jetcityimage

As we look ahead to a potential macro recession, it has become clear that some tech businesses are better-equipped to deal with a slowdown than others. Consumers have noticeably started to pull back spending especially on big-ticket discretionary purchases, which is having a disproportionate impact on companies like Wayfair (NYSE:W).

The largest and best-known furniture e-commerce vendor, Wayfair was temporarily selling like hotcakes during the pandemic. This was driven by a number of factors, including the closure of in-store furniture competitors as well as a massive nationwide moving phenomenon, where in particular many families relocated out of cities and into suburbs. Some investors may have thought that Wayfair’s growth during this time (which exceeded 2x y/y in some quarters) was proof that the company was finally executing on its long-held thesis of addressing a $1+ trillion TAM. But now in the post-pandemic fade, we’re finding that the business is struggling to maintain those demand levels – while also suffering under the weight of the added opex that it took on to support the pandemic peak period of demand.

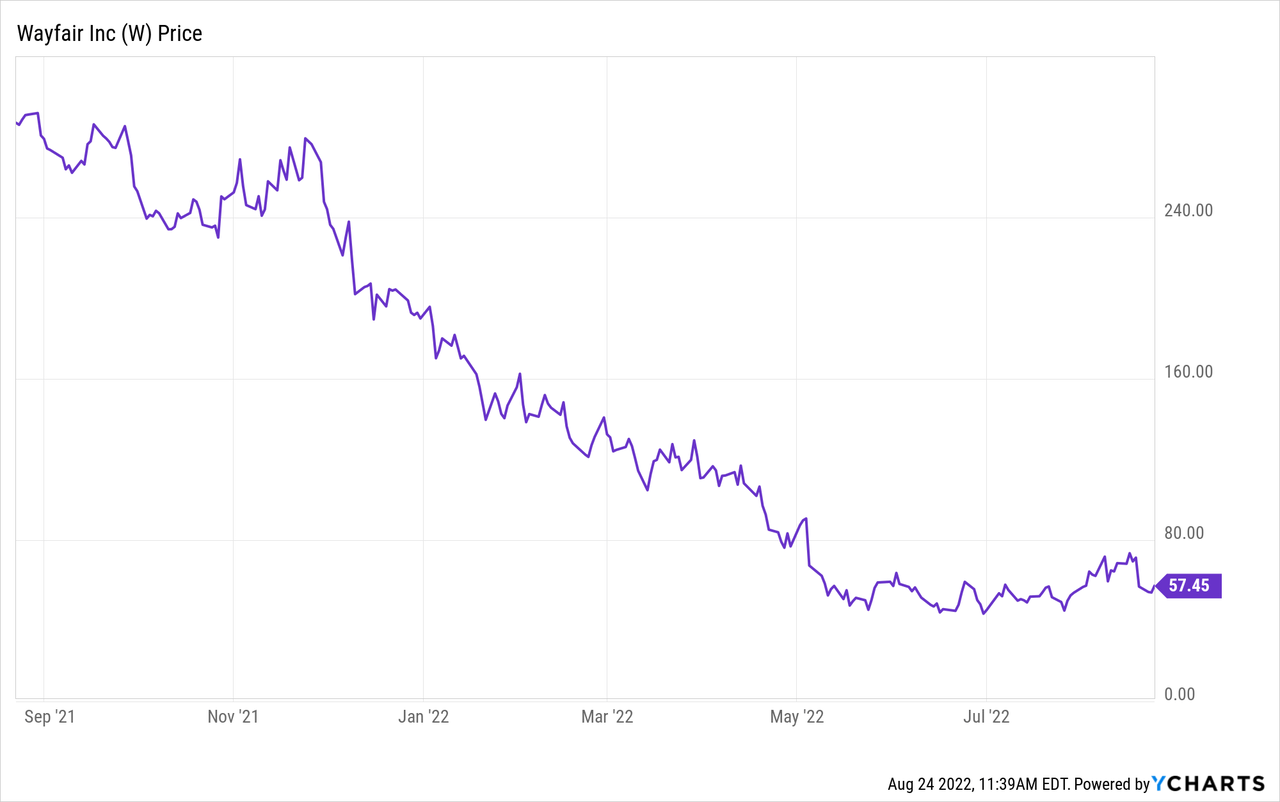

Year to date, shares of Wayfair have lost more than 70% of their value. Losses continued after the company posted disappointing Q2 results in early August, and in my view, the pain doesn’t have a short-term fix to it.

The question that investors are asking now is: is this a good time to buy Wayfair while it’s trading significantly off highs? I remain neutral on the name. I don’t think we’ve seen the worst for Wayfair yet, as we move into the back half of 2022, yet I agree that the fall in Wayfair’s stock is commensurate with the added fundamental risks that the company has exposed.

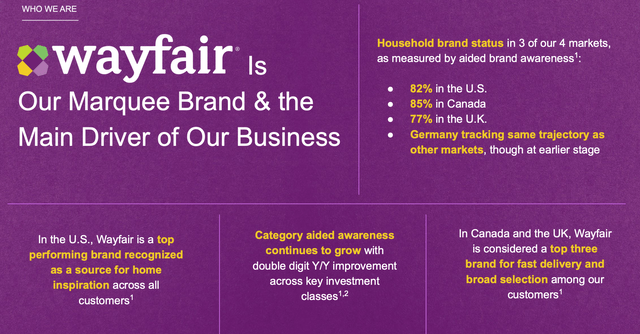

Here’s the key issue with Wayfair, in my view: it’s no longer exactly a new company with a broad mandate to grow. By its own admission, aided brand awareness in Wayfair’s key markets is already hovering around ~80%:

Wayfair brand awareness (Wayfair Q2 earnings deck)

This is unlike many other growing consumer companies, such as YETI (YETI) for example – whose brand awareness in the U.S. is hovering in the ~20% range. The key takeaway to resonate here: almost everyone already knows what Wayfair is. There isn’t an untapped swath of the market that Wayfair can grow into that it can bank on.

And yet even at its >$10 billion annual revenue scale, Wayfair was only able to post a profit during its peak pandemic year. Now gross margins are on the decline, and there doesn’t seem to be a path to further revenue growth and economies of scale.

The bottom line here: Wayfair showed the markets a glimmer of hope in 2020 and 2021 when its demand peaked at all-time highs, but those tailwinds proved to be one-time in nature. With all signs now pointing toward margin contraction and continued revenue decay, I’d steer clear of Wayfair and wait for either the stock to continue plunging or for fundamentals to turn around.

Q2 download

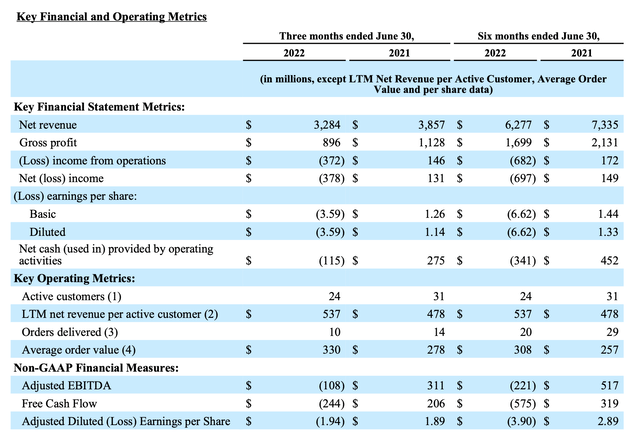

Let’s now review Wayfair’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Wayfair Q2 results (Wayfair Q2 earnings deck)

Wayfair’s revenue declined -15% y/y to $3.28 billion in the quarter, missing Wall Street’s expectations of $3.37 billion (-13% y/y) by a two-point margin. Wayfair’s revenue decline also worsened by one point relative to a -14% y/y decay in Q1.

Wayfair also continued to see its customer base peel down. It ended Q2 with 24 million active customers (defined as a person who made a purchase on one of Wayfair’s sites within the trailing twelve months), down substantially versus 31 million in the second quarter last year and down 1 million versus 25 million customers in Q1.

Anecdotally, this makes sense. Furniture tends to be a large, one-time purchase. A lot of furniture-buying happens when people are moving homes, which was accelerated during the pandemic. Far fewer people are moving now, with lots of economic uncertainty (hiring freezes, layoffs) as well as substantially higher mortgage borrowing costs that is exerting a chill on the housing market.

Looking ahead to Q3, CFO Michael Fleischer did note that the early trends so far in Q3 are soft, breaking from typical seasonality where Q2 and Q3 tend to be roughly flat to each other. Per his prepared remarks on the Q2 earnings call:

Let’s now turn to the outlook. I want to start as we have in quarters past with some details on quarter-to-date performance, after which I’ll walk through the rest of the P&L for Q3, while adding in some qualitative color on our expectations beyond that. Across the third quarter so far, our gross revenue is down about 10% year-over-year, which would indicate a break from the typical seasonal pattern, where Q2 and Q3 are typically similarly sized. Based on the current trend, we would expect Q3 net revenue to be below Q2 levels. Unsurprisingly, we see this weakness being driven by the impact of macroeconomic forces on consumers, and reflected in the growth of our category overall”

The other major callout for the quarter is on margins. Gross margins fell back to 27.4% in the quarter, down 180bps versus 29.2% in the year-ago Q2. Higher logistics costs, as well as increased spend on customer service and support, drove this decline.

We continue to worry about the sustainability of Wayfair’s business model – especially as we have already cemented that the business has hit a near-term scale peak and is unlikely to grow substantially from here. Adjusted EBITDA swung to a -$104 million loss, representing a -3.3% margin, down eleven points from a positive 8.1% margin in the year-ago Q2.

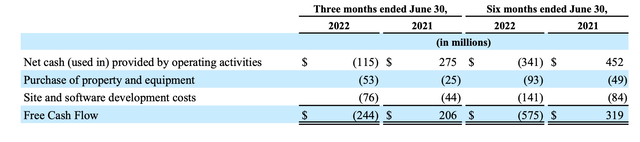

Similarly, year-to-date FCF bled to a loss of -$575 million through Q2, versus a $319 million gain in the year-ago period:

Wayfair cash flow (Wayfair Q2 earnings deck)

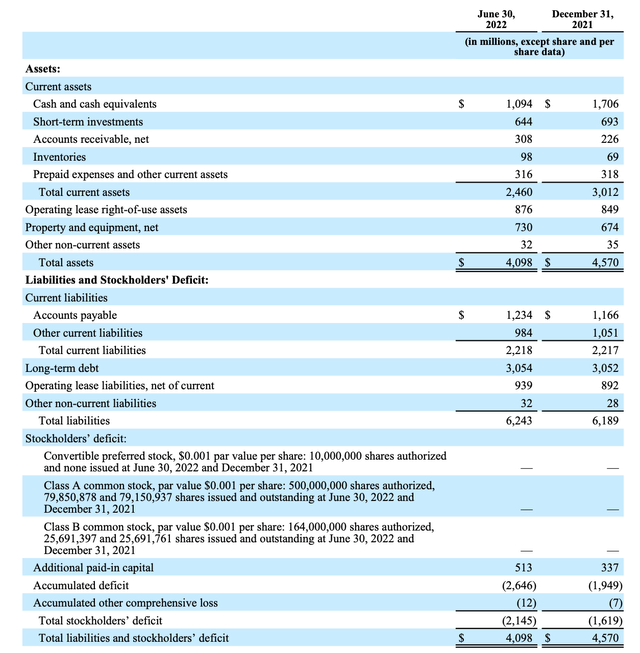

We have to start worrying about the impact to Wayfair’s balance sheet. Already, the company is sitting on only $1.09 billion of cash, not to mention $3.05 billion of debt:

Wayfair balance sheet (Wayfair Q2 earnings deck)

If these revenue and margin trends persist, it may not be long until Wayfair has to raise additional capital – precisely at the time that capital is not only getting more difficult, but more expensive to raise.

Key takeaways

There’s too much uncertainty with Wayfair to make it a comfortable investment, even at its far-diminished share prices. Continue to adopt a watch-and-wait stance here, and don’t rush in to buy.

Be the first to comment