Andrew Burton

Many of us already invest in growth exchange-traded funds (“ETFs”) with the objective of appreciating our invested capital, while others choose funds that aim to provide regular income through high dividend yields.

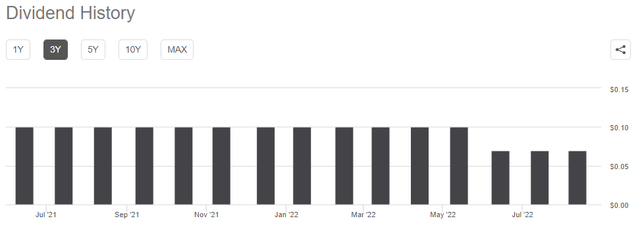

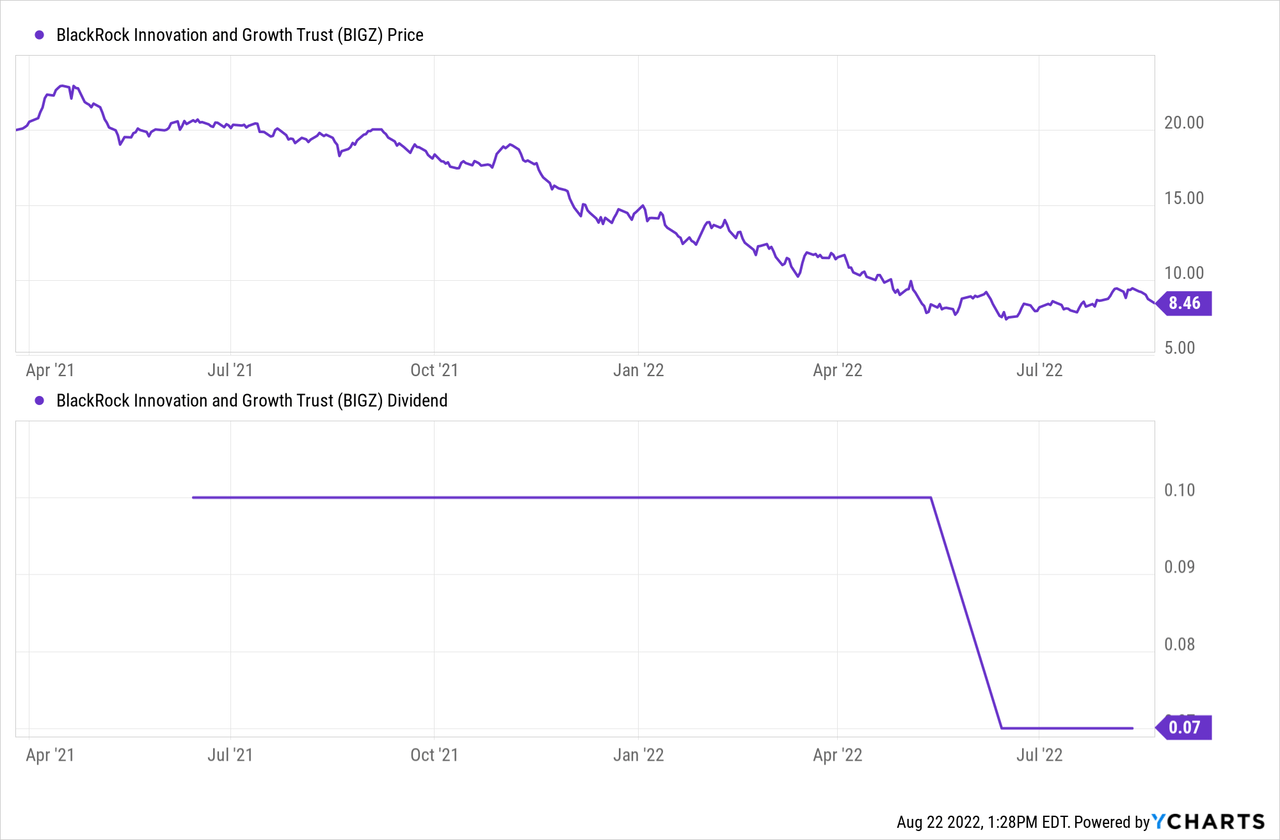

Trying to provide both growth and income is the BlackRock Innovation & Growth Trust (NYSE:BIGZ). It provides capital appreciation while generating monthly income, but after it reduced its monthly distributions for the last two months and August as shown in the chart below, it becomes important to assess whether the fund is delivering on its strategy.

Monthly Distributions (www.seekingalpha.com)

Hence, my objective with this thesis is to understand what caused this drop in dividends while at the same time providing insights as to its holdings, especially how it differentiates itself from typical innovation and growth funds in the marketplace.

The Holdings

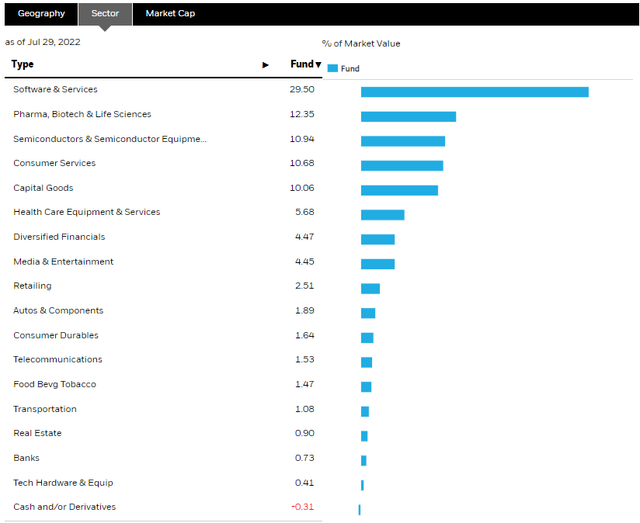

First, just like ARK Innovation ETF (ARKK), the trust is focused on finding innovative companies across a broad range of sectors. However, far from looking exclusively at disruptive innovation companies in gene therapy or technology, the fund managers at BlackRock rather see innovation as happening in all sectors of the economy, not just tech or healthcare. Thus, their fund targets a more diversified product set than ARKK and also includes sectors like Consumer Services and Capital Goods as shown in the extract below.

Sectors covered (www.blackrock.com)

Furthermore, BIGZ does not crave “the next big thing” type of stock, but instead, prioritizes the business model. Thus, potential holdings should serve a “well-defined” market with the targeted customer base being discerned. The financial structure is also tightly scrutinized with roughly 95% of stocks having positive free cash flows.

Another differentiator is that the fund also includes private companies, which formed 27.4% of its portfolio at the end of Q2-2022, up from 25% previously. This takes the form of 29 private investments from diversified industries and provides an opportunity for those who do not have access to the private equity space, especially at a time when a softening of the IPO (initial public offering) market is resulting in less publicly listed companies to enter the stock market.

I also like the fact that BlackRock looks beyond big techs and other well-publicized stocks to also include small to mid-sized companies whose market caps can be $10 billion or less.

To drive income and reduce risks, BlackRock has devised a “Dynamic options strategy” which consists of writing covered calls that use the volatility inherent in growth stocks to translate it into income for investors.

The Dynamic Options Strategy

Now, for those who are new to the field, covered calls form part of the option strategy, which as its name suggests offers investors the choice of buying or selling a particular stock at a “strike price.” Pursuing further, one of the simplest and most used options strategies is to write a covered call on the stock position that is already held. For this purpose, BlackRock held a portfolio made up of 79 stocks as of July 29.

Thus, while active fund managers make regular changes in the portfolio to get better returns, those at BIGZ can also write covered options.

Without going into the nitty-gritty of covered calls, it permits additional gains to be obtained by taking advantage of the market volatility. Here investors will note that except for a post-IPO surge to the $23 level, the trust’s unit price has been on a net downtrend from March 2021 onwards. However, during that time, it has provided shareholders with a monthly income of $0.1 per share till May 2022. As a result, the portfolio provides a distribution rate (based on the market price at the end of the quarter) of 10.6%.

Distributions subsequently decreased to a monthly rate of $0.07 in June. This can be explained by this period being relatively less volatile as shown in the chart below, thereby only allowing the fund managers to capture a smaller credit on written calls. For investors, lower implied volatility (or expectations of future volatility) shows up as a decrease in the option’s value signifying less income generated for distribution to shareholders, after accounting for the expense ratio of 1.29% which includes management fees.

However, such a strategy is not without risks.

The Risks

Since the option strategy amounts to profiting from the movement of a stock, the risks are that to achieve a certain targeted income level, one has to potentially forfeit the future upside of a given stock’s position. This ultimately comes to finding a balance between capital appreciation on the one hand and options premiums on the other.

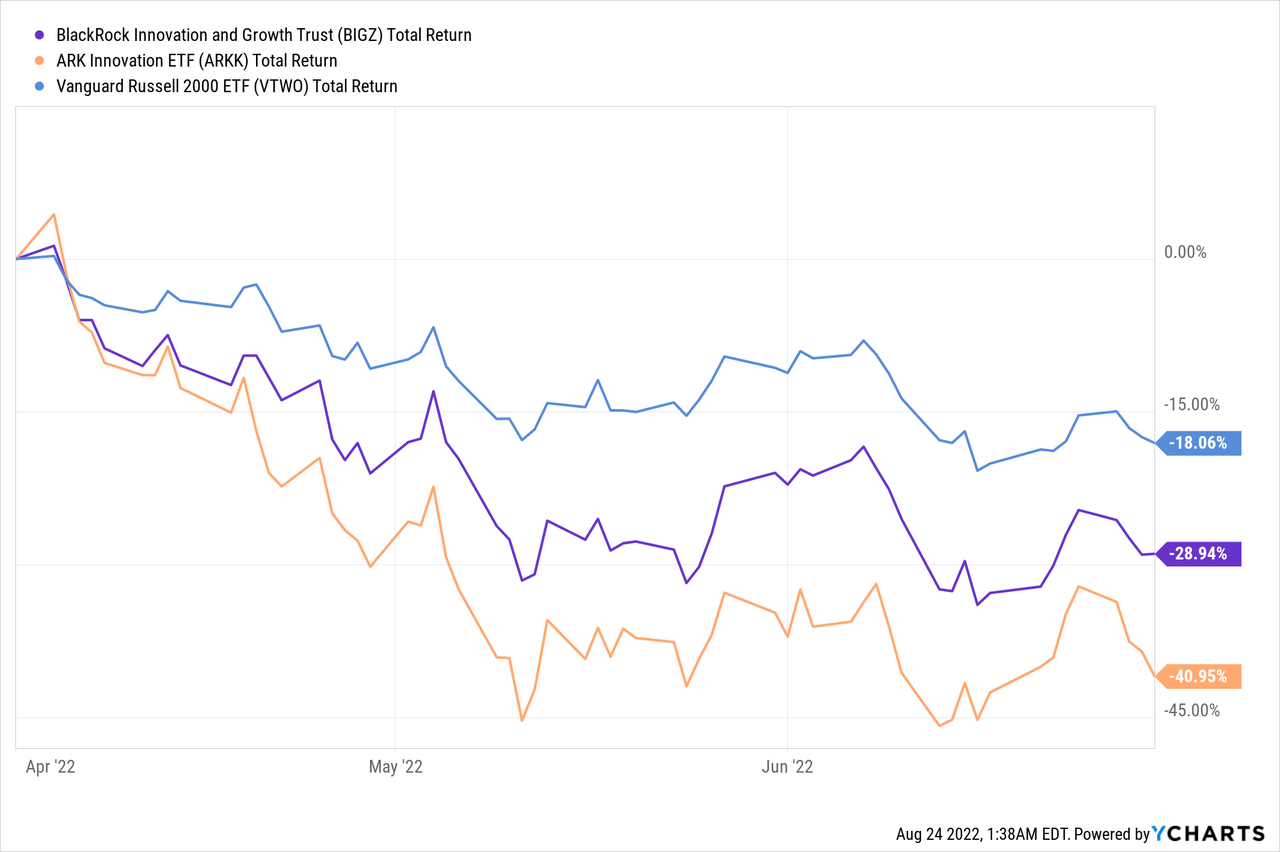

Another risk when investing in BIGZ is its high exposure of 31.96% to small caps or companies with less than $2 billion of market cap. Now, these are the companies that can deliver the best growth metrics, but, during uncertain market conditions, these smaller companies tend to be more volatile. Thus, the trust has suffered from nearly a 29% downside compared to only 16.35% by the S&P 500. However, it has suffered more than the Vanguard Russell 2000 ETF (VTWO), which includes U.S. small-cap equities.

The reason for this decline was attributed to six stocks across the healthcare, IT, and consumer discretionary sectors, which significantly underperformed the market despite reporting strong financial results or issuing strong guidance. Thus, the portfolio looks to have been pressured by short-term investor pessimism amid concerns about the economic slowdown.

To this end, the fund managers routinely upgrade their portfolio with quality in mind, and together with the covered call strategy for reducing risks, BIGZ has suffered much less than ARKK which holds stocks of medium-sized companies. Cathie Wood’s fund has suffered from a downside of nearly 41% as shown in the above chart.

Discussion

Therefore, in case you want exposure to innovation in small and growth stocks, BIGZ is a less volatile choice, especially in current market conditions. Moreover, looking into the rest of this year, with the small and mid-cap innovation market showing signs of extreme weakness, a lower percentage of the portfolio has been overwritten, which allows generation of additional revenues but at a higher risk premium too.

Furthermore, with the current turmoil impacting stocks, exposure to private markets is a positive for BIGZ as it looks to increment returns by capturing the earnings power of these enterprises as inflation dynamics change.

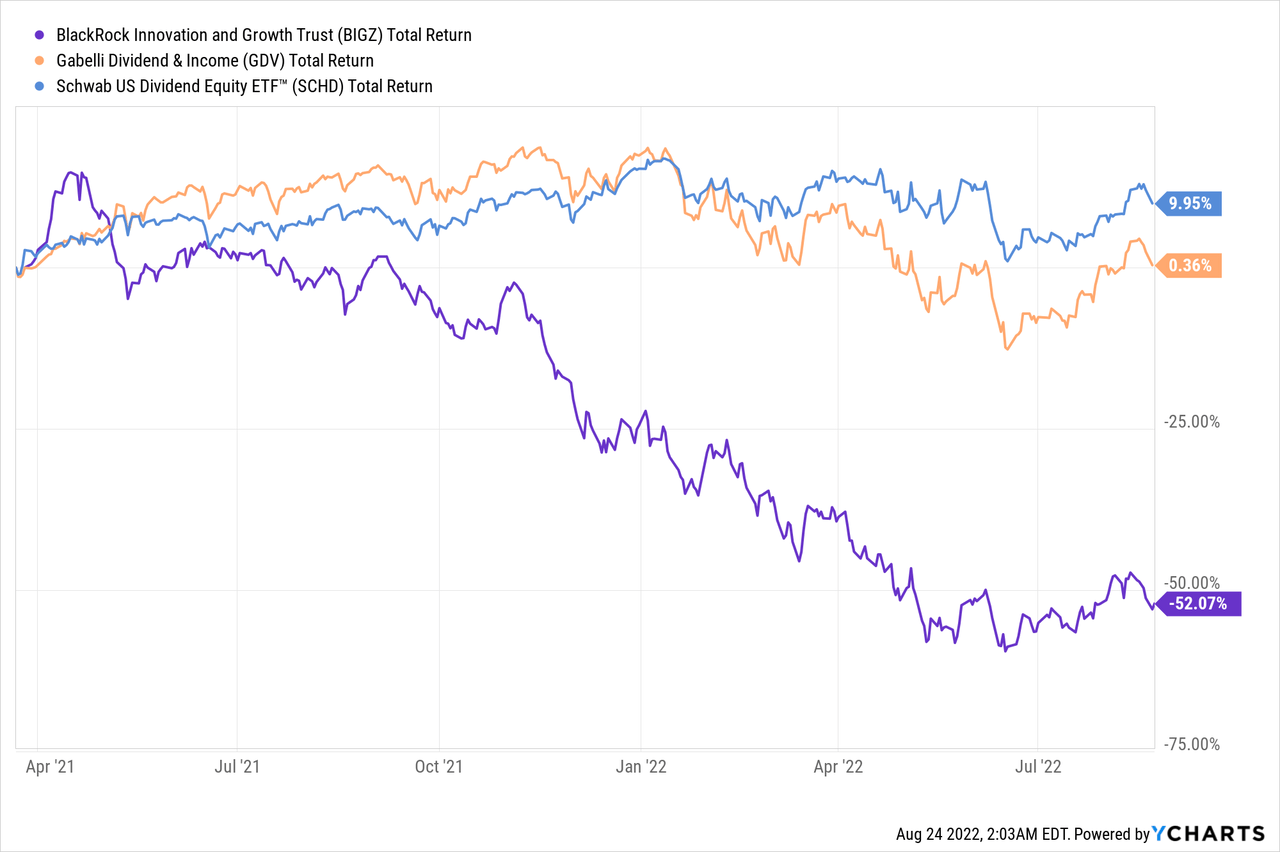

On the other hand, if you are looking for dividends together with capital appreciation, or total returns, then BIGZ is not for you despite its enticing dividend yields. For this purpose, there are other options, namely the Gabelli Dividend & Income Fund (GDV) and the Schwab U.S. Dividend Equity ETF (SCHD) as shown in the chart below. Both of these two funds have delivered better total returns which include the unit price performance and the dividends in case these are reinvested, and this is since BIGZ was incepted.

Still, for those who already own units of the trust, BIGZ can be relied upon, as a provider of consistent monthly income. There is also the fact that no leverage mechanism is used in the covered calls like for margin accounts. Instead, options writing is used to manage risks in addition to generating gains.

Moreover, according to BlackRock, small-cap stocks have delivered better returns than their large-cap counterparts during inflationary periods. This is based on historical data from the 1930s right through the 2010s, which even shows that small companies have delivered returns that exceeded inflation. This may seem counterintuitive when you look at the performance of the mega caps amid the “flight to safety” rationale since the onset of the pandemic in 2020, but this idea of small outperforming large is confirmed by other portfolio managers who see small cap retaking leadership from the larger ones.

Conclusion

Thus, BIGZ with its small to medium caps, private companies, and its covered call mechanism to generate income, should be on investors’ watchlist. One item to be watched out for by income seekers is the ability to generate more premium gains through writing option calls during the forthcoming period of high volatility.

Finally, covered calls and especially overwriting are regarded as a speculative strategy by some, but the fact is that this trust which provides exposure to growth and innovation companies where volatility is inherent while providing a regular income stream. This makes it more of a buy, especially after the above 50% drop. This said, with just a 10% upside, BIGZ could again flirt with the $9.5 level and you get paid while it rises.

Be the first to comment