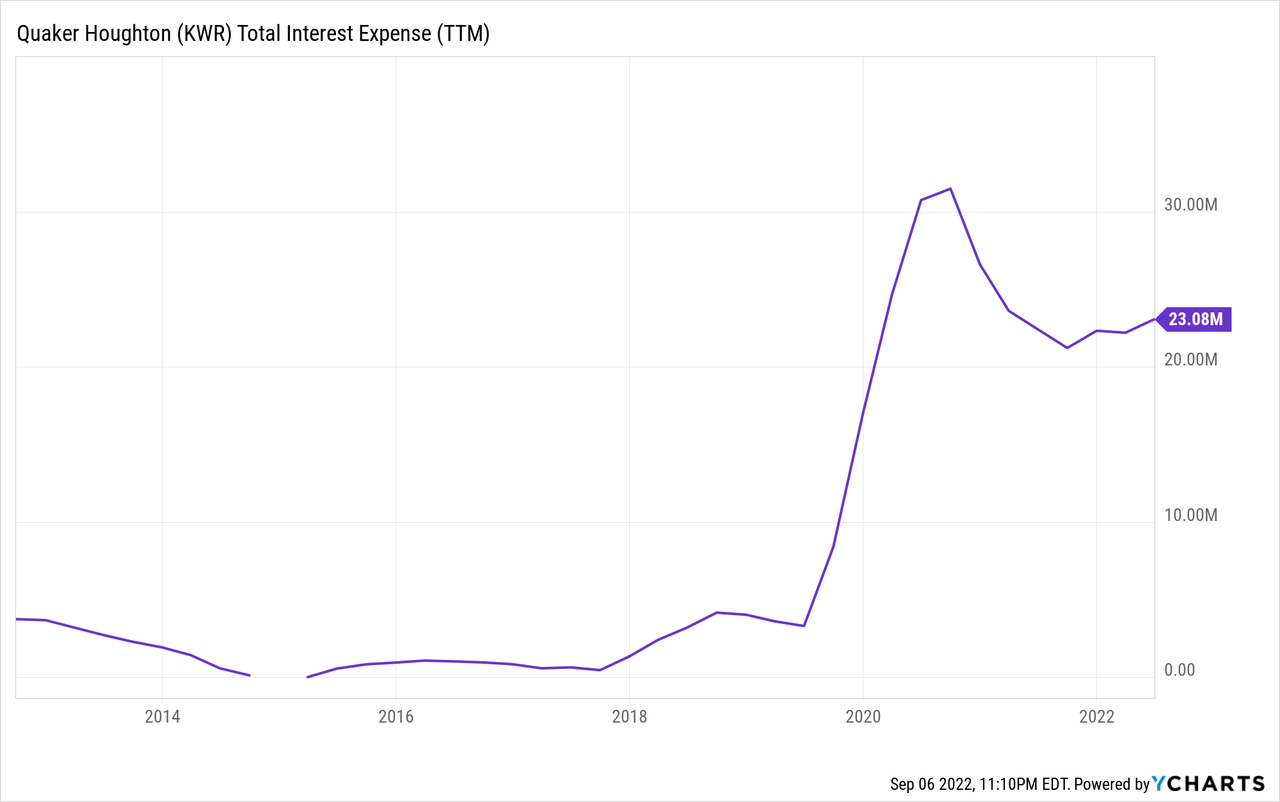

As a consequence of the acquired debt, the company now has to cover an interest payment of more than $25 million annually. Furthermore, interest expenses increased year over year due to increased borrowing costs and negative FOREX, and an expense of $6.49 million during the last quarter suggests trailing twelve months’ interest expenses may soon reach $26 million, which is significantly higher compared to the current trailing twelve months’ interest expenses of $23.08 million.

This will significantly limit the increase in dividends in the medium and long term until the company manages to reduce it significantly. This is so because the current interest expense is very close to the expense that the company faces each year to issue the dividend payment, and this is something that didn’t happen before the acquisition of Houghton.

The dividend is safe, but the company will likely have to significantly reduce its debt pile before continuing to increase it sustainably

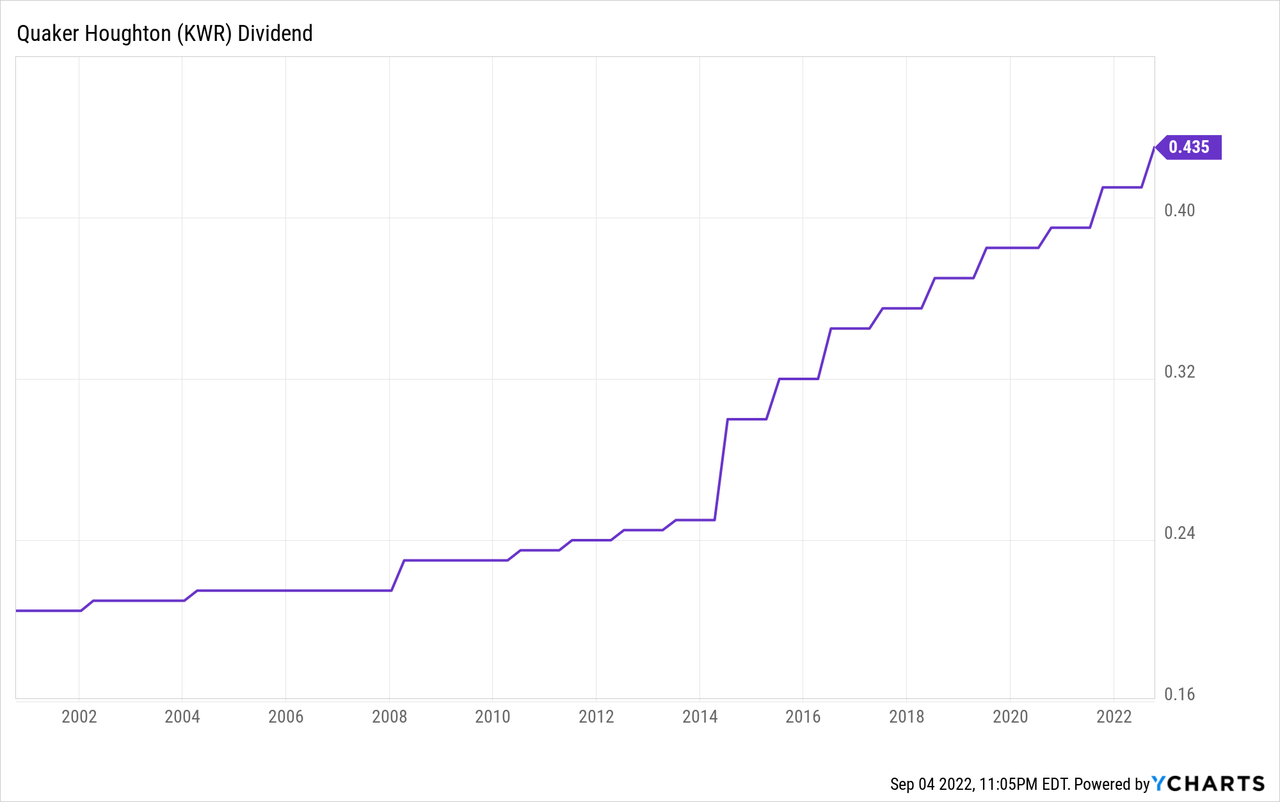

The company is a very reliable dividend payer as it has been paying a growing dividend for many years. These raises have recently accelerated as the dividend payout almost doubled during the past decade, and the last quarterly dividend increase took place in July 2022 when the company announced a 5% raise to $0.435 per quarter.

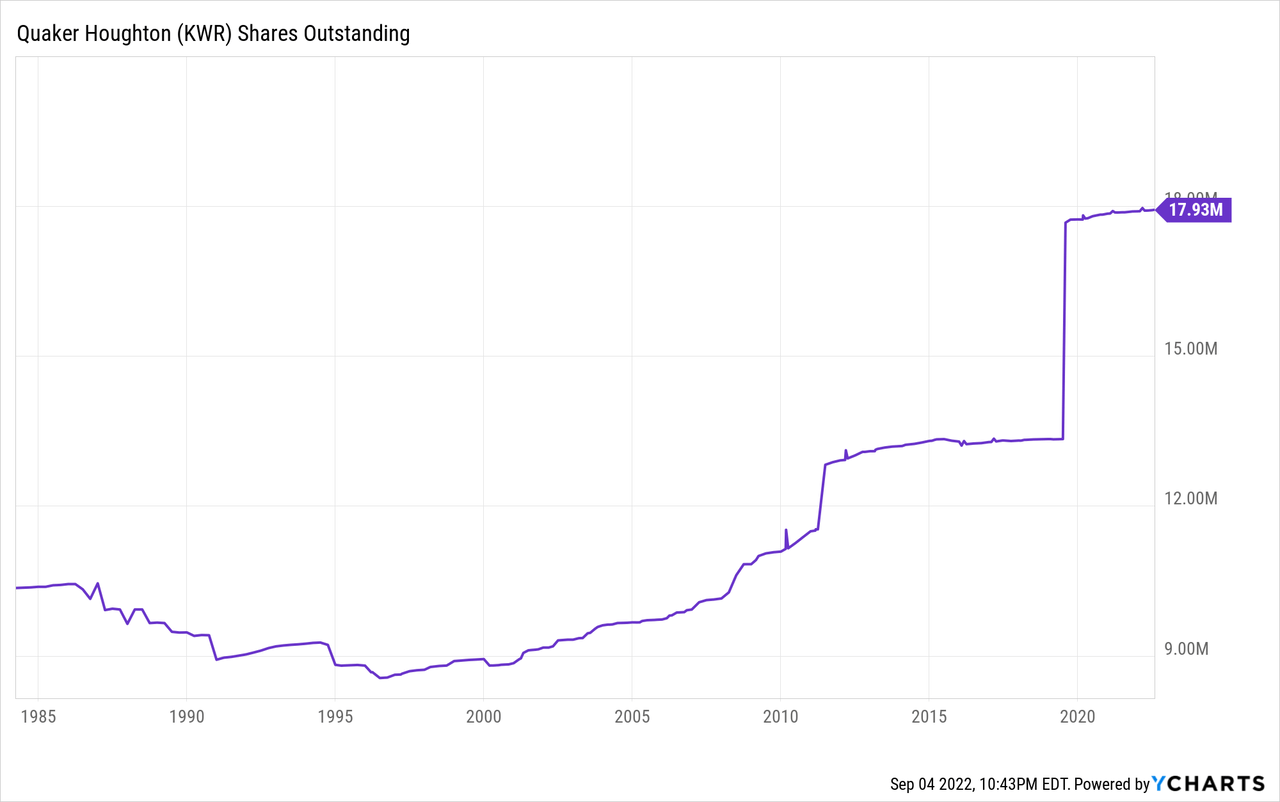

Still, and in my opinion, the rate of growth of dividends will slow down in the coming years due to two main factors: firstly, the dividend expense has increased significantly since the acquisition of Houghton as a result of share dilution, and secondly, because the expense in interest is now larger than the dividends the company paid before the acquisition. But it is also important to keep in mind that this dividend growth slowdown will be likely temporary because once the debt is significantly reduced, the company will be able to start using the cash generated by the newly acquired company to continue raising the dividend as it has done in recent years. The question is whether the management will decide to reverse the share dilution via share repurchases after that, something that investors should not count on as making significant share repurchases has not been a priority so far.

Next, I present a table where I have calculated the company’s cash payout ratio in order to determine the sustainability of the current dividend payout and the ability of the company to generate surpluses. To do this, I have calculated what percentage of the cash from operations is used to pay the dividend and cover the interest on the acquired debt. In this way, we will be able to determine how much cash the company has left over to continue with growth initiatives and reduce its current debt levels.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | $73.80 | $54.69 | $73.43 | $73.75 | $64.76 | $78.78 | $82.37 | $178.39 | $48.93 |

| Dividends (in millions) | $13.02 | $14.56 | $16.51 | $17.63 | $18.61 | $19.32 | $21.83 | $27.56 | $28.60 |

| Interest expense (in millions) | $2.92 | $2.37 | $2.59 | $2.89 | $3.89 | $6.16 | $16.98 | $26.60 | $22.33 |

| Cash payout ratio | 21.60% | 30.96% | 26.01% | 27.81% | 34.75% | 32.34% | 47.11% | 30.34% | 104.07% |

As we can see, the company has historically allocated a relatively small portion of the cash generated through its operations to the payment of dividends, including 2020, but this ratio has risen worryingly in 2021 as a result of the contracted margins added to the increased interest expense and the increase in the total number of outstanding shares derived from the acquisition of Houghton.

And looking at the present, during the first quarter of 2022, cash from operations was -$6.3 million, but inventory increased by $35.3 million and accounts receivable by $27.8 million, although accounts payable increased by $30,2 million. The second quarter of 2022 was also a relatively good quarter despite the -$2.1 million cash from operation reported as inventory increased again by $13.6 million and accounts receivable by $27.8 million in the same period while accounts payable declined by $7.6 million. Even so, the company needs to recover part of its lost margins in order to continue covering the dividend and interest expenses comfortably, otherwise it will have difficulties to reduce its current levels of debt.

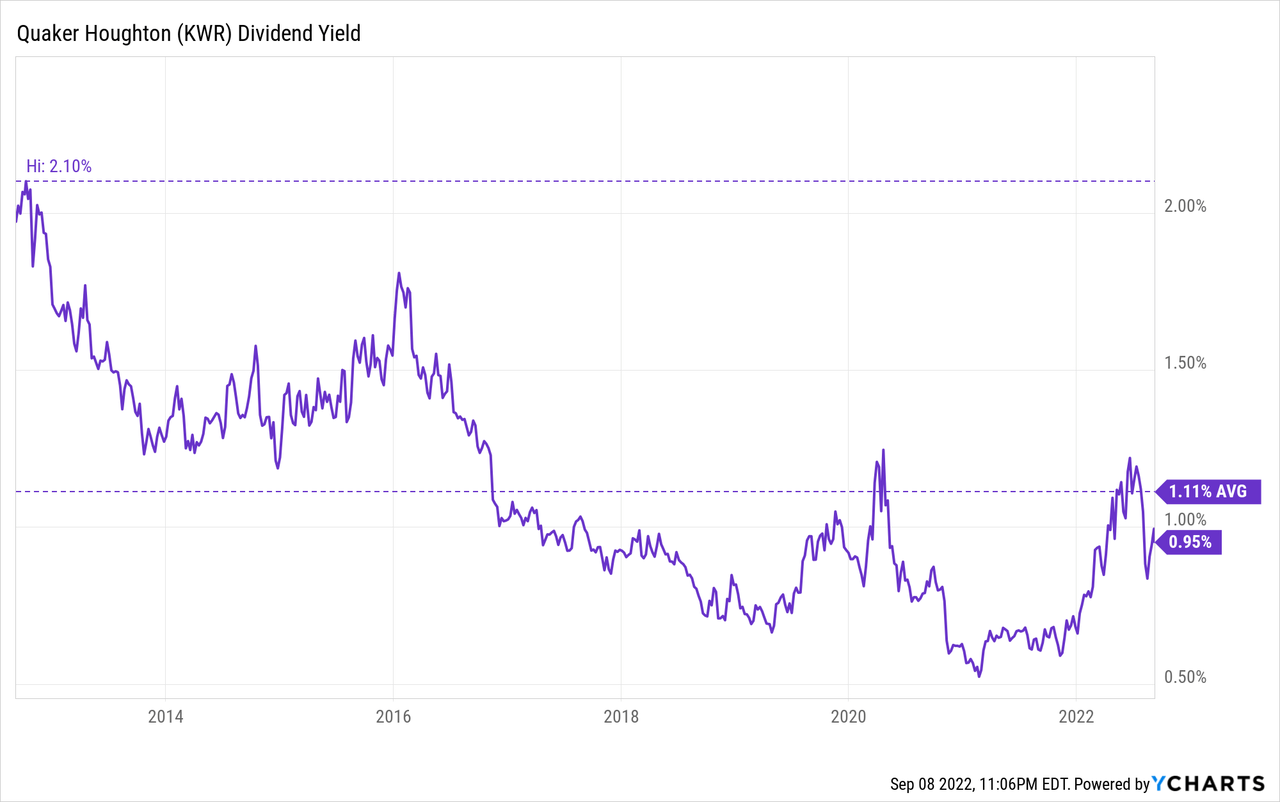

Currently, the dividend yield stands at 0.95%, which is significantly higher than the maximum of 2.10% reached a decade ago, but slightly lower than the average of 1.11% during the same period. Still, the current dividend yield still doesn’t reflect the latest dividend raise, so the forward dividend yield actually stands at 1.01%. This dividend yield, which is relatively low, is due to the fact that the company’s growth has accelerated in recent years and the cash payout ratio has historically been low and should be again once margins stabilize. In this sense, investors expect the company to keep raising it year after year. Although in the short and medium term this growth may be limited due to the debt contracted, once the profit margins stabilize, the company should be able to deleverage the balance sheet, which will continuously free up cash that can ultimately be used to pay dividends.

Risks worth mentioning

First of all, it is very important to note that the company now has almost $1 billion on the balance sheet. This means that if the margins continue to contract for a long time, the balance sheet could be weakened as a result of the interest expenses that said debt entails. Also, future growth, as well as further dividend raises, will be limited until the macroeconomic landscape allows for debt reduction.

The company’s profitability has been seriously affected as a result of the current macroeconomic headwinds. Declining gross profit and EBITDA margins have translated into reduced cash from operations. It is necessary that sooner or later these margins stabilize so that the company can cover its dividend and interest expenses with enough ease to be able to reduce its debt pile and thus continue growing its operations.

Investors who own Quaker Houghton shares should periodically monitor the number of shares outstanding as there is a risk of more share dilution because it has been going on for two decades. The total number of outstanding shares has grown over the years, with the last significant increase taking place in 2019 as a result of the Houghton acquisition. In January 2019, there was a total of 13,337,601 shares outstanding, and they increased by 34.42% to 17,929,045 as of July 31, 2022.

This means that each share represents a smaller portion of the company, which should be taken into account, especially in the case of dividend investors, since the said increase in the total number of outstanding shares has increased the cost of the dividend.

Conclusion

I do not see any problem related to the operations of Quaker Houghton, but rather a macroeconomic landscape that has caused a contraction in margins, which should stabilize once the inflationary pressures cease and the increased cost of goods sold is finally transferred to the customers completely. The current situation is far from good, but the company has enough cash on hand to withstand the current headwinds for a few years, and Quaker Houghton has historically demonstrated a high ability to generate strong cash from operations.

For this reason, I believe that the current drop of ~41% in the share price represents a good opportunity for long-term investors, as once the headwinds begin to relax, the performance of the recently acquired company, Houghton, will likely allow the company to deleverage the balance sheet, which will have a direct and very positive impact on the company’s ability to increase the dividend and continue to grow.

Despite all this, and because it is not certain when these headwinds will cease, I strongly advise potential investors to start a small position thinking about the possibility that the price could continue to fall because in this way they will be able to continue adding shares to the position at a lower and lower price in the event that the current headwinds take longer than expected to finally come to an end.

Be the first to comment