Michael H/DigitalVision via Getty Images

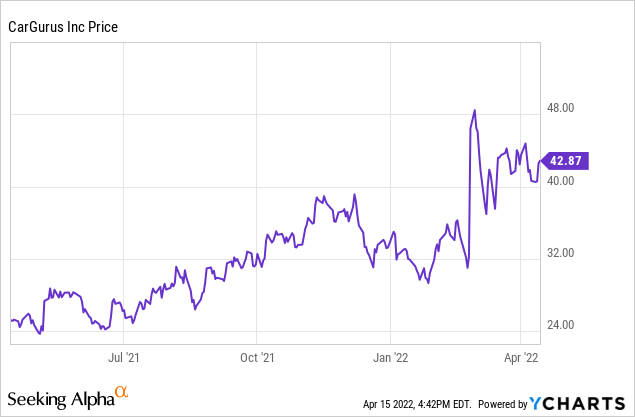

In a year where the most popular tech stocks have continued to sink underwater, older laggards are starting to come back into the spotlight and regain investors’ confidence. One good example of this is CarGurus (NASDAQ:CARG), which at its core is a used-car research website that has since evolved into becoming a one-stop shop for car dealerships to run their businesses.

CarGurus suffered dramatically during the pandemic. As brick-and-mortar dealerships boarded up shop and business shifted to online vendors like Vroom (VRM) and Carvana (CVNA), CarGurus saw massive defections from its paid dealership base and had to offer fee waivers in order to retain its customers. At a time during which demand for used cars was white-hot and prices were skyrocketing, CarGurus fell into a slump.

But fast forward to 2022, and the company is regaining strength. Year to date, the stock has rallied more than 20%, which is a reflection of A) improved fundamentals and growth, largely driven through a major recent acquisition and B) the company’s undervaluation entering into 2022. CarGurus, needless to say, has dramatically outperformed many of its flashier rivals in the tech sector (including and especially Carvana, which has seen its stock price plummet nearly 60% this year), and in my view that strength is slated to continue.

I remain quite bullish here – I think CarGurus’ rebound is just getting started.

The new face of CarGurus

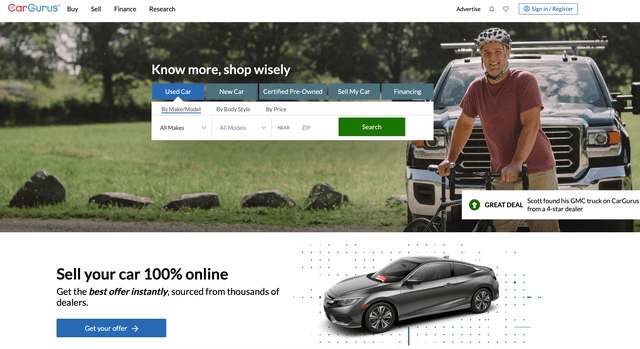

At its outset, CarGurus was (and remains today) a consumer-facing website. For investors who are unfamiliar with this company, here’s a look at what CarGurus’ landing page looks like. Car shoppers can filter for cars that they like, and are directed to available inventory in nearby dealerships:

CarGurus homepage (CarGurus.com)

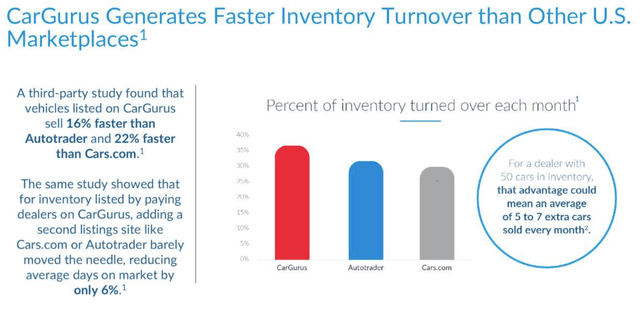

CarGurus still remains the #1 website by traffic for used cars in the U.S. Per CarGurus’ data, the company claims that inventory turnover is highest for inventory listed on its site, versus competitors Autotrader and Cars.com:

CarGurus inventory turnover metrics (CarGurus Q4 investor presentation)

While the core of this business has remained consistent, CarGurus is adapting its business model to be the one-in-all tool for dealerships to run and optimize their business. In 2021, the company acquired CarOffer, which is a wholesale auction network for dealerships to buy and sell from each other. The acquisition instantly roughly doubled CarGurus’ revenue scale.

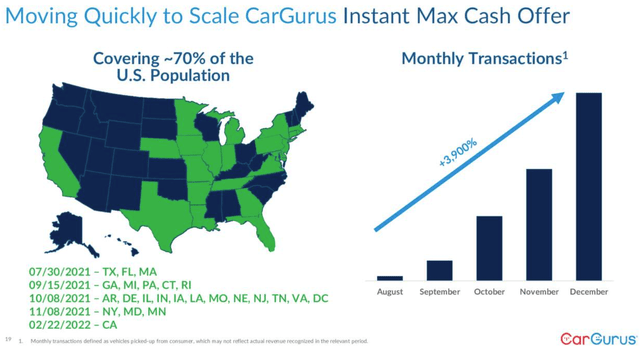

The other addition that CarGurus made was Instant Max Cash Offer. Under this program, consumers looking to sell their cars quickly can receive offers from dealerships on the spot. As of the end of Q4, Instant Max Cash Offer is now available to 70% of the U.S. population, and the chart on the right-side of the snapshot below shows the immense growth in transaction scale of this program:

CarGurus Instant Max Cash Offer (CarGurus Q4 investor presentation)

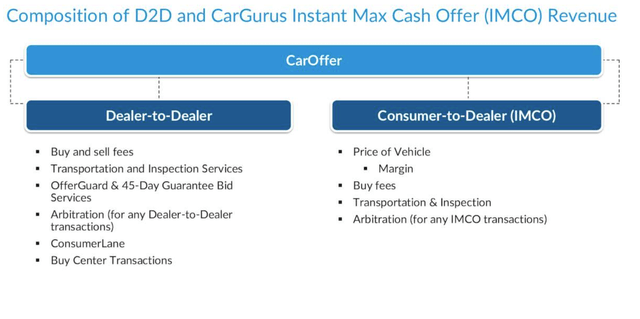

Now, CarGurus is a far more holistic platform. At its outset, CarGurus was simply a website for consumers to find and purchase cars from dealers. Now, CarGurus facilitates the buy-side of the dealers’ business as well, giving dealerships access to purchase cars through other dealerships or directly through consumers.

CarGurus dealer offering (Q4 investor presentation)

The bullish thesis for CarGurus; valuation update

In my view, the holistic buy/sell platform that CarGurus now offers for car dealerships positions it as an incredibly critical partner in the used-car industry. Here’s a refreshed look at the key points of the CarGurus bullish thesis:

- CarGurus has made itself essential for car dealerships. Even before adding CarOffer and Instant Max Cash Offer, CarGurus was long considered by dealerships to be a necessary partner due to the amount of web traffic flowing through its site nationwide. By adding the ability for dealerships to buy cars through the CarGurus network as well, CarGurus has effectively just doubled its wallet share within the used-car industry.

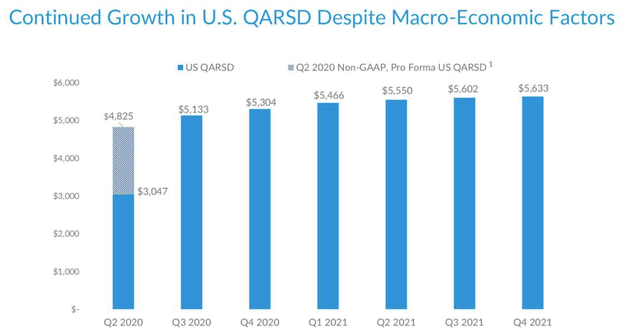

- CarGurus generates the kind of recurring revenue from dealers that Wall Street prizes. As the car dealership industry continues to heal, CarGurus will continue to enjoy a steady stream of fee income from these customers. Quarterly average revenue per car dealership also continues to rise.

- CarGurus remains the #1 site for used-car research in the U.S. By default, car dealerships (or any business, really) will go where the eyeballs are, and CarGurus has cemented its place as the leading site to do research before buying a used car.

- The used-car market is still red hot. Consumer demand for cars is still at historic highs, and a general inflation spike in all things including cars has driven up used-car prices and dealer fortunes as well.

- History of profitability. Though profitability and margins have dampened slightly as CarGurus continues to integrate the CarOffer acquisition, the high-margin nature of its web advertising business and CarGurus’ historical ability to drive profits and cash flow should lead to significant future upside.

And in spite of the recent upward drive in CarGurus’ stock, the company still remains quite modestly valued. At current share prices near $43, CarGurus trades at a market cap of $5.06 billion. After netting off the $321.9 million of cash on CarGurus’ most recent balance sheet, the company’s resulting enterprise value is $4.74 billion.

Meanwhile, for the current fiscal year FY22, Wall Street analysts are expecting CarGurus to generate $1.89 billion in revenue, representing 99% y/y growth (driven by the CarOffer contribution). Against this revenue expectation, CarGurus trades at 2.5x EV/FY22 revenue, which is a relative bargain for CarGurus’ blended ~60% gross margin profile.

Stay long here – this stock is offering quite a few fundamental strengths and growth drivers for a cheap price.

Q4 download

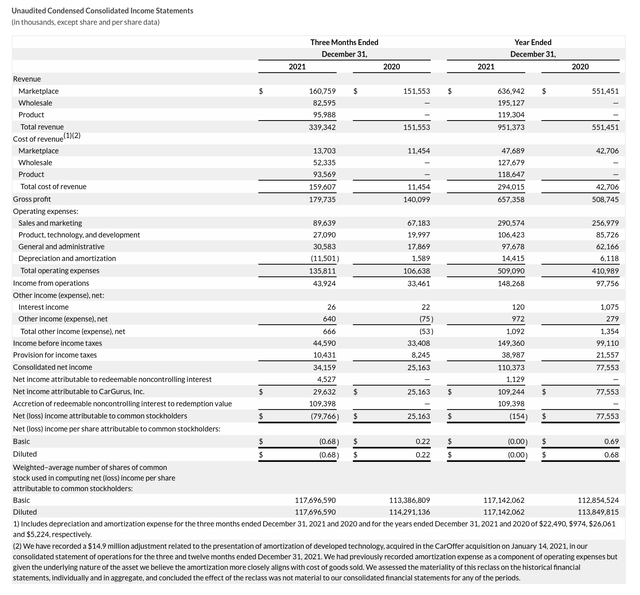

Let’s now go through CarGurus’ latest Q4 results in greater detail. The Q4 earnings summary is shown below:

CarGurus Q4 results (CarGurus Q4 earnings release)

CarGurus’ revenue grew at a consolidated 124% y/y pace to $339.3 million in the quarter, beating Wall Street’s expectations of $279.9 million (+85% y/y) by a huge margin. Excluding the CarOffer contribution (wholesale and product revenue lines in the snapshot above), CarGurus’ core marketplace business has returned to growth after stumbling during the pandemic; with marketplace revenue growing 6% y/y to $160.8 million.

Dealer counts remained stable at ~30.6K paying dealers quarter over quarter. However, quarterly revenue per paying dealer has continued to shift upward, to an all-time high of $5,633 at the end of Q4:

CarGurus QARSD (CarGurus Q4 investor presentation)

Here’s some helpful anecdotal commentary from CEO Jason Trevisan’s prepared remarks on the Q4 earnings call on the quarter’s performance, plus how the company is thinking to reinvest in growth in the current year:

Similarly, despite the macroeconomic headwinds and inventory challenges faced by dealers, we delivered an equivalent number of average leads per inventory unit for paying dealers in the US for Q4 year-over-year, further highlighting our ability to bring lower funnel, high intent shoppers to our site and deliver what we believe is industry leading ROI for our paying dealers.

As we enter 2022, we plan to increase marketing spend to bring high intent shoppers to our site and deliver the highest ROI to our dealer partners, who continue to navigate through the challenges of the semiconductor chip shortage. We are pleased with our fourth quarter full year results for the automotive industry faced numerous challenges and unknowns in 2021. Due to the semiconductor chips shortage, we remain nimble and quickly provided solutions to help combat the difficulties our dealer partners and consumers face.”

Re-acceleration in marketplace organic growth rates would help drive boosted confidence in CarGurus, especially as that is the business driving 90%+ pro forma gross margins.

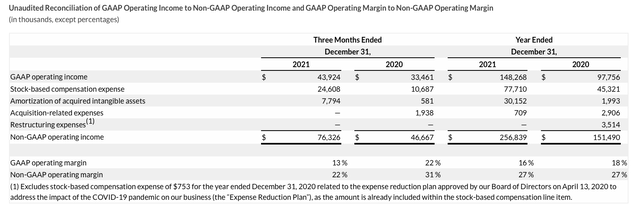

CarGurus also grew pro forma operating income by 63% y/y to $76.3 million in the quarter, though margins fell to 22% driven by the lower-margin CarOffer revenue stream:

CarGurus Q4 operating profits (CarGurus Q4 earnings release )

The company’s pro forma EPS of $0.43 also beat Wall Street’s expectations of $0.30 with considerable upside.

Key takeaways

There’s a lot to like about CarGurus as we head into the remainder of 2022. The company has fleshed out its business model to capture the buy-side of the used-car transaction and is now presenting itself as an all-in-one platform for car dealerships. Continue to ride the upward wave here.

Be the first to comment